Stocks to Cash In on World-Changing Trends

If you want to invest in the future, you're going to need a strong stomach for risk.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Healthy investing is a lot like healthy eating: Make sensible choices carefully proportioned within a diet of moderation. We get it. But everyone needs at least a little sizzle—in their diet and in their portfolio. Perhaps, like a Walter Mitty of the investing world, you’ve secretly dreamed of getting in on the ground floor of a groundbreaking trend or technology that will change history and inform the future.

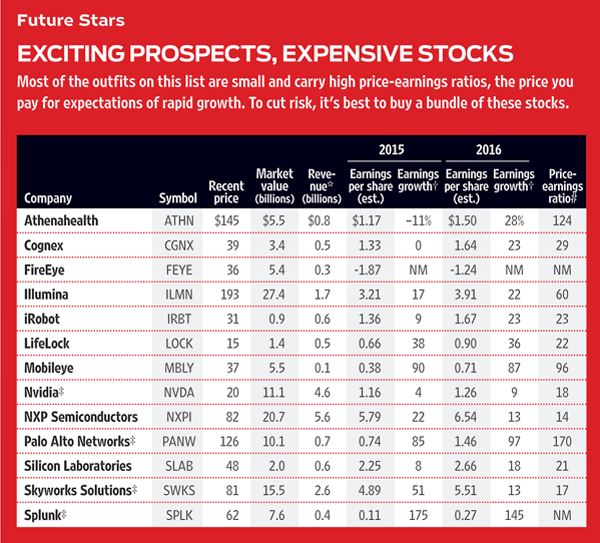

The 13 stocks highlighted below are all about breakthroughs, innovation and disruption. You’re not likely to find them in broad market benchmarks; only one of the stocks, Nvidia, is a member of Standard & Poor’s 500-stock index. And just as spicier fare isn’t suited to those with weak stomachs, these stocks aren’t for the faint of heart. Nor are they for bargain hunters, except when a bout of market volatility gives you a chance to buy on a dip.

But if you believe in a world in which cars drive themselves, robots keep house and science finds cures for cancer, consider investing in these transformative trends. And even if you don’t buy into them, at least be aware that you ignore them at your peril. “You may not care about these new or disruptive companies,” says Cathie Wood, CEO of Ark Investment Management, where she runs a collection of actively managed exchange-traded funds that seek to cash in on innovation. “But they’re going to disrupt many of the companies in your portfolio.” For a look into the future, read on.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The Internet of Things

The Internet of Things is a concept so enormous it’s hard to wrap your brain around. Think of the IoT as nothing less than the dawn of inanimate consciousness, says Stifel, Nicolaus, an investment firm. Embedded sensors, processors and communication technology are in effect waking machines from a catatonic state, extracting intelligence from the physical world that we can then use to make people healthier, cars safer, homes cozier and cheaper to maintain, factories and farms more efficient, and cities more livable and environmentally friendly.

Applications for the IoT are practically infinite. Nearly 5 billion connected things will be in use in 2015, according to Gartner Inc., a technology research firm. By 2020, the number of “things” will grow to 26 billion, encompassing everything from smart watches, smart cars and smart home appliances to networked factory machines and citywide energy grids. That will amount to some $1.9 trillion in revenues generated or savings realized. The structural change resulting from the IoT will be akin to the industrial revolution, says Goldman Sachs.

Skyworks Solutions (symbol SWKS) exemplifies how the IoT is rewiring corporate strategies. Skyworks makes smartphone chips for such powerhouse customers as Apple and Samsung, and the company is profiting from the rollout of smartphones in China. But CEO David Aldrich is leveraging decades of experience in mobile connectivity to make Skyworks a conduit to all manner of IoT devices. “The common denominator is efficient connectivity, and that’s where we excel,” says Aldrich.

