Commodities: A “Golden” Way to Play the Improving Economy

If you don’t own commodities, add them. If you do … add a little more.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

After suffering a decade-long bear market, commodities appear ready to turn around in 2018. The timing could not be better for investors feeling nervous about a sky-high stock market starting to return to reality. Now may be an excellent time to increase your portfolio’s allocation to commodities.

Don’t worry. This is not a suggestion to dump stocks and hide everything in gold mines and oil rigs. However, many financial experts agree that all investors should diversify a stocks-and-bonds portfolio with a small portion of some other type of non-correlated area, such as gold or commodities in general.

This is the case no matter where you are in your investing life.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Since commodities are growth-sensitive assets, they perform well when the economy starts to improve, as it appears to be doing now. And Pimco, one of the country’s largest fixed-income investment managers, found that a portfolio of 55% stocks, 40% bonds and 5% commodities offers lower volatility and higher risk-adjusted returns over time than a portfolio without the commodities. They help smooth portfolio performance in times of high inflation, too.

It once seemed silly to worry about inflation, what with interest rates remaining so low, even as the Federal Reserve reaffirmed its commitment to gradually raising short-term rates throughout the year. But since July 2016, the yield on the benchmark 10-year Treasury note has, in fact, been rising from its low of 1.34% to its recent 2.88%.

Commodities are poised to lock in a solid performance this year, according Bart Melek, Global Head of Commodity Strategy at TD Securities. He believes the U.S. dollar is going to fall and that, in turn, means the overall commodity complex should find strength. Commodities are priced in U.S. dollars, so with all else held constant, a decline in the value of the dollar means commodities prices should move higher.

Melek also cited strong demand from China as a secondary factor. Indeed, supplies are tight and demand is rising in many areas, from gold and platinum to oil and zinc.

Commodity Bull Markets Last for Years

Commodities tend to hold very long trends, whether they’re rising or falling. After peaking in 2008, when oil prices topped $145 per barrel, it’s been mostly downhill not just for oil, but other commodities, from gold to copper.

But that appears to be changing.

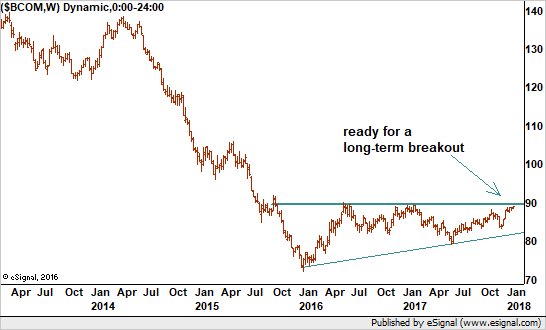

The Bloomberg Commodity Index, which tracks more than 20 commodities in energy, agriculture, industrials and precious metals, seems to be on the verge of breaking out to the upside (see the chart below). It set its low point in January 2016, coincidentally when the current leg of the bull market in stocks began. Oil, gold and copper all bottomed together around that time, as well, which reinforces the idea that it was a meaningful bottom for the entire commodities complex.

Since the middle of 2016, the index formed what analysts call a base, or a resting phase, that can appear just before the market kicks off a new bull run. From the technical point of view, this is a positive chart.

But since commodities tend to move in one direction for years at a time, there is even more encouraging news. When we look at the historical performance of commodities versus stocks, we can make a good case that we’ve reached a major turning point.

The Pendulum Is Swinging

Compared to stocks, commodities are very cheap. In the 1970s, commodities started to outperform and beat the Standard & Poor’s 500-stock index by 800% heading into the 1973 oil crisis. From there, the pendulum swung back and forth, giving each asset class the advantage for a period of seven to nine years!

The Gulf crisis in 1990 and the dot-com bubble bursting in 1999 were both major turning points in this see-saw battle. So was the 2008 peak in commodities and financial crisis bottom for stocks.

Right now, the ratio of the GSCI Commodity index to the S&P 500 is at the same extreme low level that kicked off big shifts to commodities and away from stocks in the past.

In other words, the dominance of stocks over commodities may be close to finished. That does not mean that stocks will necessary fall, but rather that commodities may just do better.

