The Best Online Brokers, 2018

Top contenders in this year’s rankings finish in a dead heat.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

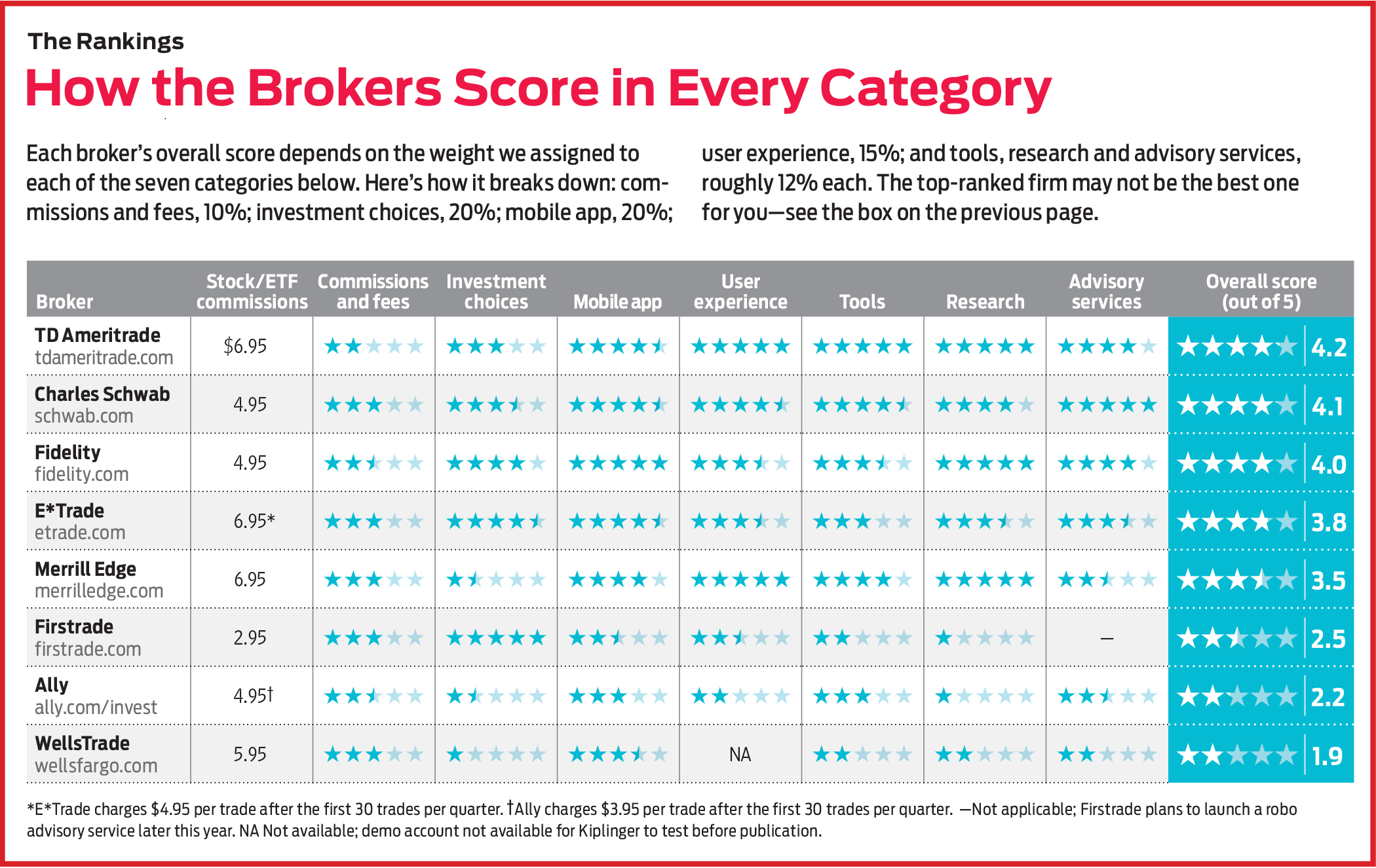

When Secretariat won the Belmont Stakes in 1973, securing his place in racing history as a Triple Crown champion, he beat the competition by a whopping 31 lengths, or about 248 feet. The results of this year’s online broker survey aren’t as clear-cut. In a photo finish, TD Ameritrade beat Charles Schwab by less than a nose, with Fidelity and then E*Trade fast on their heels.

