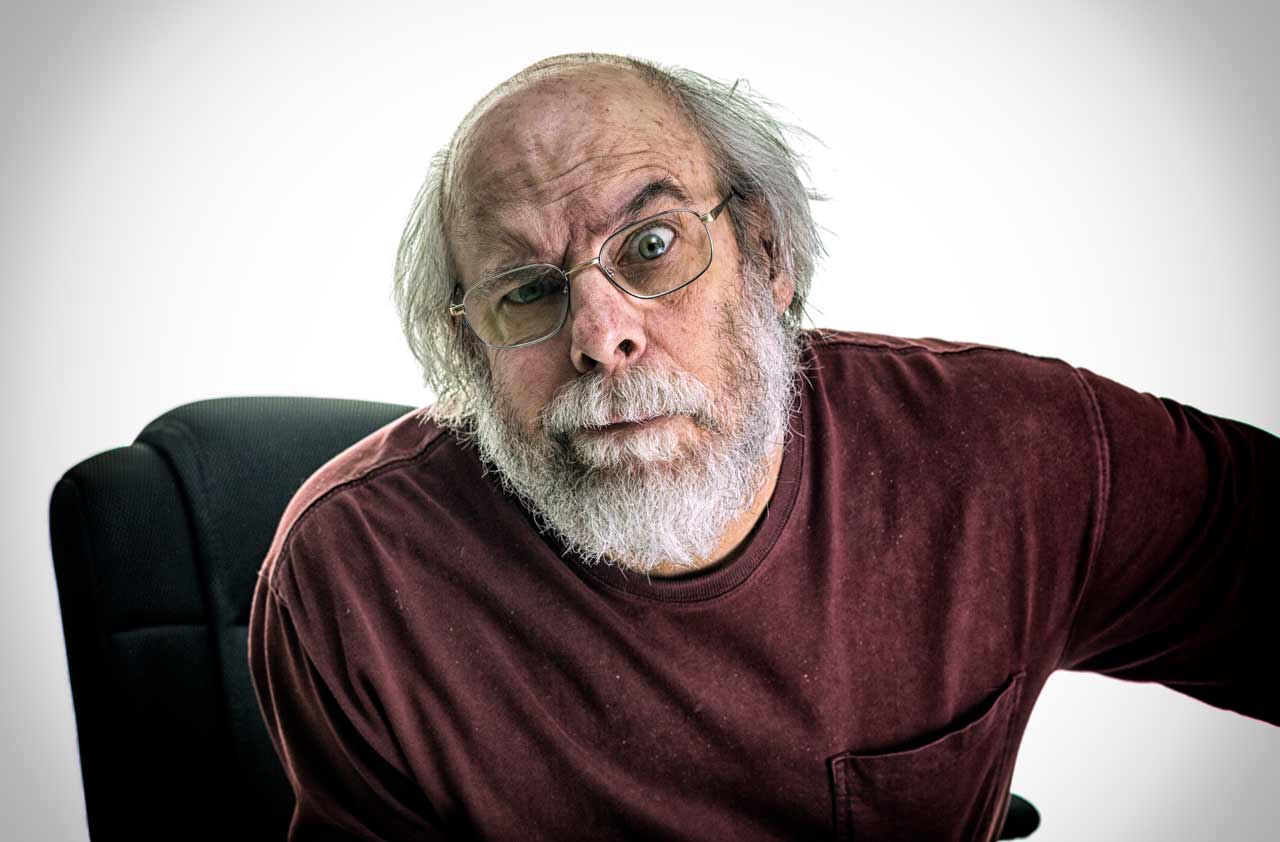

A Grumpy Old Man’s Guide to 401(k) Investing

It’s tough-love time: If you’re lucky enough to have a 401(k) plan, and you’re not filling it to the max, you’re making a rookie mistake.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Perhaps I’ve been spending too much time with my young kids, but I’ve gotten to be quite good at wagging my finger and speaking in a stern, fatherly voice. I love my kids dearly, but at times the rascals need a little discipline. And chances are, when it comes to making full use of your 401(k) plan, you do too. So, as my glasses slide down my nose, I’m going to put on my slippers, roll up my Financial Times newspaper and shake it in your general direction.

So, you — yes, you there! Sit down and listen up because this is important. And don’t you dare click out of this column. What I’m about to tell you is for your own good.

If you’re not taking full advantage of your 401(k) plan … well, shame on you. Those things aren’t free, you know. Your employer spends a lot of money administering the thing … for your benefit. So, if you can’t be bothered to log in or fill in the forms to participate, you’re just a derned fool. Do you know how many starving children in Ethiopia would love to have a 401(k) plan like yours?