The company’s Broad Markets division, a proxy for its IoT exposure, is already helping to make up for the seasonal revenue slumps endemic in the mobile-phone chip business. The division contributes roughly one-fourth of the company’s total revenues, and sales in the segment grew at a rate of 26% last year. “Over the next 10 years, it could be half the business,” says Aldrich. “The Internet of Things is the biggest growth phenomenon in our lifetime. If you’re a technology company and you’re not there, you’re not going to grow.”

Connected cars are at the forefront of the IoT. Within the next five years, roughly one in five vehicles on the road worldwide will be connected to the Internet, predicts Gartner. Eventually, cars will be self-driving. But before we take our hands completely off the wheel, expect to see widespread adoption—very possibly required by regulators—of technology aimed at assisting drivers. Adaptive cruise control adjusts to the traffic around you, for instance, while automatic braking stops your vehicle when another car or a pedestrian materializes in your path, and lane-departure warnings keep you from drifting. Currently, only about 5% of cars worldwide have active safety features.

Mobileye (MBLY) is the single most important enabler of such active safety features, says Dan Roarty, manager of AllianceBernstein’s AB Global Thematic Growth Fund. The company, headquartered in Israel, designs and develops camera-based driver-assistance technology—integrated hardware and software that in essence become the eyes and the brains of the car. Mobileye has clocked millions of miles on the road, garnering an 80% share of the active-safety market and a five-year lead on anyone else, says Roarty. Analysts on average expect the company’s earnings per share to nearly double in 2015 and again in 2016.

Two others to consider: Silicon Laboratories (SLAB) is a semiconductor company that makes a broad portfolio of energy-efficient, IoT-enabling products, including sensors, microcontrollers (the brains of a device) and the hardware that facilitates Internet connectivity. NXP Semiconductors (NXPI), known for its security features, enables the secure connection for Apple Pay.

Robots are for real

Robots have always held a cultural allure for Americans, from Gort in The Day the Earth Stood Still, to the Jetsons’ maid, Rosie, to Star Wars’ C-3PO. Robots today may not conform to the fantastic notions of Hollywood screenwriters. But they are an increasingly important, growing and widespread segment of the workforce.

The auto industry remains the largest market for robots. But they can also be found neutralizing land mines for the military, fulfilling orders in warehouses and assisting in surgical procedures in hospitals. Robots are being designed to pick fruits and vegetables. In Japan, where there are 323 robots for every 10,000 human workers, robots are being developed to assist the elderly and the disabled. And a hotel opening in Nagasaki this summer will be partially staffed by robots that will check in guests, carry luggage and clean rooms.

The International Federation of Robotics estimates that 1.3 million to 1.6 million industrial robots are in use. In 2013 (the latest year for which figures are available), nearly 180,000 robots were sold, the most ever in a single year. Spending on robots worldwide is expected to jump from an estimated $27 billion in 2015 to $67 billion by 2025, says the Boston Consulting Group. The surge will be driven by falling prices, improving capabilities and rising demand as global workforce growth begins to decline and wages rise, particularly in China.

Courtesy iRobot

The key to building a better robot is imbuing it with humanoid senses—only better. While the human eye can see 30 frames per second, for example, robots today can see thousands of frames per second. Cognex (CGNX) is a leading developer of machine-vision technologies used to monitor production lines, guide assembly robots, detect manufacturing defects and track parts. Cognex systems help automate the manufacture of cell phones, aspirin bottles and vehicle wheels, among other things. Factory automation should account for more than 80% of the company’s revenues in 2015, and that segment is growing by 20% a year, according to Canaccord Genuity, a Canadian financial-services firm. Canaccord predicts that the share price will reach $55 within a year, up more than 40% from the current level.

On the home front, maybe Rosie isn’t so far-fetched after all. The robotics federation expects 31 million robots to be sold for personal use from 2014 through 2017, most tasked with domestic chores. You may be familiar with the Roomba vacuum cleaner, made by iRobot (IRBT). The company claims roughly 75% of the robot vacuum market. That’s less than 20% of the U.S. market for higher-end vacuums, leaving plenty of room for growth, even with vacuum leader Dyson scheduled to enter the robotics market later this year.

