The Value of A Holistic Approach to Financial Planning

New research shows a comprehensive approach can boost investment return over the long term.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Since our start in 1985, Mercer Advisors has firmly believed that investors have the most to gain by looking at their financial lives holistically – a mixture of investment advice, comprehensive planning, and life-driven goals. Recent research has put a value on this integrated approach.

Studies by Morningstar and Vanguard show financial advisers who provide wealth management best practices can add significant value beyond market performance. While the findings are hypothetical and are not actual investment results, both sets of research illustrate the value provided by comprehensive financial planning.

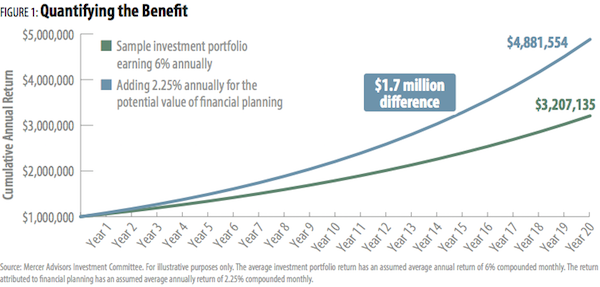

Our research shows that investors who follow best practices can earn an additional 1.50% to 3.00% annually. Splitting the difference between these statistics, Figure 1 shows how an additional 2.25% annual return could impact a portfolio over thirty years. (For illustrative purposes only.)

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The average investment portfolio return has an assumed average annual return of 6% compounded monthly. The return attributed to financial planning has an assumed average annual return of 2.25% compounded monthly.

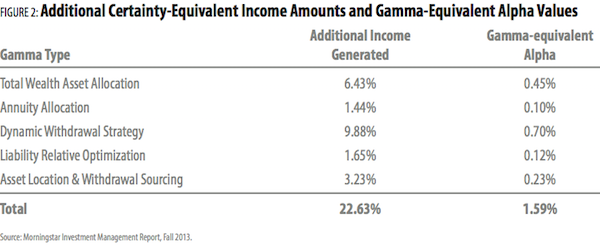

Morningstar says smart financial planning can translate to 1.5% more in annual average returns. Academics at Morningstar recently coined the term Gamma to define the potential valued added to a portfolio from intelligent financial decisions. In a white paper titled Alpha, Beta and Now….Gamma the authors stated, “Getting Gamma from financial planning best practices offers a much more certain and consistent return than seeking traditional alpha from choosing outperforming mutual funds.” Morningstar identified more than 100 financial planning techniques that can serve as sources of Gamma. They focused on five for their study: total wealth asset allocation, annuity allocation, dynamic withdrawal strategy, liability relative optimization, and asset location & withdrawal sourcing.

Figure 2 shows how properly implementing these value-added strategies can increase returns by as much as 1.59% annually. Of the five strategies, a dynamic withdrawal strategy had the highest potential Gamma. In addition to the five factors, Morningstar found that making informed Social Security claiming decisions could increase returns by another 0.74% annually.

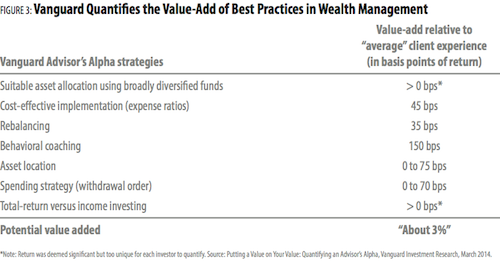

Vanguard finds working with an adviser can add up to 3% in net returns. Vanguard performed a similar study and concluded that financial advisers using wealth management best practices can add “about 3% in net returns” to their clients’ portfolios. Vanguard emphasized that while the value added will vary according to each client’s circumstances and from year to year, “It’s a number that is very real and can reinforce the importance of sticking to a plan and following sound financial advice.”

