Small-Business Success Story: Propel Electric-Assisted Bikes

This Army veteran built a million-dollar business selling electric-assisted bicycles.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

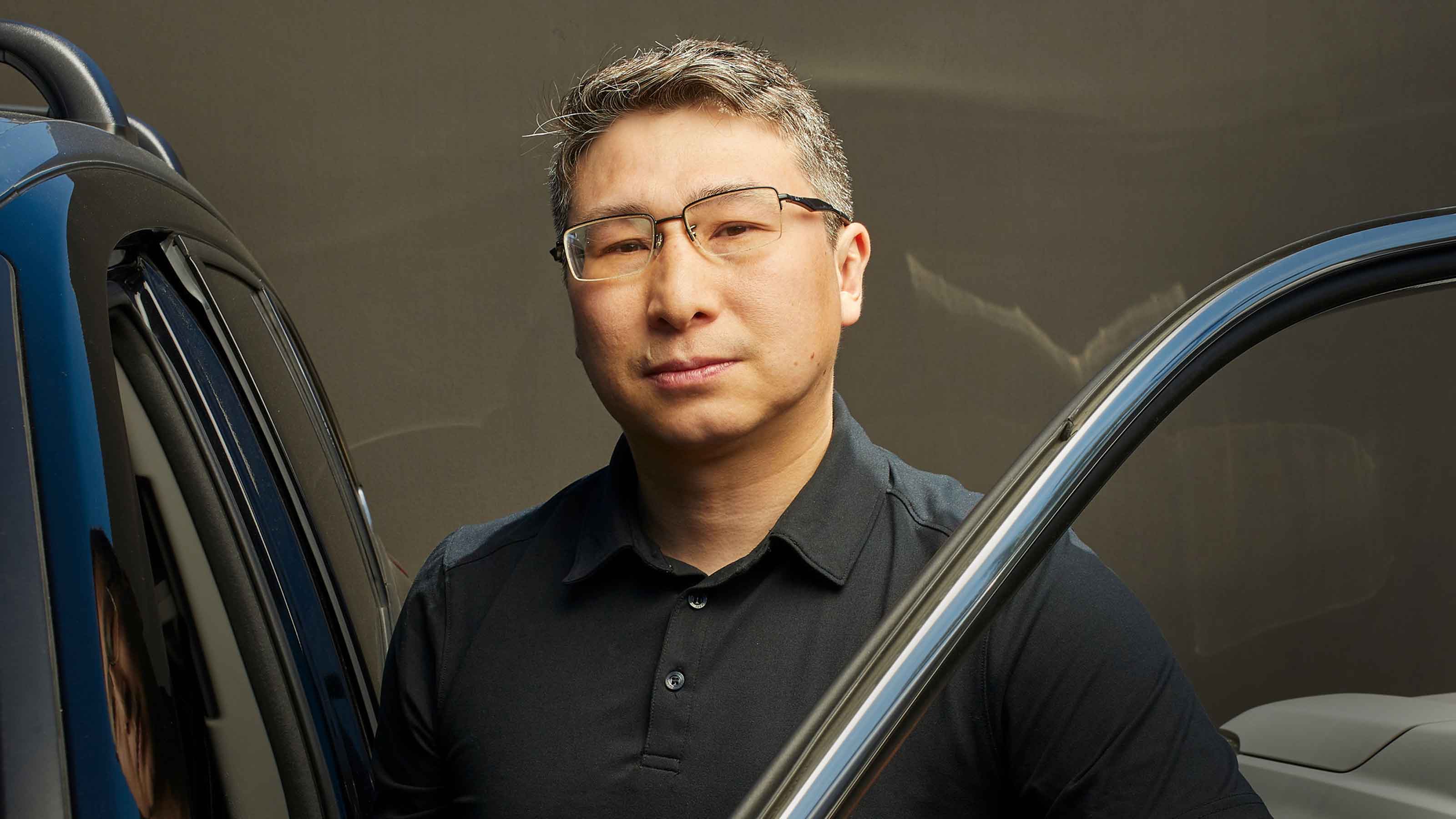

Kiplinger's spoke with Propel Bikes' founder and owner Chris Nolte (pictured at left), 34, of Brooklyn, New York, about how he used a $20,000 loan to create a million-dollar business. Read on for an excerpt from our interview:

What is an electric-assisted bike? You pedal it like any other bike, and it amplifies your efforts by 50% to almost 300% with an electric motor. Prices start at about $1,500, but most of the bikes sell for between $2,000 and $5,000.

