Kiplinger Dividend 15: Our Top Dividend Picks

Every kind of income investor will find something to like in our new list.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Investors are clamoring for dividends these days, and corporate America is happy to oblige. Profits are rolling in at such a healthy clip that companies in Standard & Poor’s 500-stock index are on track to raise their payouts by an average of 8% this year. Analysts estimate that 2018 will be even better, with dividends rising by an average of more than 9%, according to S&P.

For income investors, though, finding good dividend-paying stocks isn’t as easy as selecting a fund that mirrors the S&P 500. The index yields just 2%—barely enough to stay ahead of inflation, which is running at a 1.9% annual pace.

Yet plenty of individual stocks yield more than the market average. And if you know where to look, you can find big, blue-chip companies that have raised their dividends steadily for decades. Other companies are finding ways to sustain payouts well above 4%, and still others are hiking payouts at above-average rates, giving investors a hefty raise each year.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

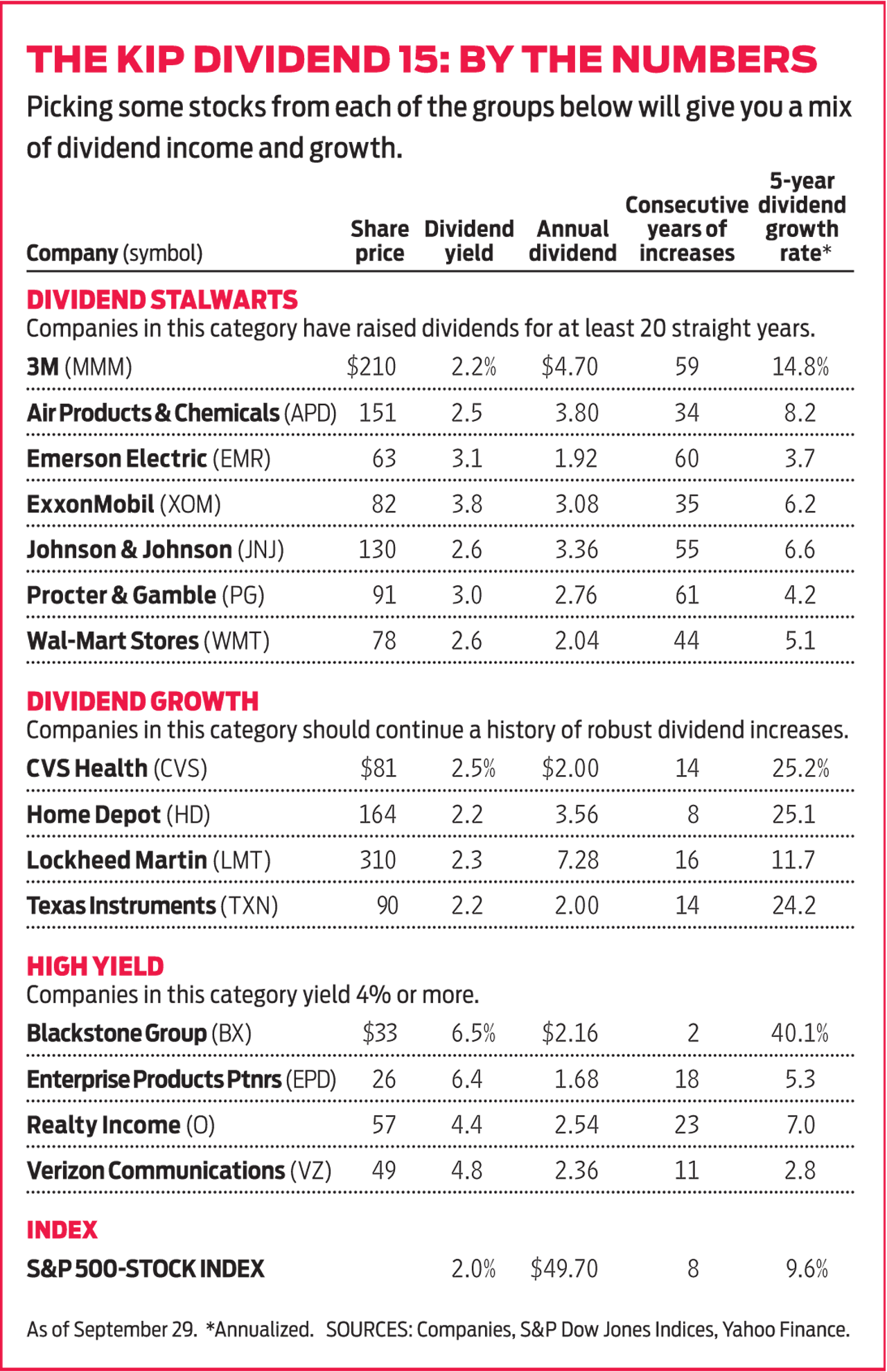

Enter the Kiplinger Dividend 15, the list of our favorite dividend-paying stocks. To make it into our lineup, stocks had to first beat a yield of 2%, the broad-market average. We then looked for firms that are leaders in their industry and that have solid prospects for expanding their sales and profits, while also generating enough cash to pay investors. We aim to avoid dividend traps—high-yielding stocks with weak underlying businesses and poor prospects for their shares.

