Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

When it comes to wedding gifts, it’s not just the thought that counts. The money counts, too. The average wedding guest will spend $160 on a gift, according to The Knot. You’re wasting your money by giving gifts that couples don’t want and won’t use.

The safe course, naturally, is to stick to the couple’s gift registry. “The key to giving a good wedding gift is pretty simple: Get the couple what they want and what they have asked for,” said Sarah Trotter of Lasting Impressions Weddings of Minnetonka, Minnesota. Nothing on the registry you like or can afford? Then give cash as a wedding gift, said Trotter.

Many guests agree. Only three out of 10 wedding gifts are not from the registry, according to a survey done by The Loupe, the blog of the jewelry company Shane Co. Nearly half of those surveyed said they gave tangible gifts, while a whopping 38.6% went with cash.

The Knot advises spending $200 on gifts for close family and friends, between $50-$100 for colleagues and coworkers, and $75-$175 for loose acquaintances.

Here’s a look at some of the worst wedding gifts to give, based on feedback from wedding experts and wedding participants. Consider yourself warned.

1. Pets

For Jim and Pam’s wedding on the hit TV show The Office, colleague Dwight Schrute gave the couple turtle boiling pots and turtle bibs to go along with live turtles (which, thankfully, escaped). But that’s a sitcom and this is, well, reality.

“While they may look cute and cuddly, pets do not make a good wedding gift,” said Sacha Patires, event planner and designer at Whimsical Weddings & Events of Oklahoma City. “Newlyweds do not need the responsibility or financial obligation that comes with a new pet.”

An alternative? “If you are looking for a gift to give the animal-loving couple,” Patires said, “consider putting together a canine or feline gift basket with toys and treats for [their current pets].”

2. Anything matching

Stay away from gifts that are branded his-and-her or his-and-his or hers-and-hers. “Couples have started their life together at their wedding ceremony, but it does not need to be represented on matching shirts or bedding,” said Trotter.

Added Patires, “Not every couple thinks that it is cute to look like ‘twinkies’ by wearing identical or matching items. This is a choice that is best made and selected by the couple if they want to do it.” As an alternative, she suggested putting together a gift basket with mugs, coffee, hot chocolate and sweets. “It will be used more than matching T-shirts.”

3. Anything monogrammed

By and large, couples and wedding planners say that unless you absolutely, positively know what monogram the couple is going to use, don’t give monogrammed… anything.

One bride says she received monogrammed towels that said “Mary” on them. Not only is her name not “Mary,” there’s not even an M in the chosen family name.

4. Anything traditional

Sorry to upset traditionalists, but wedding planners say stay away from china, crystal and similar tried-and-true “forever” items — unless the couple has specifically asked for them. “I know that it is traditional and a lot of people really appreciate the quality of this gift,” said Trotter. “However, this is not a good idea for a couple that does not have a lot of storage space or is planning to move a few times before getting their ‘forever home.’”

Plus, as many married (and once-married) folks will tell you, a lot of those precious items are one and done, taken out one day and put away forever — until divorce or downsizing, when they are then off-loaded.

5. Exercise equipment

Hint much? Don’t gift exercise equipment for a number of reasons, wedding planners say, but above all, because your intentions could be misconstrued. That and the couple may not have room for the equipment, or like the type of exercise equipment, you’ve chosen. Or, they may prefer the gym to exercising at home, and already have a membership.

An alternative? “Check the couple's registry to see if they have food-related or kitchen items on their registry,” said Patires. “If so, you can put together a healthy, nutritious gift basket by choosing a few kitchen items from their [registry] website and pairing it with non-perishable healthy food items.”