As detailed in Figure 3, clients can benefit from a qualified adviser who helps them invest in a low-cost, broadly diversified portfolio, maintain their target allocation, and draw down their savings tax efficiently. Successfully implementing all seven strategies can potentially add “about 3%” to an average client experience.

Notably, research finds that advisers can add the most value – “tens of percentage points of value-add, rather than mere basis points” – by helping clients stay the course during bear market lows and avoid performance chasing during market highs.

Best Practices at a Glance

Below are five strategies identified by this new area of best practices research. All of these potential return-enhancing strategies are practiced by Mercer Advisors:

Academic Portfolio Design

Research has found that asset allocation is the biggest driver of a portfolio’s return and risk. Best practice studies conclude that one of the advisor’s primarily responsibilities is to design a properly diversified investment portfolio tailored to each client’s personal needs, goals, and risk profile.

Ongoing Personal Guidance

Studies have shown that average investors often jump in and out of the market, buying at the euphoric highs and panic selling at the distressing lows. Not surprisingly, the returns the average investors earn on their investment portfolios are significantly lower than what the market offered. One of the most valuable services an advisor can provide is to help clients steer clear of money-losing ventures, like trying to time the market or chase returns.

Low-Cost Investing

Research has repeatedly documented that low costs lead to better investment performance. Advisers who implement investment plans with lower-cost funds can add significant value to their clients’ portfolios. Cost-effective implementation is especially important in times of low market returns, when fund expenses erode a higher proportion of returns.

Systematic Portfolio Rebalancing

A good financial adviser keeps the investment plan on track through systematic portfolio rebalancing. Regular rebalancing keeps positions within their target weights and enforces the discipline of buying low and selling high. Without guidance, many investors fail to rebalance their portfolios because it seems counterintuitive to sell winners and buy laggards.

Customized Distribution Planning

Research has shown the benefits of adjusting distributions based on the investment climate and a client’s remaining life expectancy. Advisers utilizing variable withdrawals strategies can help maximize how long their clients’ savings last. Customized distribution planning allows investors to increase spending during good markets, without having to cut back as much in down markets.

David has served as CEO of Mercer Advisors since 2008. He is responsible for the firm’s strategic vision, business plan execution, and organizational structure.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

The Cost of Leaving Your Money in a Low-Rate Account

The Cost of Leaving Your Money in a Low-Rate AccountWhy parking your cash in low-yield accounts could be costing you, and smarter alternatives that preserve liquidity while boosting returns.

-

I want to sell our beach house to retire now, but my wife wants to keep it.

I want to sell our beach house to retire now, but my wife wants to keep it.I want to sell the $610K vacation home and retire now, but my wife envisions a beach retirement in 8 years. We asked financial advisers to weigh in.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.

-

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial Advice

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial AdviceCan financial advisers who earn commissions on product sales give clients the best advice? For one professional, changing track was the clear choice.

-

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AI

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AIFor financial advisers eager to embrace AI but unsure where to start, this road map will help you integrate the right tools and safeguards into your work.

-

The Referral Revolution: How to Grow Your Business With Trust

The Referral Revolution: How to Grow Your Business With TrustYou can attract ideal clients by focusing on value and leveraging your current relationships to create a referral-based practice.

-

This Is How You Can Land a Job You'll Love

This Is How You Can Land a Job You'll Love"Work How You Are Wired" leads job seekers on a journey of self-discovery that could help them snag the job of their dreams.

-

65 or Older? Cut Your Tax Bill Before the Clock Runs Out

65 or Older? Cut Your Tax Bill Before the Clock Runs OutThanks to the OBBBA, you may be able to trim your tax bill by as much as $14,000. But you'll need to act soon, as not all of the provisions are permanent.

-

The Key to a Successful Transition When Selling Your Business: Start the Process Sooner Than You Think You Need To

The Key to a Successful Transition When Selling Your Business: Start the Process Sooner Than You Think You Need ToWay before selling your business, you can align tax strategy, estate planning, family priorities and investment decisions to create flexibility.