Where the Housing Market Is Headed in Late 2015

First-time home buyers will be a big driver of this market's recovery.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

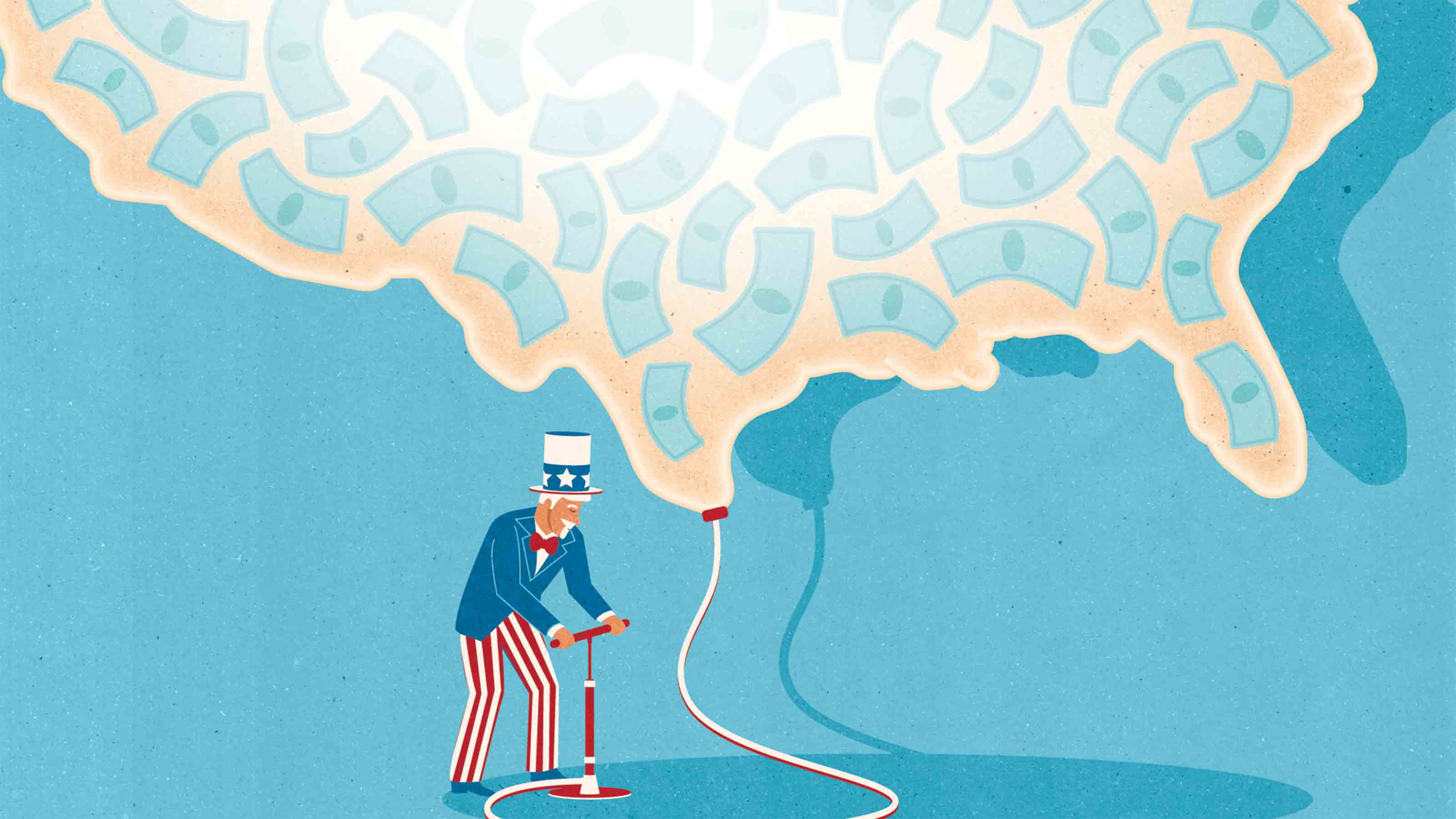

The housing recovery will step up its pace heading into the second half of the year and beyond. That’s good news for the economy overall, and especially so for the scores of home builders, craftsmen, suppliers of building materials and others who rely on this key industry for their livelihoods.

Through 2015, new-home sales will gain 22% from last year, when 440,000 such homes were sold. Existing-home sales will climb 7%, while new-home starts are poised to go up about 9%. In 2016, sales of new homes will rise 23% and sales of existing homes will top this year by 6%. We also see a 17% improvement in housing starts, with single-family homes accounting for the bulk of the gain: 25% growth vs. 2% for multifamily units.