You bought one for yourself? I drove fuel trucks in the Iraq war and injured my back. After I received a medical retirement from the military in 2005, I was pretty inactive for several years. In 2011, to get moving again, I ordered a kit and converted my bike to an electric-assisted bike. I discovered it’s less intimidating if you don’t have to do all the work yourself. I didn’t worry about whether I could handle a certain distance or terrain.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Was it a stretch for you to go into sales? Not really. I'd worked in retail since I was young, most recently with a luggage business. At the time I started Propel Bikes, I was running my own Web development and marketing business and earning my bachelor’s degree in information technology.

How did you start? I found manufacturers of high-quality bikes that were willing to ship bikes to customers after I made the sale. I already shared office space in an industrial building on Long Island. I designed my own Web site (www.propelbikes.com), and I wrote a business plan with the help of a local Small Business Development Center [part of the U.S. Small Business Administration].

How did you finance your start-up? I used a $20,000 Patriot Express Loan, designed for veterans, with a six-year term and 8% interest rate, to buy a small inventory of bikes. Once I proved that I could sell bikes, manufacturers were willing to let me buy on credit. To open our Brooklyn storefront location in 2015, I borrowed $30,000, with a three-year term and a 4% rate, from an SBA-approved microlender. I used that to outfit the space and to bring in some additional product.

How have you grown? In 2011, we sold bikes from three manufacturers and had gross sales of $50,000. In 2015, we sold bikes from 10 manufacturers and grossed $1 million. We expect to do about the same in 2016.

Are you making a living? I receive some disability income from Veterans Affairs, and I take a small salary. One of my greater successes is that I can provide a living for my two siblings, and that makes me pretty happy. My brother, Kyle, who is 25, is my right-hand man. My sister, Catherine, who is 28 and lives out of state, handles Web marketing.

What does the future hold? The potential for growth is pretty great. More people are thinking about going green, traffic is getting worse, and bicycle infrastructure is growing. An electric bike works excellently if you want to bike to work without getting sweaty.

Do you still ride? I'm pretty busy, and I live only a block and a half from work. But I ride for pleasure when I can.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

How to Search For Foreclosures Near You: Best Websites for Listings

How to Search For Foreclosures Near You: Best Websites for ListingsMaking Your Money Last Searching for a foreclosed home? These top-rated foreclosure websites — including free, paid and government options — can help you find listings near you.

-

Four Tips for Renting Out Your Home on Airbnb

Four Tips for Renting Out Your Home on Airbnbreal estate Here's what you should know before listing your home on Airbnb.

-

Is Relief from Shipping Woes Finally in Sight?

Is Relief from Shipping Woes Finally in Sight?business After years of supply chain snags, freight shipping is finally returning to something more like normal.

-

Economic Pain at a Food Pantry

Economic Pain at a Food Pantrypersonal finance The manager of this Boston-area nonprofit has had to scramble to find affordable food.

-

The Golden Age of Cinema Endures

The Golden Age of Cinema Enduressmall business About as old as talkies, the Music Box Theater has had to find new ways to attract movie lovers.

-

Pricey Gas Derails This Uber Driver

Pricey Gas Derails This Uber Driversmall business With rising gas prices, one Uber driver struggles to maintain his livelihood.

-

Smart Strategies for Couples Who Run a Business Together

Smart Strategies for Couples Who Run a Business TogetherFinancial Planning Starting an enterprise with a spouse requires balancing two partnerships: the marriage and the business. And the stakes are never higher.

-

Fair Deals in a Tough Market

Fair Deals in a Tough Marketsmall business When you live and work in a small town, it’s not all about profit.