What Long-Term Care Insurance Policyholders Need to Know

Long-term care insurance can be confusing at times, so here are some insights about premium increases, when you can use your benefits and other issues.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

About 7.5 million Americans have some form of long-term care insurance (LTCI), which is a policy that helps cover the daily living costs associated with health diagnoses not covered by standard health insurance. This coverage is crucial to people who experience a health crisis that dramatically affects their way of living, such as Alzheimer’s or mobility issues.

LTCI policyholders have significantly more options when it comes to housing or in-home health care than people who don’t. If you are lucky enough to have LTCI coverage, you may have questions about your policy. As someone who specializes in helping older adults prepare for their next phase of life, I’m often asked questions about LTCI. Based on some of the most common concerns I hear, I hope these insights below provide you with the necessary guidance to plan ahead for your future.

What Should I Do When My LTCI Premium Increases Each Year?

Keep your policy. Too many people drop their LTCI policies because they are upset by a 20% premium increase. After paying LTCI premiums for 20 or even 30 years, it’s hard to swallow increases, but the alternative of self-paying for assisted living or nursing home care can be even more costly. Instead, ask your LTCI company to reduce portions of your benefits rather than increase premiums. You can also ask your insurance company to run proposed tradeoff comparisons. Before dropping your policy, consider one of three options:

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

- How much do you need to reduce your daily benefit to keep your premiums steady?

- What happens to the premium if the total coverage pool is reduced from a five-year, $400,000 coverage cap to a three-year, $250,000 cap?

- What happens to the premiums with a reduction in inflation benefits from a 5% compounding feature to a 3.2% compounding rate?

Call the customer support phone number provided in the premium increase notification to discuss what options are available beyond what is initially presented. And make a point to know what the deadlines are for you to make a decision. Most of these premium increase notifications have a default election of the increased premium that goes into effect unless you elect differently.

When Can I Start Using My Long-Term Care Insurance Policy?

You need to meet certain criteria to activate your policy, like cognitive impairment, including Alzheimer's and other forms of dementia. You can also make an LTCI claim if you cannot perform two or more activities of daily living (ADLs) for at least 90 days. ADLs are bathing, dressing, continence/toileting, eating and transferring.

Your contract may have a waiting or elimination period (typically 90 to 100 days) before benefits are paid, so you will be responsible for all costs from when you first claim LTCI and when the elimination period ends.

Note that premium payments stop when you are in a claim period, which means you will not need to make any payments while you are receiving care.

Can I Use My Long-Term Care Insurance Policy If I Need Care at Home?

Each LTCI policy has slightly different terms for where care can take place. Your policy may pay different amounts depending on the location of the services (i.e., your home, assisted living community, nursing home). You need to read your policy to see if it covers home care aides, home health aides, care in assisted living or only care in nursing homes.

Note that if you choose home health aides or home care aides, you still must first meet the criteria for LTCI policies of cognitive impairment or needing assistance with at least two activities of daily living (mentioned above).

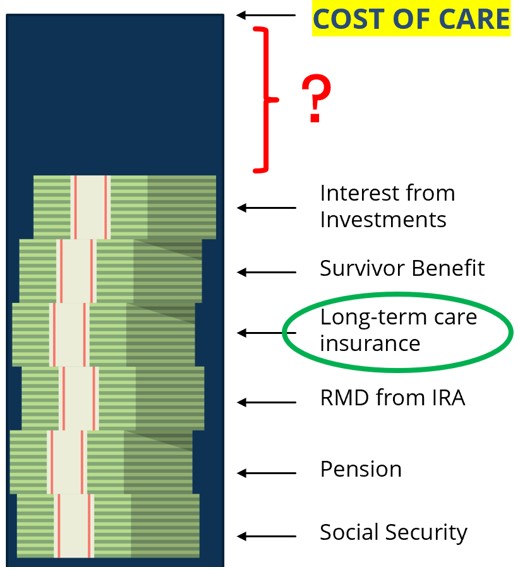

Why Do I Need to Worry About Long-Term Care Costs When I Have Long-Term Care Insurance?

"My long-term care costs are fully covered because I have long-term care insurance" is a statement I hear too frequently. Unfortunately, as this image illustrates (Source: Lifecare Affordability Plan), long-term care insurance covers only a portion of long-term care costs and services.

According to Genworth, the national average cost for assisted living is $54,000 annually, home health aides cost $62,000 annually, and nursing homes cost $108,000 annually. In some areas, the nursing home costs start much higher. Therefore, if you have an LTCI daily benefit of $200, it will only pay a portion of a $9,000 monthly fee.

The most frequent advice I give about long-term care insurance policies is: Read your policy. Too often, policyholders do not have a firm grasp of what coverages they have or how the policies work. Sometimes the policies themselves have been lost, and the only connection the policyholders have with the coverage is the annual premium notices.

If you lost your policy, get a new copy and take the time to understand your LTCI policy components. Call your long-term care insurance company and ask questions to be sure you understand what you have been paying for.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Financial adviser Tom West, CLU®, ChFC®, AIF®, founded Lifecare Affordability Plan (LCAP) to address a critical need for actionable planning that integrates finances, healthcare and senior housing. Tom has nearly 30 years of experience guiding families through financial and healthcare decisions. By bridging the gap between finance and healthcare, LCAP’s experienced team works with individuals and financial advisers to provide families with a financial strategy that meets changing healthcare needs while preserving the caregiver’s quality of life.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

7 Frugal Habits to Keep Even When You're Rich

7 Frugal Habits to Keep Even When You're RichSome frugal habits are worth it, no matter what tax bracket you're in.

-

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works Instead

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works InsteadFor retirees with a pension, traditional withdrawal rules could be too restrictive. You need a tailored income plan that is much more flexible and realistic.

-

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look Like

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look LikeThis is when you should be shifting your focus from growing your portfolio to designing an income and tax strategy that aligns your resources with your purpose.

-

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your Stress

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your StressTo be confident about retirement, consider building a safety net by dividing assets into distinct layers and establishing a regular review process. Here's how.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.