Robo Advisers Get the Human Touch

More automated advisory services are giving clients the chance to consult with financial planners and investment counselors.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Robots can do almost anything: drive a car, mix a cocktail, vacuum the house and even manage your investments. What they can’t do, however, at least when it comes to investing, is give you individual attention. And many investors want a small dose of human contact from their robo adviser, especially as their financial lives become more complex. So an increasing number of automated offerings now include a real person. In the growing world of hybrid services, which marry digital advice with human advisers, here’s how to find the combination that suits your portfolio and your pocketbook.

Booming business. When robo advisers first became popular five years ago, they were hailed as transparent, low-cost investment solutions, especially for investors just starting out. Answer a few questions online and the automated services, using complex algorithms, would match you with an appropriate, diversified portfolio of low-fee, exchange-traded funds tailored to your time horizon and tolerance for risk. The robots monitored and rebalanced your investments in tax-efficient ways, all with almost no human interaction.

Young investors and the tech-savvy gobbled it up. (The rising popularity of indexing and ETFs, the bedrock of most robo portfolios, helped.) Assets swelled at robo outfits, such as Betterment, Wealthfront and Schwab Intelligent Portfolios. In its first two years, from March 2015 through March 2017, Schwab’s service amassed $16 billion in assets.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

At the same time, a regulatory sea change was channeling advisers toward robo technology. The Department of Labor’s fiduciary rule, in effect since June, requires anyone giving investment advice regarding a 401(k) or an IRA—including, for the first time, securities brokers—to act in the client’s best interest. (Previously, brokers simply had to recommend suitable investments.) Brokerage firms revamped their practices to comply with the new rule. Some firms swapped their commission-based pay structure for one that charges clients a fee based on a percentage of assets under management. At the extreme, some brokers and money managers have raised their minimum investment requirements or asked clients with small balances to rely on customer call centers instead of a dedicated adviser. Says Juli McNeely, a former president of the National Association of Insurance and Financial Advisors: “Those small accounts will have to find another place to get advice.”

Enter the hybrid. All kinds of financial-services firms have launched robo offerings or partnered with shrewd financial-technology firms to deliver hybrid advisory services. In recent months, Betterment and Schwab introduced services that combine robo advice with input from certified financial planners. Citizens Investment Services, a unit of Citizens Bank; Wells Fargo Advisors, the investment arm of the banking giant; and UBS Wealth Management Americas have partnered with robo adviser SigFig to pair their in-house human advisers with robo technology that’s tailored to each firm’s clientele. Over the past year and a half, E*Trade, Fidelity, TD Ameritrade and T. Rowe Price have started their own robo services, with licensed representatives ready to chat.

Pioneers such as Vanguard’s Personal Advisor Services and Personal Capital have offered hybrid advice since their debut. Both programs start by taking a digital accounting of your cash and investments. Then comes a consultation with a certified financial planner (by phone or via computer), who will craft a strategy to meet your goals.

Although many traditional financial-services firms have adopted the eye-catching digital technology of the robo world, including graphics-laden, interactive websites and mobile apps, not all robo advisers plan to add the human touch. “Our clients don’t want that,” says Kate Wauck, a spokeswoman for robo adviser Wealthfront. “They consistently tell us, ‘We pay you not to talk to us.’ ”

For investors looking for high tech and a heartbeat when it comes to advice, we think services from Schwab and Vanguard stand out. Schwab Intelligent Advisory is a bargain—charging just 0.28% of assets per year in fees and requiring a $25,000 minimum. Plus, it offers well-diversified portfolios that hold a variety of assets, from large-company stocks (U.S. and foreign) to small-company stocks, U.S. and foreign bonds, high-yield debt, and even gold. And it’s a plus that it has a certified financial planner on hand. Intelligent Advisory uses the same technology behind Schwab’s robo service, Intelligent Portfolios. But Intelligent Advisory doesn’t generate a computer-prescribed portfolio until after you have a consultation with a financial planner. Every year, you’ll get a “check-in and update” with one of the 30 CFPs who work exclusively for Schwab Intelligent Advisory. And you can talk to a planner midyear if you need to.

Vanguard’s Personal Advisor Services charges low fees, too—0.30% of assets a year. You do need $50,000 to start, but for that you get access to one of the hundreds of certified financial planners employed by Vanguard (by phone, video or e-mail). The planners can customize your portfolio, which might include holding on to those General Electric shares that Grandpa gave you, for example, if that’s in your best interest. And they can give you planning advice on all aspects of your financial life.

Once you throw a human into the mix—even if you don’t ever meet with one in person—the job of picking an adviser becomes more about personal preference than about fees or minimums. And anyone evaluating a hybrid advice model should keep in mind its limitations.

