Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Don't be fooled by the recent improvement in the unemployment rate. American workers are facing the bleakest job prospects in decades.Although hiring has picked up in recent months, job creation will remain modest until well into 2013. Openings for new entry-level workers and for better-paying middle-income jobs will be difficult to find. Except for a few occupations that require highly skilled workers, businesses will have their pick of the best-qualified applicants for each slot. Opportunities for job-hopping will be limited, and job seekers will have to settle for modest wage gains and less generous benefits. Wages, generally, will continue to grow little, if at all. Income disparities will widen.

Traditional areas of job growth in recoveries won't deliver this time. The number of manufacturing jobs is increasing, but it won't rebound sharply, even as some U.S. companies move production back home. Factory employment will soon resume its decades-long decline. Construction will be slow, the lasting effect of the overbuilding of the housing bubble. The biggest gains will continue to be in health care and education, jobs that often require a high school diploma or college degree.

"The job recovery is under way, but it's facing significant headwinds," says Ray Stone, economist at Stone & McCarthy Research Associates in Princeton, N.J., who keeps close tabs on the labor market. Productivity gains have reduced the need for labor, Stone points out, while soaring health care costs make it ever more costly to hire more workers.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Other factors dim workers' prospects as well. The financial collapse of 2007-2009 damaged 401(k) accounts, prompting aging baby boomers to postpone their retirements. So employers have fewer openings for younger workers seeking entry-level jobs.

People out of work for several months or years will find that their skills have eroded and that it will be especially difficult to get the kinds of jobs and level of pay they held before the recession. Workers whose homes are worth less than the mortgages they've taken out will find themselves unable to move to other cities to take advantage of new job opportunities.

Long term, broader economic forces constrain workers' options. Globalization will increasingly limit workers' bargaining-power and flexibility -- and not just for lower-paid positions. The migration of jobs overseas is extending upward into higher-skilled, higher-paying jobs. The National Science Board reported in January that the U.S. is rapidly losing high-technology jobs as American multinationals expand their research and development laboratories to Asia. More emerging market countries are competing in service industries -- engineering, construction, financial and business services, and medical care -- as well as in the production of goods.

Technological advances increasingly mean the substitution of capital for labor as sophisticated equipment enables companies to produce more with fewer workers.

And the decline of labor unions will have practical effects on the pay and job security of unionized workers. Only 11.8% of American workers now belong to a union -- down sharply from more than 20% in the early 1980s -- and unions are no longer drawing the kind of public support that had been typical during a recession. In a Gallup poll taken last December, 42% of those surveyed said they disapproved of labor unions, up from 29% in October 2006. Some 42% said they'd like to see unions become less influential.

With states in a serious financial bind, governors and legislators have begun pushing through laws they wouldn't even have considered a few years ago, trimming pensions and other benefits for state workers, and enacting right-to-work laws, which bar unions from requiring nonunion workers to pay dues.

At the same time, businesses have begun using lockouts to pressure unionized workers into accepting givebacks in wages, benefits or work rules that unions won in previous collective bargaining agreements. According to Bloomberg BNA, at least 17 major employers imposed lockouts during union negotiations last year. Once that was a rarity.

The unemployment rate, 8.3% at last count, is likely to improve in 2012 and again in 2013. But the challenges for workers will last a lot longer.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

