3 Signs the Housing Recovery Has Arrived

Buyers are back, building is up -- and housing is poised to add to the economy instead of pulling it down.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

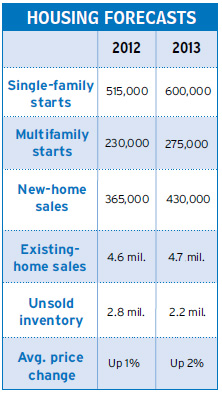

Hallelujah. Housing is firmly on the upswing. Next year, it will add half a percentage point to GDP growth. By 2014, it will once again be a significant contributor to job creation, consumer spending and economic gains, bolstering this weak recovery. Every $100 bump in average home prices lifts consumer spending by $5. Some signs that the tide has finally turned and that housing will be a positive force in coming years:

SEE ALSO: Hazards Ahead for the Economy

1) Sales of new and existing homes are climbing: 20% for new homes this year; 18% next year. For existing homes, a 2% gain in 2013 will follow about an 8% jump in 2012.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

One factor fueling the gain is buying by investors, many of them paying cash for the properties. But the investment isn't the kind of get-rich-quick, buy-and-flip purchase that fanned last decade's housing market boom and subsequent bust. This time, strong rental demand is the lure. Investors figure their properties will yield a positive cash flow right from the get-go and earn a profit month after month. It helps that about 36% of renters now opt to lease houses rather than apartments -- a share that's up from just 31% in 2006.

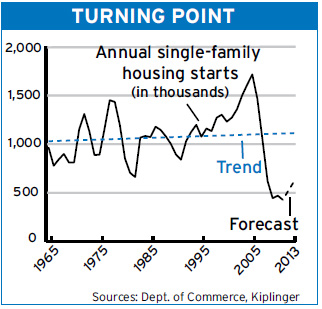

2) The pace of building is picking up as well, with housing starts in some states -- Washington, Iowa, Nebraska, Texas and South Carolina, for example -- likely to near levels last seen in 2000-2003 by the end of the year. Nationwide, starts will climb by 17% next year.

Builders are more optimistic than they've been since mid-2006, at the peak of the boom. Indeed, some are busy enough to be hiring and are having trouble finding help. (Many of the 2 million or so construction workers who lost their jobs in the recession are driving trucks, or doing landscaping or other work now. Some who immigrated during the housing boom returned to their homelands when their jobs disappeared.)

3) The number of unsold homes is easing and the foreclosure tsunami, fading, with the share of mortgages delinquent by 90 or more days a third lower than in 2010. Distressed sales are now a fourth of the total -- lower than last year, though still high. Mortgage rates are sure to remain near historical lows for a year or more, thanks to ongoing monthly buying of mortgage-backed bonds by the Federal Reserve.

What's more, a surge in pent-up housing demand is inevitable, once the economy starts to pick up some more steam and young folks who delayed home buying plunge into the market. The usual rate of household formation -- young men and women leaving their parents' nests and setting up their own abodes, plus new immigrants establishing households in the U.S. -- has been severely retarded in recent years by the recession. As a result, there are now about 4 million fewer households than there would be had the historical trend continued. Those households-to-be will come flooding on the market

Of course, the climb back for the housing industry will be neither swift nor uniform. As Celia Chen, an economist who focuses on housing for Moody's Analytics, said in a recent report, "Never before in modern history have home sales, homebuilding and house prices collapsed so deeply and so widely across the nation."

So it will be a few years yet before housing starts and sales return to their long-term trend lines, much less their peaks. For Las Vegas, Tampa, Fla., and other cities where prices have sunk up to 50% since 2006, the upward slog will be even longer, and today's tight lending standards won't help. But, after six painful years, the outlook is for real, measurable improvement.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Trump Reshapes Foreign Policy

Trump Reshapes Foreign PolicyThe Kiplinger Letter The President starts the new year by putting allies and adversaries on notice.

-

Congress Set for Busy Winter

Congress Set for Busy WinterThe Kiplinger Letter The Letter editors review the bills Congress will decide on this year. The government funding bill is paramount, but other issues vie for lawmakers’ attention.

-

The Kiplinger Letter's 10 Forecasts for 2026

The Kiplinger Letter's 10 Forecasts for 2026The Kiplinger Letter Here are some of the biggest events and trends in economics, politics and tech that will shape the new year.

-

What to Expect from the Global Economy in 2026

What to Expect from the Global Economy in 2026The Kiplinger Letter Economic growth across the globe will be highly uneven, with some major economies accelerating while others hit the brakes.

-

Amid Mounting Uncertainty: Five Forecasts About AI

Amid Mounting Uncertainty: Five Forecasts About AIThe Kiplinger Letter With the risk of overspending on AI data centers hotly debated, here are some forecasts about AI that we can make with some confidence.

-

Worried About an AI Bubble? Here’s What You Need to Know

Worried About an AI Bubble? Here’s What You Need to KnowThe Kiplinger Letter Though AI is a transformative technology, it’s worth paying attention to the rising economic and financial risks. Here’s some guidance to navigate AI’s future.

-

Will AI Videos Disrupt Social Media?

Will AI Videos Disrupt Social Media?The Kiplinger Letter With the introduction of OpenAI’s new AI social media app, Sora, the internet is about to be flooded with startling AI-generated videos.

-

What Services Are Open During the Government Shutdown?

What Services Are Open During the Government Shutdown?The Kiplinger Letter As the shutdown drags on, many basic federal services will increasingly be affected.