Housing: Subpar But Still Giving Economy a Lift

After big rebounds in housing prices, more modest gains are likely this year.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

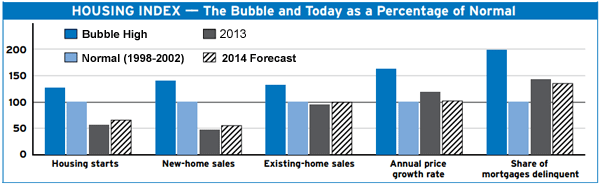

While the housing market has clearly come a long way since the depths of the recession, there’s still a long way to go before the industry returns to normal. Indeed, it’s unlikely that measures of housing activity will return to the peaks seen before the bubble burst in 2007, and in many cases it would be undesirable. But some key gauges of housing health, such as housing starts and new-home sales plus mortgage delinquencies, are still struggling to recover to levels that preceded the big run-up in the middle of the 2000s decade.

New-home inventory and new-home sales, for example, remain more than 40% below 1998-2002 levels. They are more than 60% below their peaks. In addition, the 1.07 million new homes expected to be started in 2014 is more than 30% below the typical prebubble pace of 1.5 million. The 2005 peak topped 2 million. Still, building is picking up and will gain further after the first quarter of this year; the unusually harsh winter is temporarily dampening activity in many parts of the country. Builders are eager to cash in on strong buyer demand, driven higher by inventory constrained by the construction drought that lasted from 2008 through 2012. Annual housing starts will grow by 15% this year, passing the 1 million mark for the first time since 2007.

Similarly, the number of delinquent mortgages remains a problem. Though the share of mortgages in trouble is 32% below peak levels — when more than 9 million borrowers were seriously behind on their payments — it remains 35% above the 1998-2002 norm. It’ll be a few more years before more homeowners are able to get current on loans, as deals are worked out with banks, or foreclosures and short sales fully work their way through the market.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The good news is that the average annual gain in home value and sales of existing homes are closer to hitting the mark. This year, we expect home value to appreciate by an average of 4% to 4.5% nationwide. That’s a significant cooling from 2013, when home prices climbed an average of more than 11%. Rising mortgage rates will temper demand and there’ll be fewer investors bringing all-cash offers to the table, as bargain prices and rock-bottom interest rates fade away. For the market as a whole, the slowing growth is positive, alleviating concerns about the prospect of a new housing bubble in hot markets and implying a more stable, sustainable period of growth ahead.

Steady gains in home values will also help bring sales of existing homes to normal levels, as they lift more homeowners out of underwater mortgages, encouraging them to sell. Indeed, sales of existing homes will grow by about 4% this year, with around 5.3 million homes sold in 2014. That’s within spitting distance of the pace of about 5.34 million that was considered normal during the pre-boom-and-bust period, but a long way off from the more than 7 million homes sold during the height of the bubble.

The higher home prices in combination with increased mortgage rates mean that affordability, too, is creeping back toward more normal levels. Historically, a median-price home would cost about 20% of household income. In 2013, it only took about 15%. As rates on 30-year mortgages rise to 5% in 2014, it will take closer to 17% of household income to purchase a median-price home. While that means fewer would-be buyers will be able to purchase homes, it also indicates the extremes of the market are disappearing.

In the meantime, the continued recovery of the housing industry is unequivocally good news for overall economic growth. This year, we expect housing and related industries to contribute about 0.5 percentage point to GDP growth — around 0.4 percentage point from residential building and realtor commissions and 0.1 percentage point from home furnishing sales, landscaping and other industries closely tied to housing. That’s 0.1 percentage point above the normal contribution from housing — a sorely needed bonus, given the otherwise subpar economic growth.

Staff Economist David Payne contributed to this report.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

Trump Reshapes Foreign Policy

Trump Reshapes Foreign PolicyThe Kiplinger Letter The President starts the new year by putting allies and adversaries on notice.

-

Congress Set for Busy Winter

Congress Set for Busy WinterThe Kiplinger Letter The Letter editors review the bills Congress will decide on this year. The government funding bill is paramount, but other issues vie for lawmakers’ attention.

-

The Kiplinger Letter's 10 Forecasts for 2026

The Kiplinger Letter's 10 Forecasts for 2026The Kiplinger Letter Here are some of the biggest events and trends in economics, politics and tech that will shape the new year.

-

What to Expect from the Global Economy in 2026

What to Expect from the Global Economy in 2026The Kiplinger Letter Economic growth across the globe will be highly uneven, with some major economies accelerating while others hit the brakes.

-

Amid Mounting Uncertainty: Five Forecasts About AI

Amid Mounting Uncertainty: Five Forecasts About AIThe Kiplinger Letter With the risk of overspending on AI data centers hotly debated, here are some forecasts about AI that we can make with some confidence.

-

Worried About an AI Bubble? Here’s What You Need to Know

Worried About an AI Bubble? Here’s What You Need to KnowThe Kiplinger Letter Though AI is a transformative technology, it’s worth paying attention to the rising economic and financial risks. Here’s some guidance to navigate AI’s future.

-

Will AI Videos Disrupt Social Media?

Will AI Videos Disrupt Social Media?The Kiplinger Letter With the introduction of OpenAI’s new AI social media app, Sora, the internet is about to be flooded with startling AI-generated videos.

-

What Services Are Open During the Government Shutdown?

What Services Are Open During the Government Shutdown?The Kiplinger Letter As the shutdown drags on, many basic federal services will increasingly be affected.