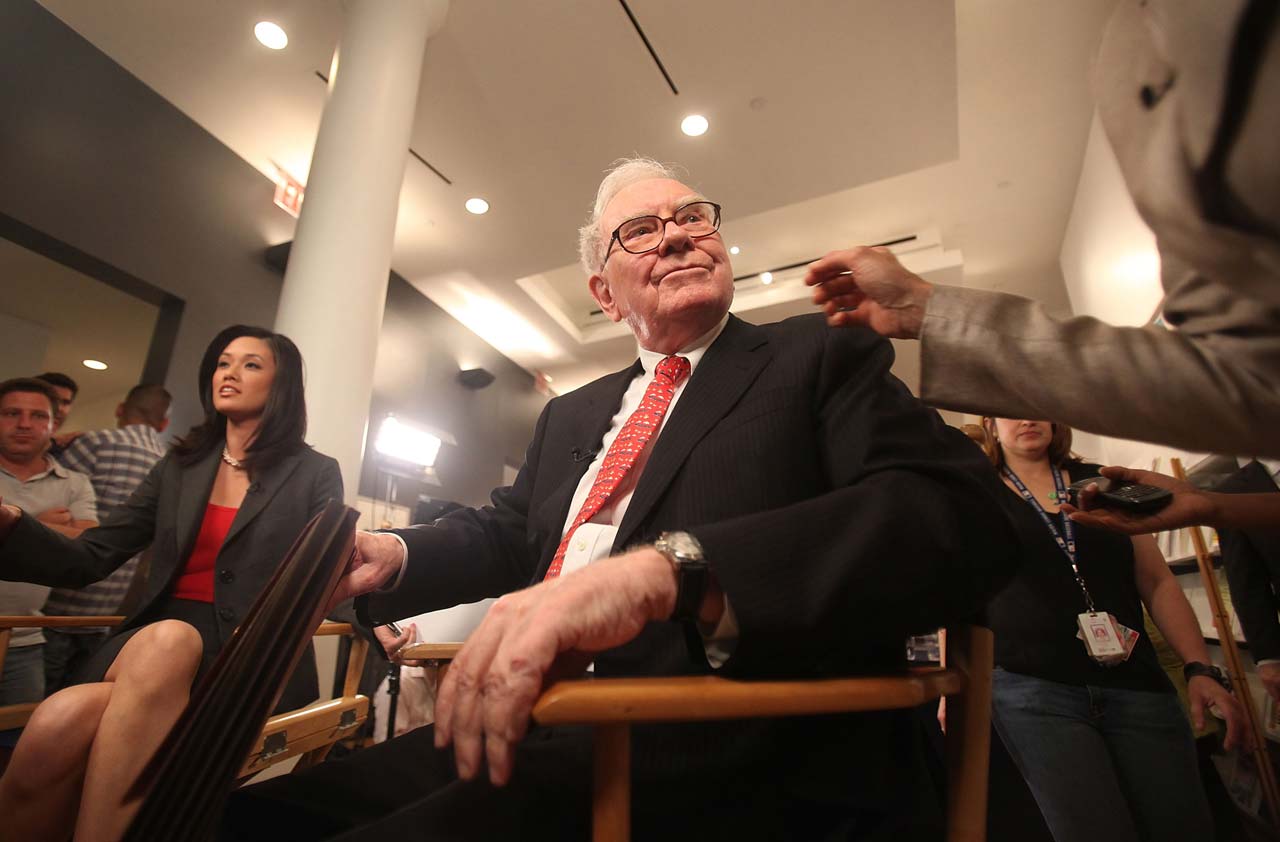

8 Stocks Warren Buffett Is Buying (or Should Be)

Following billionaire investor Warren Buffett into stocks he owns has often been a profitable strategy over the past few decades.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Following billionaire investor Warren Buffett into stocks he owns has often been a profitable strategy over the past few decades. But reversing the order—buying a stock before Buffett buys it—can be even more fun and, potentially, more rewarding.

With that in mind, we went prospecting in two groups of companies: stocks that Berkshire Hathaway (symbol BRK.B, $146.11), Buffett’s holding company, has been buying recently, and shares that Buffett doesn't hold but we think he might buy. We looked for the things he looks for: companies that are leaders in their industries, that have a strong commitment to sharing profit with investors, and whose stocks sell for relatively low prices compared with earnings and underlying asset value.

