Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Emerging-market equities solidly outperformed their developed-market peers in the second quarter of 2014.

What could this mean for investors? Get insights in a quarterly report from Fidelity’s emerging-market equityinvestment professionals—Dirk Hofschire, CFA, SVP, Asset Allocation Research, and Sammy Simnegar,portfolio manager.

Dirk Hofschire: Is the rebound sustainable?

Following the Federal Reserve's public signaling of its intent to taper its quantitative easing program in mid-2013, emerging-market (EM) equity and debt asset classes posted negative returns and trailed most otherasset classes during 2013. However, these asset classes have rebounded so far in 2014. EM equity and debtwere the top performers in the second quarter, and have been at or near the top on a year-to-date basis aswell.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Developed-market economies continue to exhibit favorable cyclical dynamics relative to emerging-marketones, but these divergences have narrowed in recent months as activity in some EMs has stabilized. Onesource of this stability is the improvement in the current account balances of many deficit countries—such asIndia, Turkey, and Indonesia—that suffered from capital outflows during the second half of 2013.

The performance of EM equities started to improve during the second quarter, boosted in part by China'spolicy easing. Low equity valuations set a low bar for investor sentiment, and EM economic data has recentlybegun to surpass subdued expectations. EM currencies have also stabilized in 2014 and are no longercreating inflationary pressures in their domestic economies through rapid depreciation.

This shift has allowed some countries to moderate their monetary stances after a period of rate hikes, withTurkey cutting its benchmark rate and Brazil and India pausing. Significant policy easing in China has alsobeen a key ingredient in stabilizing the near-term trends for EM economies.

The question now is whether or not the second-quarter rally has staying power, as several emerging marketscontinue to face late-cycle challenges. Some larger EM economies still have inflation rates above their centralbank targets due to persistent inflationary pressures from lagging cyclical productivity and structuralbottlenecks. Corporate profitability remains weak, and bank lending and monetary conditions are tighter thanthey were one year ago.

Although the switch to more EM policy easing measures may be positive for near-term growth, these late-cycledynamics leave developing economies susceptible to a potential negative shift in sentiment in global financialmarkets. Nevertheless, over a long-term horizon, we believe EM economies may be the fastest growing duringthe next 20 years, with EM assets potentially representing considerable growth opportunities as part of adiversified global portfolio.

Sammy Simnegar: Strength in Southeast Asia, uncertainty in China

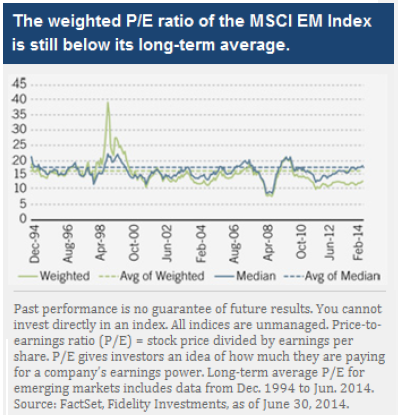

In the second quarter of 2014, emerging-market equities posted their biggest quarterly gain since 2012, asdeclining global interest rates made it cheaper for companies to access capital, and there was a reversion oflast year's underperformers. Even with the rally, the weighted P/E for EM stocks remains below its long-termaverage (see chart).

Stocks in India enjoyed a supportive backdrop tied to optimism about the May election of Prime MinisterNarendra Modi. Even though Brazil made little progress in its structural reforms, its stock market outperformedbased on hope there will be an administration changefollowing the October election. Russian stocks suffered abroad-based selloff due to the country's controversialannexation of the Crimean peninsula.

China did well late in the quarter as the economy appearsto have bottomed, but longer-term concerns remain aboutthe profitability of companies listed on its market. In myview, the best-case scenario for China is to engineer a softlanding with mid-single-digit GDP growth as it tries torestructure to more of a consumption-led economic growth model.

I remain positive on countries in emerging Asia, particularlythe Philippines, India and Indonesia. I also favor EMcompanies with costs in local currencies and profits in U.S.dollars.

Mexico, for example, could benefit from its proximity to theU.S. The Mexican government is making economic reformsand opening up the domestic energy industry. In addition,Mexican labor rates are now competitive with Chinese ratesfor goods shipped to the U.S.

From a sector perspective, health care appears to be animportant growth sector for emerging markets, as the middle class there becomes more of an economic forceto be reckoned with. I also have a favorable outlook on the long-term growth prospects of emerging markets ecommerce,where there is much less brick-and-mortar infrastructure than in developed markets.

