The Best College Savings Strategy to Use

A 529 college savings plan comes with many advantages, and the best way to harness its power is to start ASAP and front-load your contributions.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

If you’re a parent, you’ve undoubtedly wondered how you should save for your kids’ college educations … and how much you need to save.

With the cost of college only continuing to rise at a clip that outpaces inflation, we can expect higher education to require a hefty amount of money in the future. The best strategy you can use to be prepared for this reality is to start saving as early as you can — and don’t get caught playing catch-up later on.

Leverage a 529 Plan for College Savings

One of the best places to stash cash earmarked for college costs is within a 529 plan. The money you contribute here can grow and be used tax-free when your kids go to school (as long as the money is spent on qualifying education expenses).

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Because they’d need a Social Security number, your children need to be born before you can start using a plan; you can’t contribute before you have kids, or even while pregnant. (Note that, technically, if you’re determined to start saving before you start a family, there is one way around it: You can open account with yourself as the beneficiary, and then later switch it to your child.)

As soon as your children arrive in the world, I’d recommend setting aside a small amount of money each month into a 529 plan for them.

Why? Compounding! If you start when your child is born, that gives you 18 years to save. Many parents read that and feel they have plenty of time — but if you wait, you give yourself an uphill battle when it comes to saving enough.

Here’s the thing: Compounding returns is what will allow you to save less every month as long as you save longer. If you start when your child is young, it will be easier to generate the money needed to pay for college costs.

The more money you put in earlier the more time it has time to compound!

Why You Should Front-Load Your College Savings Accounts

Time is arguably your biggest advantage as an investor, because more time leads to increased compounding. Not convinced? Let’s look at a specific example with real numbers.

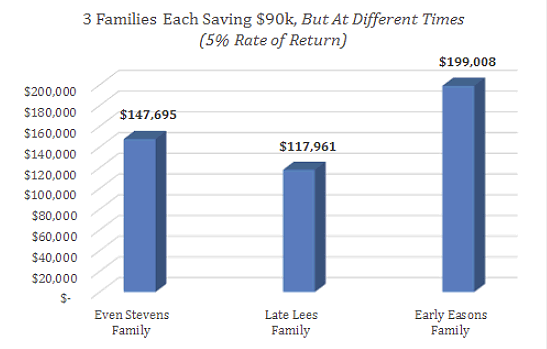

Imagine that three families all contribute the same amount of cash, $90,000, to their child’s 529 plan over 18 years — but they contribute the money at different times.

Family 1 (we’ll call them the Even Stevens Family) contributes $5,000 per year to a 529 plan.

Meanwhile, Family 2 (who we’ll call the Late Lees Family) contributes $1,000 per year in first five years. They gradually increase their contributions over time as college gets closer, with $2,500 per year for years 6-10, and $5,000 per year in years 11-15. In the last three years they have to save before their kid goes to college, they save $12,500, $15,000 and $20,000.

Finally, Family 3 (or the Early Easons Family) takes yet a different approach: Over the 18 years they have to save for college, they contribute $20,000 per year to the 529 plan for the first four years. In savings year five, they contribute $10,000. And then they simply leave the money invested in the plan, without contributing more cash between now and when their child goes to school.

Which family had the best strategy? Who ended up with the most money in the 529 plan? Here’s what each family has in their plan at the end of that 18-year savings period :

The results might surprise you. As we can see, the Stevens family ends up with almost $30,000 more saved for higher education expenses than the Lees — even though both families contributed the same amount of money.

This is how compounding works: Your money needs to time to grow. The Stevens family gave more of their money a longer period of time to grow. Even though the Lees made some pretty big contributions late in the game, that money never got a chance to compound — so they ended up with less overall.

And just look at what happens if you focus on saving as much as you can as early as you can! The Easons have vastly more money available to fund college — even though, again, they contributed the same amount as everyone else. But they also gave their money the most time to compound and grow, which is why they have over $81,000 more than the Lees and over $51,000 more than the Stevens family.

But What If Your Kid Doesn’t Go to College?

Of course, there’s one big caveat to all this, and it’s one some parents fear dealing with down the road: After all that effort to save “early and often,” what happens to the money in the 529 plan if your kid doesn’t go to college in 18 years?

