Why Interest Rates Matter

How Federal Reserve rate hikes and rising bond yields affect the economy and your investment strategy.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

What do interest rates represent?

An interest rate is the cost of borrowing money, typically expressed as an annualized percentage rate. Take out a $100 loan at a 10% rate and you’ll owe $10 a year in interest. Add up all the borrowing in the U.S. by nonfinancial companies, consumers and government entities, and you get a whopping $46.3 trillion in outstanding debt, all of it racking up interest.

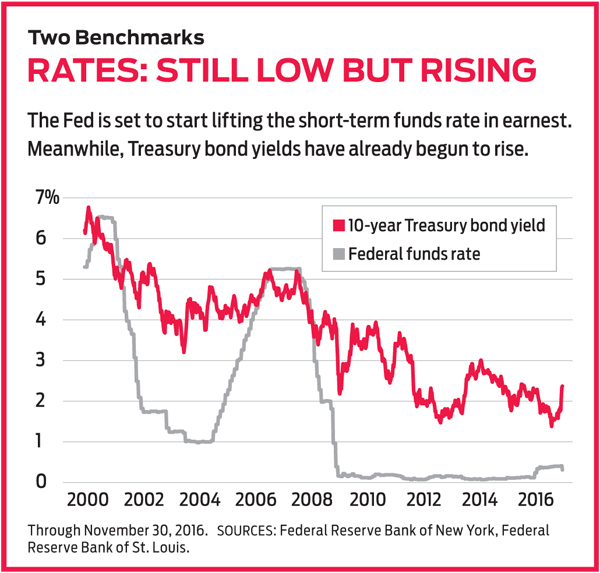

Who, or what, sets interest rates? The Federal Reserve plays a huge role in setting short- and intermediate-term rates. The Federal Open Market Committee, which consists of the Fed’s seven governors and five of the 12 presidents of regional Federal Reserve Banks, meets several times a year to set a target for the federal funds rate. Banks lend their excess reserves to one another overnight at this rate. The federal funds rate is the basis for an array of other rates, such as those for adjustable-rate mortgages, credit card debt and home-equity lines of credit.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

For long-term loan rates, the bond market steps in. Traders who buy and sell Treasury bonds push their yields up and down, based on expectations for such things as inflation and economic growth. When those yields rise, they pull up rates for 30-year mortgages and other loans tied to long-term bond yields, as well as on the rates for other kinds of bonds, such as those issued by corporations and state and local governments. Falling Treasury yields pull down rates for long-term loans and often lead to lower yields for other kinds of bonds.

Do bond yields always rise when the Fed raises rates? No. Short- and medium-term yields tend to track the federal funds rate. But long-term Treasury yields react more to inflation expectations, as well as forecasts for the federal funds rate. “When the Fed hikes rates, long-term yields don’t necessarily need to rise,” says Collin Martin, a fixed-income expert at Schwab.

What’s the difference between interest rates and bond yields? A rate usually refers to the annual interest owed on a loan or savings deposit, such as a money market account or certificate of deposit. Bonds typically pay a fixed rate of interest, called a coupon, until the bond matures, or comes due. When a firm issues a bond, the coupon rate and the yield—what an investor expects to earn—match up. But that doesn’t last once a bond starts to trade and its price begins to fluctuate. For example, a bond issued at a face value of $1,000 with a 10% interest rate would pay $100 a year and yield 10%. But if the price of the bond fell to $900, buying it would get you a current yield of 11.1%. If the price rose to $1,100, the yield would slip to 9.1%.

What determines the extent to which bond prices react to changes in interest rates? The longer it takes for a bond to mature, the more sensitive it is to changes in rates. The price of a freshly issued 30-year Treasury bond with a 5% coupon would fall substantially if the Treasury started to sell 30-year bonds with a 7% coupon. Why? Because that two-percentage-point-per-year difference would add up to a lot of interest income over three decades. But a five-year bond with a coupon of, say, 2% doesn’t put nearly as much income on the line over the lifetime of the bond. Plus, the short-term bond matures much sooner, enabling investors to reinvest more quickly at higher market rates.

The best way to check a bond’s sensitivity to interest rates is to look at its duration. The value of a bond with a duration of five years would fall by roughly 5% if rates were to rise by one percentage point. The 10-year Treasury bond, which yielded 2.4% in early December, now has a duration of nearly nine years—meaning it would take about four years of interest payments to recoup expected losses of 9% in the bond’s price if rates were to climb by one percentage point from today’s level.

