The Best Monthly Dividend Stocks to Buy Right Now

Your bills come monthly. Why not your dividend checks? These are some of the best monthly dividend stocks for income planning.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

For all the changes we've experienced in recent years, some things remain regrettably the same. We all have bills to pay, and those bills generally come monthly.

Whether it's your mortgage, your car payment or even your regular phone and utility bills, you're generally expected to pay every month.

While we're in our working years, that's not necessarily a problem, as paychecks generally come every two weeks. And even for those in retirement, Social Security and (if you're lucky enough to have one) pension payments also come on a regular monthly schedule.

Unfortunately, it doesn't work that way in our investment portfolios.

But that's where monthly dividend stocks come into play.

Dividend stocks generally pay quarterly. And most bonds pay semiannually, or twice per year. These schedules make portfolio income lumpy, as dividend and interest payments often come in clusters.

Well, monthly dividend stocks can help smooth out that income stream and better align your inflows with your outflows.

"We'd never recommend buying a stock purely because it has a monthly dividend," says Rachel Klinger, president of McCann Wealth Strategies, an investment adviser based in State College, Pennsylvania.

"But," Klinger adds, "monthly dividend stocks can be a nice addition to a portfolio and can add a little regularity to an investor's income stream."

So let's take a look at eight of the best monthly dividend stocks to buy.

You'll see some similarities across the selections. That's because monthly dividend stocks tend to be concentrated in a small handful of sectors such as real estate investment trusts (REITs) and business development companies (BDCs).

These sectors tend to be more income-focused than growth-focused and sport yields that are vastly higher than the market average. But, in a market where the yield on the S&P 500 is currently 1.2%, that's certainly welcome.

The list isn't particularly diversified, so it doesn't make a complete portfolio. In other words, you don't want to overload on them. But they do allow exposure to a handful of niche sectors that add some income stability.

So consider whether these monthly dividend stocks align with your investment style.

Data is as of November 10.

STAG Industrial

- Market value: $7.3 billion

- Dividend yield: 3.8%

Monthly dividend payer STAG Industrial (STAG) proactively benefits from the rise of internet commerce.

