How to Buy the Right ETF

Hundreds of ETFs debut every year. Use this guide to spot the good ones.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

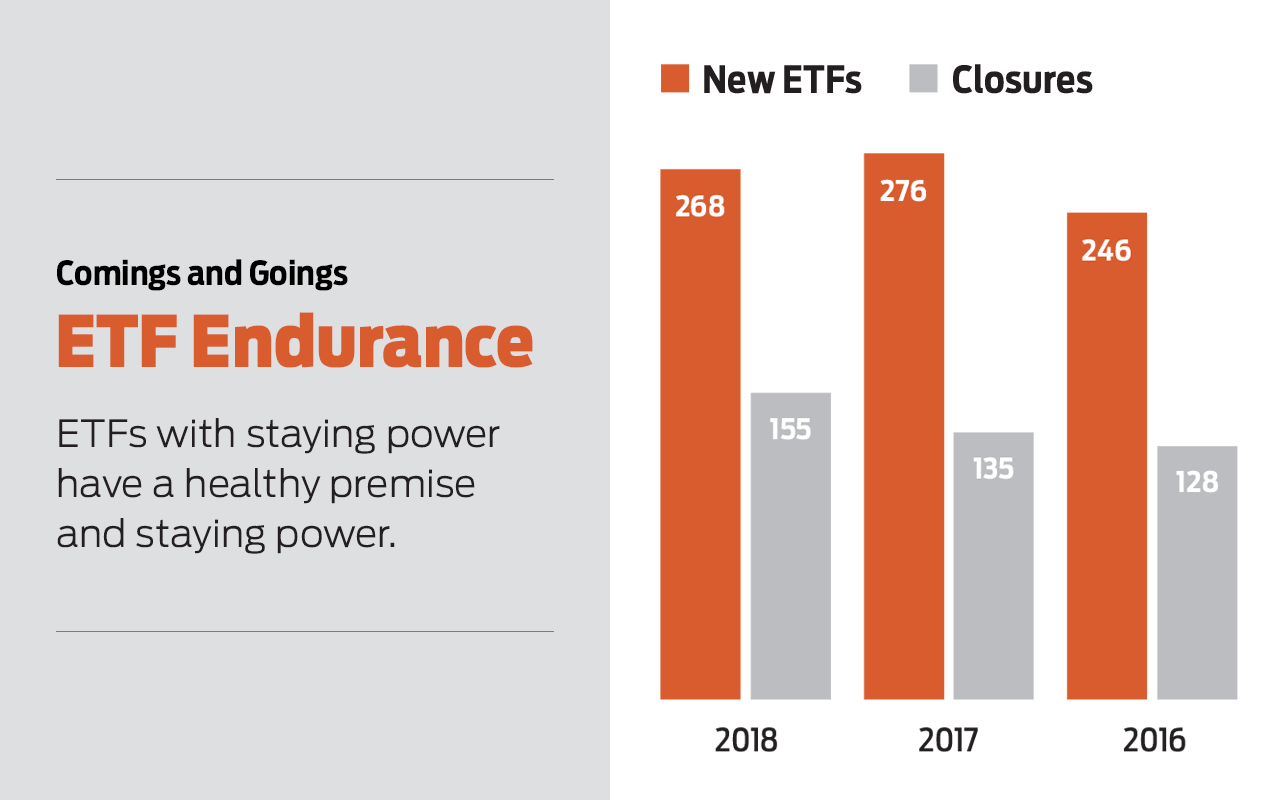

If you're trying to keep up with the exchange-traded fund (ETF) industry, don't blink. Providers have been churning out more than 200 new funds per year since 2014, including 268 new launches in 2018. So how on earth do you weed through all these offerings to buy the right ETF for you?

There's no magic formula that'll help you pinpoint a sure-fire winner. But if you do even a little homework, you can improve your chances of purchase a fund with real potential and lessen the odds of holding a fad investment that rapidly fizzles out.

Just ask these three crucial questions before you buy:

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

#1: Is there a legitimate investing theme, or is it just clever marketing?

ETF providers have developed a habit of turning every imaginable headline into a new product. Sometimes, they strike gold with genuine investing themes. But some ideas are better left alone.

Consider the LocalShares Nashville Area ETF (NASH), launched in 2013, that tracked roughly 30 companies headquartered in and around Nashville. It was a clever idea, given that Nashville was starting to experience a population boom. But the investment thesis was flawed. Being headquartered in a particular city doesn't mean a company will reap the benefits of that city's population growth or economic expansion.

