Where You Live Has a Huge Effect on Car Insurance Rates

Laws, court rulings and driver behavior mean that someone across a state line might pay double (or half) of what you do.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

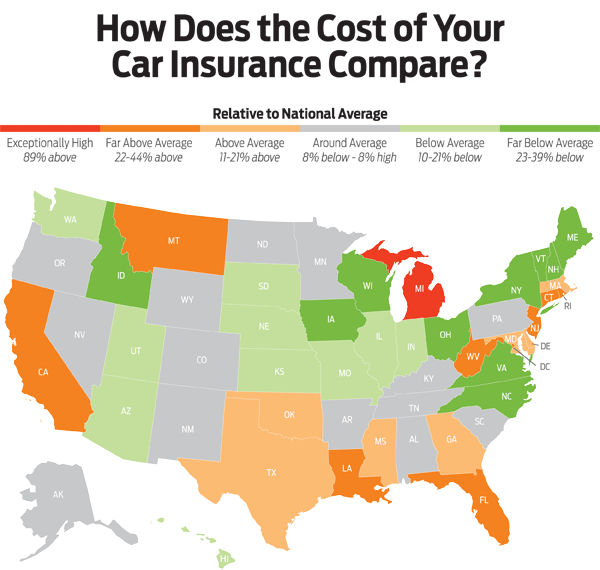

When it comes to the cost of your car insurance, there are things you can control fairly easily, such as what you drive and how you drive it. And things you can't, such as where you live. In fact, differences in state laws, court rulings and driver behavior mean the insurance bill in one state could be more than double the bill on the same vehicle in another state.

Based on Insure.com data.

This is the fifth year of the study, which gathers quotes from six major insurers in multiple zip codes in all 50 states and Washington, D.C., averaging rates for the 20 best-selling vehicles nationwide. Those models, led by the Ford F-series pickup, represented 40% of the new-car market in the U.S. in 2014.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Rates are based on full coverage for a single, 40-year-old man who commutes 12 miles to work each day. The hypothetical driver has a clean record and good credit. The policy has limits of 100/300/50 ($100,000 for injury liability for one person, $300,000 for all injuries and $50,000 for property damage in an accident) and a $500 deductible on collision and comprehensive coverage. The rate includes uninsured motorist coverage.

For the second year in a row, Michigan tops the list of the most expensive states, with rates nearly 89% above the national average. It's basically in a class of its own, with an average that’s 31% more expensive than that of the second-costliest state, Montana.

Penny Gusner, consumer analyst for Insure.com, says the main culprit is the Great Lakes State’s no-fault personal injury system, which provides unlimited lifetime medical benefits to injured motorists. "If someone is seriously injured, these auto insurance benefits could be paying out for decades," she said. Those generous benefits also attract fraudsters who file false injury claims, raising costs even more. And Michigan has a lot of uninsured drivers: 21% (versus a national average of 12.6%), according to the Insurance Research Council. Those free riders raise costs for everyone else.

Second-place Montana has insurance rates that are 44% above the national average. According to statistics from the Insurance Institute for Highway Safety, the Treasure State has the highest rate of fatal accidents in the country. "Auto accidents so severe that they result in fatalities are expensive to car insurance companies, and thus lead to higher premiums for motorists," says Gusner.

At the other end of the cost spectrum is Maine, where the average insurance premium is 39% less than the national average (and a whopping 57% less than in Montana). Although they are both relatively rural states, Maine’s fatality rate is roughly half that of Montana. And only 4.7% of Maine’s drivers are on the road without insurance, according to Insurance Research Council statistics.

Zip codes matter a lot, too. In some cases, the difference between two zip codes in the same state is bigger than between two states with sharply different average rates. Take New York, for example. It's actually a fairly low-cost state, 42nd in the nation with an average annual cost of $1,013. But in Brooklyn (zip code 11226), the average car insurance premium is $3,877, almost four times the state average, according to Insure.com,. If you want to dig into that kind of detail, check out CarInsurance.com ’s Average Car Insurance Rates calculator.

