10 Worst Things to Keep in Your Wallet

Storing a spare key, your passport card or any other important item in your wallet leaves you open to identity theft — or worse.

Donna LeValley

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Nothing gets your heart and mind racing like reaching for your wallet — and discovering it’s gone. Missing. Lost. You check your car seat. The top of the dresser where you usually keep it. Did you drop it? Or were you the victim of a pickpocket? Following our advice on what not to keep in your wallet won’t eliminate that horrible feeling in the pit of your stomach, but it may lower the panic level.

If your wallet is bursting with personal and financial information, you should know that much of that information can be exploited by identity thieves. All they need to get started is your name and Social Security number. That alone can lead to bogus loan applications and the opening of fraudulent accounts. It can get worse if they can steal from your wallet your government-issued photo ID, including your passport or passport card, and doctor the image.

We contacted consumer protection experts to identify the things you should immediately purge from your wallet. Oh, and one quick tip before we dive in: Photocopy or take a quick photo on your phone both the front and back of whatever documents you continue to keep in your wallet. Put that photocopy in a safe place at home, where you can easily retrieve it. If your wallet is lost or stolen, you can at least have the information you need to quickly and easily file reports with the appropriate government agencies and financial institutions.

1. Social Security card

Losing the protection of your full Social Security number is a fast track to identity theft. Once they have the full number, identify thieves can exploit it to get loans in your name, obtain credit cards or other financial chicanery.

For that reason, identity theft experts say, never carry your Social Security card in your wallet — or even a piece of paper with your Social Security number on it. If, on rare occasions, you need it for identification purposes — say, closing on a real estate loan or filing for benefits — go straight home and stow your Social Security card back in a secure location.

Make sure nothing else in your wallet has your Social Security number on it, including other forms of identification. States can no longer display your SSN on newly issued driver’s licenses, state ID cards and motor vehicle registrations.

However, if you still have any old photo IDs listing your Social Security number, request a new ID immediately. Even if there’s an additional fee, it’s worth it to protect your identity.

