It’s Not Just Gold That Glitters

New exchange-traded funds let you bet on platinum and palladium, too. And don’t forget silver.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

For decades, gold bugs have argued the bullish case for their favorite metal. In recent years, they’ve actually been right. The price of gold has climbed steadily for the past nine years, from $277 an ounce in 2001 to a record high (not adjusted for inflation) of $1,213 last December, as investors piled into the yellow metal because of its reputation as a safe haven and as a hedge against a falling dollar.

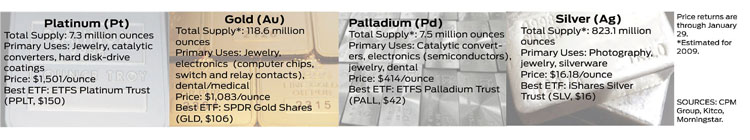

Even with the run-up in price, it’s not too late to profit from precious metals. But you may want to expand your horizons to metals that are less well known. In particular, two new exchange-traded funds, ETFS Physical Platinum Shares (symbol PPLT) and ETFS Physical Palladium Shares (PALL), let you wager on two precious metals that have a wider array of industrial uses than gold and silver.

To invest in platinum and palladium, you need to have faith in the strength and durability of the economic recovery. Both metals are used in the catalytic converters found in cars, so strong auto sales would be bullish. The pace of car sales in the U.S. is still well below the record set in 2000, but autos are zooming off the lots in China, which recently supplanted the U.S. as the world’s biggest car-buying nation.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

A plus for platinum is a supply shortage stemming from power outages in South Africa, the world’s largest producer of the metal. Jeffrey Christian, managing director of the CPM Group, a commodities-research firm in New York City, says platinum could go as high as $1,800 an ounce, and palladium could hit $525.

Don’t go overboard. Investing in raw materials doesn’t come without risk. In fact, platinum and palladium prices are actually more volatile than gold prices. Precious metals should represent only a small slice of your portfolio -- 5% at most, and probably less for most people.

The current metals mania differs from the one seen in the early 1980s, says Christian. “The move into precious metals this time is more permanent because the economic imbalances are worse than they were back then,” he says. Christian sees gold going to $1,400 an ounce early this year, before sinking back to about $1,100 as investors gain confidence in the sustainability of the economic recovery. The price of silver, which is used in flat-screen TVs and solar panels, could end the year as high as $21 an ounce, he says.

Rather than focus on one metal, consider buying a bit of all four. ETF Securities USA has approached the Securities and Exchange Commission about launching an ETF that holds such a basket. Or spread your risk by buying an ETF that includes not only gold and silver but also other materials, such as oil, corn and soybeans.

For broad exposure, we like PowerShares DB Commodity Index Tracking (DBC). Among regular mutual funds, our favorite is Pimco CommodityRealReturn Strategy D (PCRDX), a member of the Kiplinger 25.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Best Banks for High-Net-Worth Clients

Best Banks for High-Net-Worth Clientswealth management These banks welcome customers who keep high balances in deposit and investment accounts, showering them with fee breaks and access to financial-planning services.

-

Stock Market Holidays in 2026: NYSE, NASDAQ and Wall Street Holidays

Stock Market Holidays in 2026: NYSE, NASDAQ and Wall Street HolidaysMarkets When are the stock market holidays? Here, we look at which days the NYSE, Nasdaq and bond markets are off in 2026.

-

Stock Market Trading Hours: What Time Is the Stock Market Open Today?

Stock Market Trading Hours: What Time Is the Stock Market Open Today?Markets When does the market open? While the stock market has regular hours, trading doesn't necessarily stop when the major exchanges close.

-

Bogleheads Stay the Course

Bogleheads Stay the CourseBears and market volatility don’t scare these die-hard Vanguard investors.

-

The Current I-Bond Rate Is Mildly Attractive. Here's Why.

The Current I-Bond Rate Is Mildly Attractive. Here's Why.Investing for Income The current I-bond rate is active until April 2026 and presents an attractive value, if not as attractive as in the recent past.

-

What Are I-Bonds? Inflation Made Them Popular. What Now?

What Are I-Bonds? Inflation Made Them Popular. What Now?savings bonds Inflation has made Series I savings bonds, known as I-bonds, enormously popular with risk-averse investors. How do they work?

-

This New Sustainable ETF’s Pitch? Give Back Profits.

This New Sustainable ETF’s Pitch? Give Back Profits.investing Newday’s ETF partners with UNICEF and other groups.

-

As the Market Falls, New Retirees Need a Plan

As the Market Falls, New Retirees Need a Planretirement If you’re in the early stages of your retirement, you’re likely in a rough spot watching your portfolio shrink. We have some strategies to make the best of things.