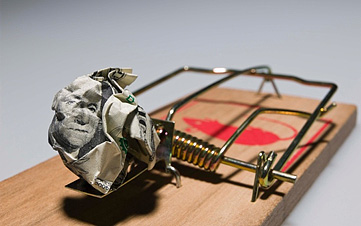

12 Smart Year-End Tax Moves to Make Now

2014 has been a prosperous year for taxpayers who own stock and mutual funds outside of their retirement accounts.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

2014 has been a prosperous year for taxpayers who own stock and mutual funds outside of their retirement accounts. But come April 2015, you’ll probably have to share some of your bull-market bounty with the IRS.

Smart tax planning now can help you reduce the taxes you’ll owe on your investment gains, and other types of income, too.

Review Your Portfolio

Allowing taxes to dictate your investment strategy is rarely a good idea. But if you’re already considering selling appreciated securities or other assets, cutting them loose by year-end could save you money.

If you’re in the 15% tax bracket, you’ll pay 0% on long-term capital gains. In 2014, you’re eligible for the 0% capital-gains rate if your taxable income is $36,900 or less if you are single, or $73,800 or less if you are married filing jointly.

Taxpayers in higher brackets should look for losses to offset investment gains. Offsetting gains is particularly important to taxpayers in the 39.6% tax bracket (income over $406,751 for singles; $457,601 for married couples), because they face taxes of up to 23.8% on dividends and long-term capital gains, not the 15% rate that applies to most investors.

Don’t sell shares to lock in a loss with the intention of buying them back right away. The IRS “wash sale” rule bars you from claiming the loss if you buy the same or a “substantially identical” investment within 30 days of the sale.

Beware End-of-Year Mutual Fund Purchases

Sometime in December, many funds pay out dividends and capital gains that have built up during the year, and the payout goes to investors who own shares on what's known as the ex-dividend date. It might sound like a savvy move to buy just before that day so you get a whole year's worth of income.

That's not how it works, though. Yes, you'd get the payout, but at the time of the payout, the share price falls by exactly the same amount. If you get $2 a share in dividends, for example, the share price drops by two bucks. In effect, the fund is simply refunding part of your purchase price.

But the IRS doesn't see it that way. You have to report the payouts as income on your 2014 return—and pay taxes on them—even if the money is automatically reinvested in extra shares. (The tax threat does not apply to mutual funds held in 401(k) plans or other tax-deferred retirement accounts.)

Before you buy shares for a nonretirement account in December, check the fund company's Web site to find out exactly when the dividend will be paid.

Convert to a Roth

If you think your tax rate is going to rise sometime in the future, converting to a Roth makes a lot of sense. Withdrawals from traditional IRAs are taxed at your ordinary income tax rate, while all withdrawals from Roths are tax-free and penalty-free as long as you're at least 59½ and the converted account has been open at least five years. You do have to pay taxes on any pretax contributions and earnings in your traditional IRA for the year you convert.

Worried about not being able to pay the tax bill? Don’t be. When you convert to a Roth, you can change your mind. You have until October 15, 2015, to undo the conversion and turn your Roth back into a regular IRA.

Give to Charity

This is a great time of year to clean out your closets and garage, but you can write off donations to a charitable organization only if you itemize deductions. A few bags full of gently used clothes and household items can add up to hundreds of dollars in tax deductions, but valuing those donations can be difficult. (Try Turbo Tax's free tool).

If you donate a used car worth more than $500 to charity, your deduction will be limited to the amount the organization receives when it sells it. But you may be able to claim a bigger deduction based on the vehicle's fair-market value if the charity uses it to deliver meals, for example, or gives it to a needy individual. The charity will list the vehicle's sale price, or whether an exception allowing a higher deduction applies, on Form 1098-C, which you must attach to your tax return. Because of previous abuses, donations of used cars and other noncash items may attract extra scrutiny from the IRS. So keep scrupulous records.

Send cash donations to your favorite charity by December 31 and hang on to your canceled check or credit card receipt as proof of your donation. If you contribute $250 or more, you'll also need an acknowledgment from the charity.

Give Really Big to Charity

If you plan to make a significant gift to charity this year, consider giving appreciated stocks or mutual fund shares that you've owned for more than one year. Doing so boosts the savings on your tax return. Your charitable-contribution deduction is the fair-market value of the securities on the date of the gift, not the amount you paid for the asset, and you never have to pay tax on the profit.