As the world of online brokers continues to evolve, it has become increasingly difficult for firms to stand apart from one another. Their fees and commissions are generally low, their online tools are plentiful, they provide generous access to low-cost investments, and the firms’ websites and mobile apps are crammed with research reports, charts and videos. Overall, the contest for best online broker is a neck-and-neck horse race.

But zoom in, and you’ll find that each firm has something different to offer—a niche that lets it shine in one way or another. This year, we surveyed eight firms: Ally Invest, Charles Schwab, E*Trade, Fidelity, Firstrade, Merrill Edge, TD Ameritrade and WellsTrade. With commissions about $7 or less at most firms this year, that category carries less weight. Because the firms we surveyed told us that investors increasingly interact with them on smartphones or tablets, we assigned more importance to mobile apps. The biggest, best-known firms, you’ll notice, score better overall in our survey. But almost all of the firms let you trade stocks, exchange-traded funds, mutual funds and individual bonds online, as well as offer some online advisory services.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

There are a couple of exceptions: Firstrade’s online robo adviser may launch later this year. And although WellsTrade offers individual bond investing, which we factored into its ranking, trades must be made over the phone. Finally, we approached T. Rowe Price and Vanguard, but both firms declined to participate in our survey this year. Read on to find out which brokers did best—and why—in each category.

Commissions & fees

Plenty of brokerages offer reasonable fees and commissions, thanks to the decades-long brokerage price wars. The latest salvo from Fidelity eliminated all account fees, including fees to wire money domestically, among others. The final scores in this category, which are based mostly on fees to trade stocks, mutual funds, bonds and options, fall within a narrow range. Five firms earn three stars out of five, but E*Trade, Firstrade and Merrill Edge top the others by super-slim margins. In the end, the best low-cost firm for you may depend on what you invest in, how actively you trade, and in some cases, how much money you have in your account.

Consider stock and ETF commissions, for example. Firstrade leads the way among firms that charge a fixed rate, at $2.95 per trade, followed by Fidelity and Schwab ($4.95) and TD Ameritrade ($6.95). The rest of the firms employ variable pricing that depends on how often you trade or on the size of your average monthly balance. E*Trade’s standard $6.95 commission drops to $4.95 for clients who make 30 or more trades per quarter. Ally Invest shaves a dollar off its fee, to $3.95, for investors with a daily balance of $100,000 or more or who trade at least 30 times per quarter.

At WellsTrade, which is affiliated with Wells Fargo, and Merrill Edge, which is the brokerage arm of Bank of America, you can get a break on stock and ETF commissions if you have money in a checking or savings account at the associated bank. For instance, WellsTrade customers who link their brokerage account with a Portfolio by Wells Fargo checking account can get their stock commissions knocked down to $2.95 from the typical $5.95 charge. At Merrill Edge, the deal is even better: The firm’s standard $6.95 commission falls to $0 for up to 30 stock and ETF trades per month for investors who have $50,000 in combined assets at Merrill and parent company Bank of America and who join the bank’s Preferred Rewards program. Nearly half of all Merrill Edge customers have snagged that bonus, and as a result, “about 80% of trades on our platform are commission-free,” says Merrill Edge’s David Poole.

Fees to trade bonds have become more transparent in recent years. Most of the firms in our survey charge $1 per security to buy and sell corporate and municipal bonds. So if you, say, buy 10 General Electric bonds, you’ll pay a $10 commission at those firms, with a maximum fee of $250. The exceptions are WellsTrade, which charges a flat $50 for bond trades, and Firstrade, which trades bonds on a “net yield” basis. That means the price of the bond includes a mark-up that represents the dealer’s profit. This pricing model is generally more expensive and is certainly less transparent.

Investment choices

Every broker in our survey gives investors access to thousands of stocks, bonds, mutual funds and ETFs. To top the list in this category, firms had to offer not only a wide variety of investments but also deep rosters of ETFs that trade commission-free and no-load or load-waived mutual funds that trade with no transaction fees.

