The New Uber Law’s Ripple Effect

Independent contractors across the U.S. could become eligible for employee benefits.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

California recently passed Assembly Bill 5, which reclassifies a swath of independent contractors, including gig economy workers, as employees. The landmark legislation could change the employment status of more than 1 million Californians. Opponents say the law could negatively affect a wide range of employers, from small churches to wineries.

We asked Lindsey Cameron, an assistant professor of management at the Wharton School of the University of Pennsylvania, to discuss what this law could mean for employees, employers and consumers.

Why is California’s Assembly Bill 5 so controversial? The status quo is working for a lot of companies. They save money by keeping workers as contractors, and they have the flexibility to hire people when they need them and let them go with no fuss or severance package. Most people rely on their employer for health insurance, so hiring independent contractors lets companies save costs.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

How would being treated as an employee benefit independent contractors? Employees get benefits that contractors don’t: a minimum wage, health insurance, sick leave, overtime pay, workers’ comp, unemployment insurance and protection by the Equal Employment Opportunity Commission against discrimination. Employers also contribute to a portion of payroll taxes by putting money into Social Security and Medicare on your behalf. Contractors need to pay the entire payroll tax. This law could also be beneficial to California’s government, which loses an estimated $7 billion a year in unpaid income taxes and more from independent contractors.

Are there disadvantages for contractors? Some independent contractors—particularly those who are highly skilled and command higher wages—may prefer to not be considered employees. Plus, there are some caveats in the law with creative professionals (for example, writers and artists) and how their intellectual property will be protected if they are considered an employee.

Who will this law affect? The law clarifies who is a contractor and who is not, based on, among other things, whether a worker is engaged in the same business as the hiring entity. It’s known as the “Uber Law,” but it has a much larger effect beyond ride-hailing drivers. The law could affect home health care workers, truckers, interpreters, freelance writers, cleaners and more. Some professions are exempt from this law, including doctors, dentists, psychologists, insurance agents, stockbrokers and lawyers. These categories of contractors work directly with their customers to set the price and are considered higher-paid professionals. Other industries and companies are lobbying for exemptions.

What will happen to the gig economy, which is dominated by companies that depend on independent workers to get the job done? My guess is either prices will go up for consumers or the quality of service will be reduced, because the law raises labor costs. Companies may take on fewer workers because they have to pay them more.

Will other states follow California’s example? The law is set to go into effect in California in January. I don’t see the law in California being enacted in every state, but it could lead some states to adopt similar laws. AB 5 allows a city to file an injunction against a company if it is violating the law, so similar laws may be implemented more at the city level rather than state. Several cities, including New York City, Portland and Seattle, are discussing or have already implemented some worker protections for ride-hailing drivers.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

How to Search For Foreclosures Near You: Best Websites for Listings

How to Search For Foreclosures Near You: Best Websites for ListingsMaking Your Money Last Searching for a foreclosed home? These top-rated foreclosure websites — including free, paid and government options — can help you find listings near you.

-

Four Tips for Renting Out Your Home on Airbnb

Four Tips for Renting Out Your Home on Airbnbreal estate Here's what you should know before listing your home on Airbnb.

-

Is Relief from Shipping Woes Finally in Sight?

Is Relief from Shipping Woes Finally in Sight?business After years of supply chain snags, freight shipping is finally returning to something more like normal.

-

Economic Pain at a Food Pantry

Economic Pain at a Food Pantrypersonal finance The manager of this Boston-area nonprofit has had to scramble to find affordable food.

-

The Golden Age of Cinema Endures

The Golden Age of Cinema Enduressmall business About as old as talkies, the Music Box Theater has had to find new ways to attract movie lovers.