A few caveats: First, Buffett's stock-picking abilities are legendary, but even the Oracle of Omaha has had some clunkers. Second, many of Berkshire's stock picks are now made by Buffett's two investing deputies, Todd Combs and Ted Weschler, not Buffett himself. And third, anyone guessing which stocks might be attractive to Berkshire is doing just that—guessing. Buffett hasn't sought our advice, and we're not waiting for the phone to ring.

Here's a look at four stocks that Berkshire has purchased recently, and four that we humbly suggest the master should consider.

Within each category, stocks are listed in order of market capitalization. Prices and related figures are as of April 22, 2016; price-earnings ratios are based on earnings estimates for the next four quarters, including the current one. The four stocks already owned by Berkshire Hathaway saw purchases since October 1, 2015, according to filings with the Securities and Exchange Commission.

Wells Fargo

- Share price: $50.62

- 52-week low/high: $44.50 - $58.77

- Market capitalization: $254.0 billion

- Price-earnings ratio: 12

- Dividend yield: 3.0%

- Ownership status: Berkshire already owns it

- QUIZ: How Well Do You Really Know Warren Buffett?

If there's one stock that epitomizes Buffett's devotion to companies he likes, it's probably Wells Fargo (WFC). The banking titan has been a Buffett holding since 1989 and now is Berkshire Hathaway's second-biggest stock bet, with 479 million shares worth $24 billion. After the stock slumped with the rest of the market late last summer, Berkshire once again stepped up to buy more, adding 9.4 million shares in the fourth quarter of 2015.

But bank stocks are off to a rough start in 2016. Wells slumped to $44.50 in early February, down 24% from its 52-week high and at a two-year low. Investors have had plenty of legitimate reasons to sell, including the weak global economy, rising energy-loan defaults as crude oil prices have crashed, and new calls to break up the megabanks—a view even espoused by Neel Kashkari, the new president of the Minneapolis Federal Reserve Bank. But Wall Street's biggest concern may be that the Fed will stop raising short-term interest rates if the U.S. economy slows further. Higher rates were expected to boost profits at Wells and other banks in 2016 because rates on loans typically rise faster than the rates banks pay depositors. As it is, Wells's earnings growth is expected to be meager this year. Analysts on average estimate earnings of $4.12 per share, down three cents from 2015.

Still, none of that is likely to change Buffett's long-term view of Wells, which he considers one of the world's best-managed big banks. When he says his favorite holding period for an investment is "forever," he's almost certainly thinking about Wells. Investors who want to tag along at this point get a stock selling for a modest 12 times estimated 2016 earnings (compared with 18 for Standard & Poor’s 500-stock index) and delivering a 3.0% dividend yield (compared with 2.1% for the S&P).

Phillips 66

- Share price: $87.98

- 52-week low/high: $69.79 – $94.12

- Market capitalization: $46.3 billion

- Price-earnings ratio: 15

- Dividend yield: 2.5%

- Ownership status: Berkshire already owns it

At a time when many investors worldwide are focused on whether crude oil prices have finally bottomed, Buffett’s hefty purchases of Phillips 66 (PSX) shares recently were bound to grab headlines. Berkshire has reported buying 14 million shares of the oil refiner since January 1, adding to the huge stake it took last year. Berkshire now controls 14.3% of Phillips, worth $6.4 billion. But investors trying to read a message about oil's next move in Buffett's latest Phillips purchases should recall what he said last year about his initial stake. He told CNBC in September that "we're not buying it as a refiner and we're certainly not buying it as an integrated oil company. We're buying it because we like the company and we like the management very much." That's classic Buffett: buying a business for the brains behind the physical assets.

What Phillips investors get, though, is in fact a major oil refiner, operating 14 refining facilities. "But it's a company that is more than just a 'downstream' refiner," says David Kass, a finance professor at the University of Maryland-College Park who tracks Buffett and is a Berkshire shareholder.

Phillips sees its future in its other businesses, which include natural gas purification, gas pipelines, and production of olefins, the building blocks of many plastics and fibers. While many energy firms fell deep into the red in 2015, Phillips earned $7.67 per share on revenue of $101 billion. In 2016, however, analysts on average expect profit to fall to $5.89 per share because lower prices for refined gasoline have caught up with the cheap prices Phillips pays for crude. At the stock’s current price, investors who want to join Buffett in Phillips would pay about the same price Berkshire has paid this year and would get a 2.5% dividend yield. If you think Buffett probably knows some good things about Phillips that you don't, this looks like a fairly low-risk way of hitching a ride with him.

Deere & Co.