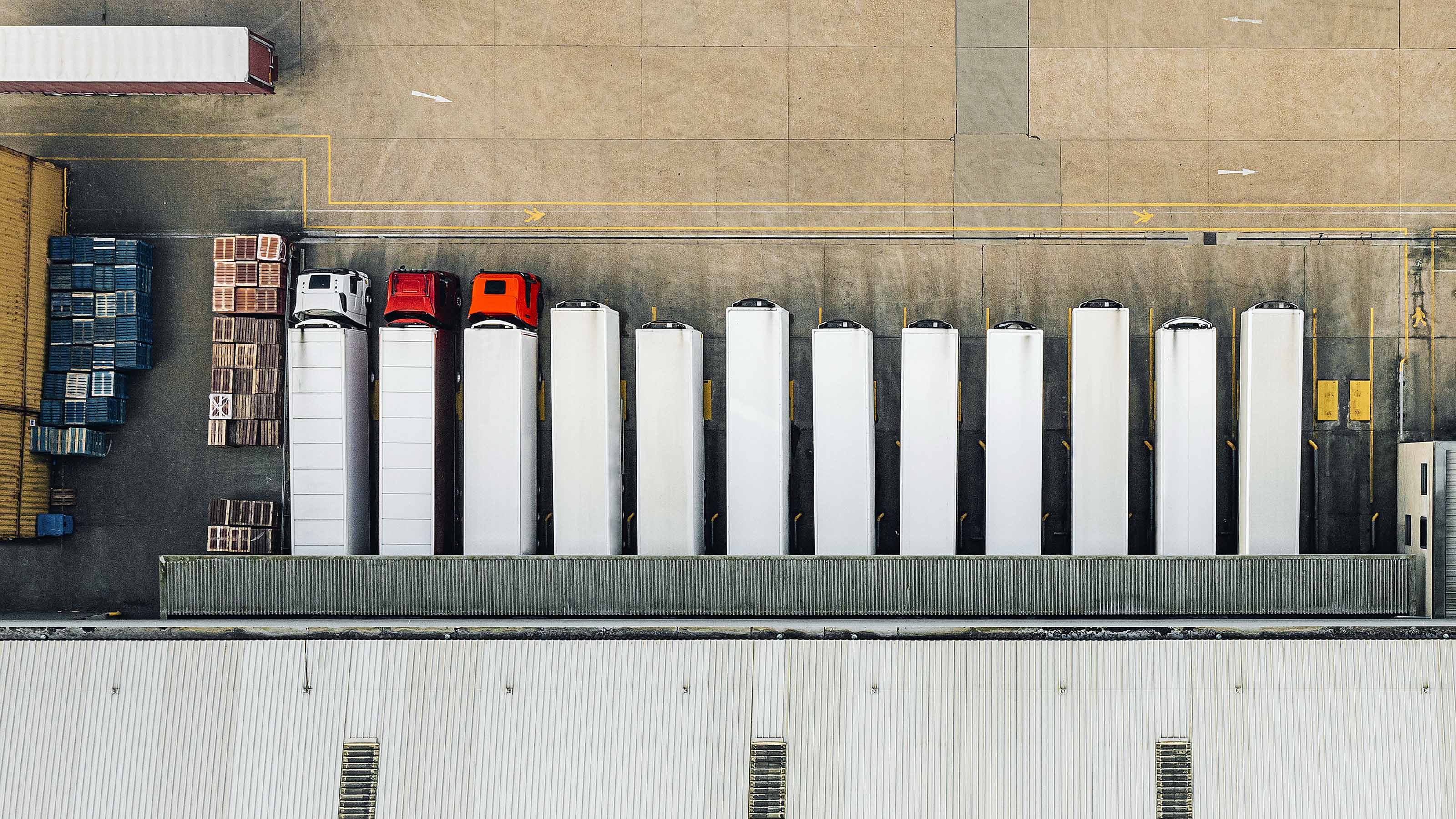

STAG invests in logistics and light industrial properties. You know those gritty warehouse properties you might see near the airport with 18-wheelers constantly coming and going?

That's exactly the kind of property that STAG Industrial buys and holds.

E-commerce is growing by leaps and bounds, it's a trend that's unlikely to slow, and STAG is well positioned to profit from it. Roughly 30% of STAG Industrial's portfolio handles e-commerce fulfillment or other activity.

In fact, Amazon (AMZN), FedEx (FDX) and DHL are among STAG's largest tenants.

We're making a larger percentage of our purchases online, but there's still plenty of room for growth. As crazy as this might sound, approximately 16% of retail sales are made online, according to the Census Bureau.

Furthermore, the logistical space is highly fragmented, and STAG's management estimates the value of its market to be around $1 trillion. In other words, it's unlikely STAG will be running out of opportunities any time soon.

STAG Industrial isn't sexy. But it's one of the best monthly dividend stocks to buy, with plenty of growth in front of it. And its 3.8% yield is competitive in this market.

Realty Income

- Market value: $51.9 billion

- Dividend yield: 5.7%

Conservative triple-net retail REIT Realty Income (O) is so well-known for its history as a monthly-dividend-paying stock that it went so far as to trademark the "The Monthly Dividend Company" as its official nickname.

Realty Income is a stock, of course, and its share price can be just as volatile as any other equity. But it's still as close to a bond as you're going to get in the stock market in terms of the safety and reliability of its payout.

It has stable recurring rental cash flows from its empire of nearly 15,600 properties spread across over 1,550 different tenants in nearly 90 separate industries throughout all 50 states, as well as Puerto Rico, the U.K. and Spain.

O focuses on high-traffic retail properties that are generally recession-proof and, perhaps more importantly, "Amazon-proof." Perhaps no business is completely free of risk of competition from Amazon and other e-commerce titans, but Realty Income comes close.

Its largest tenants include 7-Eleven, Dollar General (DG) and Dollar Tree (DLTR), among others. More than a quarter of the portfolio is in grocery stores, dollar stores and convenience stores, all of which tend to be pretty recession-proof or in some cases actually benefit from trading down in a recession.

That's good because, with the labor market slowing down, worries about a recession are lingering.

At current prices, Realty Income yields 5.7%. That's not a monster windfall, but it's much higher than the S&P 500 and the 10-year Treasury, with the latter yielding 4.09% at last check.

It's not the raw yield we're looking for here, but rather income consistency and growth. As of this writing, Realty Income has made 664 consecutive monthly dividend payments and has raised its dividend for 30 straight years – making it a proud member of the S&P 500 Dividend Aristocrats.

Since going public in 1994, Realty Income has grown its dividend at a compound annual growth rate of more than 4%, well above the current rate of inflation.