IRobot also makes bomb-disarming robots for the military. That segment is struggling as U.S. defense spending declines and troops are pulled from harm’s way. But the company’s disciplined research and development in that area are driving innovation in broader product lines focused on three key robotic capabilities: the ability to navigate, perceive the surrounding environment and interact with it. IRobot’s “telepresence” bots—at about $70,000 each, they look like a mobile stand with a screen on top—allow doctors to consult from afar, or business people to meet or manage remotely. After mapping out your office (or factory floor or medical center), the bots can show up automatically for scheduled events or simply enable you to virtually roam distant halls at will, interacting with those you meet.

For the time being, the Roomba accounts for 75% to 80% of iRobot’s profits, says Morningstar analyst Adam Fleck. But as other products gain ground, that percentage is bound to decline. Says Brian Gesuale, an analyst at the Raymond James brokerage, “iRobot’s ambition is to be a robot company, not a vacuum company.”

Making medicine personal

A decade ago, sequencing one human genome cost $10 million and several months’ worth of computing power. Today, the cost is $1,000 and a day of computing, and within a few years, say researchers, the cost of mapping the complete set of a human being’s genetic information will drop to $100 and a few minutes. This genetic intelligence is ushering in an age of personalized medicine, with one-size-fits-all protocols giving way to more customized—and therefore more effective—treatments for cancer and other challenging diseases. President Obama called the practice “precision medicine” in his State of the Union address and earmarked $215 million in the federal budget to help fund its development.

The change is evolutionary and revolutionary at the same time. “I try to avoid military analogies, but we’re moving from World War II–era carpet bombing to dropping laser-guided bombs down chimneys,” says Gavin Baker, who tracks transformative technology as the manager of Fidelity OTC Portfolio. For example, each cancer tumor has its own genetic mutations, which change over time. Sequencing and re-sequencing the tumor will reveal which treatments will be most effective at any given point. “Instead of being diagnosed with breast or colon cancer, you’ll be diagnosed as to mutations,” says Baker. Within 20 years, cancer could become a manageable disease instead of a terminal one, he says.

The prime mover in personalized medicine is Illumina (ILMN), which makes gene-sequencing tools and equipment. Illumina claims 70% of the sequencing market, which is growing at a 10% annual rate and is expected to approach $25 billion in revenues by 2020. In addition to mapping human genomes, the company’s equipment is used to sequence viruses (including Ebola), bacteria, plants for the agriculture industry—just about any organism. Oncology and prenatal screening are promising growth areas.

Potential rivals will have a tough time unseating Illumina, but that doesn’t mean the stock is without risk. One serious misstep or failure to keep on the cutting edge of technology could inhibit Illumina’s long-term success, says Morningstar analyst Michael Waterhouse. The stock, which has soared by more than sevenfold since October 2011, is certainly not cheap, trading at 60 times estimated 2015 earnings. But as the number of genomes sequenced grows from the hundreds of thousands to the tens of millions, bulls say, Illumina’s earnings should continue to expand by at least 20% annually over the next few years, driving the share price ever higher.

Athenahealth (ATHN) isn’t a sexy biotech with a potential cure for cancer. The electronic medical records firm started by helping doctors collect fees from insurers, which it does efficiently. But in a basic way, Athena also makes personalized medicine possible, says Elizabeth Jones, a former physician who comanages the Buffalo Discovery Fund. “When I practiced medicine, I would see patients in the ER, and I wouldn’t know what drugs they were on, what their allergies were or if an old EKG existed,” she says. “That’s ridiculous. That information is all there, somewhere.” Even today, most medical practices are isolated islands of patient information. Athena’s cloud-based platform makes it easier for data to travel among providers, giving a more complete picture of patients.

