A Real Estate Fund With Focus

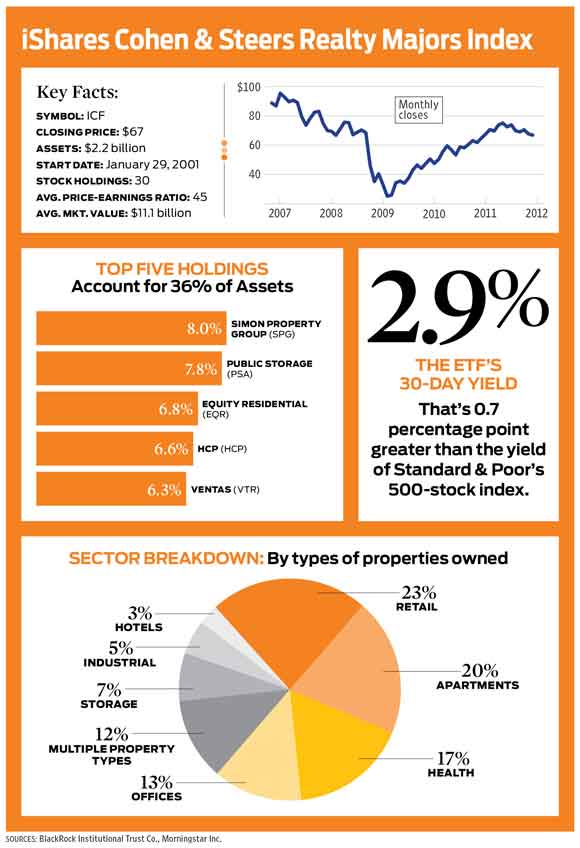

This ETF holds only 30 real estate investment trusts.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Real estate investment trusts stumbled badly in 2008, surged the next two years and held up better than most stock groups in 2011 (through December 1, the MSCI U.S. REIT index gained 2.6%). And because REITs must pay out essentially all of their profits to shareholders, the stocks are generally a fine source of income in today's low-yield world.

One of the more compelling REIT-oriented exchange-traded funds is iShares Cohen & Steers Realty Majors Index (symbol ICF). The ETF follows an index of the same name, a proprietary benchmark of the 30 most actively traded U.S. REITs. The index is far more concentrated than others of its kind. For instance, Vanguard REIT ETF (VNQ) holds 106 stocks. But iShares managers believe that the Cohen & Steers index -- and its focus on large-capitalization REITs -- is poised to benefit from future consolidation in the U.S. real estate industry. In fact, two industrial-property REITs that had been in the index, ProLogis and AMB Property, merged in 2011 (Cohen & Steers added General Growth Properties, a REIT that owns shopping malls, to replace AMB).

The ETF does a good job of tracking its index: In the year that ended December 1, the ETF lagged the Cohen & Steers index by a mere 0.16 percentage point. "We're tracking the index spot on" when you add back the fund's annual expenses, says Rene Casis, a portfolio manager at BlackRock, which owns iShares ETFs.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Nellie joined Kiplinger in August 2011 after a seven-year stint in Hong Kong. There, she worked for the Wall Street Journal Asia, where as lifestyle editor, she launched and edited Scene Asia, an online guide to food, wine, entertainment and the arts in Asia. Prior to that, she was an editor at Weekend Journal, the Friday lifestyle section of the Wall Street Journal Asia. Kiplinger isn't Nellie's first foray into personal finance: She has also worked at SmartMoney (rising from fact-checker to senior writer), and she was a senior editor at Money.

-

The Cost of Leaving Your Money in a Low-Rate Account

The Cost of Leaving Your Money in a Low-Rate AccountWhy parking your cash in low-yield accounts could be costing you, and smarter alternatives that preserve liquidity while boosting returns.

-

I want to sell our beach house to retire now, but my wife wants to keep it.

I want to sell our beach house to retire now, but my wife wants to keep it.I want to sell the $610K vacation home and retire now, but my wife envisions a beach retirement in 8 years. We asked financial advisers to weigh in.

-

How to Add a Pet Trust to Your Estate Plan

How to Add a Pet Trust to Your Estate PlanAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

I Hear REITs Are One of the Best Ways To Get Income From Investing, Especially in Retirement. Should I Buy Them?

I Hear REITs Are One of the Best Ways To Get Income From Investing, Especially in Retirement. Should I Buy Them?We ask a financial expert for advice.

-

Should You Buy These ETFs Before the Fed Cuts Rates?

Should You Buy These ETFs Before the Fed Cuts Rates?The Fed is expected to cut the federal funds rate at the December Fed meeting, and investors should consider these ETFs as interest rates head lower.

-

Investing Moves to Make at the Start of the Year

Investing Moves to Make at the Start of the YearAfter another big year for stocks in 2024, investors may want to diversify in 2025. Here are five portfolio moves to make at the start of the year.

-

The 5 Best Actively Managed Fidelity Funds to Buy and Hold

The 5 Best Actively Managed Fidelity Funds to Buy and Holdmutual funds Sometimes it's best to leave the driving to the pros – and these actively managed Fidelity funds do just that, at low costs to boot.

-

The 12 Best Bear Market ETFs to Buy Now

The 12 Best Bear Market ETFs to Buy NowETFs Investors who are fearful about the more uncertainty in the new year can find plenty of protection among these bear market ETFs.

-

Don't Give Up on the Eurozone

Don't Give Up on the Eurozonemutual funds As Europe’s economy (and stock markets) wobble, Janus Henderson European Focus Fund (HFETX) keeps its footing with a focus on large Europe-based multinationals.

-

Vanguard Global ESG Select Stock Profits from ESG Leaders

Vanguard Global ESG Select Stock Profits from ESG Leadersmutual funds Vanguard Global ESG Select Stock (VEIGX) favors firms with high standards for their businesses.

-

Kip ETF 20: What's In, What's Out and Why

Kip ETF 20: What's In, What's Out and WhyKip ETF 20 The broad market has taken a major hit so far in 2022, sparking some tactical changes to Kiplinger's lineup of the best low-cost ETFs.