Far from perfect. Hybrids come with some downsides. For starters, there’s a higher minimum investment to get in the door, and you’ll pay more for advisory services than you would for a robo-only model. Betterment Premium, for example, offers unlimited consultations with certified financial planners for a $100,000 investment minimum and charges 0.50% in annual fees. That’s less than the typical annual rate of 1% for a money manager. But it’s more than Betterment’s Digital service, which offers no consultations, has a $0 minimum and costs 0.25% per year.

And you won’t develop an ongoing relationship with a dedicated adviser with these hybrids, as you would at a traditional money-management firm. When you call, you’ll talk to the first person available. The advice you get won’t be customized, either. With almost all hybrids, you’re stuck with the model portfolios on offer.

What’s more, the advice itself can be formulaic. Say you’re a 45-year-old woman who will retire in 20-odd years and has a host of career, family and personal issues affecting your financial life. “You’re going to get generic advice for a generic 45-year-old,” says McNeely, a certified financial planner in Spencer, Wis. The hybrid won’t take into account whether you have significant health issues, for instance, or a job that generates uneven income.

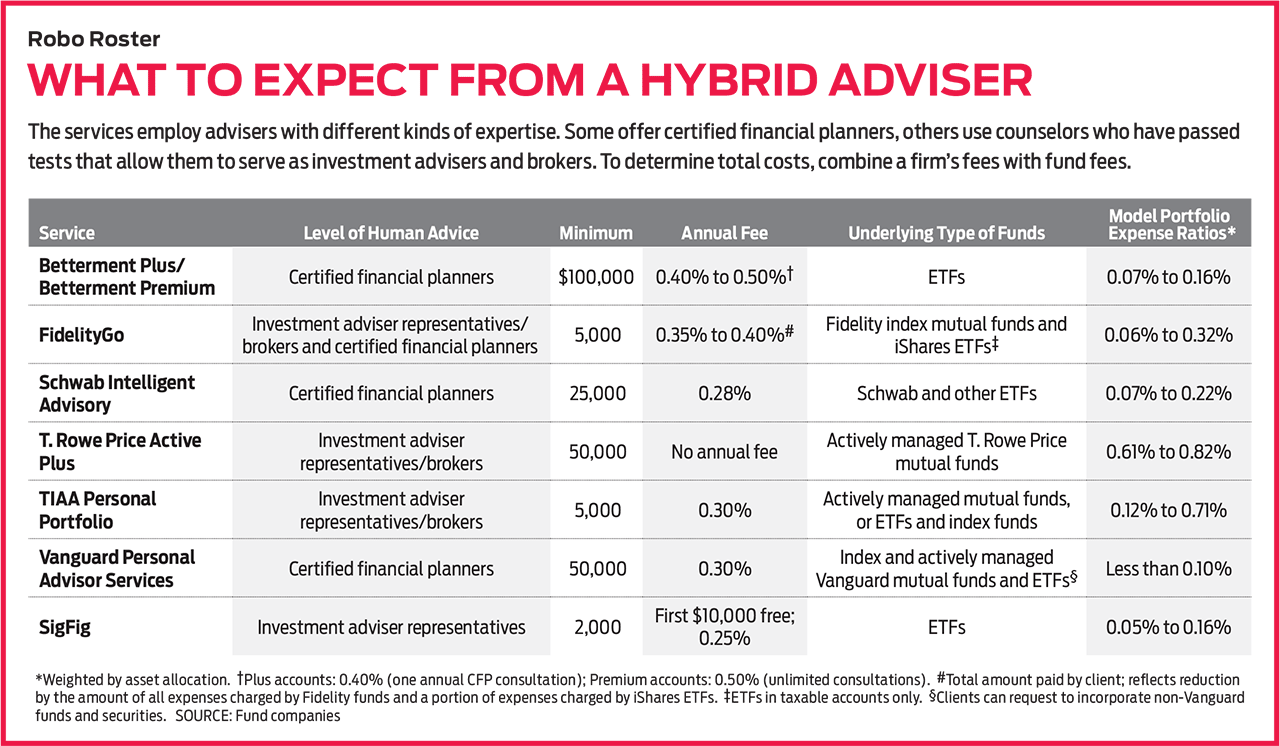

The level of advisory expertise varies, too. Some services hire certified financial planners, who are qualified to give you investment advice and help you with other aspects of your financial life, from banking and insurance to when to claim Social Security benefits. Such planners must pass a rigorous seven-hour exam and complete an apprenticeship before they earn the CFP designation.

Other hybrids hire so-called investment adviser representatives, who have passed tests, such as the Series 65 or Series 66, that show a command of general investing topics, portfolio strategies, taxes and regulations. (Some have also passed the Series 7 exam, which allows them to serve as brokers.) These reps can give you investment guidance—say, walk you through the differences between two portfolios. They can even talk you down from the ledge when you’re panicking about market turmoil. But they cannot advise you to choose one course, or one investment, over another. And they can’t help you with broad financial-planning questions.