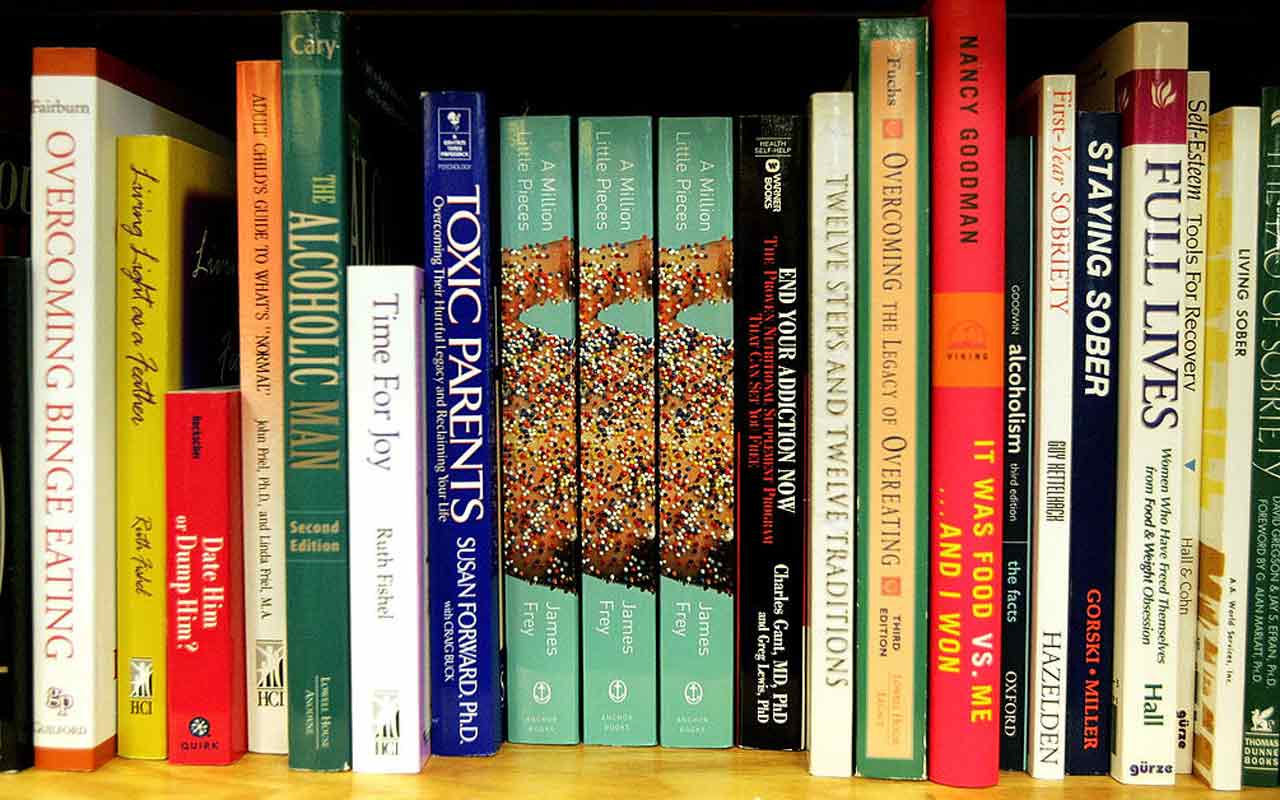

6. Self-help books

Like exercise equipment, the gifting of self-help books, while done with good intentions, may not be well-received. Same goes for anything related to relationship advice or having children.

Instead, focus on fun experiences the newlyweds can share. “Purchase a gift that is something the couple can do together,” said Patires. “Research the city the couple lives in and see what kind of classes you can find. Some examples include: dance, rock climbing, cooking or painting. Then buy them a gift certificate.”

7. Home decor

Table the thought. Buying furniture as a gift has multiple risks. The item might not physically fit in the home or it might not match the couple’s style. The same goes for art or other home decor. Your taste for the finer things in Elvis-on-velvet may not be matched by the newlyweds’.

If you can’t suppress your inner interior decorator, at least start with the wedding registry. “Find out where the couple is registered to see if they have any furniture or home decor on their registry,” said Patires. “Couples love receiving gifts for items they have put on their registry, and you know they will like it since they picked it out.”

9. Decorations to use at the wedding

Come on now, really? You want to chip in at the last minute with your fashion-forward ideas for decorating your bestie's big day? Don't.

Said Patires: "The bride and groom have spent countless hours creating the design for their wedding. It is unlikely that the gift that you may want for them to incorporate will work with the plan they have created. It is not nice to make them feel obligated to use it either. Leave the planning to the couple and let them get what they need for their wedding."

10. Baby gifts

The focus is on the soon-to-be-wed couple, not any offspring they may (or may not) be planning. But, it happens, wedding planners say.

"Soon after the wedding, and sometimes at the wedding, people start asking, 'So, when are you going to have a baby?' Baby gifts have no place at a wedding," said Patires. "Instead, buy the couple something for just the two of them. Let the newlyweds enjoy being married for a while. Getting married is enough of an adjustment without the added pressures of what the future will hold."

11. Nothing

You're all they need, am I right? No. It's just bad juju to show up at a wedding you're invited to and offer no gifts, other than your good looks.

Don't bring nothing.

"This is probably the worst gift of all," said Patires. "I know you may feel like your presence at the wedding is enough, but you should really get a gift, as well."

Related Content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Bob was Senior Editor at Kiplinger.com for seven years and is now a contributor to the website. He has more than 40 years of experience in online, print and visual journalism. Bob has worked as an award-winning writer and editor in the Washington, D.C., market as well as at news organizations in New York, Michigan and California. Bob joined Kiplinger in 2016, bringing a wealth of expertise covering retail, entertainment, and money-saving trends and topics. He was one of the first journalists at a daily news organization to aggressively cover retail as a specialty and has been lauded in the retail industry for his expertise. Bob has also been an adjunct and associate professor of print, online and visual journalism at Syracuse University and Ithaca College. He has a master’s degree from Syracuse University’s S.I. Newhouse School of Public Communications and a bachelor’s degree in communications and theater from Hope College.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

The Cost of Leaving Your Money in a Low-Rate Account

The Cost of Leaving Your Money in a Low-Rate AccountWhy parking your cash in low-yield accounts could be costing you, and smarter alternatives that preserve liquidity while boosting returns.

-

This Is How You Can Land a Job You'll Love

This Is How You Can Land a Job You'll Love"Work How You Are Wired" leads job seekers on a journey of self-discovery that could help them snag the job of their dreams.

-

We Inherited $250K: I Want a Second Home, but My Wife Wants to Save for Our Kids' College.

We Inherited $250K: I Want a Second Home, but My Wife Wants to Save for Our Kids' College.He wants a vacation home, but she wants a 529 plan for the kids. Who's right? The experts weigh in.

-

4 Psychological Tricks to Save More in 2026

4 Psychological Tricks to Save More in 2026Psychology and money are linked. Learn how you can use this to help you save more throughout 2026.