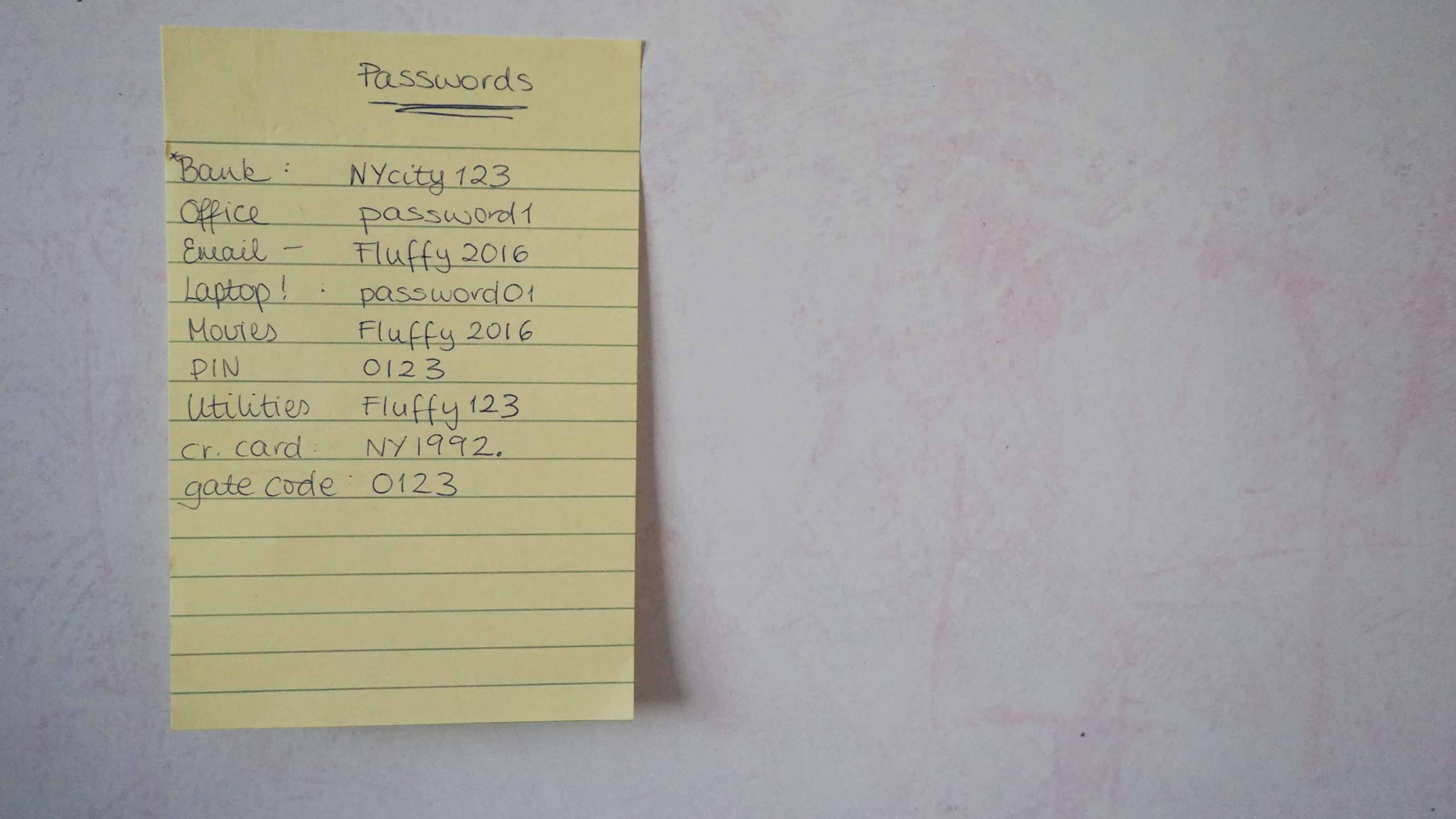

2. A password cheat sheet

We might not want to admit it, but many of us have them, somewhere — password cheat sheets. That’s because the average American uses at least seven different passwords to access everything from ATMs to credit card accounts.

The smart play, experts say, is to have individual passwords made up of unique combinations of numbers, letters and symbols that you change regularly. But how do you remember them all?

A 2023 Pew Research Center survey (the most recent data) found that 41% of U.S. adults "always, almost always, or often" write down their passwords on paper or use a digital note. And, many people carry these in their wallets, where they are easily accessible and also easy to lose or steal.

There are better options: If you have to keep passwords jotted down somewhere, keep them in a locked box in your house. You should also explore a digital password manager. One to consider is LastPass. The basic service is free, or you can upgrade to one of the other versions, starting at $3 per month. That gets you a whole lot more features and storage.

It’s also a good idea to enable two-factor authentication on any account that allows you to. You’ll enter your username and password as usual, but the account will then confirm your identity by asking you to enter a code that has been sent to your smartphone or e-mail address. Some people consider this a hassle, but if it saves you time and money, it's more than worth it.

3. Spare keys

Be careful with your home security. A lost wallet containing your spare house key along with your ID that shows your home address is a treasure map for thieves to find their way into your house. And even if your home isn’t robbed after losing a spare key, you’ll likely spend more than $100 to pay a locksmith to change the locks for peace of mind.

While putting a key under a rock or flower pot may seem safe, thieves know where to look. The best move is to keep your spare key with a relative or friend. If you’re ever locked out, it may take a little bit longer to retrieve your backup key, but that’s a relatively minor inconvenience.

Or, consider a smart digital lock such as Google’s Nest x Yale Smart Lock. It will set you back about $196, but there are also less expensive options from companies like Phillips and Kwikset.

4. Blank checks

Some of us still write the occasional check, though far fewer than back in the day. And for emergency purposes, our parents told us, always carry a blank check in your wallet, "just in case." That’s not good advice.

Blank checks are risky. In the wrong hands, a blank check could be used to quickly drain money from your bank account. And even if the stolen check isn’t used, the check has on it your bank account and routing numbers, a target for electronic withdrawals from your account.

To pile on, that blank check will also likely have your home address and maybe telephone number (and some people have added their Social Security numbers, too, another strict no-no).

The better option: Only carry with you the check or checks you think you might need immediately, and leave the checkbook at home.

5. A passport or passport card

A passport or passport card, like any government-issued photo ID, can be a weapon used against your finances if it falls into the wrong hands, ID-theft experts warn. It could be used to travel in your name, get a new copy of your Social Security card or open bank accounts.

If you’re thinking, "Who carries their passport in their wallet?" there are passport wallets with slots for cash, credit cards and more, along with the passport.

And passport cards, helpful for Americans who cross the northern or southern borders frequently, are about the same size as a driver’s license and easy to forget that you slipped it into your wallet.

When traveling in the U.S., have with you only your driver’s license or other personal ID. Leave your passport book and wallet-size passport card in a secure place at home, such as a fire-proof safe. When traveling abroad, experts advise, carry a photocopy of your passport and leave the original in a hotel safe.

6. Multiple credit cards

You could slim down that bulging wallet by rolling with fewer credit cards in it. That way, if your wallet is lost or stolen, you won’t have as many credit cards that you’ll have to cancel.

Our recommendation: Carry one rewards credit card for everyday purchases as well as a backup card for unplanned purchases or emergencies.

And as we mentioned, photocopy the front and back of everything in your wallet, or write the cancellation phone numbers or websites for your credit cards on a piece of paper. The "lost or stolen" number is typically on the back of your credit card, but if your credit card is stolen, that won’t do you any good.

7. Birth certificate

Your birth certificate, if stolen, won’t get a thief very far. But if they have it in conjunction with other types of fraudulent IDs, security experts say, thieves can do some major damage to your finances.

