Some Capital One Customers Getting a Refund

Here's what credit cardholders need to know about the money they will receive as a result of an enforcement action taken by the Consumer Financial Protection Bureau against Capital One.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

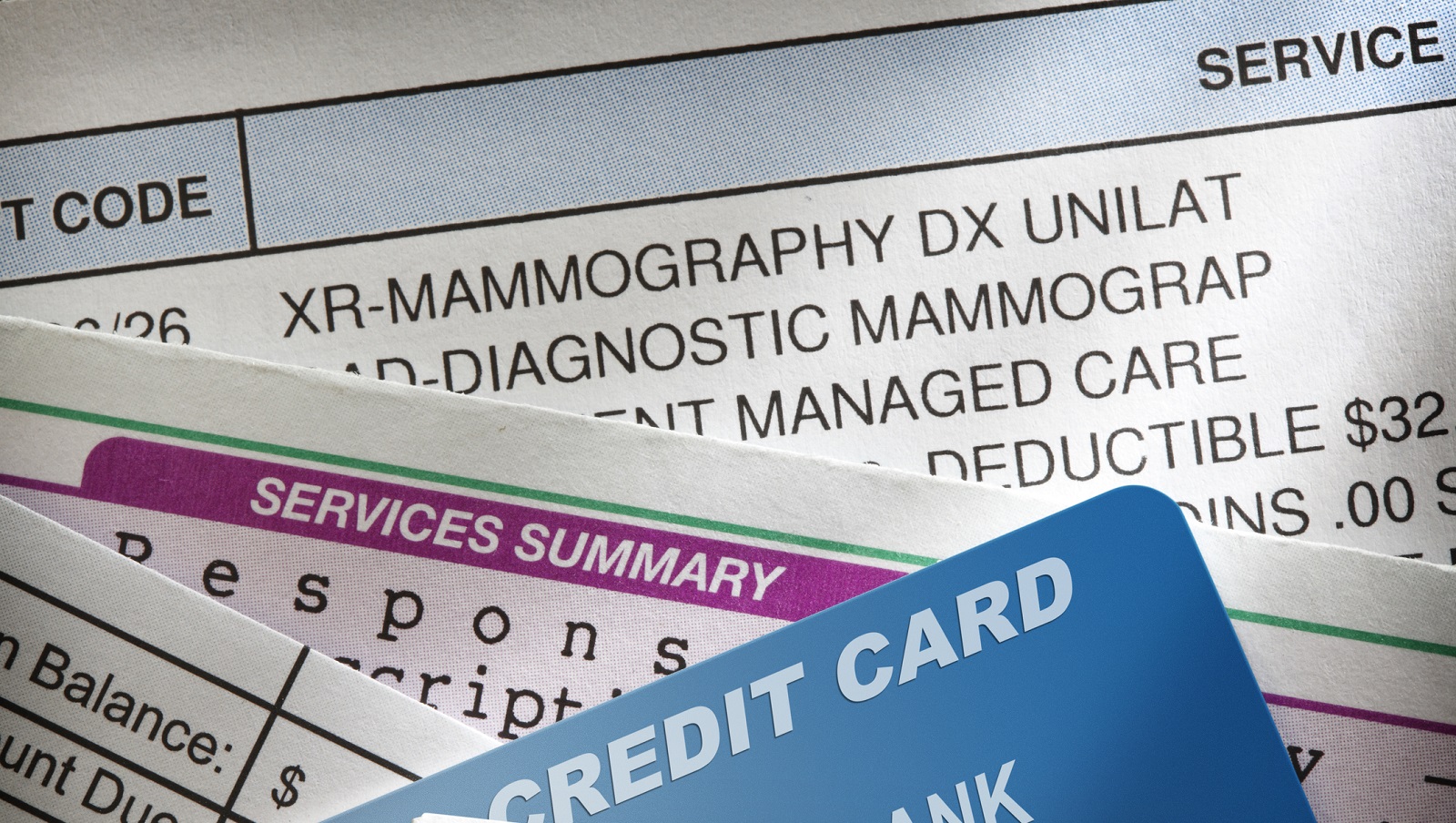

If you have a Capital One credit card, you might be entitled to a refund. That's because the Consumer Financial Protection Bureau (CFPB) recently ordered Capital One Bank to refund $140 million to about 2 million customers who were pressured or mislead into paying for credit-card products they didn't understand, want or, in some cases, even need.

DOWNLOAD: The Kip Tips iPad App

Capital One call-center vendors offered consumers with low credit scores or low credit limits payment protection, which allowed them to ask the bank to cancel up to a year of payments if they encountered certain life events, such as unemployment. The vendors also offered credit monitoring with identity-theft protection and access to credit education specialists.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Consumers were led to believe that the products would improve their credit scores and sometimes were told the products were free. Some consumers were enrolled without their consent, and some were sold the products even though they were ineligible for them, according to CFPB.

Capital One will automatically refund customers with open accounts by crediting their accounts. Customers who have closed their accounts will receive a check in the mail. The CFPB says customers should expect to receive refunds later this year. If you have questions about the refund, contact Capital One directly by using the customer service number on your credit card.

The CFPB also is warning consumers to watch out for scammers who may try to charge a fee, ask them to cash a check or divulge personal information to claim their refund.

Get 100 of our top money-saving tips by downloading the new iPad app or purchasing the PDF version.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Award-winning journalist, speaker, family finance expert, and author of Mom and Dad, We Need to Talk.

Cameron Huddleston wrote the daily "Kip Tips" column for Kiplinger.com. She joined Kiplinger in 2001 after graduating from American University with an MA in economic journalism.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Mortgage Closing Costs and Fees Leapt 22% in 2022, Study Shows

Mortgage Closing Costs and Fees Leapt 22% in 2022, Study ShowsThe mortgage market was profoundly affected by high interest rates last year, a trend that is likely to continue given this year's rate increases, CFPB director says.

-

Leasing Firm 'Tricked' Shoppers, Ordered to Pay into Victims Relief Fund

Leasing Firm 'Tricked' Shoppers, Ordered to Pay into Victims Relief FundShoppers at stores including Sears and Kmart were ‘kept in the dark’ about contract terms, CFPB says.

-

Medical Credit Card Marketers Are Trying More Ways to Reach You

Medical Credit Card Marketers Are Trying More Ways to Reach YouMedical credit card promotions can now be found at physician offices, diagnostic centers and hospital websites, group says.

-

Five Ways to Save on Vacation Rental Properties

Five Ways to Save on Vacation Rental PropertiesTravel Use these strategies to pay less for an apartment, condo or house when you travel.

-

How to Avoid Annoying Hotel Fees: Per Person, Parking and More

How to Avoid Annoying Hotel Fees: Per Person, Parking and MoreTravel Here's how to avoid extra charges and make sure you don't get stuck paying for amenities that you don't use.

-

Loan Lender Sued for 'Trapping' Borrowers

Loan Lender Sued for 'Trapping' BorrowersHeights Finance was charged over a loan-churning scheme that aggressively pushed borrowers to refinance.

-

Medical Credit Cards Drive Up Cost of Care, Says CFPB

Medical Credit Cards Drive Up Cost of Care, Says CFPBCFPB says medical credit cards are driving up the cost of care with more than $1 billion accrued in deferred interest.

-

Your Credit Card Late Fees Could be Slashed, Thanks to CFPB Proposals

Your Credit Card Late Fees Could be Slashed, Thanks to CFPB ProposalsFederal bureau CFPB moves to rein in credit card late fees, which could save customers as much as $9 billion a year.