Investing in an HSA? Better Shop Around

Health savings accounts are a great way to save long term, but high fees can hurt returns.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Nearly half of all people covered by private health insurance are now in high-deductible plans, with the percentage rising every year, according to the National Center for Health Statistics. Whether you sign up for a high-deductible plan by choice or because it’s the only option available, having a high-deductible policy unlocks a valuable opportunity: the ability to get a triple tax break with a health savings account. Your contributions are tax-deductible (or pretax if made through your employer), the money grows tax-deferred, and you can withdraw money tax-free for eligible medical expenses at any time.

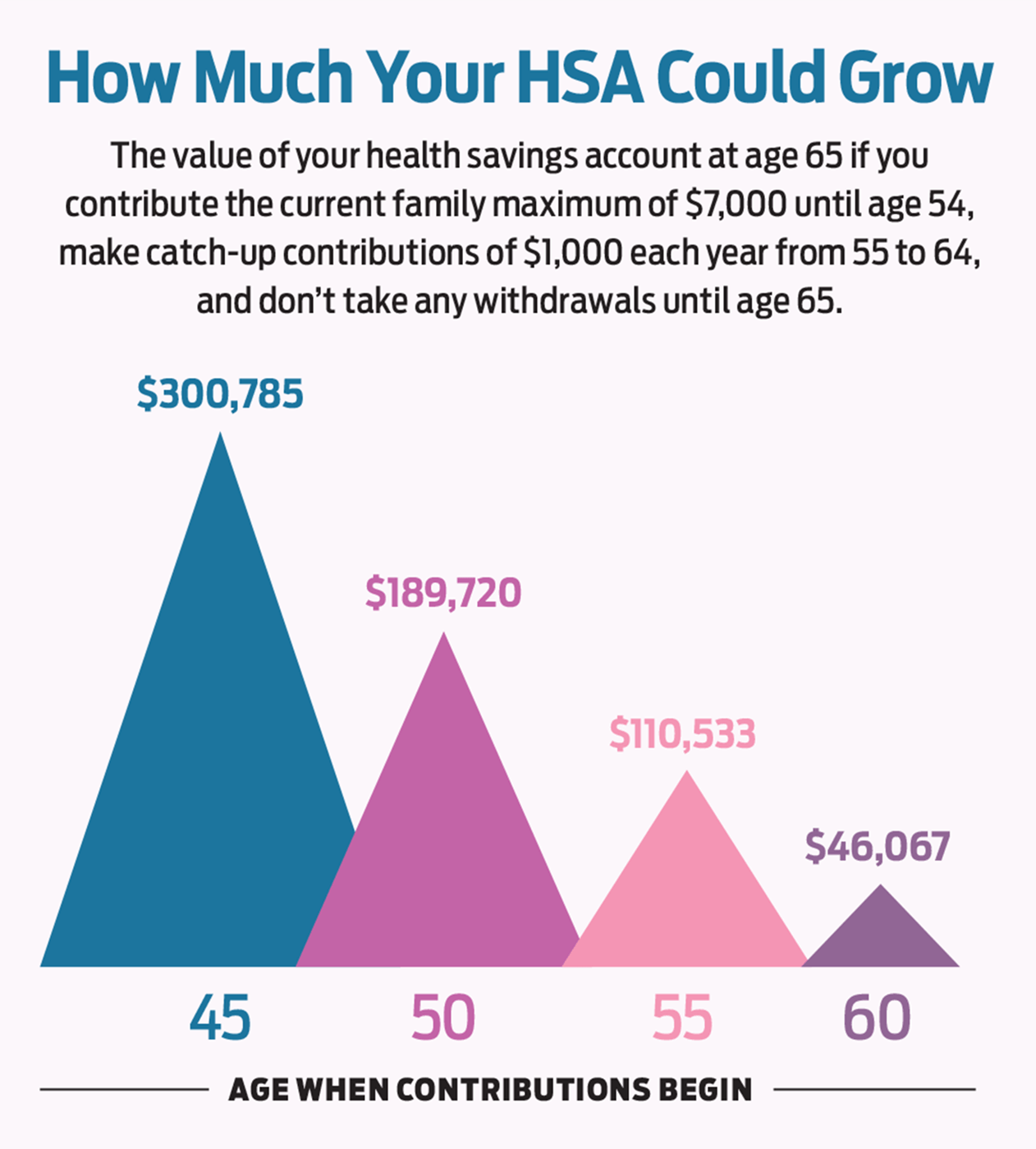

You’ll get the biggest benefit if you invest the HSA money for the future and use other cash for current expenses. There’s no time limit for withdrawing HSA money tax-free for eligible expenses you incur once you open the account, as long as you keep your receipts.