For parents of multiple children, you could change the beneficiary of the account to another child in your household (or another family member, even yourself). And if you don’t need the money because your child gets a full scholarship, the 10% penalty for taking the cash out of the 529 plan is waived. (For more on that, read The 529 Plan Scholarship Exception.)

If this isn’t an option for whatever reason, then you might be looking at a worst-case scenario: a bunch of college savings with no college student. But this isn’t actually as bad as it seems, because you can access that money. You pay a 10% penalty on the earnings, but most families agree this potential risk is much better than not having enough savings for college for a child who does end up going.

Want to learn more? Be sure to check out this post about difference between direct and broker sold 529 plans — and why you need a direct plan.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Paul Sydlansky, founder of Lake Road Advisors LLC, has worked in the financial services industry for over 20 years. Prior to founding Lake Road Advisors, Paul worked as relationship manager for a Registered Investment Adviser. Previously, Paul worked at Morgan Stanley in New York City for 13 years. Paul is a CERTIFIED FINANCIAL PLANNER™ and a member of the National Association of Personal Financial Advisors (NAPFA) and the XY Planning Network (XYPN).

-

Look Out for These Gold Bar Scams as Prices Surge

Look Out for These Gold Bar Scams as Prices SurgeFraudsters impersonating government agents are convincing victims to convert savings into gold — and handing it over in courier scams costing Americans millions.

-

How to Turn Your 401(k) Into A Real Estate Empire

How to Turn Your 401(k) Into A Real Estate EmpireTapping your 401(k) to purchase investment properties is risky, but it could deliver valuable rental income in your golden years.

-

My First $1 Million: Retired Nuclear Plant Supervisor, 68

My First $1 Million: Retired Nuclear Plant Supervisor, 68Ever wonder how someone who's made a million dollars or more did it? Kiplinger's My First $1 Million series uncovers the answers.

-

This Is How You Can Land a Job You'll Love

This Is How You Can Land a Job You'll Love"Work How You Are Wired" leads job seekers on a journey of self-discovery that could help them snag the job of their dreams.

-

Have You Aligned Your Tax Strategy With These 5 OBBBA Changes?

Have You Aligned Your Tax Strategy With These 5 OBBBA Changes?Individuals and businesses should work closely with their financial advisers to refine tax strategies this season in light of these five OBBBA changes.

-

A Financial Plan Is a Living Document: Is Yours Still Breathing?

A Financial Plan Is a Living Document: Is Yours Still Breathing?If you've made a financial plan, congratulations, but have you reviewed it recently? Here are six reasons why your plan needs regular TLC.

-

Your Guide to Financial Stability as a Military Spouse, Courtesy of a Financial Planner

Your Guide to Financial Stability as a Military Spouse, Courtesy of a Financial PlannerThese practical resources and benefits can help military spouses with managing a budget, tax and retirement planning, as well as supporting their own career

-

3 Steps to Keep Your Digital Data Safe, Courtesy of a Financial Planner

3 Steps to Keep Your Digital Data Safe, Courtesy of a Financial PlannerAs data breaches and cyberattacks increase, it's vital to maintain good data hygiene and reduce your personal information footprint. Find out how.

-

Here's Why You Can Afford to Ignore College Sticker Prices

Here's Why You Can Afford to Ignore College Sticker PricesCollege tuition fees can seem prohibitive, but don't let advertised prices stop you from applying. Instead, focus on net costs after grants and scholarships.

-

'You Owe Me a Refund': Readers Report Challenging Their Attorneys' Bills

'You Owe Me a Refund': Readers Report Challenging Their Attorneys' BillsThe article about lawyers billing clients for hours of work that AI did in seconds generated quite a response. One law firm even called a staff meeting.

-

Divide and Conquer: Your Annual Financial Plan Made Easy, Courtesy of a Financial Adviser

Divide and Conquer: Your Annual Financial Plan Made Easy, Courtesy of a Financial AdviserOverwhelmed by your financial to-do list? Split it into four quarters and assign each one goals that connect to the time of year. It could be life-changing.