Finally, hybrid advisory services are only as good as the advice they deliver. And for now, that’s hard to measure. Many offerings are new, and few have records of as long as five years. Condor Capital Management, a Martinsville, N.J., adviser, has started to keep tabs. The firm has opened a taxable account and an IRA (where possible) using real money at more than a dozen robo services. In the Robo Report, published quarterly, it recounts the performance of each account, as well as how investments are divided among major asset classes (U.S. stocks, foreign stocks, bonds and cash). “The report allows people to know what’s under the hood,” says Condor’s Michael Walliser.

But many of the accounts tracked in the Robo Report have been open for less than a year, so there’s not much of a track record to analyze yet. What’s more, it’s difficult to compare results from different services. Some robo IRAs, for instance, hold stocks and cash; others hold stocks, bonds and cash. For what it’s worth, the Robo Report shows that in the first three months of 2017, Schwab-managed IRAs returned 5.2%, and SigFig accounts earned 7.1%, compared with 6.1% for Standard & Poor’s 500-stock index. Both accounts had more than 90% of their assets in stocks, but SigFig got a boost from having a surprisingly high 55% of its stock allocation in foreign firms, compared with 47% in Schwab’s portfolios.

How to choose. New robo and hybrid services launch every month. More than 80 emerged between 2015 and 2016, according to BlackRock, the money-management giant. With so many outfits to choose from, how do you winnow the list? First check whether your online broker offers a hybrid robo service. Otherwise, as you sift through offerings, focus on fees. After all, that’s the biggest advantage that these hybrid services have over traditional money managers. Bear in mind that with most hybrids, you’ll pay an annual fee plus the underlying fund expense ratios.

Next, determine what level of expertise you need—whether an investment adviser representative will suffice or whether you need the overview of the big pictures that a certified financial planner can provide. If you’re willing to spend a little time, fill out the online questionnaire at one or two hybrids to compare their recommended portfolios. Transparency is a big selling point for robos, so they will often show you how they will invest your money—by asset class or by particular ETF—before you even open an account.

Finally, consider your personal preferences. Although most robos rely on index-based ETFs, for instance, fans of actively managed funds have hybrid options, too. T. Rowe Price’s Active Plus portfolios hold only actively managed Price funds. You won’t pay an annual fee for Active Plus, but, reflecting the additional costs of active management, the portfolios’ average expense ratios are higher than those of typical packages that are based on index funds. And TIAA Personal Portfolio offers two robo portfolios that hold actively managed funds, as well as a third option comprising ETFs and low-cost index funds. One active portfolio, called Impact, even focuses on funds that follow socially responsible investment strategies. As robos evolve and proliferate, chances are you’ll eventually find a service that’s right for you.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Nellie joined Kiplinger in August 2011 after a seven-year stint in Hong Kong. There, she worked for the Wall Street Journal Asia, where as lifestyle editor, she launched and edited Scene Asia, an online guide to food, wine, entertainment and the arts in Asia. Prior to that, she was an editor at Weekend Journal, the Friday lifestyle section of the Wall Street Journal Asia. Kiplinger isn't Nellie's first foray into personal finance: She has also worked at SmartMoney (rising from fact-checker to senior writer), and she was a senior editor at Money.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

Best Banks for High-Net-Worth Clients

Best Banks for High-Net-Worth Clientswealth management These banks welcome customers who keep high balances in deposit and investment accounts, showering them with fee breaks and access to financial-planning services.

-

Stock Market Holidays in 2026: NYSE, NASDAQ and Wall Street Holidays

Stock Market Holidays in 2026: NYSE, NASDAQ and Wall Street HolidaysMarkets When are the stock market holidays? Here, we look at which days the NYSE, Nasdaq and bond markets are off in 2026.

-

Stock Market Trading Hours: What Time Is the Stock Market Open Today?

Stock Market Trading Hours: What Time Is the Stock Market Open Today?Markets When does the market open? While the stock market has regular hours, trading doesn't necessarily stop when the major exchanges close.

-

Bogleheads Stay the Course

Bogleheads Stay the CourseBears and market volatility don’t scare these die-hard Vanguard investors.

-

The Current I-Bond Rate Is Mildly Attractive. Here's Why.

The Current I-Bond Rate Is Mildly Attractive. Here's Why.Investing for Income The current I-bond rate is active until April 2026 and presents an attractive value, if not as attractive as in the recent past.

-

What Are I-Bonds? Inflation Made Them Popular. What Now?

What Are I-Bonds? Inflation Made Them Popular. What Now?savings bonds Inflation has made Series I savings bonds, known as I-bonds, enormously popular with risk-averse investors. How do they work?

-

This New Sustainable ETF’s Pitch? Give Back Profits.

This New Sustainable ETF’s Pitch? Give Back Profits.investing Newday’s ETF partners with UNICEF and other groups.

-

As the Market Falls, New Retirees Need a Plan

As the Market Falls, New Retirees Need a Planretirement If you’re in the early stages of your retirement, you’re likely in a rough spot watching your portfolio shrink. We have some strategies to make the best of things.