How do interest rates affect the economy? As rates fall, they stimulate economic activity by making it cheaper to borrow money, encouraging consumers and businesses to ramp up spending and investment. Rising rates do the opposite: They clog the economy’s arteries by raising borrowing costs for banks, businesses and consumers. By adjusting short-term rates, the Fed aims to keep the economy humming at a sustainable pace, without causing too much or too little inflation. But the central bank doesn’t always succeed. Slashing rates to nearly zero in 2008 didn’t prevent the Great Recession. And the post-recession recovery has been one of the most sluggish ever, even though the Fed has kept rates near zero ever since.

What’s the relationship between inflation and interest rates? Interest rates (and bond yields) tend to tick up when signs of inflation emerge. If the Fed senses that the economy is overheating, central bankers will raise rates to inhibit economic activity and rein in price increases. When inflation is slowing, the Fed will cut rates if it feels the economy could fall into recession. But the Fed doesn’t want inflation to be too low (or, even worse, for prices to fall), either, because that tends to inhibit spending. The Fed is now aiming for a 2% inflation rate, about where the rate is today.

How do interest rates impact the stock market? Companies can take advantage of declining rates to reduce their borrowing costs, helping their bottom line. That can lead to more investment and spending, further boosting revenues and earnings. When rates rise, the demand for goods and services slows, squeezing corporate profits and putting pressure on stocks.

Rates can also tug on the stock market by influencing bond yields. When rates and bond yields climb, investors may find higher yields in the fixed-income market more attractive than stock investments. Most vulnerable are high-yielding stocks, such as utilities and phone companies, that are viewed as “bond proxies.” Higher rates can also cause the broad stock market to slump if investors conclude that steeper borrowing costs will lead to a weaker economy.

If rates continue to rise, what should my investment strategy be? Stick with bonds or funds that have a relatively low duration, says Jeffrey Gundlach, CEO of DoubleLine Investment Management and comanager of DoubleLine Total Return, a member of the Kiplinger 25. Funds that invest in floating-rate bank loans would also be a good bet, Gundlach says. Interest rates on the loans will adjust upward if short-term market rates increase, helping them hold more of their value than fixed-rate bonds. “If you have something that reprices every three months, you have very little interest rate risk,” he says.

Gundlach also recommends parts of the stock market that could benefit from higher rates and inflation. Shares of banks, industrial companies and producers of basic materials, such as copper and cement, should all fare well in that scenario, he says. “The stuff that goes into building things is where you want to be,” says Gundlach.

One area to avoid may be municipal bonds. If Congress cuts income-tax rates for individuals, munis would lose some of their advantage over taxable bonds. That could make munis less appealing and push down prices of the bonds, says Mitch Zacks, a money manager with Zacks Investment Management.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

The New Fed Chair Was Announced: What You Need to Know

The New Fed Chair Was Announced: What You Need to KnowPresident Donald Trump announced Kevin Warsh as his selection for the next chair of the Federal Reserve, who will replace Jerome Powell.

-

The U.S. Economy Will Gain Steam This Year

The U.S. Economy Will Gain Steam This YearThe Kiplinger Letter The Letter editors review the projected pace of the economy for 2026. Bigger tax refunds and resilient consumers will keep the economy humming in 2026.

-

January Fed Meeting: Updates and Commentary

January Fed Meeting: Updates and CommentaryThe January Fed meeting marked the first central bank gathering of 2026, with Fed Chair Powell & Co. voting to keep interest rates unchanged.

-

Trump Reshapes Foreign Policy

Trump Reshapes Foreign PolicyThe Kiplinger Letter The President starts the new year by putting allies and adversaries on notice.

-

Congress Set for Busy Winter

Congress Set for Busy WinterThe Kiplinger Letter The Letter editors review the bills Congress will decide on this year. The government funding bill is paramount, but other issues vie for lawmakers’ attention.

-

The December CPI Report Is Out. Here's What It Means for the Fed's Next Move

The December CPI Report Is Out. Here's What It Means for the Fed's Next MoveThe December CPI report came in lighter than expected, but housing costs remain an overhang.

-

How Worried Should Investors Be About a Jerome Powell Investigation?

How Worried Should Investors Be About a Jerome Powell Investigation?The Justice Department served subpoenas on the Fed about a project to remodel the central bank's historic buildings.

-

The December Jobs Report Is Out. Here's What It Means for the Next Fed Meeting

The December Jobs Report Is Out. Here's What It Means for the Next Fed MeetingThe December jobs report signaled a sluggish labor market, but it's not weak enough for the Fed to cut rates later this month.