Economist: We're Taxing the Wrong Things

Arthur Laffer is sticking to his guns about the hazards of over-taxing the economy.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

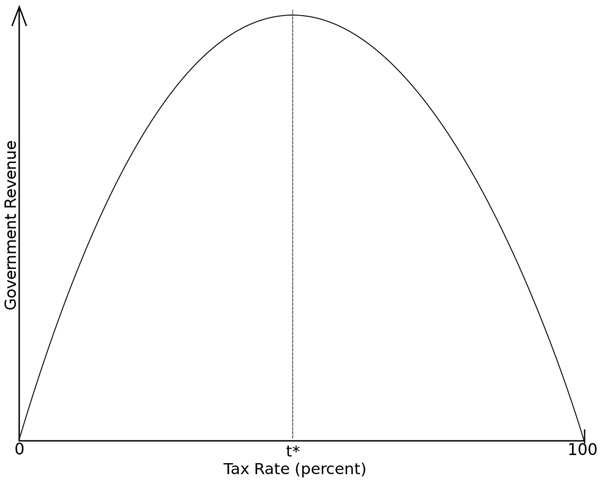

Arthur Laffer is best known as the economist who invented the Laffer Curve, a diagram that purports to show how an optimal tax rate can maximize revenues without discouraging people from working. In an unexpected role, he recently co-authored a picture book for children called Let’s Chat About Economics! I interviewed Laffer and his co-author, Michelle Balconi, about the book for my Money-Smart Kids column.

Arthur Laffer

BODNAR: With regard to the children’s book, you said that the most important lesson you would like to teach kids is that trade-offs are the essence of economics: You can’t always have all the a you want and all the b you want. What’s the most important lesson you’d like adults to learn about economics?

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

LAFFER: One lesson I’ve spent my life on is that when you tax something, you get less of it, and when you subsidize something, you get more of it. You know, we tax speeders to get them to stop speeding, and we tax cigarette smokers because we want them to stop smoking. And then we come along and tax people who work, and especially people who work very productively and make a lot of money. Do we do that to stop them from working and stop them from being productive? If you tax work, output and employment, and you subsidize non-work, leisure and unemployment, don’t be surprised if you get less work and a lot more leisure and unemployment. You can’t tax an economy into wealth.

What would you like policymakers to learn about economics? Same thing, or something different? Basically, policymakers should know where the limits of policy are, where government activities cease being better than private, and, vice versa, where private activities cease being better than government. Then you draw the lines and get the hell out of the way. You don’t want a private military, that’s for sure, and you don’t want public grocery stores. The law of diminishing returns is a perfect concept in this context.

So you think the Laffer Curve is still operational? It’s a basic principle of economics that’s always there. Sometimes we’re in a reasonable range of the Laffer Curve, and sometimes we’re not. In terms of what presidents Bush and Obama have done, we’ve gone outside the range and we’ve done a lot of damage to the economy because of government intervention. I think what presidents Reagan and Clinton did were exactly the right policies to create prosperity.

What do you think of the Fed’s zero-interest-rate policy? Forgive me, but I think it’s totally wrong. I mean, who wants to lend mortgage money at 3% to 3.5% for 30 years? The problem is that government people don’t understand that there’s both a supply curve and a demand curve. You can have interest rates that are too high and discourage borrowers, and interest rates that are too low and discourage lenders. There’s an interest rate right in the middle—the Goldilocks interest rate, if you will—where you get just the right amount of borrowers and lenders.

And we’re not there? The government is trying to set rates, which is the wrong thing to do, as opposed to letting the market set rates. That’s why we’ve had such a weak economic recovery. And they just keep on doing the same old policies. It’s really very sad, especially when you see kids in the inner city, teenagers who can’t get a job. After being unemployed for a while they become unemployable, and you’ve created a whole lost generation. We’re bearing the cost.

What made you decide to collaborate on a children’s book? For one thing, Michelle is the most energetic, enthusiastic, focused person you’ve ever seen. How could I say no? Also, I’ve been a professor all my life and a math person. What I try to do is take the math and bring it to life with things like the Laffer Curve or an example I use with Farmer A and Farmer B. In a world with only two people, Farmer A and Farmer B, if Farmer B gets unemployment benefits, who pays for them? Government doesn’t create resources, it redistributes resources. These aren’t the same examples you’d use with kids at the dinner table, but the idea is the same: Trade-offs are the key to economics.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Janet Bodnar is editor-at-large of Kiplinger's Personal Finance, a position she assumed after retiring as editor of the magazine after eight years at the helm. She is a nationally recognized expert on the subjects of women and money, children's and family finances, and financial literacy. She is the author of two books, Money Smart Women and Raising Money Smart Kids. As editor-at-large, she writes two popular columns for Kiplinger, "Money Smart Women" and "Living in Retirement." Bodnar is a graduate of St. Bonaventure University and is a member of its Board of Trustees. She received her master's degree from Columbia University, where she was also a Knight-Bagehot Fellow in Business and Economics Journalism.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

Trump Reshapes Foreign Policy

Trump Reshapes Foreign PolicyThe Kiplinger Letter The President starts the new year by putting allies and adversaries on notice.

-

Congress Set for Busy Winter

Congress Set for Busy WinterThe Kiplinger Letter The Letter editors review the bills Congress will decide on this year. The government funding bill is paramount, but other issues vie for lawmakers’ attention.

-

The Kiplinger Letter's 10 Forecasts for 2026

The Kiplinger Letter's 10 Forecasts for 2026The Kiplinger Letter Here are some of the biggest events and trends in economics, politics and tech that will shape the new year.

-

What to Expect from the Global Economy in 2026

What to Expect from the Global Economy in 2026The Kiplinger Letter Economic growth across the globe will be highly uneven, with some major economies accelerating while others hit the brakes.

-

Amid Mounting Uncertainty: Five Forecasts About AI

Amid Mounting Uncertainty: Five Forecasts About AIThe Kiplinger Letter With the risk of overspending on AI data centers hotly debated, here are some forecasts about AI that we can make with some confidence.

-

Worried About an AI Bubble? Here’s What You Need to Know

Worried About an AI Bubble? Here’s What You Need to KnowThe Kiplinger Letter Though AI is a transformative technology, it’s worth paying attention to the rising economic and financial risks. Here’s some guidance to navigate AI’s future.

-

Will AI Videos Disrupt Social Media?

Will AI Videos Disrupt Social Media?The Kiplinger Letter With the introduction of OpenAI’s new AI social media app, Sora, the internet is about to be flooded with startling AI-generated videos.

-

What Services Are Open During the Government Shutdown?

What Services Are Open During the Government Shutdown?The Kiplinger Letter As the shutdown drags on, many basic federal services will increasingly be affected.