- Share price: $82.60

- 52-week low/high: $70.16 - $98.23

- Market capitalization: $26.1 billion

- Price-earnings ratio: 20

- Dividend yield: 2.9%

- Ownership status: Berkshire already owns it

- SEE ALSO: The Next Great Dividend Stocks of the S&P 500

Berkshire Hathaway was a big buyer of farm machinery leader Deere (DE) in the fourth quarter of 2015, adding 5.8 million shares to a stake Buffett Co. have had since at least 2014. Berkshire now holds 22.9 million shares, or 7.2% of the company. But if Buffett liked the stock last quarter, he should have loved it by mid January, when the price hit a 3 1/2-year low of $70.16.

The shares have tumbled 16% from their 52-week high as Deere’s outlook has worsened because of weak crop prices. As farmers earn less from important crops such as corn and wheat, their income dives—and with it, their ability to buy new tractors, harvesters and other equipment. Deere reported earnings of 80 cents per share for the quarter that ended January 31, a drop of 28% from the same period a year earlier. Sales slid 13%, to $5.5 billion. Worse, the company projected a 10% decline in sales for its full fiscal year, which ends next October, a grimmer forecast than Wall Street had expected. Even so, Deere still thinks it can earn about $4 per share in the fiscal year. That may be key to keeping Buffett aboard for an eventual rebound. Helped by cost cutting, Deere's results are "much better than we have experienced in previous downturns," CEO Samuel Allen told investors in the report on November-January results.

Deere also boasts another attribute that Buffett cherishes: The company has been disciplined about returning capital to shareholders, including via stock buybacks, which have shrunk total shares outstanding by 29% over the past 10 years. Research firm Morningstar, which grades companies for their stewardship of investors' capital, rates Deere as "exemplary"—a grade given to just 12% of the companies that Morningstar tracks.

Axalta Coating Systems

- Share price: $29.84

- 52-week low/high: $20.67 - $36.50

- Market capitalization: $7.1 billion

- Price-earnings ratio: 24

- Dividend yield: 0%

- Ownership status: Berkshire already owns it

One of Buffett's cardinal investing rules is to avoid an industry’s weak players. He wants strong franchises that lead rather than follow. That's what Axalta Coating Systems (AXTA) brings to Buffett's table. The 150-year-old company, once part of DuPont (DD, $65.97), has about 25% of the global market for paint and other coatings used in auto repair and refinishing, outselling such rivals as PPG Industries (PPG, $113.19) and BASF (BASFY, $79.92). Berkshire initially bought 20 million Axalta shares from controlling investor Carlyle Group in April 2015, and it has added more since, including 124,000 shares in the fourth quarter, bringing its stake to 9.8%.

So far this year, Axalta's shares have slid with the rest of the market. They fell as low as $20.67 in February, down from a peak of $36.50 last summer. The stock has rebounded somewhat since the company reported fourth-quarter results. Excluding the depressing effect of the U.S. dollar's strength against other currencies, Axalta's global sales rose 4.5% in the fourth quarter, to $1 billion. The company earned 16 cents per share, compared with a loss of one cent per share a year earlier.

One issue facing Axalta is the need to reduce heavy debt taken on in its split from DuPont. That debt obviously didn't deter Berkshire from investing in the firm, but it limits Axalta's near-term earnings power. Over the longer term, a key question is whether self-driving cars will reduce accidents and therefore demand for auto-body repairs. The minds at Berkshire, of course, know all this — and still chose to become a major Axalta shareholder, adding it to a stable of auto-related investments that includes lubricants firm Lubrizol (a fully owned Berkshire subsidiary), a 6.2% stake in brake manufacturer Wabco Holdings (WBC, $113.50), a 3.3% stake in General Motors (GM, $32.18) and total ownership of the ubiquitous Geico insurance business.

Spectra Energy Partners

- Share price: $49.41

- 52-week low/high: $36.21 - $55.95

- Market capitalization: $14.5 billion

- Price-earnings ratio: 14

- Dividend yield: 5.2%

- Ownership status: Berkshire should buy it

- SEE ALSO: 7 Energy Stocks to Buy While Oil Prices Are Cheap

As energy prices plunged from the middle of 2014 into early 2016, it was inevitable that investors would start dumping anything tied to the industry—even stocks of companies that had little exposure to oil and gas prices. One such victim was Spectra Energy Partners (SEP), a master limited partnership that owns major natural gas pipelines and storage facilities in the East and the South. MLPs are set up to pay their owners whatever cash flow the business doesn't need for debt service or capital spending. Spectra's shares, or units, slid from $60.07 in 2014 to a low of $36.21 last year, even though most of Spectra's revenue comes from set fees paid by gas customers under long-term contracts. The units have since rebounded as more investors have caught on, but the company still pays a hefty yield of 5.42% based on the current annualized distribution of $2.555 per unit. What's more, brokerage RBC Capital projects that Spectra's distributions will jump 8.1% this year and 7.5% in 2017. For Buffett, who appreciates rising dividends, Spectra would seem to be an alluring prospect.

