Stock Market Today: Major Indexes Quietly Etch New Highs

The Dow, S&P 500 and Nasdaq all squeaked out fresh highs in a fairly quiet Monday session. Much more explosive was the cryptocurrency space.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Monday was a slow-news day for the equity markets, but you might consider it the calm before the storm.

This week's earnings calendar is packed to the gills, with some 35% of S&P 500 companies releasing their quarterly financials – including mega-caps such as Apple (AAPL), Google parent Alphabet (GOOGL) and Microsoft (MSFT).

For today, however, U.S. markets mostly seemed to ignore ripples from China, where the government cracked down both on Tencent Music (TME, -3.0%) and the country's for-profit education industry, sending stocks such as New Oriental Education (EDU, -33.8%) and TAL Education Group (TAL, -26.7%) plunging, which in turn weighed on Chinese and European indices.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Here at home, June new-home sales declined 6.6% month-over-month to a seasonally adjusted annualized rate of 676,000 homes, 120,000 below estimates. That appeared to hamper the SPDR S&P Homebuilders ETF (XHB, -0.9%).

"Although one should always be mindful of the imprecision of these estimates, due to the small sample size used in the survey, incoming data for the past few months show tentative signs that new housing demand has moderated after surging during the pandemic," says Barclays economist Jonathan Millar. "If sustained, this softening could have adverse implications for the residential construction outlook."