When it comes to the breadth of investment options, Firstrade reigns supreme. That doesn’t mean it offers more of everything compared with other firms in the survey, however. Firstrade’s lineup of no-transaction-fee mutual funds falls several hundred funds short of Schwab, TD Ameritrade and Fidelity, all of which surpass 4,000. But Firstrade wins on the ETF front. It offers 703 ETFs commission-free. The number of ETFs offered with no sales charge at Fidelity, E*Trade, Schwab and TD Ameritrade ranges from 265 to 313. (It’s worth noting that Vanguard now charges nothing to buy and sell 1,800 ETFs on its platform.) Firstrade also offers access to more corporate and municipal bonds than any broker in our survey, with E*Trade close behind.

Fidelity is the best choice for investors who want access to initial public offerings. Over the past two calendar years, Fidelity has made 397 IPOs available to customers, compared with 64 for E*Trade and 48 for TD Ameritrade. In each case, gaining access to shares comes with eligibility requirements. TD Ameritrade customers, for instance, must have $250,000 in assets in their account, place 30 trades per quarter, or be a customer of the firm’s private client services.

Mobile apps

Investors increasingly want to manage their brokerage business on the go. In response, brokers have rolled out mobile apps for smartphones and tablets that allow clients to make trades, read analyst reports on stocks, pay bills, transfer money to outside accounts, and even check on how they are doing with regard to their retirement savings with the touch of a button (or in some cases, after a facial recognition scan).

Fidelity’s mobile app wins the highest marks for checking all the essential boxes. You can buy or sell stocks, ETFs, mutual funds and bonds on Fidelity’s app. No other firm in our survey can say the same. But Fidelity also excels in this category because its app offers virtually all of the other conveniences that brokerage clients now expect, such as mobile bill pay and check deposit, as well as the ability to set up watch lists and view educational videos.

Schwab, TD Ameritrade and E*Trade score well in this category, too. Active traders may appreciate the stock charts available on the mobile apps of E*Trade and TD Ameritrade. The charts can be customized with dozens of indicators used in technical analysis—for example, those based on price momentum. The apps of both E*Trade and TD also allow investors to scan product barcodes and instantly receive stock information on their smartphone about the product’s manufacturer (assuming the company has a publicly traded stock). But TD Ameritrade, unlike Schwab and E*Trade, doesn’t allow mobile users to pay bills from brokerage accounts.

Finally, Merrill Edge’s app is worth a mention. Its intuitive interface, particularly when it comes to stock research, makes it one of the most engaging apps on our list. The app lost a few points, however, because it doesn’t offer bond trading or let you transfer money electronically between other banks. (Transfers between Bank of America and Merrill Edge, however, are instantaneous.)

On the whole, most of the apps we checked out allow investors to easily trade, deposit money and transfer funds. Ally Invest and Firstrade, the laggards in the mobile app category, fell behind because their apps don’t offer mutual fund or bond trading, mobile check deposits, or bill pay. Firstrade’s mobile users can’t make electronic fund transfers in the app, either.

User experience

To evaluate our only truly subjective category, three Kiplinger investing staffers test-drove the brokers’ websites and mobile apps in search of the most intuitive and user-friendly platforms for all types of investors. WellsTrade was unable to provide us with a test account. But among the others, two firms stand out: Merrill Edge and TD Ameritrade.

Merrill’s platform transforms the sometimes-daunting work of analyzing your portfolio and researching stocks into an engaging experience. In “Portfolio Story” mode, the site poses eight questions that investors should ask about their portfolio, from “How is my portfolio performing?” to “What could I potentially earn?” It even examines how your investments rank on certain environmental, social and corporate governance measures. “We wanted Portfolio Story to feel like sitting down with an expert, with users learning what questions they should ask about their portfolio,” says Merrill Edge’s Steve Lucas.