For example, retailer Dollar General (DG), based in Goodlettsville, Tennessee, near Nashville, boasts 15,000 stores across 44 states. But only a few dozen of those are located in and around Music City. Nashville's economy might have tanked, and as long as customers across the rest of the country had money to spend, Dollar General would have done just fine.

A Nashville-linked ETFsounded good. But ultimately, NASH was just an index fund that revolved around where a small bundle of companies had their mail sent. That's not a sound investing thesis. Investors agreed, and they voted with their wallets; NASH stopped trading in 2018.

By contrast, the ROBO Global Robotics and Automation ETF (ROBO, $39.50) – which wants to capture the rise of robotics, automation and artificial intelligence – is an example of how to "do it right."

There's a clear growth story. For instance, the global AI market is expected to explode by 57.2% annually, on average, between 2017 and 2025. And factory automation, although a more-established global industry, still is expected to expand by an annualized 8.8% between 2018 and 2025.

More importantly, ROBO invests in companies that stand to directly benefit from these trends, such as American chipmaker Nvidia (NVDA), whose technologies are helping to power the rise of AI, and Japanese automation firm Fanuc. (Prices are as of October 31.)

#2: What's under the hood?

Investors tend to focus on two things when examining a fund, says Jared Snider, Senior Wealth Advisor at Oklahoma City-based Exencial Wealth Advisors. "They tend to look at the name of the fund, to try to determine what the fund is accomplishing, and then recent performance."

That's not sufficient, Snider says.

"You don't always get the investment experience that you're hoping to get if that's the only information you're looking at."

ETFdb.com lists roughly 170 ETFs that are classified as "dividend equity." They all invest in dividend-paying companies. But how the ETFs approach dividend investing differs from fund to fund. Some target high levels of yield, while others view dividends merely as a measure of quality.

The product names sometimes give only a few clues. Would high-income seekers know just by the moniker that the iShares Select Dividend ETF (DVY, 3.4% yield) delivers 1.2 percentage points more in yield than the First Trust Value Line Dividend Index Fund (FVD, 2.2%)?

Look deeper – into the fund's goals, its strategies and its holdings, which can be found on fund providers' product pages and data provider websites such as Morningstar.com.

This is particularly important for investors in thematic ETFs, who might have to do some digging to be sure they're getting the kind of exposure they expect.

For a few years after its 2011 launch, for example, the Global X Social ETF (SOCL), which invests in stocks such as Facebook (FB), Twitter (TWTR) and Snap Inc. (SNAP), had a couple of eyebrow-raising holdings. These included weight-loss company Nutrisystem, which considered social media part of its customer support system. It's a technical tie-in to the social theme, but few investors would consider stocks such as Nutrisystem an ideal way to invest in the growth of the social media industry.

However, the Global X U.S. Infrastructure Development ETF (PAVE, $16.58), launched in March 2017, aptly addresses a theme that other existing funds don't cover as well: the potential for a large governmental infrastructure package.

Many existing infrastructure funds own assets such as utilities and pipelines that already are in use, says Jay Jacobs, head of research for ETF provider Global X. And many of those funds are heavily invested overseas.

Thus, investors in those funds "had very little U.S. exposure, and really weren't going to benefit from an infrastructure bill," he says.

In contrast, PAVE's holdings – which include railroads as well as construction, electrical component and industrial machinery companies, all domiciled here in the U.S. – seem better positioned to enjoy the fruits of a bipartisan plan to spend on infrastructure, should we get one.

#3: How much in assets?

Lastly, take a quick look at assets under management, which tells you how much money the fund is working with.

"In money management, scale really matters," says Charles Lewis Sizemore, of Dallas, Texas-based Sizemore Capital Management. "The basic expenses of a fund don't change all that much whether the fund has $500,000 in assets or $500 billion. The larger the fund, the more those expenses get diluted," he says.

When you see an ETF with less than $20 million or so in assets, it's highly likely that the managers are losing money, Sizemore says. "If they don't get the AUM up to a sustainable level, they'll generally have little choice but to close the fund."

That doesn't mean to indiscriminately avoid any fund with less than $20 million in assets, or even those under the $10 million mark that other experts point to as a line in the sand. If you can accept some risk, and the fund seems to have a valid premise, treat it as you would any speculative investment.

Just keep an eye on asset growth. If it remains low, as it did with NASH, which closed with less than $9 million in assets, understand that the fund might liquidate, leaving you to find a new home for your money.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.