Again, the bottom line here for most investors is raising your portfolio’s allocation to commodities by 5 percentage points. If you have no exposure, then go to 5%. If you already have 5%, then perhaps raise it to 10%.

Depending on an individual client’s profile, Rob Isbitts, Chief Investment Officer at Sungarden Fund Management, LLC, said that up to a 15% allocation to commodities is reasonable for growth-oriented portfolios. As you can see, this is not a wholesale shift in your investment strategy but rather a tweak with several benefits.

- You take advantage of the pending strength in commodities.

- You slightly reduce exposure to equities, and even bonds, as both those markets are extended.

- You reduce portfolio volatility.

For the high-rolling speculator, futures are the most popular. However, for most of the rest of us, there are many exchange-traded funds (ETFs) and exchange-traded notes (ETNs) that track commodities and are as easy to buy and sell as common stocks. Investors also can buy ETFs and individual stocks in sectors that directly benefit from rising commodities prices, such as oil exploration, gold mining and agriculture.

Legendary money manager Jeffrey Gundlach, CEO of DoubleLine Capital, also thinks the time has come for adding commodities to a portfolio. He suggested the PowerShares DB Commodity Index Tracking Fund (DBC, $16.83), iPath Bloomberg Commodity Index Total Return ETN (DJP, $24.54) and the iShares S&P GSCI Commodity-Indexed ETF (GSG, $17.04).

These are diversified instruments. For example, the DBC is based on an index composed of futures contracts on 14 of the most heavily traded physical commodities in the world.

If you believe strongly about gold, which is most sensitive to the weak U.S. dollar, then there are SPDR Gold Shares (GLD, $126.71), which hold physical gold. If you are more comfortable with stocks than actual commodities, the VanEck Vectors Gold Miners ETF (GDX, $22.71) provides indirect exposure to the yellow metal via gold miners, which often move like gold but in an even more exaggerated manner.

The choices are endless. Just remember that the more diversified your selection, the less you must rely on your own determination of which commodities are strongest and which are weakest. However, by going with a basket of commodities that blend strong performers with weak performers, you could mute your returns.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

7 Frugal Habits to Keep Even When You're Rich

7 Frugal Habits to Keep Even When You're RichSome frugal habits are worth it, no matter what tax bracket you're in.

-

The 5 Best Actively Managed Fidelity Funds to Buy and Hold

The 5 Best Actively Managed Fidelity Funds to Buy and Holdmutual funds Sometimes it's best to leave the driving to the pros – and these actively managed Fidelity funds do just that, at low costs to boot.

-

The 12 Best Bear Market ETFs to Buy Now

The 12 Best Bear Market ETFs to Buy NowETFs Investors who are fearful about the more uncertainty in the new year can find plenty of protection among these bear market ETFs.

-

Don't Give Up on the Eurozone

Don't Give Up on the Eurozonemutual funds As Europe’s economy (and stock markets) wobble, Janus Henderson European Focus Fund (HFETX) keeps its footing with a focus on large Europe-based multinationals.

-

Vanguard Global ESG Select Stock Profits from ESG Leaders

Vanguard Global ESG Select Stock Profits from ESG Leadersmutual funds Vanguard Global ESG Select Stock (VEIGX) favors firms with high standards for their businesses.

-

Kip ETF 20: What's In, What's Out and Why

Kip ETF 20: What's In, What's Out and WhyKip ETF 20 The broad market has taken a major hit so far in 2022, sparking some tactical changes to Kiplinger's lineup of the best low-cost ETFs.

-

ETFs Are Now Mainstream. Here's Why They're So Appealing.

ETFs Are Now Mainstream. Here's Why They're So Appealing.Investing for Income ETFs offer investors broad diversification to their portfolios and at low costs to boot.

-

Do You Have Gun Stocks in Your Funds?

Do You Have Gun Stocks in Your Funds?ESG Investors looking to make changes amid gun violence can easily divest from gun stocks ... though it's trickier if they own them through funds.

-

How to Choose a Mutual Fund

How to Choose a Mutual Fundmutual funds Investors wanting to build a portfolio will have no shortage of mutual funds at their disposal. And that's one of the biggest problems in choosing just one or two.