Why Google and Facebook Get No Love from the Big Money

Neither company has been particularly friendly to dividend investors. And managers and activists know their votes hardly matter.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Big institutional money managers tend to be the conventional sort, though I’m not talking about their blue power suits or country club memberships. I’m talking about their stock holdings. Managers tend to pile into the same set of large, mega-cap stocks because deviating from the crowd comes with major career risk.

Let me explain. Running a mutual fund is a fantastic, high-paying job, but it is also a precarious one. The fund’s success — and thus the manager’s paycheck — is directly tied to its assets under management. This creates tremendous pressure to conform to a benchmark, which is often the S&P 500.

A manager’s thinking goes like this: If I bet big and beat the benchmark by going outside the mainstream, my investors are happy…for a day or two. But if I bet big and lose, I might be out of a job.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

So, the result is that most managers become closet indexers who overweight a handful of stocks and hope to beat the market by a percent or two.

Imagine how surprised I was when I saw this chart in the Financial Times, which tracks institutional ownership of nine major tech companies. (Google makes the list twice, so it’s ten stocks but just nine companies.)

The large overweightings in Expedia (EXPE) and Trip Advisor (TRIP) aren’t that surprising. Expedia and Trip Advisor account for just 0.059% and 0.054% of the S&P 500, respectively, so even a small amount of institutional buying will put these stocks out of proportion to the rest. And the overweighting of Netflix (NFLX) is also pretty understandable given that it is one of the best performing stocks in the S&P 500 this year. It’s near the tail end of the chart that the numbers get interesting.

Two of the biggest names in tech — Facebook (FB) and Google (GOOGL) — are massively underowned by institutional investors relative to what their weightings in the S&P 500. And where it gets even stranger, institutional ownership of the less favorable of Google’s two traded share classes — the non-voting Class C shares (GOOG) — is “where it should be” relative to its weighting in the S&P 500. It’s the A shares (GOOGL), which actually have voting rights, that are underowned.

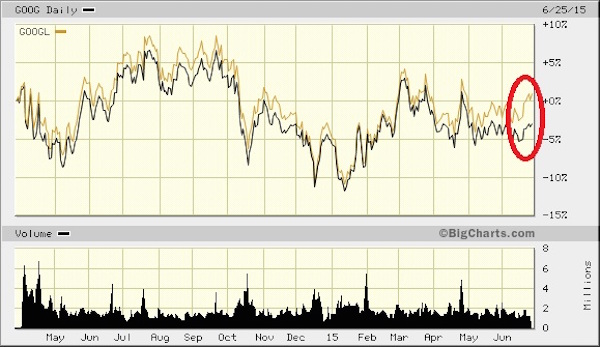

What’s going on here? Why are big money investors shunning Facebook and Google? Let’s look at Google first. There are two issues: The discrepancy between the share classes and the overall underweighting of Google stock by institutional investors. The latter is the easier of the two to explain. Managers don’t care about the lack of voting rights because they know their votes hardly matter. For would-be activists or corporate raiders, Google is an unassailable company. Its founders hold non-traded “super voting” class B shares that make any sort of proxy battle a virtual impossibility. GOOG’s consistent discount to GOOGL, which has actually widened recently, really makes no sense in this context, so it’s perfectly logical for an institutional manager to overweight the cheaper GOOG relative to GOOGL.

As for the issue of Google being underweighted overall… well, it might come back to that point I made about Google being unassailable. Google is not known for being particularly friendly to its shareholders (see my blog post Hey Google, Stop Being Such a Baby and Pay a Dividend.) Google is a profitable company that mints money, yet it has developed a reputation for being the plaything of its founders rather than a profit-maximizing business.

The same goes for Facebook. Zuckerberg is a ruthless competitor and one of the few people that seems to know how to actually make money in social media. Yet, Facebook has also burned through shareholder money on expensive acquisitions of dubious economic value (Oculus, Whatsapp, etc.) and expenses grew at twice the rate of revenues last quarter. Is there a trade here?

Maybe. While I don’t see an immediate catalyst to change big money minds (neither Google nor Facebook will be paying a dividend anytime soon… sigh…), you could view the underownership as a contrarian value signal.

The safest move, however, might be a pair trade. Short GOOGL and go long GOOG, and eke out an arbitrage profit as the discount closes.

Charles Lewis Sizemore, CFA, is chief investment officer of the investment firm Sizemore Capital Management and the author of the Sizemore Insights blog.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Charles Lewis Sizemore, CFA is the Chief Investment Officer of Sizemore Capital Management LLC, a registered investment advisor based in Dallas, Texas. Charles is a frequent guest on CNBC, Bloomberg TV and Fox Business News, has been quoted in Barron's Magazine, The Wall Street Journal, and The Washington Post and is a frequent contributor to Yahoo Finance, Forbes Moneybuilder, GuruFocus, MarketWatch and InvestorPlace.com.

-

Look Out for These Gold Bar Scams as Prices Surge

Look Out for These Gold Bar Scams as Prices SurgeFraudsters impersonating government agents are convincing victims to convert savings into gold — and handing it over in courier scams costing Americans millions.

-

How to Turn Your 401(k) Into A Real Estate Empire

How to Turn Your 401(k) Into A Real Estate EmpireTapping your 401(k) to purchase investment properties is risky, but it could deliver valuable rental income in your golden years.

-

My First $1 Million: Retired Nuclear Plant Supervisor, 68

My First $1 Million: Retired Nuclear Plant Supervisor, 68Ever wonder how someone who's made a million dollars or more did it? Kiplinger's My First $1 Million series uncovers the answers.

-

Don't Bury Your Kids in Taxes: How to Position Your Investments to Help Create More Wealth for Them

Don't Bury Your Kids in Taxes: How to Position Your Investments to Help Create More Wealth for ThemTo minimize your heirs' tax burden, focus on aligning your investment account types and assets with your estate plan, and pay attention to the impact of RMDs.

-

Are You 'Too Old' to Benefit From an Annuity?

Are You 'Too Old' to Benefit From an Annuity?Probably not, even if you're in your 70s or 80s, but it depends on your circumstances and the kind of annuity you're considering.

-

In Your 50s and Seeing Retirement in the Distance? What You Do Now Can Make a Significant Impact

In Your 50s and Seeing Retirement in the Distance? What You Do Now Can Make a Significant ImpactThis is the perfect time to assess whether your retirement planning is on track and determine what steps you need to take if it's not.

-

Your Retirement Isn't Set in Stone, But It Can Be a Work of Art

Your Retirement Isn't Set in Stone, But It Can Be a Work of ArtSetting and forgetting your retirement plan will make it hard to cope with life's challenges. Instead, consider redrawing and refining your plan as you go.

-

The Bear Market Protocol: 3 Strategies to Consider in a Down Market

The Bear Market Protocol: 3 Strategies to Consider in a Down MarketThe Bear Market Protocol: 3 Strategies for a Down Market From buying the dip to strategic Roth conversions, there are several ways to use a bear market to your advantage — once you get over the fear factor.

-

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works Instead

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works InsteadFor retirees with a pension, traditional withdrawal rules could be too restrictive. You need a tailored income plan that is much more flexible and realistic.

-

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look Like

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look LikeThis is when you should be shifting your focus from growing your portfolio to designing an income and tax strategy that aligns your resources with your purpose.

-

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your Stress

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your StressTo be confident about retirement, consider building a safety net by dividing assets into distinct layers and establishing a regular review process. Here's how.