Solar and Wind Power Going Mainstream

Both industries are surviving on economic merits, not government help.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Can renewable energy continue to thrive as government subsidies for it evaporate? For wind and solar power, the answer is a strong yes.

A recently expired federal grant program offers a case in point. The 2009 economic stimulus law converted the Treasury Department's previous tax credit for solar installations -- available to homeowners and businesses alike -- into a more generous grant program that reimbursed customers for 30% of the cost of a new solar power installation. That up-front cash, plus various state and utility rebates, sparked a burst of new solar projects: In 2011, solar installations shattered previous records, doubling 2010's level.

SEE ALSO: How to Lease Your Own Solar Power

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Although the grant program ran out last year and has switched back to a less generous tax credit, the solar business is still booming.

Just ask Kelcy Pegler Jr., cofounder of New Jersey-based solar installer Roof Diagnostics Inc. A relative newcomer to solar, the company sees strong demand for rooftop solar systems from homeowners, businesses and nonprofit organizations. Pegler says that the loss of the largest single up-front subsidy for solar isn't deterring his clients; the "vast majority" now just lease, rather than buy.

Financing Options

Solar leases -- also called power purchase agreements, or PPAs -- let customers generate green energy and lower their electric bills without shelling out tens of thousands of dollars for a rooftop solar system. Instead, a solar company such as Roof Diagnostics installs and maintains the panels at little or no up-front cost and then sells the customer the resulting power below the price charged by the local utility.

In return, the solar installer -- often in partnership with large financial institutions looking to cut their tax bills -- pockets the federal tax break and collects the revenue from selling the electricity.

In the wake of declining grants from Uncle Sam, such "third party" leases are the predominant method of financing solar power. Jamie Hahn, managing director at Solis Partners Inc., a New Jersey-based provider of solar designs and financing arrangements for businesses, figures that 80% of new solar installations now rely on some form of the PPA model.

Homeowners with good credit and south-facing rooftops make especially good candidates for solar leasing, says Roof Diagnostics' Pegler. Large solar installers such as Sunrun and SolarCity, working in partnership with big banks, are becoming more efficient at lining up customers, getting systems installed and scoring the resulting tax credits.

Extending that model to corporate customers with larger power needs can be more challenging, says Solis Partners' Hahn, since the installation company and any financial partners have to invest more money in a bigger installation, and then suffer more if the customer falls behind on its power bills. But he's confident that leasing and other traditional financing mechanisms, such as bond issues, will keep growing to meet the needs of commercial customers aspiring to go solar.

States Pushing for More Solar

If improving affordability and expanding financing options make solar power more realistic for more customers, state governments are keeping up the pressure on electric utilities to invest in more renewable energy. About three-fourths of states have adopted green power goals -- known collectively as renewable portfolio standards, or RPS -- requiring their respective utilities to generate a portion of their total power from renewable sources by a target date.

These RPS targets vary widely, from California's mandate of getting 33% of its power from renewables by 2020, to South Dakota's voluntary target of 10% by 2015. And different state standards allow for different methods of meeting the goals -- say by importing clean power from neighboring states, or by allowing a wide range of low-carbon energy sources, such as hydropower.

But the net effect of states' RPS goals is to ramp up investment in wind and solar power even as funding support pulls back. Kyle Aarons, a solutions fellow and an expert on state-level renewable energy programs at the Center for Climate and Energy Solutions, says there are "definitely challenges" for states trying to hit their RPS targets. But with a few exceptions, they're staying the course rather than watering down their standards.

Vermont Law School professor Kevin Jones, who studies state RPS programs, figures that trend will continue, despite some "bumps along the road." One big bump coming up is the expiration of Uncle Sam's tax credit for wind power after 2012. That'll make it tough for states to adopt loftier RPS targets, he says, since wind supplies the bulk of renewable energy today. But falling prices of wind turbines and a slow rise in the price of natural gas -- wind's biggest energy competitor -- will make wind more financially attractive in a few years.

Toward "Grid Parity"

The fate of alternative energy ultimately hinges on its ability to compete on a level playing field with conventional energy sources. The gradual decline in government subsidies will force renewable power to compete based on its economic merits.

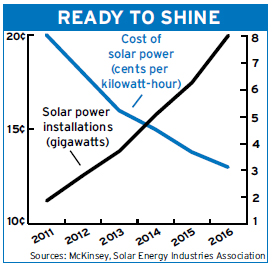

For wind power, matching the cost of electricity generated from fossil fuels is a long-term project, given the relatively high cost of installing large wind turbines. But for solar, the goal of competing with conventional electricity sources -- the point known as "grid parity" -- is already in sight. Consulting firm McKinsey & Company sees the cost of electricity from future solar panels falling to 10¢ per kilowatt-hour by 2020. That would match the price the average consumer pays for power today.

That trend has already knocked down the price of rooftop solar arrays in California to less than $4 per watt of output potential, according to Paul Detering, chief executive of PPA provider Tioga Energy, based in California. Those sorts of costs, which would have been almost unimaginably low a few years ago, have him excited about solar's long-term prospects. "I don't want to be in a business that needs subsidies forever," he says.

Given the falling cost of solar power, the potential for efficiency gains to drive further decreases and the expanding universe of financing options, Solis Partners' Hahn concurs: "I'm very, very bullish" on solar.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jim joined Kiplinger in December 2010, covering energy and commodities markets, autos, environment and sports business for The Kiplinger Letter. He is now the managing editor of The Kiplinger Letter and The Kiplinger Tax Letter. He also frequently appears on radio and podcasts to discuss the outlook for gasoline prices and new car technologies. Prior to joining Kiplinger, he covered federal grant funding and congressional appropriations for Thompson Publishing Group, writing for a range of print and online publications. He holds a BA in history from the University of Rochester.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Federal Debt: A Heavy Load

Federal Debt: A Heavy LoadEconomic Forecasts The debt continues to grow, but record-low interest rates could ease the long-term damage.

-

How the Fed's Moves Affect You

How the Fed's Moves Affect YouEconomic Forecasts It’s pumping trillions of dollars into the economy and keeping rates near zero. Savers are sunk, but borrowers get a boost.

-

U.S. Manufacturing Is Already Ailing from Coronavirus

U.S. Manufacturing Is Already Ailing from CoronavirusEconomic Forecasts Supplies are hard to come by, and in the longer-term demand may be at risk.

-

Consumers Will Feel Impact of Rapidly Falling Interest Rates

Consumers Will Feel Impact of Rapidly Falling Interest RatesEconomic Forecasts Mortgage and car loans will experience the most significant dips, while some holders of Treasuries may get a slight boost.

-

Is a Recession Imminent?

Is a Recession Imminent?Economic Forecasts Shoppers will have to carry the load for now because weak business investment shows no sign of perking up anytime soon. Odds are, they’ll be able to.

-

Will You Have to Pay More Sales Taxes on Your Online Purchases?

Will You Have to Pay More Sales Taxes on Your Online Purchases?business One thing’s for sure: Consumers who live in one of the five states without a sales tax won’t be affected by the Supreme Court’s ruling.

-

3 Factors That Could Drive the Next Recession

3 Factors That Could Drive the Next RecessionEconomic Forecasts The economy is humming along nicely, but how long can the good times continue?

-

What to Expect From the New Fed Chief

What to Expect From the New Fed ChiefEconomic Forecasts By and large, Jerome Powell will move along the path set by his predecessor.