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

At my first job, we didn’t have 401(k) plans. I had to settle for the measly $2,000 I was allowed to contribute to an IRA at the time. Well, I maxed out that IRA, and I loved it! But what I wouldn’t have done for a proper 401(k) plan. So, show some gratitude, would ya?

I know, I know. Money saved in a 401(k) plan is money you can’t spend on some newfangled gewgaw. But if you make decent money, a huge chunk of it is just going to end up going to the tax man.

Stop and use your head for a minute. If you’re in the 28% tax bracket — and if you’re still single (at your age!), you would be in the 28% bracket at an income of just $91,150 — then you effectively earn a 28% “return” on every dollar you contribute, as of Day One. Would you rather that 28% go to the government? Yeah, that’s what I thought.

You can save $18,000 in a 401(k) plan in 2017. That’s $692 per paycheck. You can do that. Your grandmother used to feed a family of seven growing kids on $692 per year and never complained. So stop your whining, log in to your plan or call your HR department now and get your contributions on track.

Don’t make me come over there and swat you with my newspaper.

And matching … don’t even get me started on matching. When I was your age, I was lucky if my cheapskate boss matched me even 2%. These days, I’ve seen companies match as much as 6% or 7%. If you’re too big of a sissy to contribute the full $18,000 in salary deferral to your 401(k) plan, then for crying out loud, at least contribute enough to get the full matching amount from your employer. If you don’t, you’re leaving money on the table. And I don’t know about you, son, but I don’t have a money tree in the backyard. When someone offers me free money, I take it.

OK, I’m going to unroll the newspaper and push my glasses back into place for a moment. In all seriousness, this is the time of year to make changes to your 401(k) plan. If you’re not already maxing out your 401(k) for the full $18,000 (or $24,000 if you’re 50 or older) you really should make that a priority. Even if the stock market fails to return a single red cent, the tax savings and employer matching alone make it more than worthwhile.

I realize that not everyone can realistically defer $18,000 of their annual pay. If you’re young, recently started a family or have a non-working spouse, that might not be an attainable goal. But here are a few tips to get you closer.

If you got a raise to start the year, I strongly encourage you to allocate the difference to your 401(k) plan. You were already surviving at your previous pay rate; continue to live your current lifestyle a little longer, and push the salary increase into your retirement plan. Years from now, you’ll be happy you did.

If you generally get large tax refunds every year, consider chatting with your HR department about increasing the number of exemptions you claim. This will cause you to withhold less in taxes, which will boost your paychecks. You can then use your higher effective pay to contribute more to your 401(k) plan.

And finally, consider living more modestly. If you rent an apartment, consider getting a roommate or downgrading to a cheaper place. Money spent on rent is effectively money wasted. It’s better to use that money to build your future.

Listen to me, son. It’s for your own good.

Charles Lewis Sizemore, CFA is chief investment officer of Sizemore Capital Management LLC, a registered investment adviser based in Dallas. Charles is a frequent guest on CNBC, Bloomberg TV and Fox Business News, has been quoted in Barron's Magazine, The Wall Street Journal and The Washington Post and is a frequent contributor to Yahoo Finance, Forbes Moneybuilder, GuruFocus, MarketWatch and InvestorPlace.com.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Charles Lewis Sizemore, CFA is the Chief Investment Officer of Sizemore Capital Management LLC, a registered investment advisor based in Dallas, Texas. Charles is a frequent guest on CNBC, Bloomberg TV and Fox Business News, has been quoted in Barron's Magazine, The Wall Street Journal, and The Washington Post and is a frequent contributor to Yahoo Finance, Forbes Moneybuilder, GuruFocus, MarketWatch and InvestorPlace.com.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.

-

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial Advice

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial AdviceCan financial advisers who earn commissions on product sales give clients the best advice? For one professional, changing track was the clear choice.

-

65 or Older? Cut Your Tax Bill Before the Clock Runs Out

65 or Older? Cut Your Tax Bill Before the Clock Runs OutThanks to the OBBBA, you may be able to trim your tax bill by as much as $14,000. But you'll need to act soon, as not all of the provisions are permanent.

-

I'm a Financial Adviser: This Is the $300,000 Social Security Decision Many People Get Wrong

I'm a Financial Adviser: This Is the $300,000 Social Security Decision Many People Get WrongDeciding when to claim Social Security is a complex, high-stakes decision that shouldn't be based on fear or simple break-even math.

-

4 Ways Washington Could Put Your Retirement at Risk (and How to Prepare)

4 Ways Washington Could Put Your Retirement at Risk (and How to Prepare)Legislative changes, such as shifting tax brackets or altering retirement account rules, could affect your nest egg, so it'd be prudent to prepare. Here's how.