Emerging markets are a mixed bag, with needed structural reforms being discussed or implemented in somecountries and not in others. At the same time, many good growth stocks are available at reasonable prices. Aslong as the global economic recovery remains on track, I am optimistic about the prospects of firms that haveabove-average earnings growth, where we have high conviction in that earnings growth, and that are trading atattractive valuations.

Learn more

- Get the latest global markets news.

- Find emerging market mutual funds, ETFs, and stocks.

Views expressed are as of the date indicated, based on the information available at that time, and may change based onmarket and other conditions. Unless otherwise noted, the opinions provided are those of the authors and not necessarilythose of Fidelity Investments or its affiliates. Fidelity does not assume any duty to update any of the information.Investment decisions should be based on an individual’s own goals, time horizon, and tolerance for risk. Examplesprovided are for illustrative purposes only and are not intended to be reflective of results you can expect to achieve.

Past performance is no guarantee of future results.

Neither asset allocation nor diversification ensures a profit or guarantees against a loss.

Information presented is for informational purposes only and is not intended as investment advice or an offer of anyparticular security. This information must not be relied upon in making any investment decision. Fidelity cannot be heldresponsible for any type of loss incurred by applying any of the information presented.

Stock markets, especially foreign markets, are volatile and can decline significantly in response to adverse issuer,political, regulatory, market, or economic developments.

Foreign markets can be more volatile than U.S. markets due to increased risks of adverse issuer, political, market, oreconomic developments, all of which are magnified in emerging markets. These risks are particularly significant forinvestments that focus on a single country or region.

In general the bond market is volatile, and fixed-income securities carry interest rate risk. (As interest rates rise, bondprices usually fall, and vice versa. This effect is usually more pronounced for longer-term securities.) Fixed-incomesecurities also carry inflation risk, liquidity risk, call risk, and credit and default risks for both issuers and counterparties.Unlike individual bonds, most bond funds do not have a maturity date, so avoiding losses caused by price volatility byholding them until maturity is not possible. High-yield/noninvestment-grade bonds involve greater price volatility and risk ofdefault than investment-grade bonds.

1. For Government Debt, emerging markets are represented by JPMorgan Emerging Markets Bond Index (EMBI) Global;U.S. debt by Barclays U.S. Aggregate Bond Index; and developed markets by Citigroup Non-U.S. G-7 Index. For Equity,emerging markets are represented by MSCI® Emerging Markets (EM) Index; U.S. stocks by Standard & Poor’s 500 Index;and developed markets by MSCI® Europe, Australasia, Far East (EAFE) Index. The index performance includes thereinvestment of dividends and interest income. Securities indices are not subject to fees and expenses typicallyassociated with managed accounts or investment funds.

Index definitions

JPM® EMBI Global Index, and its country sub-indices, tracks total returns for traded external debt instruments issued byemerging-market sovereign and quasi-sovereign entities.

Barclays U.S. Aggregate Bond Index is an unmanaged, market valueweighted performance benchmark for investmentgradefixed-rate debt issues, including government, corporate, asset-backed, and mortgagebacked securities withmaturities of at least one year.

Citigroup Non-USD Group-of-Seven (G7) Index is designed to measure the unhedged performance of the governmentbond markets of the G7 excluding the U.S., which are Japan, Germany, France, United Kingdom, Italy, and Canada.Issues included in the index have fixed-rate coupons and maturities of one year or more.

MSCI® Emerging Markets (EM) Index is an unmanaged market capitalization-weighted index of over 850 stocks traded in21 world markets.

Standard & Poor’s 500 Index (S&P 500®) is an unmanaged market capitalization-weighted index of 500 widely held U.S.stocks and includes reinvestment of dividends.

MSCI Europe, Australasia, Far East (EAFE) Index is an unmanaged market capitalization-weighted index designed torepresent the performance of developed stock markets outside the U.S. and Canada.

Barclays ABS Index is a market value-weighted index that covers fixedrate asset-backed securities with average livesgreater than or equal to one year and that are part of a public deal; the index covers the following collateral types: creditcards, autos, home equity loans, stranded-cost utility (rate-reduction bonds), and manufactured housing.

Barclays U.S. Agency Bond Index is a market value-weighted index of U.S. agency government and investment-gradecorporate fixed-rate debt issues.