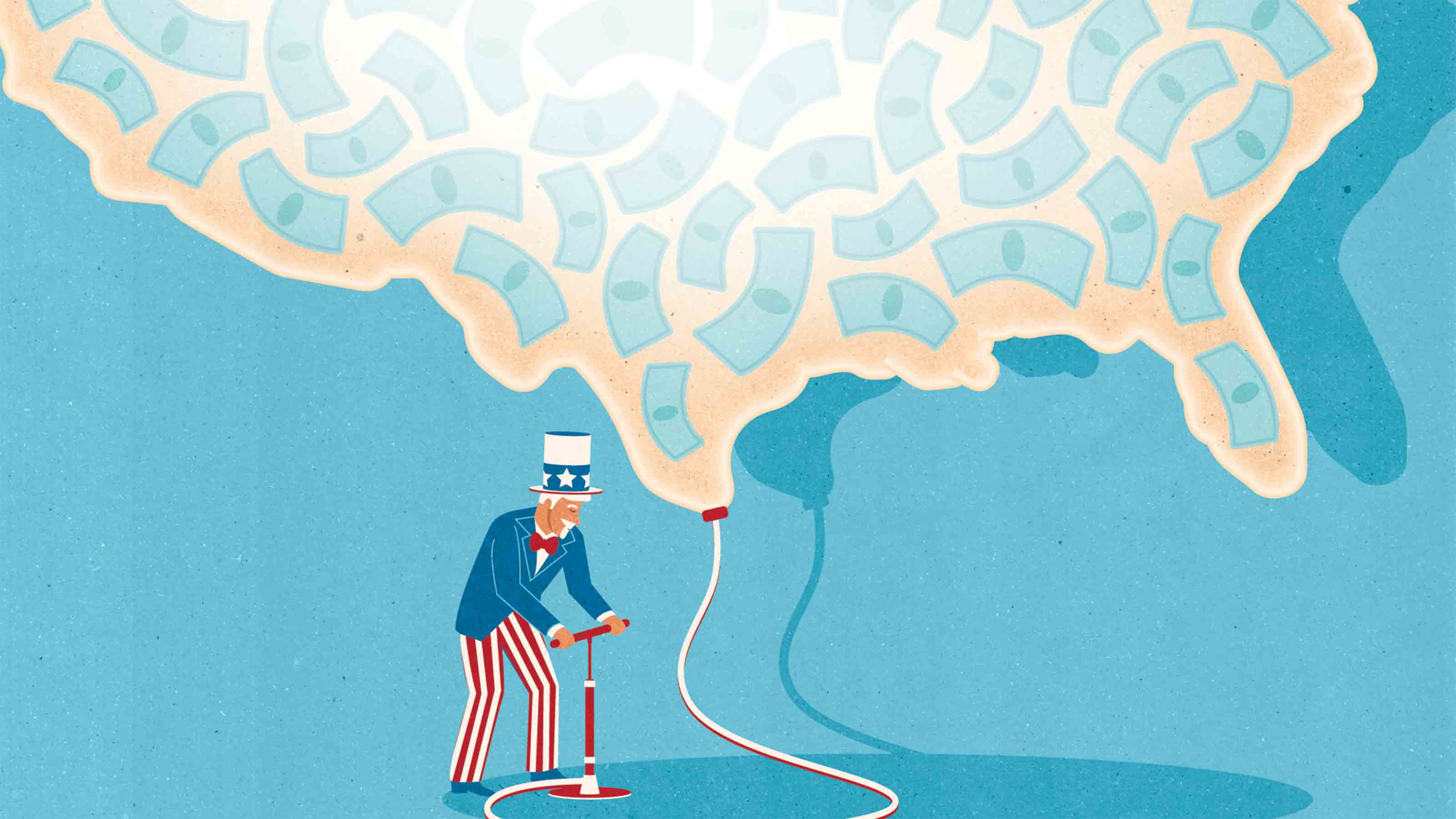

Federal Debt: A Heavy Load

Federal Debt: A Heavy LoadEconomic Forecasts The debt continues to grow, but record-low interest rates could ease the long-term damage.

-

How the Fed's Moves Affect You

How the Fed's Moves Affect YouEconomic Forecasts It’s pumping trillions of dollars into the economy and keeping rates near zero. Savers are sunk, but borrowers get a boost.

-

U.S. Manufacturing Is Already Ailing from Coronavirus

U.S. Manufacturing Is Already Ailing from CoronavirusEconomic Forecasts Supplies are hard to come by, and in the longer-term demand may be at risk.

-

Consumers Will Feel Impact of Rapidly Falling Interest Rates

Consumers Will Feel Impact of Rapidly Falling Interest RatesEconomic Forecasts Mortgage and car loans will experience the most significant dips, while some holders of Treasuries may get a slight boost.

-

Will You Have to Pay More Sales Taxes on Your Online Purchases?

Will You Have to Pay More Sales Taxes on Your Online Purchases?business One thing’s for sure: Consumers who live in one of the five states without a sales tax won’t be affected by the Supreme Court’s ruling.

-

What to Expect From the New Fed Chief

What to Expect From the New Fed ChiefEconomic Forecasts By and large, Jerome Powell will move along the path set by his predecessor.

-

How a Border Tax Would Affect You

How a Border Tax Would Affect YouBusiness Costs & Regulation A plan to limit imports could raise prices but also create more jobs.

-

A Housing Shortage Looms: Builders Can’t Keep Up

A Housing Shortage Looms: Builders Can’t Keep Upbusiness Starter homes especially are becoming scarce.