While these accounts provide a tax-efficient way to save for future health care costs, high fees can diminish their appeal.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

If your employer offers an HSA, that’s usually your best bet; most employers cover the administrative fees, and employers often contribute to employees’ accounts. But if you’re getting an HSA on your own, it’s important to compare the costs of different plans. Morningstar found that nine out of 10 popular HSAs charge a maintenance fee, ranging from $12 to $54 per year, and several charge an extra fee of $18 to $36 to invest the money, in addition to annual mutual fund expenses. (Some waived the maintenance or investing fee if you keep a minimum of $2,000 to $5,000 in the account.) The fees can be difficult to decipher. The industry needs a lot more transparency, says Morningstar’s Leo Acheson.

The options are improving. Fidelity, which used to offer HSAs only through employers, recently introduced an HSA available directly to consumers that charges no annual or maintenance fees. And Vanguard just started to offer HSAs to employers. The competition from new offerings should help lower fees and improve transparency; Acheson saw the same thing happen with 529 college-savings plans.

To qualify for an HSA, you need an HSA-eligible insurance policy with a deductible of at least $1,350 for individual coverage or $2,700 for family coverage, whether you get insurance through your employer or on your own (you can’t contribute if you’re enrolled in Medicare).

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

As the "Ask Kim" columnist for Kiplinger's Personal Finance, Lankford receives hundreds of personal finance questions from readers every month. She is the author of Rescue Your Financial Life (McGraw-Hill, 2003), The Insurance Maze: How You Can Save Money on Insurance -- and Still Get the Coverage You Need (Kaplan, 2006), Kiplinger's Ask Kim for Money Smart Solutions (Kaplan, 2007) and The Kiplinger/BBB Personal Finance Guide for Military Families. She is frequently featured as a financial expert on television and radio, including NBC's Today Show, CNN, CNBC and National Public Radio.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

9 Types of Insurance You Probably Don't Need

9 Types of Insurance You Probably Don't NeedFinancial Planning If you're paying for these types of insurance, you may be wasting your money. Here's what you need to know.

-

Amazon Resale: Where Amazon Prime Returns Become Your Online Bargains

Amazon Resale: Where Amazon Prime Returns Become Your Online BargainsFeature Amazon Resale products may have some imperfections, but that often leads to wildly discounted prices.

-

Roth IRA Contribution Limits for 2026

Roth IRA Contribution Limits for 2026Roth IRAs Roth IRAs allow you to save for retirement with after-tax dollars while you're working, and then withdraw those contributions and earnings tax-free when you retire. Here's a look at 2026 limits and income-based phaseouts.

-

Four Tips for Renting Out Your Home on Airbnb

Four Tips for Renting Out Your Home on Airbnbreal estate Here's what you should know before listing your home on Airbnb.

-

Five Ways to a Cheap Last-Minute Vacation

Five Ways to a Cheap Last-Minute VacationTravel It is possible to pull off a cheap last-minute vacation. Here are some tips to make it happen.

-

How Much Life Insurance Do You Need?

How Much Life Insurance Do You Need?insurance When assessing how much life insurance you need, take a systematic approach instead of relying on rules of thumb.

-

When Does Amazon Prime Day End in October? Everything We Know, Plus the Best Deals on Samsonite, Samsung and More

When Does Amazon Prime Day End in October? Everything We Know, Plus the Best Deals on Samsonite, Samsung and MoreAmazon Prime The Amazon Prime Big Deal Days sale ends soon. Here are the key details you need to know, plus some of our favorite deals members can shop before it's over.

-

How to Shop for Life Insurance in 3 Easy Steps

How to Shop for Life Insurance in 3 Easy Stepsinsurance Shopping for life insurance? You may be able to estimate how much you need online, but that's just the start of your search.