Athena claims some 62,000 providers as customers, representing 62.5 million patients. As it gathers more information into its cloud, “Athena will be able to do predictive analysis at a very high level,” says Fidelity’s Baker. That allows for early intervention or preventive care that can both improve outcomes and cut costs—vital in a medical system that’s transitioning from paying doctors by the visit or the procedure to paying for keeping patients healthy and costs down. Athena’s earnings are likely to be down this year because of acquisition costs, and its stock trades at a stiff premium—124 times estimated 2015 earnings. Is that too much for a company that says it is building the health care Internet? Athena is the purest play on the migration of medical data to the cloud, says Ark Investment’s Wood. “This is a winner-take-most stock.”

Blocking cyberattacks

There’s nothing like a giant health insurer’s computer system getting hacked to remind us of the critical importance of defending against cyberthreats. The massive breach at Anthem, which put at risk the sensitive personal data of millions of customers, is the latest in a long line. The number of U.S. data breaches exposing individuals to the risk of identity theft hit a record high of 783 in 2014, up 28% from 2013, says the Identity Theft Resource Center.

Our growing connectedness intensifies the risk. The Internet of Things links everything from our cars to our coffeepots to the Internet, while more of our personal data gets stored in the cloud. Consider this dire observation from the World Economic Forum’s 2015 Global Threat Report: “There are more devices to secure against hackers and bigger downsides from failure: Hacking the location data on a car is merely an invasion of privacy, whereas hacking the control system of a car would be a threat to life.”

Cyberattacks have become business as usual, says Sarbjit Nahal, a strategist at Bank of America Merrill Lynch. A recent survey of 257 companies, in varied industries and headquartered in seven countries, found that they experienced an average of 1.6 attacks each week. As a result, the information-security market is expected to grow more than 10% annually, from $96 billion in revenues in 2014 to nearly $156 billion in 2019, according to market research firm MarketsandMarkets. RBC Capital Markets analyst Matthew Hedberg believes high-profile breaches could lead to U.S. government regulation aimed at beefing up cybersecurity.

Palo Alto Networks (PANW) is well positioned to benefit. What differentiates Palo Alto from its peers is its ability to defend against attacks all along the data pathway—in the cloud, along the network and in devices themselves. The company’s sales growth is consistently outpacing the information-security market as a whole, gaining market share relative to competitors. Hedberg sees sales growth of 41% in the fiscal year that ends this July, with roughly 30% growth in each of the following two years. The stock, which has tripled since November 2013, now trades at 170 times estimated earnings for the 2015 fiscal year, a premium ratio that Hedberg says is justified by the company’s impressive growth prospects. Indeed, analysts expect earnings to double in the fiscal year that ends in July 2016.

The recent cloudburst of data breaches should mean more customers for LifeLock (LOCK). The company protects consumers against identity theft by monitoring new-account openings, credit applications and other identity-related activities, then alerting subscribers to suspicious activity. Businesses, including lenders, retailers and cable-TV firms, use LifeLock to authenticate customer IDs and gauge the risk of fraud in any given transaction.

LifeLock has been under its own cloud, presenting opportunity for intrepid investors. The company recently set aside $20 million to settle any charges that might stem from a Federal Trade Commission investigation into whether LifeLock is complying with earlier orders to fairly represent its services. The charge against earnings decimated 2014 results, and the growth in the number of new subscribers dipped in the fourth quarter. Blame the FTC matter for distracting the top brass, says analyst Rob Breza, at the investment firm of Sterne Agee. But he thinks the issue will be settled soon and that LifeLock is already back on track, substantially boosting spending on marketing to take advantage of the spate of highly publicized data breaches. “Is the company broken? I don’t think so; 2015 will be a year of growth,” says Breza. LifeLock’s stock has dropped 36% from its record high, set in February 2014, and now trades at a reasonable 22 times estimated 2015 earnings. Breza, who sees earnings jumping 31% in 2016, predicts that the stock will reach $20 within a year, up one-third from the current price.

