Why Silver and Gold Look Shiny to Investors Right Now

While they have their downsides, precious metals offer a hedge in times of trouble and inflation. Now could be a good time to take a look.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

With so much going on in the world these days, it’s easy to overlook the developments in the precious metal markets. Even as governments continue to devalue currencies, central banks across the globe have been accumulating gold. I think investors should start considering a small allocation in precious metals as well.

I realize that probably doesn’t sit well with many other advisers, who regard gold and silver as nothing more than shiny metal that sits in a vault, collecting dust and earning no interest or dividends.

But investors, in general, need to protect themselves from these currency devaluations, which will likely lead to inflation in the future. Even if we are currently in a deflationary environment, central banks continue to pursue inflation. I think they will, at some point be successful in achieving this goal. As such, a small allocation to precious metals could protect the purchasing power of your savings and insure your overall wealth.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

How much you should invest in precious metals, of course, depends on your portfolio and other factors. A good baseline for any investor interested in maintaining a small allocation in precious metals would be to keep a 10-to-1 ratio in mind. For these investors, every $10 you have in bonds or annuities should be matched by $1 invested in precious metals.

In the current global economic environment, precious metals look like a good short term-investment. Simply put, precious metals may be a good hedge for investors facing the myriad problems associated with the present economic environment, especially currency devaluation.

A diversified portfolio of tangible assets such as gold or silver should equal about 5% (and sometimes more) of an investor’s portfolio. That's a prudent asset-diversification strategy at any time. And in today's uncertain political and economic environment, there are many (and very sound) reasons to consider investing in precious metals to diversify your holdings.

Keep in mind, precious metals are not like other asset allocations. For example, putting money in precious metals is very different than investing in the stock market. Even the word “investment" seems a bit out of place here. Gold doesn’t pay dividends; gold doesn’t pay interest. It’s a metal that has historically been used as money. Throughout the world, gold continues to be recognized as money. As such, it offers long-term protection as our currency is devalued for investors looking to be able to maintain their lifestyles 10 to 15 years down the road.

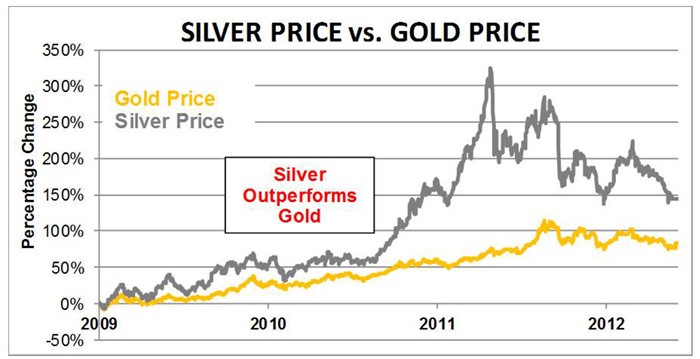

I think silver is an even better option than gold for investors looking to diversify. Right now, the silver-to-gold price ratio is fairly high. Historically, that ratio has been 16-to-1; meaning 16 ounces of silver are valued the same as 1 ounce of gold. Right now, the ratio is far higher: 65 to 70 ounces of silver have the same dollar value as every ounce of gold. If history repeats itself, we should see that 16-to-1 ratio of silver to gold return in the near future. As such, I see far more upside with silver than I do with gold.

Allocating a portion of your assets in silver, at current prices, could offer investors and retirees one of the single best long-term investments available today. Along with gold, it is recognized as a store of value. What is not so well known is that, while gold has demonstrated a solid trend of price appreciation since 2001, more than quintupling in price, the price of silver has in the past outperformed gold.

Precious metals have been a safe haven in times of war, political strife and uncertainty. With the potential for rising inflation and the continued devaluation of paper currency as likely possibilities, I think it’s a good time to consider precious metals for your retirement portfolio.

The safest way to do that may be to own the metal outright. You can also consider gold and silver mining company’s such as Goldcorp (GG), Barrick Gold (ABX) and Newmont Mining (NEM) to name a few. For silver, consider First Majestic (AG), Silver Wheaton Corp. (SLW) and Pan American Silver Corp. (PAAS).

Kevin Derby contributed to this article.

Investment Advisory Services offered through Brookstone Capital Management LLC an SEC Registered Investment Adviser.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dr. Richard Pucciarelli is the president and founder of Carolina Retirement Resources Inc. He has over 15 years experience serving retirees and pre-retirees in planning for and protecting their financial futures. Pucciarelli is an Investment Adviser Representative and a licensed insurance professional. He hosts the "Financial Symphony" show on WBT Radio 1110 AM every Saturday morning at 11 a.m.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.

-

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial Advice

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial AdviceCan financial advisers who earn commissions on product sales give clients the best advice? For one professional, changing track was the clear choice.

-

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AI

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AIFor financial advisers eager to embrace AI but unsure where to start, this road map will help you integrate the right tools and safeguards into your work.

-

The Referral Revolution: How to Grow Your Business With Trust

The Referral Revolution: How to Grow Your Business With TrustYou can attract ideal clients by focusing on value and leveraging your current relationships to create a referral-based practice.

-

This Is How You Can Land a Job You'll Love

This Is How You Can Land a Job You'll Love"Work How You Are Wired" leads job seekers on a journey of self-discovery that could help them snag the job of their dreams.

-

65 or Older? Cut Your Tax Bill Before the Clock Runs Out

65 or Older? Cut Your Tax Bill Before the Clock Runs OutThanks to the OBBBA, you may be able to trim your tax bill by as much as $14,000. But you'll need to act soon, as not all of the provisions are permanent.

-

The Key to a Successful Transition When Selling Your Business: Start the Process Sooner Than You Think You Need To

The Key to a Successful Transition When Selling Your Business: Start the Process Sooner Than You Think You Need ToWay before selling your business, you can align tax strategy, estate planning, family priorities and investment decisions to create flexibility.