A Unique Strategy to Prosper From Junk Bonds

Market Vectors Fallen Angel High Yield Bond ETF has topped most junk funds by owning bonds that were once high-grade.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Junk bonds appeal to investors who are willing to accept more risk in exchange for superior yields. But a subset of the high-yield universe—bonds that were issued with investment-grade ratings but have since descended to junk status—has delivered blissful results of late. Over the past five years, an index of these “fallen angel” bonds has returned an annualized 10.6%, crushing the broad U.S. bond market by an average of 6.5 percentage points per year and traditional junk bonds by 3.6 points per year.

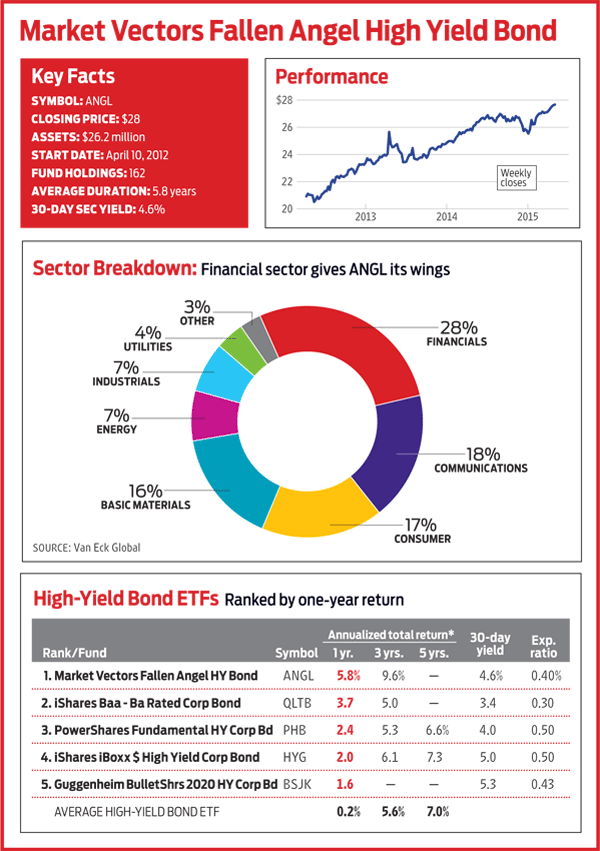

A way to play formerly high-grade IOUs is Market Vectors Fallen Angel High Yield Bond ETF (symbol ANGL). The exchange-traded fund holds debt from 162 issuers. Nearly three-fourths of its assets are in bonds that occupy the highest rung of the junk ladder (those rated double-B), more than twice that of the typical high-yield bond ETF. “Weak balance sheets, poor management, a loss of market share or other troubles brought these fallen angels into the index,” says manager Fran Rodilosso. “But the companies still tend to have valuable assets.”

Thanks to the collapse of oil prices, several energy companies earned their wings as fallen angels this year. As a result, the fund’s stake in bonds issued by energy firms, such as Transocean and DCP Midstream Partners, has increased in recent months. Other top holdings include bonds of loan servicer Sallie Mae and aluminum maker Alcoa.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

What Fed Rate Cuts Mean For Fixed-Income Investors

What Fed Rate Cuts Mean For Fixed-Income InvestorsThe Fed's rate-cutting campaign has the fixed-income market set for an encore of Q4 2024.

-

The Most Tax-Friendly States for Investing in 2025 (Hint: There Are Two)

The Most Tax-Friendly States for Investing in 2025 (Hint: There Are Two)State Taxes Living in one of these places could lower your 2025 investment taxes — especially if you invest in real estate.

-

The Final Countdown for Retirees with Investment Income

The Final Countdown for Retirees with Investment IncomeRetirement Tax Don’t assume Social Security withholding is enough. Some retirement income may require a quarterly estimated tax payment by the September 15 deadline.

-

Dividends Are in a Rut

Dividends Are in a RutDividends may be going through a rough patch, but income investors should exercise patience.

-

Municipal Bonds Stand Firm

Municipal Bonds Stand FirmIf you have the cash to invest, municipal bonds are a worthy alternative to CDs or Treasuries – even as they stare down credit-market Armageddon.

-

High Yields From High-Rate Lenders

High Yields From High-Rate LendersInvestors seeking out high yields can find them in high-rate lenders, non-bank lenders and a few financial REITs.

-

Time to Consider Foreign Bonds

Time to Consider Foreign BondsIn 2023, foreign bonds deserve a place on the fringes of a total-return-oriented fixed-income portfolio.

-

The 5 Best Actively Managed Fidelity Funds to Buy and Hold

The 5 Best Actively Managed Fidelity Funds to Buy and Holdmutual funds Sometimes it's best to leave the driving to the pros – and these actively managed Fidelity funds do just that, at low costs to boot.