Our picks fall into one of three categories, depending on the most salient aspect of their dividend: stability, brisk growth or high yield. Picking some from each group will give you a mix of companies with different income and growth profiles, and you can customize your mix to suit your goals. You might emphasize steady Eddies if stability is important to you, or high-yield stocks if you want larger payouts.

Keep in mind that you’ll face trade-offs no matter what you choose. High-yield stocks probably won’t deliver sizable share-price gains; stocks with greater dividend growth (and lower yields) are likely to produce stronger price appreciation. Also note that dividend stocks often lag in markets (such as the current one) that favor growth-oriented companies, which tend to pay below-average dividends or none at all. Here’s a look at each category and the stocks that made it into the Dividend 15.

Dividend stalwarts. If you like sturdy companies that steadily raise their dividends, consider these stocks. For this category, we looked for firms that have increased their dividends for at least 20 consecutive years.

Industrial conglomerate 3M (MMM) sells everything from health care products to safety equipment to consumer goods under brands such as Scotch and Thinsulate. Sales growth has been sluggish for the past few years. But the firm is boosting its bottom line with cost savings, stock buybacks, acquisitions and the introduction of new products. 3M’s free cash flow (the cash profits a company generates annually after making the capital expenditures necessary to maintain the business) is nearly twice what it pays in dividends, leaving ample capacity to keep a 59-year streak of dividend hikes alive.

Industrial gas supplier Air Products & Chemicals (APD) is expanding in emerging markets with a new hydrogen plant in India and an oxygen plant in China (supplying the gas to transform coal into cleaner-burning synthetic natural gas). Much of the company’s sales are locked in by long-term contracts, creating steady revenues and boding well for dividend payments. And Air Products plans to invest heavily in its business, aiming to spend $8 billion over the next three years to secure earnings growth of at least 10% a year over the same period. The firm also says it’s committed to increasing its dividend, which it has raised for 34 straight years.

Emerson Electric (EMR) makes hundreds of products for industrial businesses, along with consumer goods such as LED lights and thermostats. Sales are rising as the firm expands into areas such as valves and controls for the energy industry, plus sensors and software that monitor equipment and conditions via the industrial Internet of Things. Analysts expect profits to climb by 7.6% in 2018 compared with 2017, according to estimates compiled by Zacks Investment Research. That should be enough for Emerson to add to an impressive history of dividend increases.

ExxonMobil (XOM) has invested heavily to produce oil and gas more efficiently in a world of low energy prices. The firm is expanding into chemical processing and other areas to diversify from oil-and-gas production and refining. The stock won’t be a big winner without more of a rebound in oil prices. But Exxon’s dividends look as dependable as they come. When oil prices collapsed in 2014 and 2015, the company still managed to hike quarterly payouts in both years. Over the past 35 years, Exxon has increased its dividend at just over a 6% annualized rate.

With a product line ranging from medical devices to prescription drugs and consumer goods such as baby shampoo, Johnson & Johnson (JNJ) possesses one of the broadest businesses in health care. Profits are likely to roll in steadily as J&J brings new drugs and medical devices to market. A pristine balance sheet, earning the company one of only two triple-A credit ratings bestowed by S&P, gives J&J flexibility to pursue acquisitions and pay more cash to shareholders, too.

Boosting revenue growth is a challenge for Procter & Gamble (PG) , the giant consumer goods company whose brands include Crest, Bounty, Gillette, Pampers and Tide. The company is grappling with an activist investor who wants a seat on the board in hopes of turbocharging growth. Regardless of the outcome of that battle, analysts expect P&G to lift profits by 7.4% in 2018. Moreover, few companies have a dividend history that compares with P&G’s: 127 consecutive years of dividend payments, with increased payouts for 61 years straight.

Wal-Mart Stores (WMT) may not be the belle of the retail ball (that would be Amazon.com), but Wal-Mart is plowing billions of dollars into its internet business, and the strategy is paying off. Online sales surged by 60% in the second quarter of this year compared with the same quarter a year earlier. And the closing of department stores, supermarkets and specialty retailers should benefit the company. Wal-Mart has raised its dividend every year since declaring one in 1974, boosting the payout at a 5.1% annualized rate over the past five years.