Two groups of buyers are making a difference: First-time purchasers of existing homes, whose presence among all buyers rose to 32% in May from 29% last year. Their participation rate will tick up a notch by year-end and hit 35% by the end of 2016.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

And people with less-than-stellar credit. More of them are able to secure home mortgage loans as lenders loosen credit terms. The percentage of Federal Housing Administration loans given to borrowers with credit scores of less than 640 is up from 8% in 2013 to 18% today. FHA loans also allow higher debt-to-income ratios — up to 45% — and are less strict than ones from private lenders with regard to the sources of down payment money. But both FHA and private lending guidelines will generally remain strict, according to Kenny Sylvester, a mortgage broker with Bank of America — no repeat of the easy-peasy lending ways prior to the recession.

Higher rents are coaxing many first-time home buyers into taking the plunge. The stronger job market and climbing incomes give people more confidence to buy, especially in and around large urban areas, where rents are increasing fastest.

Gradually rising mortgage interest rates also play a role. Many first-timers feel that now’s the time to purchase a home to beat even higher rates down the road. We see the 30-year fixed mortgage rate rising from 4% now to 4.2% by year-end.

Note that many first-time buyers are a bit older than their predecessors in years past. The recently sagging job market, student loan debt and other factors had led many millennials to delay marriage and home buying. That’s changing now.

Several builders are moving to accommodate buyers of entry-level homes. For example, Meritage Homes, based in Scottsdale, Ariz., is ramping up construction of starter homes priced in the low $200,000s. The company typically caters to more affluent buyers at an average selling price of nearly twice that amount. Pulte Homes, KB Home and D.R. Horton (the largest home construction company in the U.S.) also report seeing more neophytes entering the ranks of home buyers.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

David is both staff economist and reporter for The Kiplinger Letter, overseeing Kiplinger forecasts for the U.S. and world economies. Previously, he was senior principal economist in the Center for Forecasting and Modeling at IHS/GlobalInsight, and an economist in the Chief Economist's Office of the U.S. Department of Commerce. David has co-written weekly reports on economic conditions since 1992, and has forecasted GDP and its components since 1995, beating the Blue Chip Indicators forecasts two-thirds of the time. David is a Certified Business Economist as recognized by the National Association for Business Economics. He has two master's degrees and is ABD in economics from the University of North Carolina at Chapel Hill.

-

I want to sell our beach house to retire now, but my wife wants to keep it.

I want to sell our beach house to retire now, but my wife wants to keep it.I want to sell the $610K vacation home and retire now, but my wife envisions a beach retirement in 8 years. We asked financial advisers to weigh in.

-

How to Add a Pet Trust to Your Estate Plan

How to Add a Pet Trust to Your Estate PlanAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Avoid Leaving Chaos in Your Wake: Keep an Updated Estate Plan

Avoid Leaving Chaos in Your Wake: Keep an Updated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.

-

Federal Debt: A Heavy Load

Federal Debt: A Heavy LoadEconomic Forecasts The debt continues to grow, but record-low interest rates could ease the long-term damage.

-

How the Fed's Moves Affect You

How the Fed's Moves Affect YouEconomic Forecasts It’s pumping trillions of dollars into the economy and keeping rates near zero. Savers are sunk, but borrowers get a boost.

-

U.S. Manufacturing Is Already Ailing from Coronavirus

U.S. Manufacturing Is Already Ailing from CoronavirusEconomic Forecasts Supplies are hard to come by, and in the longer-term demand may be at risk.

-

Consumers Will Feel Impact of Rapidly Falling Interest Rates

Consumers Will Feel Impact of Rapidly Falling Interest RatesEconomic Forecasts Mortgage and car loans will experience the most significant dips, while some holders of Treasuries may get a slight boost.

-

Will You Have to Pay More Sales Taxes on Your Online Purchases?

Will You Have to Pay More Sales Taxes on Your Online Purchases?business One thing’s for sure: Consumers who live in one of the five states without a sales tax won’t be affected by the Supreme Court’s ruling.

-

What to Expect From the New Fed Chief

What to Expect From the New Fed ChiefEconomic Forecasts By and large, Jerome Powell will move along the path set by his predecessor.

-

How a Border Tax Would Affect You

How a Border Tax Would Affect YouBusiness Costs & Regulation A plan to limit imports could raise prices but also create more jobs.

-

A Housing Shortage Looms: Builders Can’t Keep Up

A Housing Shortage Looms: Builders Can’t Keep Upbusiness Starter homes especially are becoming scarce.