As you work through each step, you’re presented with colorful graphics and digestible data that you can act on. If the tool tells you that a particular stock makes up an outsize portion of your portfolio, for instance, you can sell some shares with just a few clicks. Merrill’s platform uses the same approach for stock research with “Stock Story,” a similarly engaging tool that investors can use to work through four essential questions of stock analysis.

TD Ameritrade scores points for meeting clients where they spend their time—texting on their smartphones or browsing Twitter or Facebook on a computer, tablet or smartphone. Anyone can contact TD through direct messages on Twitter, on Facebook Messenger, through the iPhone Messages app or by talking to their Amazon Alexa–equipped device. “We want the brokerage experience to be part of the existing tapestry of your life,” says TD’s Sunayna Tuteja. For example, you might use Facebook’s messaging feature to ask a broad investing question, get a stock quote, or even buy or sell shares—all without leaving the Facebook app. TD uses artificial intelligence to generate automated responses to your query; if that doesn’t satisfy you, TD will automatically connect you with a live representative.

Most of the firms score well for their easy-to-navigate platforms. Both E*Trade and Fidelity lose points for their sprawling and sometimes lumbering websites. We found inconsistencies, for example, in the way the trade window pops up on different pages on Fidelity’s site and the way graphics show up (or don’t) on E*Trade’s site.

Ally Invest’s platform is almost too basic, with what seems like acres of white space that makes the site feel sparse. And although Firstrade’s website is zippy when it comes to loading pages, its retirement-and-planning section isn’t as robust as others. And the site offers limited research on stocks, funds and bonds.

Tools

Are you on track to retire when you want? Are you getting the steady payments you need from your income portfolio? Ideally, brokerages should make it easy to find promising investments, but they should also provide you with the tools to help with life’s other financial issues.

TD Ameritrade distinguishes itself with its commitment to investor education. The website’s education center is a treasure trove of short explanatory videos on everything from the basics of money market accounts to the ins and outs of cryptocurrency. Longer and more detailed online courses are also available, with titles such as “Trading Options” and “Fundamental Analysis.” The firm held nearly 6,000 webinars on online-trading education in 2017 alone. TD is one of two brokers, along with Fidelity, to offer some form of virtual trading. Fidelity allows users to see how a hypothetical trade might affect their portfolio’s asset allocation, among other things. TD’s version is available on its downloadable trading software and lets investors practice trading with virtual money on the platform before diving in with the real thing.

Other standouts at TD include a tool that breaks down the fees you pay in your 401(k) account and another that charts your portfolio’s expected dividends for the next 12 months. Merrill Edge and E*Trade offer tools that track future dividend payouts, too.

Kudos go to Merrill Edge and Schwab in this category for an abundance of offerings. Calculators abound in Merrill’s toolbox. Retirement planners, for example, can get help figuring out annuity payouts, 401(k) contributions, Roth IRA conversions and estimated required minimum distributions in retirement. Schwab stands out for its robust collection of investing screens for stocks, options, ETFs and mutual funds. Users can search for investments based on their own criteria, select from the firm’s list of predefined strategies, or pick stocks from rosters from CFRA and S&P Capital IQ, including CFRA’s recommended “Five-Star” stocks and those screened for exceptional earnings growth.

Research

These days, investors don’t have to look very hard to find basic information about stocks and mutual funds online. Brokers that score well in this category go the extra mile to keep their clients informed, offering investment information that goes beyond summaries and snapshots.

With the exception of Firstrade, every broker on our list provides some form of bond market commentary or analysis. But research on individual stocks, mutual funds and ETFs varies from broker to broker. Fidelity earns high marks for the range of research available on its site. The firm boasts more independent sources of investment research than any other broker in our survey, and indeed, its stock pages are packed with reports from the likes of Thomson Reuters and Zacks Investment Research. But much of Fidelity’s research is quantitatively focused and lacks in-depth analysis of individual stocks, mutual funds or ETFs. Fidelity lost points for that, but the sheer number of sources it offers, combined with the mix of broad stock and bond market commentary, lifted it to the top in this category.

