The Problem With PLUS Loans

New student loan rates are lower, but parent loans are still no bargain.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Interest rates on federal student loans are set to fall by more than half a percentage point on July 1, 2019, for loans issued for the upcoming academic year. But while that will offer modest relief to new borrowers, the rate on one of the fastest-growing types of loans—parent PLUS loans—remains well above rates on other types of loans.

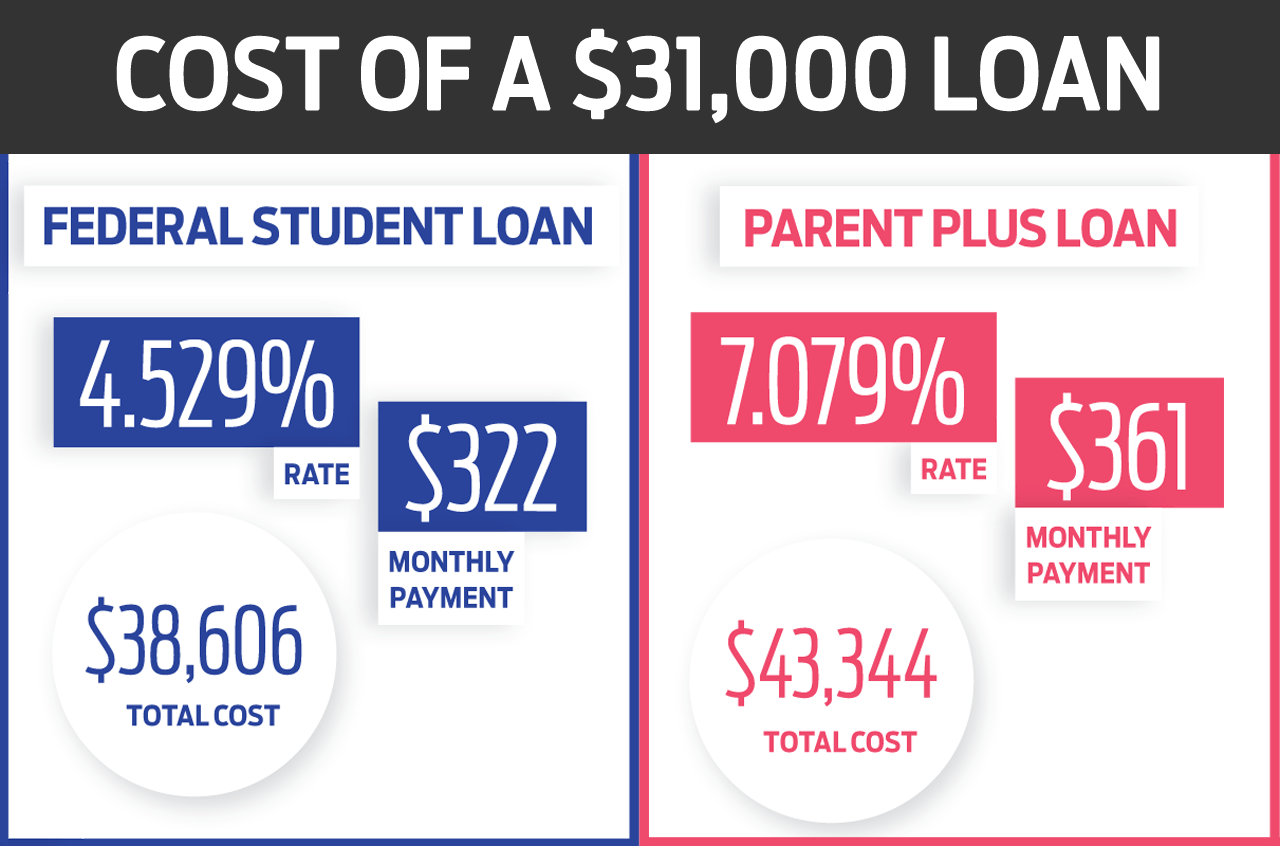

The rate on PLUS loans issued on or after July 1 is 7.079%, compared with 4.529% for federal Stafford loans taken out by undergraduates. That adds up: A $31,000 federal direct loan—the lifetime maximum most undergrads can borrow—paid off over 10 years would cost about $38,600 with interest, while a Parent PLUS loan for the same amount would cost more than $43,300.

PLUS loans appeal to a lot of parents because they’re easy to qualify for and can cover the full cost of attendance. The government paid out $12.7 billion in parent PLUS loans over the 2017–18 academic year, compared with $7.7 billion in 2007–08, according to Mark Kantrowitz, of Savingforcollege.com. In the 2017–18 academic year, the average PLUS loan balance was $35,600.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

A recent AARP survey found that nearly one-third of parents who had taken out a PLUS loan had difficulty making at least one payment over the course of five years. “We have a growing population of parents with tens of thousands of dollars in student loan debt,” says Betsy Mayotte, president of the Institute of Student Loan Advisors. “At 45 or 55, your spending should be focused on retirement, not loans.”

A better strategy. Some parents also want to help their children avoid debt. But with such a wide disparity in interest rates, parents may be better off having their child take out federal student loans and then helping to pay them off.

There are limits on how much a student can borrow each year in federal loans. For example, most freshmen can borrow no more than $5,500 in direct Stafford student loans. But if that’s not enough to cover expenses, there are other options that cost less than parent PLUS loans. Many schools offer interest-free tuition payment plans that stretch the length of a semester or school year. You might also be able to take out a home equity line of credit, or HELOC. The average rate on those loans, which is tied to the federal prime rate, is about 6.1%.

If you have good credit, you may find better rates through a private loan provider. The interest will most likely be a variable rate, meaning it could rise if overall interest rates move higher.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

9 Types of Insurance You Probably Don't Need

9 Types of Insurance You Probably Don't NeedFinancial Planning If you're paying for these types of insurance, you may be wasting your money. Here's what you need to know.

-

New Ways to Use 529 Plans

New Ways to Use 529 PlansTax-free withdrawals from 529 plans could help you sharpen your job skills.

-

I Want to Help Pay for My Grandkids' College. Should I Make a Lump-Sum 529 Plan Contribution or Spread Funds out Through the Years?

I Want to Help Pay for My Grandkids' College. Should I Make a Lump-Sum 529 Plan Contribution or Spread Funds out Through the Years?We asked a college savings professional and a financial planning expert for their advice.

-

Amazon Resale: Where Amazon Prime Returns Become Your Online Bargains

Amazon Resale: Where Amazon Prime Returns Become Your Online BargainsFeature Amazon Resale products may have some imperfections, but that often leads to wildly discounted prices.

-

How Intrafamily Loans Can Bridge the Education Funding Gap

How Intrafamily Loans Can Bridge the Education Funding GapTo avoid triggering federal gift taxes, a family member can lend a student money for education at IRS-set interest rates. Here's what to keep in mind.

-

How an Irrevocable Trust Could Pay for Education

How an Irrevocable Trust Could Pay for EducationAn education trust can be set up for one person or multiple people, and the trust maker decides how the money should be used and at what age.

-

UTMA: A Flexible Alternative for Education Expenses and More

UTMA: A Flexible Alternative for Education Expenses and MoreThis custodial account can be used to pay for anything once the beneficiary is considered an adult in their state. There are some considerations, though.

-

Coverdell Education Savings Accounts: A Deep Dive

Coverdell Education Savings Accounts: A Deep DiveWhile there are some limitations on income and contributions, as well as other restrictions, a Coverdell can be a bit more flexible than a 529 plan.