Be especially vigilant on the rare occasions when you’re required to carry all of your most sensitive documents at the same time. One example of that is at a mortgage closing, when you might need to bring your birth certificate, Social Security card and passport.

Don’t let them out of your sight, and take them straight home before you celebrate selling (or buying) a home. It’s not a good idea to leave them in your car either.

8. A stack of receipts

You don’t need all those receipts jammed into your wallet. While businesses have not been allowed to print on paper receipts more than the last five digits of your credit card number for years, ID-theft experts say skilled thieves could use those last five digits and merchant information on receipts to phish for the remaining numbers on your credit card (quite often, your full name, taken from the credit card you used, is also on those receipts).

Remove those receipts from your wallet daily and shred them. If you need to retain receipts for possible returns or warranties, ask the merchant to skip the paper and send you a digital receipt instead. Most retailers will.

If you have a printed receipt you need to keep, consider making it digital and storing it securely in the cloud. Apps that do this include Shoeboxed, which lets you create and categorize digital copies of your receipts and business cards.

9. Medicare card

Many retirees still have old Medicare cards with their Social Security numbers printed on them in their wallets. Carry only your new Medicare card.

Medicare has stopped issuing Medicare cards with Social Security numbers on them and replaced them with new wallet-size paper cards. The new Medicare cards have a number on it that’s unique to you.

If you have an old Medicare card with your Social Security number on it, remove it from your wallet and replace it with the new card. Shred the Medicare card that has your Social Security number on it.

10. Gift cards

Many of us carry gift cards in our wallets just in case we happen to end up in the retailer or restaurant that the card is good for. That's not such a great idea.

Retailers don't ask for ID when using gift cards, after all, because your name isn't on them (even though the Home Depot gift card you got on Father's Day does say "To Dad" on the back).

That means anyone who rifles through your lost wallet can redeem those gift cards — same as cash — no questions asked. The smarter way to use them is to leave them at home until you know for sure you are headed to that destination where you can use those gift cards. Or redeem them online.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Bob was Senior Editor at Kiplinger.com for seven years and is now a contributor to the website. He has more than 40 years of experience in online, print and visual journalism. Bob has worked as an award-winning writer and editor in the Washington, D.C., market as well as at news organizations in New York, Michigan and California. Bob joined Kiplinger in 2016, bringing a wealth of expertise covering retail, entertainment, and money-saving trends and topics. He was one of the first journalists at a daily news organization to aggressively cover retail as a specialty and has been lauded in the retail industry for his expertise. Bob has also been an adjunct and associate professor of print, online and visual journalism at Syracuse University and Ithaca College. He has a master’s degree from Syracuse University’s S.I. Newhouse School of Public Communications and a bachelor’s degree in communications and theater from Hope College.

- Donna LeValleyRetirement Writer

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Seven Things You Should Do Now if You Think Your Identity Was Stolen

Seven Things You Should Do Now if You Think Your Identity Was StolenIf you suspect your identity was stolen, there are several steps you can take to protect yourself, but make sure you take action fast.

-

The 8 Financial Documents You Should Always Shred

The 8 Financial Documents You Should Always ShredIdentity Theft The financial documents piling up at home put you at risk of fraud. Learn the eight types of financial documents you should always shred to protect yourself.

-

How to Guard Against the New Generation of Fraud and Identity Theft

How to Guard Against the New Generation of Fraud and Identity TheftIdentity Theft Fraud and identity theft are getting more sophisticated and harder to spot. Stay ahead of the scammers with our advice.

-

12 Ways to Protect Yourself From Fraud and Scams

12 Ways to Protect Yourself From Fraud and ScamsIdentity Theft Think you can spot the telltale signs of frauds and scams? Follow these 12 tips to stay safe from evolving threats and prevent others from falling victim.

-

Watch Out for These Travel Scams This Summer

Watch Out for These Travel Scams This SummerIdentity Theft These travel scams are easy to fall for and could wreck your summer. Take a moment to read up on the warning signs and simple ways to protect yourself.

-

What to Do With Your Tax Refund: 6 Ways to Bring Growth

What to Do With Your Tax Refund: 6 Ways to Bring GrowthUse your 2024 tax refund to boost short-term or long-term financial goals by putting it in one of these six places.

-

What Does Medicare Not Cover? Eight Things You Should Know

What Does Medicare Not Cover? Eight Things You Should KnowMedicare Part A and Part B leave gaps in your healthcare coverage. But Medicare Advantage has problems, too.

-

15 Reasons You'll Regret an RV in Retirement

15 Reasons You'll Regret an RV in RetirementMaking Your Money Last Here's why you might regret an RV in retirement. RV-savvy retirees talk about the downsides of spending retirement in a motorhome, travel trailer, fifth wheel, or other recreational vehicle.