Dividend growth. For this category we looked for stocks that we think are likely to continue a history of robust dividend hikes. We also focused on businesses that are delivering growth in revenues and profits, providing fuel for strong total returns (a mix of stock-price gains and dividends).

A series of acquisitions has made CVS Health (CVS) one of the largest drugstore chains and pharmacy benefit managers in the U.S. The drugstore business looks sluggish. But pharmacy benefit revenues are thriving and should help CVS boost earnings by 9.3% in 2018, according to analysts’ estimates. With CVS paying a meager 34% of its profits as dividends, it has the leeway to keep raising its payout.

Strong demand for building materials is bringing in buckets of cash for Home Depot (HD) . The company’s free cash flow amounted to $9 billion in the 12-month period that ended in July—more than twice what HD paid in dividends. Online competition from Amazon doesn’t appear to be putting a dent in HD’s sales. The retailer is expanding abroad in China and Mexico, and it is providing services to professional contractors with its Pro division. Even if the housing market heads south, Home Depot’s dividend is likely to survive: The company sustained payments through the real estate bust from 2007 through 2009.

Defense contractor Lockheed Martin (LMT) is prospering as the U.S. and foreign governments increase spending on fighter jets, warships, missile systems and other defense products. Lockheed recently announced an arms deal with Saudi Arabia worth more than $28 billion. That should add to a backlog of $92 billion in awarded contracts and increase revenue growth. The firm now generates more than $4 billion a year in free cash flow—easily supporting dividends of about $2 billion at the current payout rate.

Texas Instruments (TXN) has carved out a leading niche in analog processors, which are computer chips that convert real-world sounds and other signals into digital format. The company also sells embedded processors—the “brains” of electronics equipment. New fabrication techniques are cutting manufacturing costs, and demand is growing as automakers and other industrial companies embed more of TI’s chips in their products. The company raised its quarterly payout by 32% in 2016 and declared a 24% increase in 2017. Analysts expect earnings to rise by 9.6% in 2018, and dividends should ramp up, too.

High yield. These stocks all yield at least 4%, our cutoff to be included in this category. The companies also possess businesses that we think will fare well in the current economic climate. Our highest-yielding picks—a financial services firm and an energy pipeline business—pose greater risks than our other two choices.

Asset manager Blackstone Group (BX) handles more than $371 billion in investments, including private equity funds, mutual funds and real estate that the firm directly owns. Blackstone pulls in huge fees based on the size and performance of the assets it manages, and its fee income should increase as the firm invests more capital. The risk is that a prolonged slump in financial markets would erode asset values and fees. At worst, Blackstone could cut its payout, which would pull down the stock. For now, though, Blackstone’s dividends look well supported.

One of the largest energy master limited partnerships, Enterprise Products Partners runs oil-and-gas pipelines, processing plants, storage depots and export facilities. A drop in oil prices would pressure the stock, but investors are still likely to receive cash distributions, which Enterprise has increased for 18 straight years. Enterprise is investing in new pipelines and other projects to lift its payouts, aiming to spend more than $6 billion through 2019. Note: MLPs issue K-1 forms that may complicate your tax filings. Consult a tax professional before investing.

Realty Income (O), a real estate investment trust, owns hundreds of retail properties leased to major national companies, such as Walgreens, FedEx and Dollar General. The firm’s tenants sign long-term leases averaging 15 years, and they’re responsible for expenses such as insurance, maintenance and taxes. That means that rental income rolls in steadily, and Realty shells out most of it (after the expenses of running the trust) every month, increasing payouts at a 4.6% annualized rate since the firm went public in 1994.

Verizon Communications (VZ) rakes in about $30 billion every quarter from more than 109 million subscribers to its phone, internet and TV services. Sales aren’t growing much. But the firm makes enough money to support its dividend, which accounts for 63% of free cash flow. The payout is likely to increase moderately as Verizon makes money from new ventures, such as internet advertising and content (through its AOL and Yahoo brands) and telematics (GPS tracking for vehicle fleets).

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

How to Turn Your 401(k) Into A Real Estate Empire

How to Turn Your 401(k) Into A Real Estate EmpireTapping your 401(k) to purchase investment properties is risky, but it could deliver valuable rental income in your golden years.

-

My First $1 Million: Retired Nuclear Plant Supervisor, 68

My First $1 Million: Retired Nuclear Plant Supervisor, 68Ever wonder how someone who's made a million dollars or more did it? Kiplinger's My First $1 Million series uncovers the answers.

-

How to Position Investments to Minimize Taxes for Your Heirs

How to Position Investments to Minimize Taxes for Your HeirsTo minimize your heirs' tax burden, focus on aligning your investment account types and assets with your estate plan, and pay attention to the impact of RMDs.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.