5 Key Investing Tips to Remember When Your Emotions Start to Get the Best of You

Here is why even professional investors work with a financial advisor to help stay objective in fluctuating markets.August 2013

Emotions can be powerful, especially when money is involved. Some experience euphoria or despair when the markets rise or fall – after all, it’s your nest egg. It is only natural that as humans we allow our emotions to cloud our judgment and potentially get in the way when it comes to investing. That’s why having a professional can help us take a step back and keep our emotions in check. Even professional investment advisors have personal Financial Advisors who manage their money because it is helpful to have someone on the outside who is able to take a step back and help maintain a realistic perspective.

Here is an example of an emotional experience for investors:

A new-to-the-market investor bought her very first mutual fund. She picked a fund based on a sector she thought was going to do well and then proceeded to watch it constantly. The first day it went up, she was excited and thought she really had a knack for this investing thing. Then for the next month it went down. Eventually when the idea of losing any more money was unbearable she sold the fund.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Here is another investor experience:

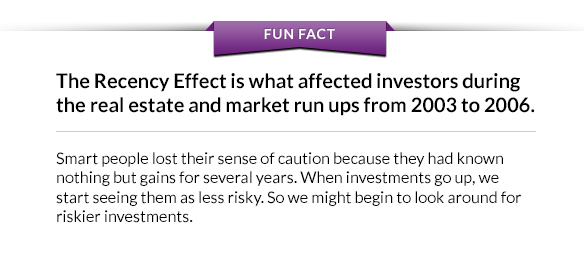

An investor buys into an ETF he’s been watching for months. Upon buying into the ETF it continues to rise. The investor is excited that his investment is doing so well, so he buys even more of the ETF or maybe he is starting to chase a hot new trend (an example is the tech boom in the late 90s). Now the investor has all of his eggs in one basket and is unprepared when the market takes an unexpected downward turn.

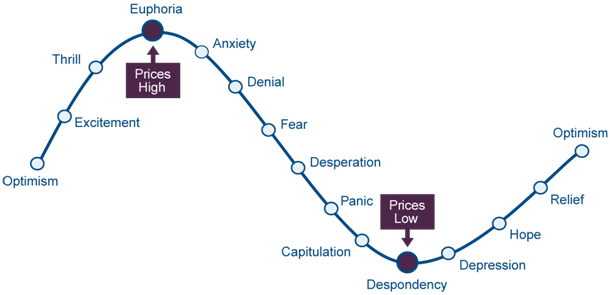

While these markets are unpredictable, the effect they have on investors’ emotions can be much more anticipated. In rising markets, investors are more optimistic, they get excited that their investments are doing well and can often lead to making risky financial decisions, such as putting more money into investments of a similar style because higher returns seem so common.

Then, in falling markets, that euphoria quickly fades into a pessimistic outlook. This cycle then tempts investors to take impulsive action when prices drop and can place their long term financial goals in jeopardy.

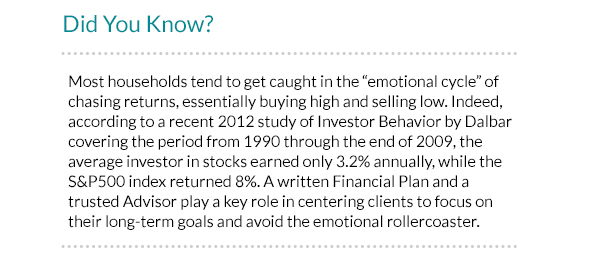

When emotions become the predominant reason for making investment decisions, you could end up making bad decisions that potentially result in losing more money in the long run. With self-awareness and a few practical tips, we can try and neutralize the rollercoaster in our heads.

Here are key tips to remember when your emotions start to get the best of you:

1. Work with a Financial Advisor

We believe that no one should have to try and tackle the markets alone; working with an Advisor, such as a NestWise Advisor, can help you stay on course. When you are ready to start investing your money, it’s a good time to start working with a Financial Advisor, so she can get to know you and help you create the ideal portfolio for your specific goals.

