When Will the Economy Feel Better?

We’re almost there. As the expansion continues to improve, more of its rewards will be seen and felt.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Though the recession has been over for five years, and GDP recaptured its previous peak some time back, for many, the economy still feels punk. In fact, in surveys, some people say they think the country is still in recession. Certainly, growth has been sluggish. Annual GDP gains haven’t topped a middling 2.5% since the end of the recession.

So when will the economy feel strong again -- more like a typical expansion of recent decades? The best bet is by mid-2015 or so, barring some new foreign or domestic crisis that wreaks havoc on consumers and businesses.

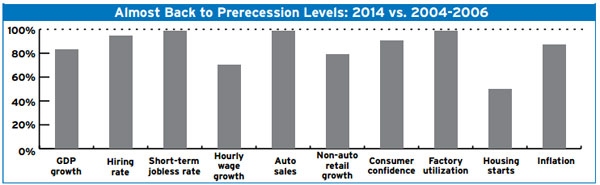

By some measures, the economy is almost there. Auto sales, for example, are vigorous and just a whisker under the prerecession level. Corporate profits are robust as well. Indeed, a variety of economic gauges -- from GDP growth to consumer confidence to hiring -- are all approaching levels that are typical of periods of expansion in the 1980s, 1990s and 2000s. (The major exception: housing starts and sales. These were so overheated last decade that it’ll take even longer for them to recover to healthy expansion rates.)

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

And momentum is building. Hiring and income gains are beginning to fuel spending by consumers, which will lead to more business investment and job creation, and hence to even more consumer spending. A lot of the slack has disappeared, opening the door to more-robust growth. For example, industrial capacity utilization is at about 79% now, just slightly below the 2004–2006 average from the previous expansion, and well removed from the 67% recession low. So businesses are more likely to expand, investing in plant and equipment.

The labor market, too, is tightening. The number of long-term unemployed (those unemployed over six months) has dropped from 6.8 million to 3.2 million, though this is still above a more normal level of 1.5 million, the 2004–2006 average. Meanwhile, the unemployment rate for those out of work for less than six months is just 4.1%, the same as it was in 2004–2006. Hiring, measured as a share of total employment, is in high gear, and monthly job gains are regularly topping 200,000. Job openings have surged from 2.9% of employment in March to 3.3% in June, suggesting that hiring will continue to be strong in the near future. Because of that, more workers now have the confidence to quit one job to seek a better one, as the current quit rate of 1.9% of employment has risen nearly to the level of the 2004–2006 average of 2.1%.

As a result of the labor market improvements, total wages and salaries have climbed nearly 5% since mid-2013. The hourly wage rate of nonsupervisory workers grew 2.3% in the past twelve months. While this is only a little above inflation, it has been gradually climbing, indicating both potential cost pressures and a widening of income gains for workers. The latter translates into a broader base of consumer spending.

Finally, faster inflation, though not a desirable outcome, is another characteristic of a stronger expansion, and inflation has indeed picked up in recent months. It’s unlikely, however, that inflationary pressures will ratchet up much in coming months, given that productivity growth is likely to pick up to match wage growth and nonlabor business costs are not rising. The 2.2% annual rate expected for the remainder of this year is still well below the 3.1 % average inflation rate in 2004–2006.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

David is both staff economist and reporter for The Kiplinger Letter, overseeing Kiplinger forecasts for the U.S. and world economies. Previously, he was senior principal economist in the Center for Forecasting and Modeling at IHS/GlobalInsight, and an economist in the Chief Economist's Office of the U.S. Department of Commerce. David has co-written weekly reports on economic conditions since 1992, and has forecasted GDP and its components since 1995, beating the Blue Chip Indicators forecasts two-thirds of the time. David is a Certified Business Economist as recognized by the National Association for Business Economics. He has two master's degrees and is ABD in economics from the University of North Carolina at Chapel Hill.

-

Hiding the Truth From Your Financial Adviser Can Cost You

Hiding the Truth From Your Financial Adviser Can Cost YouHiding assets or debt from a financial adviser damages the relationship as well as your finances. If you're not being fully transparent, it's time to ask why.

-

How to Manage a Disagreement With Your Financial Adviser

How to Manage a Disagreement With Your Financial AdviserKnowing how to deal with a disagreement can improve both your finances and your relationship with your planner.

-

5 Actions to Set Up Your Business With Your Exit in Mind

5 Actions to Set Up Your Business With Your Exit in MindWhen you're starting a business, it may seem counterintuitive to begin with exit planning. But preparing will put you on a more secure footing in the long run.

-

Farmers Brace for Another Rough Year

Farmers Brace for Another Rough YearThe Kiplinger Letter The agriculture sector has been plagued by low commodity prices and is facing an uncertain trade outlook.

-

Trump Reshapes Foreign Policy

Trump Reshapes Foreign PolicyThe Kiplinger Letter The President starts the new year by putting allies and adversaries on notice.

-

Congress Set for Busy Winter

Congress Set for Busy WinterThe Kiplinger Letter The Letter editors review the bills Congress will decide on this year. The government funding bill is paramount, but other issues vie for lawmakers’ attention.

-

The Kiplinger Letter's 10 Forecasts for 2026

The Kiplinger Letter's 10 Forecasts for 2026The Kiplinger Letter Here are some of the biggest events and trends in economics, politics and tech that will shape the new year.

-

What to Expect from the Global Economy in 2026

What to Expect from the Global Economy in 2026The Kiplinger Letter Economic growth across the globe will be highly uneven, with some major economies accelerating while others hit the brakes.

-

Amid Mounting Uncertainty: Five Forecasts About AI

Amid Mounting Uncertainty: Five Forecasts About AIThe Kiplinger Letter With the risk of overspending on AI data centers hotly debated, here are some forecasts about AI that we can make with some confidence.

-

Worried About an AI Bubble? Here’s What You Need to Know

Worried About an AI Bubble? Here’s What You Need to KnowThe Kiplinger Letter Though AI is a transformative technology, it’s worth paying attention to the rising economic and financial risks. Here’s some guidance to navigate AI’s future.

-

Will AI Videos Disrupt Social Media?

Will AI Videos Disrupt Social Media?The Kiplinger Letter With the introduction of OpenAI’s new AI social media app, Sora, the internet is about to be flooded with startling AI-generated videos.