Preferred Stocks Paying 5% or More to Income Investors

These high-paying hybrid securities belong in most income portfolios.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Even with interest rates edging up lately, it still isn’t easy to pocket much income from traditional stocks and bonds. But you may be overlooking preferred stocks, hybrid investments that offer a bit of both worlds.

For income seekers, preferreds offer great deals. Yields average 6.1%, well above the 2.3% payout of the Barclays Aggregate U.S. Bond index. Preferreds also beat the 2.1% dividend yield of Standard & Poor’s 500-stock index, along with higher-yielding areas of the market, such as utility stocks and real estate investment trusts.

But preferreds pose risks, too. As bondlike investments, they’re sensitive to swings in interest rates and would lose value if rates were to rise sharply. Preferreds could also tumble if banks and other big issuers of the stocks run into a financial buzz saw.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Yet in a normal market climate, preferreds should beat high-quality bonds as a source of steady income. Plus, preferred dividends tend to be taxed at rates well below those for bond interest, making preferreds a better deal if you’re in a high tax bracket.

Below, we offer a primer on these stocks and show you how to research and buy them — and recommend four.

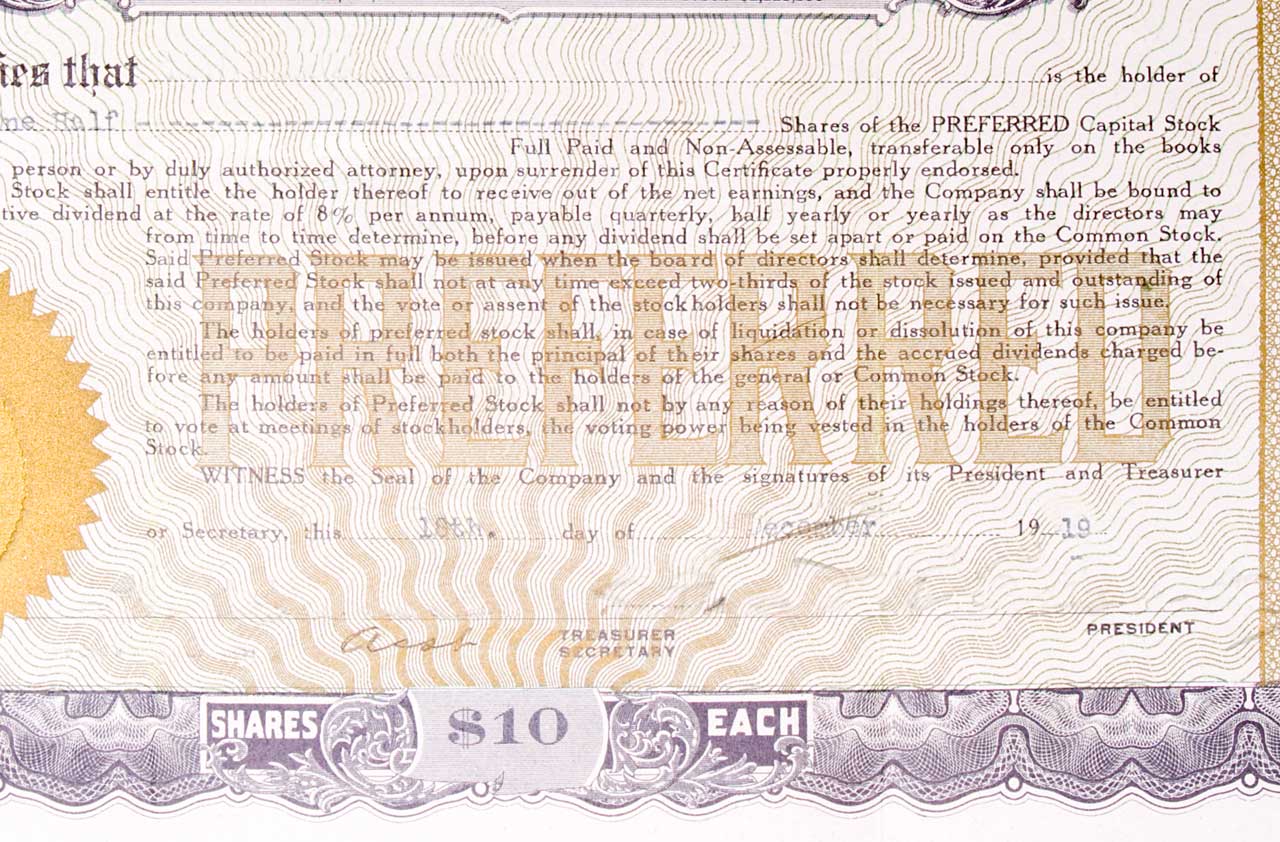

What are preferred stocks? Similar to common stocks, preferreds represent an ownership stake in a company. The shares pay a fixed, preset dividend, typically every three months. They’re called preferred because companies must pay dividends to preferred holders before they can pay dividends on common stocks. Banks, insurers and other financial firms issue more than 80% of preferreds. You can also find preferreds from companies in industries such as energy, health care and telecommunications

Companies typically issue preferreds at $25 per share, known as par value. Once preferreds start trading, prices move up or down, often in response to changes in interest rates. As with bonds, prices of preferred shares usually fall when rates rise and climb when rates fall.

Are preferred dividends guaranteed? Companies can miss a payment without triggering a technical default (as missing an interest payment on a bond would do). Some preferreds are cumulative, meaning that any missed dividend payments would add up and have to be distributed before common stockholders could receive their next dividend payment. However, most preferreds are noncumulative, letting the company off the hook for missed payments.