| Ranking the States: Average Car Insurance Premiums | |||||

|---|---|---|---|---|---|

| 1 | Michigan | $2,476 | 26 | Colorado | $1,245 |

| 2 | Montana | $1,886 | 27 | Arkansas | $1,239 |

| 3 | Washington, D.C. | $1,799 | 28 | New Mexico | $1,237 |

| 4 | Louisiana | $1,774 | 29 | Minnesota | $1,222 |

| 5 | Florida | $1,742 | 30 | Oregon | $1,211 |

| 6 | West Virginia | $1,716 | 31 | South Carolina | $1,210 |

| 7 | Connecticut | $1,690 | 32 | South Dakota | $1,180 |

| 8 | Rhode Island | $1,656 | 33 | Kansas | $1,147 |

| 9 | California | $1,643 | 34 | Hawaii | $1,114 |

| 10 | New Jersey | $1,595 | 35 | Missouri | $1,112 |

| 11 | Maryland | $1,590 | 36 | Washington | $1,110 |

| 12 | Mississippi | $1,584 | 37 | Arizona | $1,103 |

| 13 | Delaware | $1,542 | 38 | Nebraska | $1,086 |

| 14 | Georgia | $1,519 | 39 | Illinois | $1,079 |

| 15 | Oklahoma | $1,496 | 40 | Utah | $1,059 |

| 16 | Massachusetts | $1,460 | 41 | Indiana | $1,033 |

| 17 | Texas | $1,449 | 42 | New York | $1,013 |

| 18 | Alaska | $1,410 | 43 | Virginia | $1,008 |

| 19 | North Dakota | $1,377 | 44 | North Carolina | $986 |

| 20 | Wyoming | $1,371 | 45 | Vermont | $957 |

| 21 | Kentucky | $1,341 | 46 | Wisconsin | $930 |

| 22 | Alabama | $1,320 | 47 | New Hampshire | $905 |

| Row 22 - Cell 0 | National Average | $1,311 | 48 | Iowa | $886 |

| 23 | Pennsylvania | $1,304 | 49 | Idaho | $877 |

| 24 | Tennessee | $1,263 | 50 | Ohio | $843 |

| 25 | Nevada | $1,248 | 51 | Maine | $805 |

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

In his former role as Senior Online Editor, David edited and wrote a wide range of content for Kiplinger.com. With more than 20 years of experience with Kiplinger, David worked on numerous Kiplinger publications, including The Kiplinger Letter and Kiplinger’s Personal Finance magazine. He co-hosted Your Money's Worth, Kiplinger's podcast and helped develop the Economic Forecasts feature.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

9 Types of Insurance You Probably Don't Need

9 Types of Insurance You Probably Don't NeedFinancial Planning If you're paying for these types of insurance, you may be wasting your money. Here's what you need to know.

-

Amazon Resale: Where Amazon Prime Returns Become Your Online Bargains

Amazon Resale: Where Amazon Prime Returns Become Your Online BargainsFeature Amazon Resale products may have some imperfections, but that often leads to wildly discounted prices.

-

How Much Will Car Prices Go Up With Tariffs?

How Much Will Car Prices Go Up With Tariffs?Tariffs could drive car prices up even higher, for new and used cars, as well as for American brands.

-

Roth IRA Contribution Limits for 2026

Roth IRA Contribution Limits for 2026Roth IRAs Roth IRAs allow you to save for retirement with after-tax dollars while you're working, and then withdraw those contributions and earnings tax-free when you retire. Here's a look at 2026 limits and income-based phaseouts.

-

Ford Recalls 45,000 Cars Over Faulty Door Latches

Ford Recalls 45,000 Cars Over Faulty Door LatchesThe Ford recall follows its 2020 recall for the same issue. Here's what to know.

-

Four Tips for Renting Out Your Home on Airbnb

Four Tips for Renting Out Your Home on Airbnbreal estate Here's what you should know before listing your home on Airbnb.

-

Five Ways to a Cheap Last-Minute Vacation

Five Ways to a Cheap Last-Minute VacationTravel It is possible to pull off a cheap last-minute vacation. Here are some tips to make it happen.

-

UAW, Ford Reach Tentative Deal As GM, Stellantis Strike Continues

UAW, Ford Reach Tentative Deal As GM, Stellantis Strike ContinuesUAW and Ford's proposed agreement must be approved by union membership but workers can return to before that.