TD Ameritrade and Merrill Edge end up in a virtual tie with Fidelity for research, with Schwab posting strong results, too. Each provides individual stock reports from investment research firm CFRA. TD Ameritrade and Merrill also offer breakdowns of individual funds and ETFs by Morningstar analysts. All three include input from analysts at major financial institutions. Merrill Edge provides reports from Bank of America Merrill Lynch; TD Ameritrade and Schwab (as well as E*Trade and WellsTrade) feature individual stock reports from analysts at investment bank Credit Suisse. Fidelity, Firstrade and Ally Invest lack research from a big bank.

Advisory services

All of the brokers in our survey except Firstrade offer clients some level of financial guidance, from computer-generated robo advice to access to dedicated financial planners. Depending on the size of your account, you can get help with calibrating your investment mix, creating a retirement plan or even doing some estate planning.

Schwab’s advisory service stands out for the breadth, quality and price of its offerings. Schwab’s robo adviser, Intelligent Portfolios, does not charge an asset-management fee, which sets it apart from others. You need $5,000 to open an account at Intelligent Portfolios, which is on the high end of minimums (but not the highest). Clients can start investing with just $10 at Fidelity’s “Fidelity Go” digital adviser, for instance. But once funded, Schwab’s Intelligent Portfolios use low-cost ETFs to tailor dozens of portfolios. One caveat: Schwab’s most aggressive Intelligent Portfolio holds 7% in cash. Such a large cash position could hamper returns. But according to The Robo Report, which tracks the performance of digital advisory portfolios, Schwab’s portfolios don’t disappoint. Over the past two years, a moderate-risk portfolio at Schwab that held 62% of assets in stocks, 23% in bonds, 10% in cash and 5% in other assets returned 13.6% annualized through June 30. That beat the nearly 10% return of a hypothetical portfolio of broad-market indexes held in similar proportions over the same period.

TD Ameritrade and Fidelity also post high scores thanks to their digital advisory services. Each keeps investor expenses to a minimum: TD charges 0.30% of assets, and Fidelity charges 0.35%. At Fidelity, that includes the expenses of the portfolios’ underlying investments. Among firms dinged in our survey for high-cost robos: Merrill Edge, which charges a management fee of 0.45% of assets, and WellsTrade, which levies a 0.50% fee (although that is lowered to 0.40% for clients who link a Portfolio by Wells Fargo checking account). But the biggest knock on WellsTrade’s digital offering, Intuitive Investor, is its $10,000 minimum to open an account.

Schwab and TD Ameritrade both offer a hybrid service that combines algorithm-based advice with help from a human adviser for clients with more than $25,000 in assets. Fees on such an account will run you 0.28% of assets at Schwab, and they range from 1.25% to 0.75% at TD Ameritrade. Investors looking for professionally managed accounts will find the most-robust services at Schwab, Fidelity, TD Ameritrade and WellsTrade. Each offers access to specialists in trading, options and estate planning.

Finally, a word about Ally Invest. Its digital advisory service, Advisors Managed Portfolios, charges a 0.30% management fee and requires just $2,500 to get started. But the firm suffers in this category ranking because it doesn’t offer as hearty an array of planning advice (estate planning specialists, for example) as other firms.

Find the right broker for you

All types of investors can find standouts in a niche they care about.

Best for exchange-traded fund investors. Firstrade slays the competition in our survey with its roster of 703 commission-free exchange-traded funds. It includes 15 of the Kiplinger ETF 20, our favorite ETFs, including iShares Core S&P 500 (symbol IVV), Vanguard Dividend Appreciation (VIG) and Pimco Active Bond (BOND). Vanguard, which opted not to participate in our survey, charges nothing to buy or sell 1,800 ETFs on its platform.

Best for mutual fund investors. Fidelity, Schwab and TD Ameritrade all offer customers access to more than 4,000 no-fee mutual funds on their no-transaction-fee networks. That means you pay no sales load and no fee to trade. Schwab, as it has in past years, topped the list, with 4,121 no-fee funds. It’s worth noting that Fidelity has debuted the first index funds with a 0% expense ratio.

Best for bond investors. Firstrade wins by a nose, followed by E*Trade. These firms offer their clients access to tens of thousands of corporate and municipal bonds, leading their peers in both categories.