Yet instead of buying battered energy MLPs, Buffett's Berkshire Hathaway went another route: It snapped up 26 million shares of Kinder Morgan (KMI, $18.12) last quarter. The attraction? Kinder is the largest U.S. energy infrastructure firm, with pipelines and other facilities nationwide. But it isn't an MLP. When Kinder's stock crashed last year on worries about high debt levels, the firm bit the bullet and slashed its dividend by 75% in December, aiming to use the savings to pay down debt.

Why would Berkshire move in? Perhaps because it's easy to believe that the worst is over for Kinder, and buyers now are getting premier energy assets in the U.S. at a deeply depressed price. Also, MLPs can complicate your tax return (don't buy one without consulting your tax adviser), but Kinder avoids that. Kinder’s current yield of 6.9% is above Spectra's and may make more sense than Spectra for investors who believe Berkshire has flagged a great long-term bargain.

Alliance Data Systems

- Share price: $205.99

- 52-week low/high: $176.63 - $308.78

- Market capitalization: $12.2 billion

- Price-earnings ratio: 12

- Dividend yield: 0%

- Ownership status: Berkshire should buy it

One of Buffett's classic bits of investment advice is to "be greedy when others are fearful." Some Wall Street analysts believe that shares of Alliance Data Systems (ADS) have been wrongly trashed by fearful investors. Alliance, which had $6.4 billion in revenues last year, operates mainly in two businesses. One is managing private-label credit cards, such as those offered by major retailers. The other is providing data-driven marketing services—mainly, tracking consumers' purchases to help merchants target their marketing to keep customers coming back. As worries about the weak global economy have deepened lately, financial stocks have been hit hard because of fears that loan losses could surge, including on credit cards. Alliance's shares crashed from a high of $312 in 2015 to a low of $176.63 in February, before rebounding a bit recently.

Ramsey El-Assal, an analyst at brokerage Jefferies, says the stock's plunge is "baking in severe credit losses" that are unlikely to materialize. As soon as that scare abates, he said, the stock should recover as investors focus on the "resurgence" of private-label credit cards that Alliance is riding, and on merchants' rising demand for the firm's data-based marketing programs. Based on analysts’ average estimates, Alliance in 2016 is expected to post “core” earnings of $16.81 per share this year, up 12% from 2015. Core earnings adds back certain noncash expenses. Using that measure, the stock's 2016 price-earnings ratio is a modest 12.

If Alliance's card business is as strong as analysts believe, that could impress Buffett, who knows something about the industry: Berkshire owns a 15.3% stake in American Express (AXP, $65.93) and small stakes in card processors MasterCard (MA, $97.45) and Visa (V, $79.11). But what might impress Buffett most is Alliance's track record of returning cash to investors. Via buybacks, Alliance has shrunk the number of shares outstanding by 24% over the past 10 years.

Harley-Davidson

- Share price: $48.57

- 52-week low/high: $36.36 - $60.67

- Market capitalization: $8.9 billion

- Price-earnings ratio: 12

- Dividend yield: 2.9%

- Ownership status: Berkshire should buy it

- SEE ALSO: 9 Great Dividend Stocks for 2016

Buffett doesn't own shares in the legendary U.S. motorcycle manufacturer, but for years some analysts have repeatedly raised the question: Why not? That talk may have begun in the aftermath of the 2008 financial crash, when Buffett stepped in to help Harley-Davidson (HOG) survive — for a price. Harley needed a loan so it could keep offering financing to its customers. Berkshire agreed to a $300 million, five-year credit deal. The interest rate: a steep 15%. Buffett might wish he had bought some Harley stock, too. The shares briefly fell below $10 in 2009, then went screaming higher through 2013, peaking at $74.13 in 2014.

Since then, however, the stock has been cut in half as sales and earnings have stagnated. The dollar's strength since the spring of 2014 has given foreign cycle makers a leg up in the competition. And some analysts worry that Harley hasn't done enough to court younger customers, as its core fan group of aging males gets, well, more aged. "Now is the time for us to dial things up," CEO Matt Levatich told investors in October. That dial-up includes a sharp rise in marketing and revved-up spending on new bike models. Wall Street analysts on average see sales of $5.4 billion in 2016 and profit of $3.99 per share, up 8% from last year's depressed results.