2. Write down your goals

When keeping track of your financial goals, be specific. How much do you want to save? When do you want to complete this goal? This will help you figure out how much volatility you can comfortably tolerate.

3. Stick to your Financial Plan

Do not let short-term moves in the market prompt rash investment decisions. Re-read your financial goals to remind yourself what you want to achieve with your Financial Plan. Remind yourself that you do not need this money in the short term and remember what you are trying to accomplish in the long run.

4. Diversify your portfolio

A diversified portfolio will help diminish the emotional response to investing. You’ve probably heard the expression “don’t put all your eggs into one basket". It is important to have an investment portfolio that aims to balance the level of risk that is right for you and your investment horizon.

5. Dollar-Cost Averaging

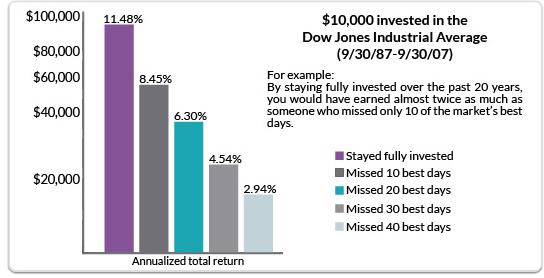

It is one of the oldest tried and tested formulas for investing. This is when you invest equal dollar amounts regularly over a specific time period (such as $100 a month for 3 years). The idea behind this method is that you are no longer trying to time the market and at the same time, are getting used to the idea of continuously investing.

Keeping your emotions in check while making investment decisions is easier said than done, especially when markets are volatile and news about the market is everywhere we turn. When investing, it’s important to follow a plan, consult with knowledgeable sources when you have questions, and work with an Advisor, such as a NestWise Advisor, who can help keep you on the right path, so the decisions you make in the short term get you to where you want to be over the long haul.

This content was provided by Nestwise.com and did not involve the Kiplinger editorial staff.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

Best Banks for High-Net-Worth Clients

Best Banks for High-Net-Worth Clientswealth management These banks welcome customers who keep high balances in deposit and investment accounts, showering them with fee breaks and access to financial-planning services.

-

Stock Market Holidays in 2026: NYSE, NASDAQ and Wall Street Holidays

Stock Market Holidays in 2026: NYSE, NASDAQ and Wall Street HolidaysMarkets When are the stock market holidays? Here, we look at which days the NYSE, Nasdaq and bond markets are off in 2026.

-

Stock Market Trading Hours: What Time Is the Stock Market Open Today?

Stock Market Trading Hours: What Time Is the Stock Market Open Today?Markets When does the market open? While the stock market has regular hours, trading doesn't necessarily stop when the major exchanges close.

-

Bogleheads Stay the Course

Bogleheads Stay the CourseBears and market volatility don’t scare these die-hard Vanguard investors.

-

The Current I-Bond Rate Is Mildly Attractive. Here's Why.

The Current I-Bond Rate Is Mildly Attractive. Here's Why.Investing for Income The current I-bond rate is active until April 2026 and presents an attractive value, if not as attractive as in the recent past.

-

What Are I-Bonds? Inflation Made Them Popular. What Now?

What Are I-Bonds? Inflation Made Them Popular. What Now?savings bonds Inflation has made Series I savings bonds, known as I-bonds, enormously popular with risk-averse investors. How do they work?

-

This New Sustainable ETF’s Pitch? Give Back Profits.

This New Sustainable ETF’s Pitch? Give Back Profits.investing Newday’s ETF partners with UNICEF and other groups.

-

As the Market Falls, New Retirees Need a Plan

As the Market Falls, New Retirees Need a Planretirement If you’re in the early stages of your retirement, you’re likely in a rough spot watching your portfolio shrink. We have some strategies to make the best of things.