Barclays CMBS Index is designed to mirror commercial mortgage-backed securities of investment-grade quality(Baa3/BBB-/BBB- or above) using Moody’s, S&P, and Fitch, respectively, with maturities of at least one year. BarclaysU.S. Credit Bond Index is a market value-weighted index of investment-grade corporate fixed-rate debt issues withmaturities of one year or more. BofA Merrill Lynch U.S. High Yield Master II Index tracks the performance of belowinvestment-grade, but not in default, U.S. dollar-denominated corporate bonds publicly issued in the U.S. market, andincludes issues with a credit rating of BBB or below, as rated by Moody’s and S&P. Standard & Poor’s/Loan Syndicationsand Trading Association (S&P/ LSTA) Leveraged Performing Loan Index is a market value-weighted index designed torepresent the performance of U.S. dollar-denominated, institutional leveraged performing loan portfolios (excluding loansin payment default) using current market weightings, spreads, and interest payments.

Barclays Long U.S. Government Credit Index includes all publicly issued U.S. government and corporate securities thathave a remaining maturity of 10 or more years, are rated investment grade, and have $250 million or more of outstandingface value.

Barclays U.S. MBS Index is a market value-weighted index of fixed-rate securities that represent interests in pools ofmortgage loans, including balloon mortgages, with original terms of 15 and 30 years that are issued by the GovernmentNational Mortgage Association (GNMA), the Federal National Mortgage Association (FNMA), and the Federal Home LoanMortgage Corp. (FHLMC). Barclays Global Treasury Index tracks fixedrate local currency government debt of investmentgradecountries in developed and EM markets.

Barclays Municipal Bond Index is a market value-weighted index of investment-grade municipal bonds with maturities ofone year or more. Barclays U.S. Treasury Inflation-Protected Securities (TIPS) Index (Series-L) is a market valueweightedindex that measures the performance of inflation-protected securities issued by the U.S. Treasury.

Barclays U.S. Treasury Bond Index is a market value-weighted index of public obligations of the U.S. Treasury withmaturities of one year or more.

Third-party marks are the property of their respective owners; all other marks are the property of FMR LLC.Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. A percentage valuefor helpfulness will display once a sufficient number of votes have been submitted.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

692196.4.0

This content was provided by Fidelity Investments and did not involve the Kiplinger editorial staff.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

The Cost of Leaving Your Money in a Low-Rate Account

The Cost of Leaving Your Money in a Low-Rate AccountWhy parking your cash in low-yield accounts could be costing you, and smarter alternatives that preserve liquidity while boosting returns.

-

I want to sell our beach house to retire now, but my wife wants to keep it.

I want to sell our beach house to retire now, but my wife wants to keep it.I want to sell the $610K vacation home and retire now, but my wife envisions a beach retirement in 8 years. We asked financial advisers to weigh in.

-

The U.S. Economy Will Gain Steam This Year

The U.S. Economy Will Gain Steam This YearThe Kiplinger Letter The Letter editors review the projected pace of the economy for 2026. Bigger tax refunds and resilient consumers will keep the economy humming in 2026.

-

Trump Reshapes Foreign Policy

Trump Reshapes Foreign PolicyThe Kiplinger Letter The President starts the new year by putting allies and adversaries on notice.

-

Congress Set for Busy Winter

Congress Set for Busy WinterThe Kiplinger Letter The Letter editors review the bills Congress will decide on this year. The government funding bill is paramount, but other issues vie for lawmakers’ attention.

-

The Kiplinger Letter's 10 Forecasts for 2026

The Kiplinger Letter's 10 Forecasts for 2026The Kiplinger Letter Here are some of the biggest events and trends in economics, politics and tech that will shape the new year.

-

Special Report: The Future of American Politics

Special Report: The Future of American PoliticsThe Kiplinger Letter The Political Trends and Challenges that Will Define the Next Decade

-

What to Expect from the Global Economy in 2026

What to Expect from the Global Economy in 2026The Kiplinger Letter Economic growth across the globe will be highly uneven, with some major economies accelerating while others hit the brakes.

-

Shoppers Hit the Brakes on EV Purchases After Tax Credits Expire

Shoppers Hit the Brakes on EV Purchases After Tax Credits ExpireThe Letter Electric cars are here to stay, but they'll have to compete harder to get shoppers interested without the federal tax credit.

-

The Economy on a Knife's Edge

The Economy on a Knife's EdgeThe Letter GDP is growing, but employers have all but stopped hiring as they watch how the trade war plays out.