Main Street Capital

- Market value: $5.3 billion

- Dividend yield: 5.3%

Business development companies (BDCs) are where the proverbial Main Street means the proverbial Wall Street. BDCs provide debt and equity capital mostly to middle-market companies.

These are entities that have gotten a little big to get financing from bank loans and retained earnings but aren't quite big enough yet to warrant an initial public offering (IPO).

BDCs exist to bridge that gap. And the appropriately named Main Street Capital (MAIN) is a best-in-class BDC based in Houston, Texas.

Like some of the stocks on this list, Main Street is something of a turnaround play.

The past few years were not particularly easy for MAIN's portfolio companies, as many smaller firms were less able to navigate pandemic-related headwinds than their larger peers.

But the company persevered, and today it is stronger than ever.

Main Street has a conservative monthly dividend model in that it pays a relatively modest monthly dividend, but then uses any excess earnings to issue special dividends twice per year.

This keeps MAIN out of trouble and prevents it from suffering the embarrassment of a dividend cut in years where earnings might be temporarily depressed.

As far as monthly dividend stocks go, Main Street's regular payout works out to a solid 5.3%, and this does not include the special dividends. Main Street raised its monthly dividend in November and managed to throw in an additional 30 cents per share in special dividends.

Should a recession hit, it might slow down additional growth and special dividends for a few quarters, but don't expect it to slow Main Street down for long!

LTC Properties

- Market value: $1.7 billion

- Dividend yield: 6.3%

LTC Properties (LTC) is another one of the traditional REITs found on this list of the best monthly dividend stocks.

LTC is a REIT with a portfolio roughly split between senior living properties and skilled nursing facilities. The long-term demographic trends here are just about unstoppable and LTC is an attractive turnaround play going forward.

Senior living properties face less pressure from the labor shortage in that the tenants are generally younger and live independently without medical care. They also offer an attractive, active lifestyle for many seniors, and that hasn't fundamentally changed.

With many Baby Boomers now retired empty nesters, the investment case for senior living properties essentially makes itself.

Skilled nursing may take a little longer to fully recover. Home care might be a viable option for many seniors who need assistance but either can't afford or who are reluctant to live in a nursing home.

But, ultimately, there comes a point where there are few alternatives to the care of a nursing home.

Importantly, the longer-term demographic trends here are supportive of growth in LTC. The peak of the Baby Boomer generation is in its early to mid-60s today – far too young to need long-term care.

But, over the course of the next two decades, demand will continue to build as more and more boomers age into the need for these services.

And at 6.3%, LTC is one of the higher-yielding monthly dividend stocks out there.

Gladstone Commercial

- Market value: $531.5 million

- Dividend yield: 10.9%

For another gritty industrial play, consider the shares of Gladstone Commercial (GOOD). Gladstone Commercial, like STAG, has a large portfolio of logistical and light industrial properties.

Approximately 63% of its rental revenue come from industrial properties, with another 33% coming from office real estate. The remaining 4% is split between retail properties (3%) and medical offices (1%).

Such a diversified portfolio has had little difficulty navigating the crazy volatility of the past few years.

As of September, the REIT had a portfolio of 151 properties and 110 tenants spread across 27 states. GOOD's occupancy stands at 99.1% and has never dipped below 95.0%.

No tenant makes up more than 6% of annualized rent, and nearly half of its tenants are publicly traded companies.

Gladstone Commercial has also been one of the most consistent monthly dividend stocks, paying shareholders uninterrupted since January 2005.

That's not a bad run. What's more, GOOD currently yields a juicy 10.9%.

EPR Properties

- Market value: $3.9 billion

- Dividend yield: 6.9%

EPR Properties (EPR) owns a diverse and eclectic portfolio of amusement parts, ski parks, movie theaters, amusement parks, "eat and play" properties and a host of others.

In other words, it focuses on experiences over things.

The company was a consistent dividend payer and raiser pre-pandemic. But with its tenants facing an existential crisis, EPR eliminated its dividend in 2020.

That cut was short-lived, however, and the REIT reinstated its monthly dividend in July 2021 and has raised it each year since. The shares now yield an attractive 6.9%.

EPR is not without its risks.

The U.S. economy may still enter a recession, and when times get tough, discretionary spending often takes a hit.

Inflation doesn't help on that front, either.

Still, if you’re willing to take a modest amount of risk, EPR is a solid choice with an attractive yield and the potential for significant dividend growth in the years ahead.