One other company to watch: FireEye (FEYE), whose recently purchased forensic security division has become the go-to source for investigating breaches, including Anthem’s.

Managing big data

The collection, transmission and analysis of data underlie every megatrend we’ve been talking about, with people, businesses and now things adding to the digital explosion. The digital universe is doubling in size every two years, according to International Data Corp., a technology market-intelligence firm. By 2020, there will be almost as many digital bits as there are stars in the universe. The data we create, copy and consume annually will reach some 44 zettabytes, or 44 trillion gigabytes—enough to fill up nearly 688 billion midrange iPhone 6’s.

And yet, by IDC’s most recent measure, less than 5% of potentially usable data is currently being analyzed. The opportunities are enormous for companies that are able to marshal and make sense of the exploding volume of unstructured information.

If you’re a gamer, you may have heard of Nvidia Corp. (NVDA), the semiconductor company that invented the graphics processing units for computer video games back in the 1990s. But the company’s future rests on the power of big data, says Wood, the Ark ETF manager. “Nvidia is in every one of our funds,” she says. “Its chips can handle unstructured data—social networking data, sensor data, genomic data—unlike those of any other chip maker out there.” The company is making a push into the assisted-driving and auto “infotainment” market as well. Wedbush Securities deemed the stock a “top pick for 2015,” based on solid growth in an array of Nvidia’s products and the company’s propensity to return cash to shareholders. Nvidia is one of only two stocks on our list that pay a dividend. It sports a 1.7% yield. (The other dividend payer is Skyworks, which yields just 0.6%.)

Splunk (SPLK) makes sense of machine-generated data. The company’s software allows customers to monitor, correlate, search and analyze massive streams of data in real time, putting Splunk right at the heart of the Internet of Things. For example, a Coca-Cola executive revealed at a Splunk-hosted conference last fall that the beverage giant, using Splunk’s software, was able to see that sales at vending machines on college campuses spike right before weekly airings of the hit TV show The Walking Dead. Splunk counts customers among a variety of industries, including retail, energy, manufacturing, financial services and travel. The technology is a natural fit for information-security applications, and about 40% of Splunk’s revenues are tied to cybersecurity, says AllianceBernstein fund manager Roarty.

Investors should bear in mind that Splunk, which went public in 2012, is investing heavily in the growth of its business. That means current profits are modest, although revenues are expected to grow at a 32% clip this year. After losing money in 2013, Splunk earned an estimated 4 cents a share last year. Analysts forecast profits of 11 cents per share this year (or $13.3 million) and 27 cents in 2016.

Figures as of Feb. 6. * Based on revenue for the past year. † Based on estimated change in earnings per share from the previous year. # Based on estimated 2015 earnings. ‡ Estimates are for the company's fiscal year. NM Not meaningful. Sources: Thomson Reuters, Yahoo.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Anne Kates Smith brings Wall Street to Main Street, with decades of experience covering investments and personal finance for real people trying to navigate fast-changing markets, preserve financial security or plan for the future. She oversees the magazine's investing coverage, authors Kiplinger’s biannual stock-market outlooks and writes the "Your Mind and Your Money" column, a take on behavioral finance and how investors can get out of their own way. Smith began her journalism career as a writer and columnist for USA Today. Prior to joining Kiplinger, she was a senior editor at U.S. News & World Report and a contributing columnist for TheStreet. Smith is a graduate of St. John's College in Annapolis, Md., the third-oldest college in America.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.

-

Why I Trust These Trillion-Dollar Stocks

Why I Trust These Trillion-Dollar StocksThe top-heavy nature of the S&P 500 should make any investor nervous, but there's still plenty to like in these trillion-dollar stocks.

-

Nvidia Earnings: Updates and Commentary November 2025

Nvidia Earnings: Updates and Commentary November 2025Nvidia reported fiscal 2026 third-quarter earnings and the leader of the AI revolution delivered the goods once again.