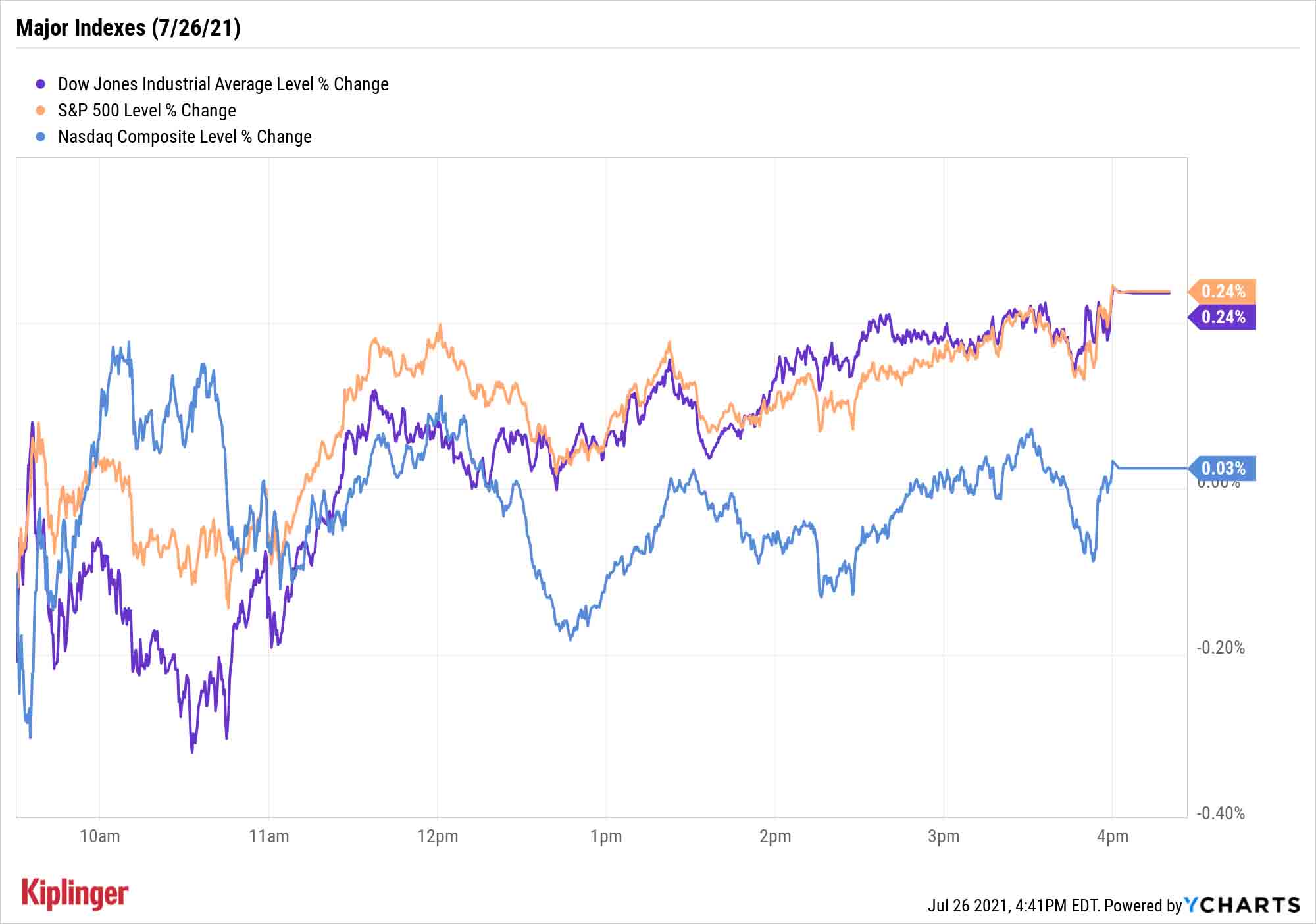

But the broader indexes remained aloft. The Dow Jones Industrial Average (+0.2% to 35,144), S&P 500 (+0.2% to 4,422) and Nasdaq (up marginally to 14,840) all scratched out new all-time highs.

- Hasbro (HAS) kicked off a busy week of corporate earnings with a big win. The toymaker reported second-quarter adjusted earnings of $1.05 per share on revenues of $1.32 billion – a marked improvement over its year-ago results of earnings of 2 cents per share on $1.16 billion in sales. The results easily topped analysts' estimates, as well. HAS stock finished the day up 12.2%.

- In M&A news, Aon (AON) and Willis Towers Watson (WLTW) agreed to end plans for a proposed $30 billion merger, which would have resulted in the largest global insurance firm. The deal was first announced in March 2020, but "reached an impasse with the U.S. Department of Justice," according to Aon CEO Greg Case. AON closed the session up 8.2%, while WLTW fell 9.0%.

- U.S. crude oil futures slipped 0.2% to end at $71.91 per barrel, snapping their four-day winning streak.

- Gold futures gave back 0.1% to settle at $1,799.20 an ounce.

- The CBOE Volatility Index (VIX) improved 2.2% to 17.58.

Cryptocurrency Parties Over the Weekend

However, one of the most exciting investment stories of late went down while equity markets were closed over the weekend.

A host of factors combined to spark a massive run in cryptocurrencies over the weekend, including Bitcoin, which shot 23.3% higher to $39,837 between Friday and Monday afternoon. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Chief among them were the discovery of an Amazon.com (AMZN) job posting seeking a "digital currency and blockchain product lead," driving speculation that the online retailer is somehow involving itself with cryptocurrency. Also helping was nearly $1 billion in bearish bets against cryptocurrency that were liquidated (to cover a short bet, an investor must buy more of the underlying asset, driving up prices further – a phenomenon known as a "short squeeze").

For many, it's a fresh reason to get excited about digital currencies – and for others, it's a new chance to get acquainted. We can help.

To start, it always helps to know what risks you're taking with any investment: These are the five biggest threats to cryptocurrency dominance.

You should also know how you can invest. If you're constrained to your brokerage account, for instance, you can't buy Bitcoin directly – but you can buy several stocks that get you exposed to it and/or other digital currencies. And if you simply want to know the biggest players in the space, look no further. From Bitcoin to Ethereum to … yes, even Dogecoin … we break down eight of the largest, most influential cryptocurrencies the market has to offer.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.