Dynex Capital

- Market value: $2.0 billion

- Dividend yield: 15.0%

Dynex Capital (DX) is another mortgage REIT.

Approximately 98% of its portfolio is invested in agency residential mortgage-backed securities (MBS) – bonds made out of the mortgages of ordinary Americans. But it also has exposure to commercial mortgage-backed securities (CMBS) and a small allocation to non-agency securities.

It's important to remember that the mortgage REIT sector has been a roller coaster in recent years. In the upheavals of the pandemic, many mortgage REITs took catastrophic losses and some failed altogether.

DX is one of the survivors. And, frankly, any mortgage REIT that could survive the chaos in the bond markets of recent years is one that can likely survive the apocalypse.

Dynex sports a jaw-dropping yield of 15.0%, which makes it one of the best monthly dividend stocks to buy if you're looking for seriously high yield.

AGNC Investment

- Market value: $11.0 billion

- Dividend yield: 14.1%

AGNC Investment (AGNC) is a REIT, strictly speaking, but it's very different from the likes of Realty Income, STAG or any of the others covered on this list of monthly dividend stocks.

Rather than own properties, AGNC owns a portfolio of mortgage securities. This gives it the same tax benefits of a REIT – no federal income taxes so long as the company distributes at least 90% of its net income as dividends – but a very different return profile.

Mortgage REITs (mREITs) are designed to be income vehicles, with capital gains not really much of a priority. As such, they tend to be monster yielders. Case in point: AGNC yields 14.1%.

If you say "AGNC" out loud, it sounds a lot like "agency." There's a reason for that.

AGNC invests exclusively in agency mortgage-backed securities, meaning bonds and other securities issued by Fannie Mae, Freddie Mac, Ginnie Mae or the Federal Home Loan Banks.

This makes it one of the safest plays in this space.

The massive spike in interest rates in recent years wreaked havoc on a lot of income investments, particularly mortgage REITs like AGNC.

Still, this gives investors a chance to buy one of the best monthly dividend stocks at a discount.

Unlike equity REITs, which are backed by real properties, mortgage REITs really are at the mercy of market yields. If the yield curve re-inverts, AGNC might be at risk of a dividend cut. Dividend cuts are common in this space.

Still, with its very healthy yield, the company could trim its payout and still be very competitive.

Related content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Charles Lewis Sizemore, CFA is the Chief Investment Officer of Sizemore Capital Management LLC, a registered investment advisor based in Dallas, Texas, where he specializes in dividend-focused portfolios and in building alternative allocations with minimal correlation to the stock market.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

Don't Bury Your Kids in Taxes: How to Position Your Investments to Help Create More Wealth for Them

Don't Bury Your Kids in Taxes: How to Position Your Investments to Help Create More Wealth for ThemTo minimize your heirs' tax burden, focus on aligning your investment account types and assets with your estate plan, and pay attention to the impact of RMDs.

-

Are You 'Too Old' to Benefit From an Annuity?

Are You 'Too Old' to Benefit From an Annuity?Probably not, even if you're in your 70s or 80s, but it depends on your circumstances and the kind of annuity you're considering.

-

In Your 50s and Seeing Retirement in the Distance? What You Do Now Can Make a Significant Impact

In Your 50s and Seeing Retirement in the Distance? What You Do Now Can Make a Significant ImpactThis is the perfect time to assess whether your retirement planning is on track and determine what steps you need to take if it's not.

-

Your Retirement Isn't Set in Stone, But It Can Be a Work of Art

Your Retirement Isn't Set in Stone, But It Can Be a Work of ArtSetting and forgetting your retirement plan will make it hard to cope with life's challenges. Instead, consider redrawing and refining your plan as you go.

-

The Bear Market Protocol: 3 Strategies to Consider in a Down Market

The Bear Market Protocol: 3 Strategies to Consider in a Down MarketThe Bear Market Protocol: 3 Strategies for a Down Market From buying the dip to strategic Roth conversions, there are several ways to use a bear market to your advantage — once you get over the fear factor.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

The Best Precious Metals ETFs to Buy in 2026

The Best Precious Metals ETFs to Buy in 2026Precious metals ETFs provide a hedge against monetary debasement and exposure to industrial-related tailwinds from emerging markets.

-

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works Instead

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works InsteadFor retirees with a pension, traditional withdrawal rules could be too restrictive. You need a tailored income plan that is much more flexible and realistic.