Best robo adviser services. Schwab’s Intelligent Portfolios wins. The service is free, and it offers more portfolios than any other firm. There are 43 in all, tailored to your goals, tolerance for risk and stage in life. Intelligent Portfolios has a couple of downsides: It requires $5,000 or more to start, and its most aggressive portfolio currently holds a hefty 7% cash position, a potential drag on returns. But according to The Robo Report, which tracks the performance of digital advisory portfolios, Schwab has achieved good results over time.

Best for active traders with high balances. Customers with deep pockets can pay $0 in commissions at Merrill Edge. If you have an active Bank of America checking account and a three-month average balance of $50,000 at Bank of America, Merrill Edge or Merrill Lynch investment accounts (singly or in combination), you can join a rewards program and qualify for no commissions on up to 30 stock and ETF trades per month. Investors with a $100,000 average balance can get 100 free trades every month.

Best for students of investing. E*Trade and TD Ameritrade have made it a priority to teach and inform customers about investing, each in its own way. “Our goal is to make investing easier for people,” says E*Trade’s Rich Messina. E*Trade caters to beginner investors with “All Star” lists of recommended ETFs, stocks and mutual funds, plus ready-to-go ETF portfolios. TD Ameritrade’s website is chock full of short videos and longer online courses for investors of all experience levels. The firm also does a good job of defining and explaining key investing terms on its site, from “earnings per share” to “annual dividend yield.”

Update: Since our story went to press, Firstrade announced it would offer free online trading for stocks, ETFs, options and mutual funds (down from $2.95 per trade). Also, Ally Invest announced it would offer more than 100 exchange-traded funds commission-free (in other words, there is no sales charge to buy or sell shares) to customers on its online trading platform. (Previously, all ETFs purchased on the Ally Invest platform incurred a $4.95 commission; $3.95 for active traders or customers with high balance.)

With additional reporting by Kyle Woodley

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Nellie joined Kiplinger in August 2011 after a seven-year stint in Hong Kong. There, she worked for the Wall Street Journal Asia, where as lifestyle editor, she launched and edited Scene Asia, an online guide to food, wine, entertainment and the arts in Asia. Prior to that, she was an editor at Weekend Journal, the Friday lifestyle section of the Wall Street Journal Asia. Kiplinger isn't Nellie's first foray into personal finance: She has also worked at SmartMoney (rising from fact-checker to senior writer), and she was a senior editor at Money.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

Best Mutual Funds to Invest In for 2026

Best Mutual Funds to Invest In for 2026The best mutual funds will capitalize on new trends expected to emerge in the new year, all while offering low costs and solid management.

-

Smart Ways to Invest Your Money This Year

Smart Ways to Invest Your Money This YearFollowing a red-hot run for the equities market, folks are looking for smart ways to invest this year. Stocks, bonds and CDs all have something to offer in 2024.

-

Vanguard's New International Fund Targets Dividend Growth

Vanguard's New International Fund Targets Dividend GrowthInvestors may be skittish about buying international stocks, but this new Vanguard fund that targets stable dividend growers could ease their minds.

-

Best 401(k) Investments: Where to Invest

Best 401(k) Investments: Where to InvestKnowing where to find the best 401(k) investments to put your money can be difficult. Here, we rank 10 of the largest retirement funds.

-

Fidelity Strategic Income Fund Excels In Hard Year for Bonds

Fidelity Strategic Income Fund Excels In Hard Year for BondsThe fixed-income market was volatile in 2023, but this Fidelity bond fund outperformed its peers thanks to strategic moves by management.

-

What Is Margin Trading?

What Is Margin Trading?Margin trading is buying and selling stocks with borrowed money. It can generate big rewards, but margin trading also involves multiple risks.

-

7 Best Stocks to Gift Your Grandchildren

7 Best Stocks to Gift Your GrandchildrenThe best stocks to give your grandchildren have certain qualities in common. Here, we let you know what those are.

-

How to Find the Best 401(k) Investments

How to Find the Best 401(k) InvestmentsMany folks are likely wondering how to find the best 401(k) investments after signing up for their company's retirement plan. Here's where to get started.