If your favorite cause can't accept donations of appreciated securities, consider opening a donor-advised fund instead. The fund administrator will sell the securities for you and add the proceeds to your account. You can deduct the value of the securities on your 2014 tax return and decide later where you want to donate the money.

A tax break that allowed individuals 70 ½ to make a tax-free distribution of up to $100,000 from their IRAs directly to charity expired on Dec. 31, 2013. Congress is expected to renew it, but not until after the mid-term elections. The charitable transfer lets you give the money to charity and count it as a required minimum distribution but avoid taxes on the withdrawal. Not including RMD in your adjusted gross income can also help you stay under the income cutoffs for the Medicare Part B and Part D high-income surcharge or taxable Social Security benefits.If you’re charitably inclined and have more money than you need in your IRA, postpone taking RMDs for as long as possible. Just don’t wait too long, because the penalty for failing to take an RMD by Dec. 31 is 50% of the amount you should have withdrawn.

Give to Your Family (or Other Lucky People)

You can give up to $14,000 to as many individuals as you like before Dec. 31 without filing a gift-tax return. If you’re married, you and your spouse can give up to $28,000 per recipient.

The case for using the annual gift-tax exclusion for transferring wealth to adult children (or other lucky recipients) isn't as strong this year as it has been in the past. The estate-tax exemption is now $5.34 million (and twice that for married couples), indexed to inflation. Only a handful of ultra-wealthy families need to worry about the estate tax at that level. But 20 states and the District of Columbia impose some type of estate or inheritance tax, and most come with much lower exemptions. Rhode Island, for example, taxes estates valued at more than $921,655 at a maximum rate of 16%.

If you're feeling really generous, you could do it all over again on January 1, 2015, when you can give up to $14,000 per person.

Give the Gift of Securities

If your adult children or parents are in the 10% or 15% tax bracket (taxable income of up to $36,900 for singles, $73,800 for married couples), they qualify for the 0% tax rate on long-term capital gains. When they sell the securities, profit that would have been taxed at a rate as high as 23.8% on your return will be tax-free on theirs. Children under 18 and full-time students under age 24 are subject to the “kiddie” tax. Investment income that exceeds $2,000 will be taxed at the parent’s higher rate.

To qualify for the special rate for capital gains, the securities must have been held for at least 12 months. For securities given as gifts, though, the holding period includes the time you owned them.

This strategy requires finesse. When you sell stocks or funds, your gains lift your taxable income. Sell too much and you could push yourself out of the 15% tax bracket, which means you’ll end up paying taxes on some of your profits. To avoid taxes entirely, you’ll need to calculate the amount of gains you can reap before your income exceeds the threshold. Note also that your state may tax long-term gains that go tax-free at the federal level.

Feed Your 401(k)

Money you contribute to your 401(k) or similar employer-based retirement plan plan (if it's not a Roth) is excluded from your income, lowering your tax bill.

If you're not yet on track to max out your contributions by year-end, you can direct some extra dollars to your retirement plan during your last few pay periods—or, if you get a year-end bonus, use it to fatten your savings.

This year, workers can contribute up to $17,500 to employer-based plans, the same as in 2013. Workers 50 and older can contribute up to $23,000.

Safeguard Your Refund (by Shrinking It)

When you file your tax return each year, the amount of tax withheld from your paycheck or submitted through estimated quarterly tax payments ideally should match the amount of tax you owe. In reality, that seldom happens.

The majority of Americans are addicted to refunds. More than 75% of U.S. taxpayers give Uncle Sam an interest-free loan year after year, with an average refund of about $3,000—that's $250 per month. Wouldn't you rather get your money when you earn it instead of waiting a year for a refund? What’s more, that fat refund represents a security risk—identity thieves have been filing fraudulent returns and stealing refunds.

There's an easy fix. Just file a revised Form W-4 with your employer. The more "allowances" you claim on the W-4, the less tax will be withheld.

If your current financial situation is similar to last year's, just use our Tax Withholding Calculator. Answer three simple questions (you'll find the answers on your 2013 tax return), and we'll estimate how many additional allowances you deserve -- and how much your take-home pay could rise.

However, this tool won't be much help if your tax situation has changed since last year because, for example, you got married, had a baby or switched jobs. In that case, you might want to give the more-complicated IRS online withholding calculator a whirl.

Penalty-Proof Your Return

If you expect that you'll owe money when you file your 2014 tax return next spring, you can avoid an underpayment penalty by boosting your withholding now.