Like Coke, Deere and See’s Candies, Harley is the kind of iconic brand that Buffett loves to own, says Berkshire-watcher Kass. Brokerage Robert W. Baird & Co. says that Harley checks another one of Buffett's favorite boxes: The firm is committed to returning capital to shareholders through stock buybacks and dividends. With the March payment, the dividend rate rises 13%. Finally, there's this interesting side note: Berkshire last year bought Detlev Louis Motorrad-Vertriebs, a major German retailer of clothing … for bikers.

Harman International

- Share price: $88.27

- 52-week low/high: $66.20 - $146.99

- Market capitalization: $6.3 billion

- Price-earnings ratio: 13

- Dividend yield: 1.6%

- Ownership status: Berkshire should buy it

- SEE ALSO: 3 Things You Didn't Know About Warren Buffett

The sound-system giant has a number of key attributes that might attract maestro Buffett. Harman International (HAR) owns a number of well-known brands, including Harman Kardon, JBL and Infinity. But its largest business now is technology systems for the "connected car." That means one platform that integrates high-quality sound, the Internet, safety features, cybersecurity and navigation aids. CEO Dinesh Paliwal expects to double Harman's annual sales, which were $6.2 billion in the fiscal year that ended last June, over the next five years as cars get loaded with more tech. But some investors have gotten cold feet, fearful that despite Harman's relationships with major automakers, it might lose the connected-car race to much bigger players, such as Apple (AAPL, $105.68). As a result, Harman stock has lost more than 40% over the past year

Harman's fans say the drop is a gift to bargain hunters. Analysts on average estimate that Harman will earn $6.46 per share in the fiscal year that ends this June, which would be a 13% gain from fiscal 2015. The stock sells at a modest 13 times estimated-year ahead earnings.

Brokerage William Blair says that mid-priced cars now are the biggest source of orders for Harman's systems, indicating that demand has broadened beyond the luxury-car niche. Brokerage Barclays calls Harman "the best pure-play option to capitalize on growth in infotainment." Why might that appeal to Berkshire? Harman is at the crossroads of two industries Berkshire has favored. One is autos (see Axalta Coating Systems). The other is entertainment. Berkshire has stakes in content providers including Liberty Media (LMCA, $18.72), Twenty-First Century Fox (FOXA, $30.93) and Media General (MEG, $17.26). Harman would be an interesting complement to those lineups.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

The New Fed Chair Was Announced: What You Need to Know

The New Fed Chair Was Announced: What You Need to KnowPresident Donald Trump announced Kevin Warsh as his selection for the next chair of the Federal Reserve, who will replace Jerome Powell.

-

January Fed Meeting: Updates and Commentary

January Fed Meeting: Updates and CommentaryThe January Fed meeting marked the first central bank gathering of 2026, with Fed Chair Powell & Co. voting to keep interest rates unchanged.

-

The December CPI Report Is Out. Here's What It Means for the Fed's Next Move

The December CPI Report Is Out. Here's What It Means for the Fed's Next MoveThe December CPI report came in lighter than expected, but housing costs remain an overhang.

-

How Worried Should Investors Be About a Jerome Powell Investigation?

How Worried Should Investors Be About a Jerome Powell Investigation?The Justice Department served subpoenas on the Fed about a project to remodel the central bank's historic buildings.

-

The December Jobs Report Is Out. Here's What It Means for the Next Fed Meeting

The December Jobs Report Is Out. Here's What It Means for the Next Fed MeetingThe December jobs report signaled a sluggish labor market, but it's not weak enough for the Fed to cut rates later this month.

-

The November CPI Report Is Out. Here's What It Means for Rising Prices

The November CPI Report Is Out. Here's What It Means for Rising PricesThe November CPI report came in lighter than expected, but the delayed data give an incomplete picture of inflation, say economists.

-

The Delayed November Jobs Report Is Out. Here's What It Means for the Fed and Rate Cuts

The Delayed November Jobs Report Is Out. Here's What It Means for the Fed and Rate CutsThe November jobs report came in higher than expected, although it still shows plenty of signs of weakness in the labor market.

-

December Fed Meeting: Updates and Commentary

December Fed Meeting: Updates and CommentaryThe December Fed meeting is one of the last key economic events of 2025, with Wall Street closely watching what Chair Powell & Co. will do about interest rates.