Theoretically, cumulative preferreds should be safer. But in practice, the distinction matters little. Whether its preferred is cumulative or not, a firm that misses a dividend payment is probably facing financial distress, and its preferred shares are likely to tumble.

Are preferreds more tax-efficient than bonds? Generally speaking, yes. Most preferreds pay “qualified” dividends, which are eligible for federal tax rates of 15% or 20%—well below rates on taxable bonds, which can be 43.4% for taxpayers in the highest bracket. Some payouts don’t qualify, though, making it important to check the tax status before you invest. “Trust” preferreds are basically long-term bonds in a stock wrapper, and they typically pay interest taxed at ordinary rates. Preferreds issued by REITs and firms with a partnership structure (which don’t pay tax at the corporate level) don’t qualify for lower rates, either.

Are preferreds sensitive to interest rates? Yes. Because they pay dividends at a fixed rate, preferreds can lose value if interest rates climb. On average, preferred stock prices would likely fall by about 4.5% if rates were to climb by one percentage point, according to investment firm Nuveen. If you hold preferreds for several years, you’ll eventually pocket enough dividend income to overcome declines in the share price. But if rates keep rising, you could end up losing money, even after taking dividends into account.

What are some other drawbacks? A company could decide to redeem shares below their current market price. If a stock trades at $28 and the issuing company “calls” it in at face value, or $25, an investor would lose 10.7% off the top. If you buy a preferred just before a company announces that it will call the shares, you won’t earn enough dividend income to make up for those losses. Companies usually provide some “call protection” before they can redeem shares, typically a grace period of five years after they issue preferreds. Beyond that, a firm may recall its shares at any time, making it critical to keep a close eye on the call date.

A stock market sell-off would take down preferreds, too. During the Great Recession, preferreds tumbled by an average of 58% from July 1, 2008, to March 9, 2009. They have rebounded since then, and banks are now stronger, reducing the likelihood of another financial-industry collapse. Still, high-quality bonds don’t pose nearly as much credit risk and would likely fare much better in a downturn.

What’s the simplest way to invest? Buy an exchange-traded fund. Our favorite is iShares U.S. Preferred Stock ETF (symbol PFF, $39, yield 5.6%). The fund, a member of the Kiplinger ETF 20, holds more than 270 stocks issued mainly by banks, such as Citigroup, HSBC and Wells Fargo. The ETF charges fees of 0.47% annually.

How do I buy individual preferreds? A good starting place is to see what’s available through an online broker. Firms such as Fidelity and Schwab provide screening tools to help you select preferreds based on criteria such as credit rating, share price and yield. You can also screen for cumulative dividends and see upcoming call dates.

Check those dates closely to make sure you have at least 18 months before a company can redeem shares. Stick with investment-grade preferreds. And look for issues trading between $23 and $28 per share. A price below $23 probably reflects major risks, such as the potential for a missed payment. Above $28, the yield may be too low to be attractive and the potential loss too big if the stock is called for $25 a share. A sweet spot for yield now is between 5% and 7%, says Michael Greco, a preferred-stock expert and chief investment officer of GCI Financial Group, a money-management firm in Mendham, N.J. Yields below 5% are less than what you could pocket with a preferred-stock ETF. If a preferred stock yields more than 7%, it’s probably riskier than most. “High yields are there for a reason,” Greco says.

A note about preferred symbols: They aren’t consistent across websites. If you’re having trouble finding an issue, or you want to do more research, visit www.quantumonline.com, a free website that allows you to search for a preferred by a company’s common-stock symbol.

Our pick of the preferreds

These four stocks all offer attractive yields and pay qualified dividends. (Prices and yields are as of September 30.)

AmTrust Financial Services 7.75% Depositary Shares Non-Cumulative Preferred Stock Series E (symbol AFSI.E, $27, yield 7.2%).

AmTrust specializes in insurance policies for small businesses. The firm looks financially healthy, with profits expected to rise 8% in 2017, to $562 million. The shares aren’t callable until March 2021.

Goldman Sachs 6.30% Dep Shares Non-Cumulative Preferred Stock Series N (GS.N, $27, 5.8%).

One of Wall Street’s premier firms, Goldman makes money off investment banking, trading and an array of financial services. Analysts expect the firm to boost annual profits by 20% in 2017 and 10% in 2018. Goldman can’t redeem the preferreds until May 2021.

JPMorgan Chase & Co. 6.30% Dep Shares Non-Cumulative Preferred, Series W (JPM.E, $28, 5.7%).

J.P. Morgan’s balance sheet has improved in recent years, providing more of a bulwark against potential losses. This issue looks compelling for its above-average yield and call protection until September 2019

KKR & Co. L.P. 6.75% Series A Non-Cumulative Preferred Units (KKR.A, $27, 6.3%).

KKR owns more than $30 billion in real estate, publicly traded stocks and other investments. Profits can be erratic, but analysts expect KKR to earn $222 million this year, providing ample coverage for these preferred shares—which pay out $23.3 million annually—and other interest and dividend obligations. The shares aren’t redeemable until June 2021.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Why Picking a Retirement Age Feels Impossible (and How to Finally Decide)

Why Picking a Retirement Age Feels Impossible (and How to Finally Decide)Struggling with picking a date? Experts explain how to get out of your head and retire on your own terms.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

What Fed Rate Cuts Mean For Fixed-Income Investors

What Fed Rate Cuts Mean For Fixed-Income InvestorsThe Fed's rate-cutting campaign has the fixed-income market set for an encore of Q4 2024.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.

-

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have TodayHome Depot stock has been a buy-and-hold banger for truly long-term investors.