Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

If you inherit an annuity contract, one of the most important decisions you need to make is how you’ll claim the assets.

If you don’t need the inherited assets right away and want to minimize immediate tax implications, consider taking a stretch distribution. This option allows you to take annual distributions from an annuity over your life expectancy, which limits your short-term tax liability.

While you take distributions, the remaining assets in your annuity stay invested, giving your assets continued opportunity to grow. And if you need to withdraw more than your annual distribution in any given year, you can access your funds without penalty.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

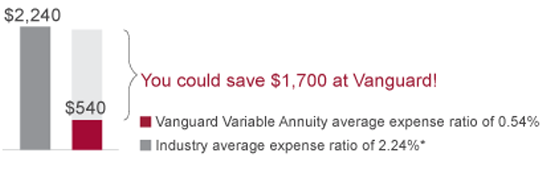

Consider costs

Costs count because they can eat into your investment return—especially over the long term if you decide to take a stretch distribution. Take control of what you pay to invest by choosing a low-cost Vanguard Variable Annuity.

With an average expense ratio of 0.54%, the Vanguard Variable Annuity's costs are more than 70% below the annuity industry average of 2.24%. This difference can save you an average of $1,700 a year in fees for every $100,000 you invest.

*Source: Morningstar, Inc., as of December 2015. The Vanguard Variable Annuity has an average expense ratio of 0.54%, versus the annuity industry average of 2.24%; excludes fees for optional riders. Actual expense ratios for the Vanguard Variable Annuity range from 0.44% to 0.73%, depending on the investment allocation. The expense ratio includes an administrative fee of 0.10% and a mortality and expense risk fee of 0.19%. The expense ratio excludes additional fees that would apply if the Return of Premium death benefit rider or Secure Income (Guaranteed Lifetime Withdrawal Benefit) rider is elected. In addition, contracts with balances under $25,000 are subject to a $25 annual maintenance fee.

Use our deferred variable annuity cost calculator to see if you’re paying too much for your variable annuity, or call 800-873-0201 for a free assessment of your current annuity. Our annuity specialists don’t work on commission, so you’ll get an unbiased evaluation with no obligation.

The Vanguard Variable Annuity offers a diverse lineup of stock, bond, and money market portfolios and has no commissions or purchase fees. You can exchange money tax-free among portfolios without incurring transaction fees, and there's never a surrender charge if you decide to move your contract.

Switch to the Vanguard Variable Annuity

The Vanguard Variable Annuity, which offers a stretch option, is issued by Transamerica Premier Life Insurance Company and, in New York State only, by Transamerica Financial Life Insurance Company.

If another provider holds your annuity, you may be able to transfer it to Vanguard without tax liability. (This is called a 1035 exchange.)

To determine if you can transfer your annuity to Vanguard, give us a call at 800-873-0201 between 8 a.m. and 8 p.m., Eastern time to speak with a licensed, noncommissioned annuity specialist.

Notes:

This content was provided by Vanguard Annuity and Insurance Services. Kiplinger is not affiliated with and does not endorse the company or products mentioned above.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

Best Mutual Funds to Invest In for 2026

Best Mutual Funds to Invest In for 2026The best mutual funds will capitalize on new trends expected to emerge in the new year, all while offering low costs and solid management.

-

457 Plan Contribution Limits for 2026

457 Plan Contribution Limits for 2026Retirement plans There are higher 457 plan contribution limits in 2026. That's good news for state and local government employees.

-

Medicare Basics: 12 Things You Need to Know

Medicare Basics: 12 Things You Need to KnowMedicare There's Medicare Part A, Part B, Part D, Medigap plans, Medicare Advantage plans and so on. We sort out the confusion about signing up for Medicare — and much more.

-

The Seven Worst Assets to Leave Your Kids or Grandkids

The Seven Worst Assets to Leave Your Kids or Grandkidsinheritance Leaving these assets to your loved ones may be more trouble than it’s worth. Here's how to avoid adding to their grief after you're gone.

-

SEP IRA Contribution Limits for 2026

SEP IRA Contribution Limits for 2026SEP IRA A good option for small business owners, SEP IRAs allow individual annual contributions of as much as $70,000 in 2025, and up to $72,000 in 2026.

-

Smart Ways to Invest Your Money This Year

Smart Ways to Invest Your Money This YearFollowing a red-hot run for the equities market, folks are looking for smart ways to invest this year. Stocks, bonds and CDs all have something to offer in 2024.

-

Roth IRA Contribution Limits for 2026

Roth IRA Contribution Limits for 2026Roth IRAs Roth IRAs allow you to save for retirement with after-tax dollars while you're working, and then withdraw those contributions and earnings tax-free when you retire. Here's a look at 2026 limits and income-based phaseouts.

-

SIMPLE IRA Contribution Limits for 2026

SIMPLE IRA Contribution Limits for 2026simple IRA For 2026, the SIMPLE IRA contribution limit rises to $17,000, with a $4,000 catch-up for those 50 and over, totaling $21,000.