You needn't pay every penny of the tax you expect to owe. As long as you prepay 90% of this year's tax bill, you're off the hook for the penalty. Or you can escape its reach, in most cases, by prepaying 100% of last year's tax liability. However, note that if your 2013 adjusted gross income topped $150,000, you'll have to prepay 110% of last year's tax liability to avoid a penalty.

Taking these steps to boost your withholding at year-end will shield you from an underpayment penalty on your 2014 return, no matter how much you actually owe when you file your return.

If you have both wage and consulting income and expect to owe money on your tax return, you'll do better by boosting the taxes withheld from your last few paychecks rather than trying to make up the shortfall with your final estimated quarterly payment, due January 15, 2015.

Taxes that are withheld are treated as if they were spread out evenly throughout the year, so that approach sidesteps an underpayment penalty; the estimated-tax-payment approach does not.

Plan Your Itemized Deductions

If you expect your income to drop next year—you plan to retire, for example—deductions will probably be more valuable this year.

You may want to pay deductible expenses before year-end, such as your January mortgage, 2015 real estate taxes and fourth-quarter estimated state income taxes. Be careful, though: If you're a candidate for the Alternative Minimum Tax, some of those deductions could be disallowed.

On the other hand, if you expect your income to increase next year, you’ll want to defer charitable gifts and other deductible expenses because they’ll be more valuable.

Spend Down Your Flex Plan (if You Need to)

Last year, the Treasury Department and IRS changed the rules so employers can allow people to carry over up to $500 in their accounts from one year to the next. Companies can choose to make this change, but they’re not required to do it.

If your employer didn’t make the change and doesn’t offer a grace period, it’s time to clean out your flexible spending account. (You may also need to spend some money if you expect to end the year with more than $500 in your account.) Remember that you can no longer use flex funds to pay for over-the-counter medicines, such as aspirin, ibuprofen or allergy meds, without a prescription (except for insulin). But that restriction does not apply to other nonprescription medical items, such as crutches, contact-lens solution or bandages. (For a list of what is allowed by law, see IRS Publication 502.) The same rules on eligible purchases apply to health savings accounts.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Block joined Kiplinger in June 2012 from USA Today, where she was a reporter and personal finance columnist for more than 15 years. Prior to that, she worked for the Akron Beacon-Journal and Dow Jones Newswires. In 1993, she was a Knight-Bagehot fellow in economics and business journalism at the Columbia University Graduate School of Journalism. She has a BA in communications from Bethany College in Bethany, W.Va.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

Can I Deduct My Pet On My Taxes?

Can I Deduct My Pet On My Taxes?Tax Deductions Your cat isn't a dependent, but your guard dog might be a business expense. Here are the IRS rules for pet-related tax deductions in 2026.

-

Tax Season 2026 Is Here: 8 Big Changes to Know Before You File

Tax Season 2026 Is Here: 8 Big Changes to Know Before You FileTax Season Due to several major tax rule changes, your 2025 return might feel unfamiliar even if your income looks the same.

-

2026 State Tax Changes to Know Now: Is Your Tax Rate Lower?

2026 State Tax Changes to Know Now: Is Your Tax Rate Lower?Tax Changes As a new year begins, taxpayers across the country are navigating a new round of state tax changes.

-

States That Tax Social Security Benefits in 2026

States That Tax Social Security Benefits in 2026Retirement Tax Not all retirees who live in states that tax Social Security benefits have to pay state income taxes. Will your benefits be taxed?

-

3 Major Changes to the Charitable Deduction for 2026

3 Major Changes to the Charitable Deduction for 2026Tax Breaks About 144 million Americans might qualify for the 2026 universal charity deduction, while high earners face new IRS limits. Here's what to know.

-

Retirees in These 7 States Could Pay Less Property Taxes Next Year

Retirees in These 7 States Could Pay Less Property Taxes Next YearState Taxes Retirement property tax bills could be up to 65% cheaper for some older adults in 2026. Do you qualify?

-

Estate Tax Quiz: Can You Pass the Test on the 40% Federal Rate?

Estate Tax Quiz: Can You Pass the Test on the 40% Federal Rate?Quiz How well do you know the new 2026 IRS rules for wealth transfer and the specific tax brackets that affect your heirs? Let's find out!

-

5 Types of Gifts the IRS Won’t Tax: Even If They’re Big

5 Types of Gifts the IRS Won’t Tax: Even If They’re BigGift Tax Several categories of gifts don’t count toward annual gift tax limits. Here's what you need to know.