-

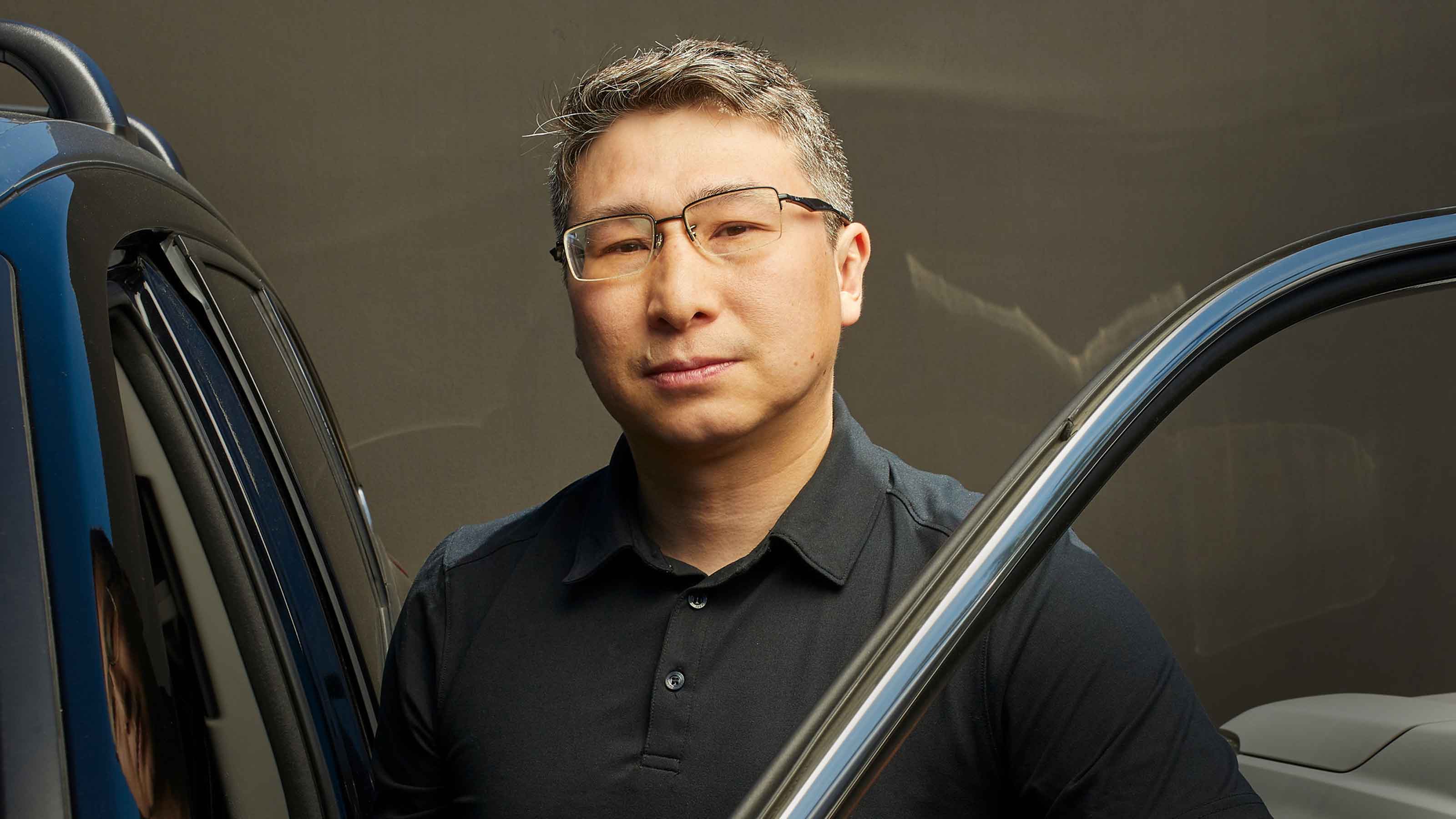

Pricey Gas Derails This Uber Driver

Pricey Gas Derails This Uber Driversmall business With rising gas prices, one Uber driver struggles to maintain his livelihood.

-

Smart Strategies for Couples Who Run a Business Together

Smart Strategies for Couples Who Run a Business TogetherFinancial Planning Starting an enterprise with a spouse requires balancing two partnerships: the marriage and the business. And the stakes are never higher.

-

Fair Deals in a Tough Market

Fair Deals in a Tough Marketsmall business When you live and work in a small town, it’s not all about profit.