International Fund Follows in the Family Tradition

This new-ish international fund continues Grandeur Peak’s winning ways.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

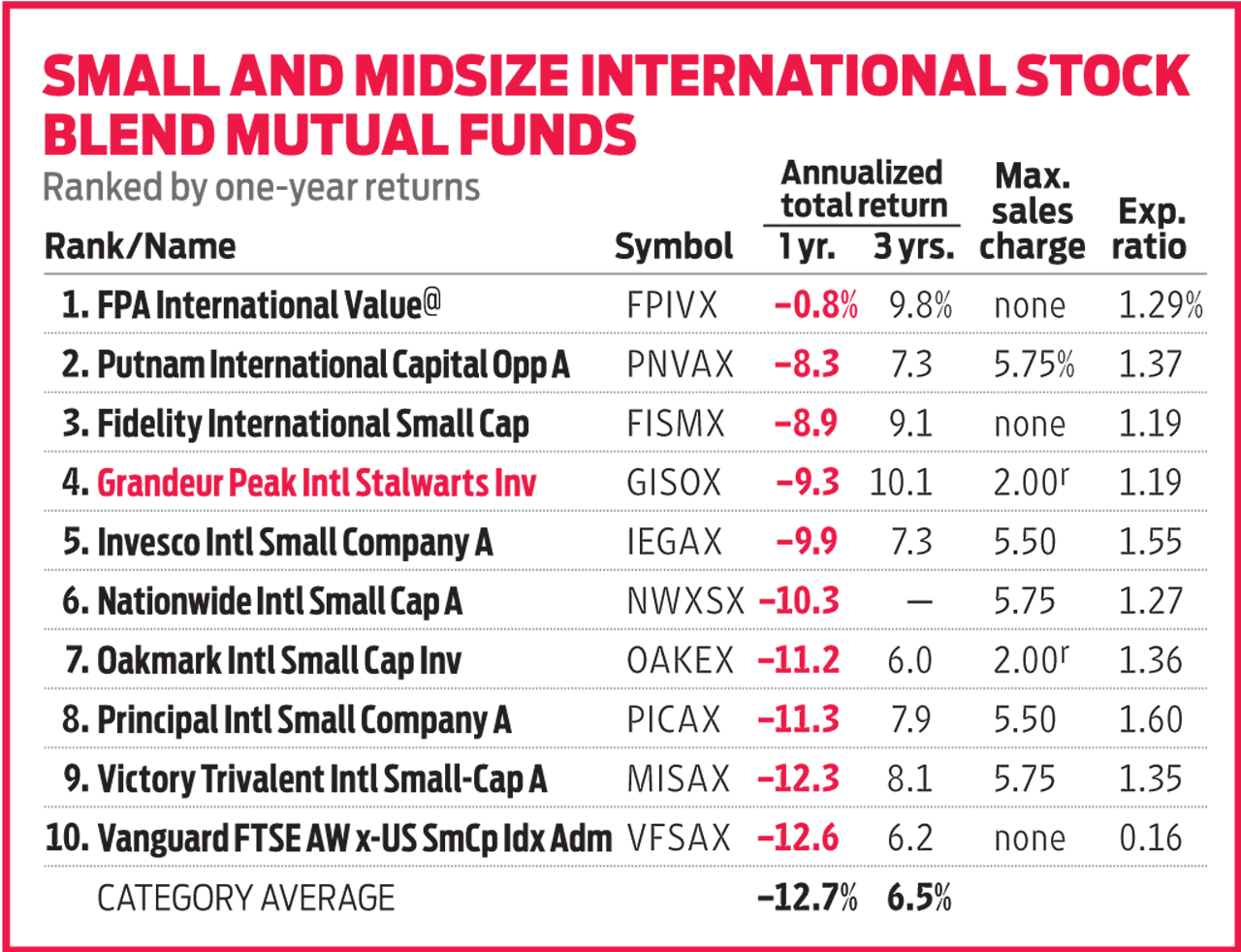

The prospectus for Grandeur Peak International Stalwarts (symbol GISOX, $15) lists three portfolio managers, but they’d be the first to tell you that their portfolio is the result of a much broader team effort. The boutique investment firm leans on a 25-analyst research team to generate stock ideas for its seven mutual funds (two are closed; three require new investors to purchase directly from the company). All of the funds have beaten their respective benchmarks since inception, with six of seven beating their bogeys by 2 percentage points per year or more, on average.

Launched in 2015, International Stalwarts and its sister fund, Global Stalwarts, are two of the youngest in Grandeur Peak’s lineup. They can also hold bigger companies than their siblings, which invest in small companies across the globe. The Stalwarts funds hold a mix of small companies and midsize firms that have outgrown Grandeur Peak’s other portfolios.

International Stalwarts invests nearly 86% of assets in overseas firms, with the remainder in U.S. stocks. Companies in the portfolio typically have a market capitalization (stock price times shares outstanding) of $1 billion to $10 billion, though the managers will stick with a firm if it grows bigger and they still like the stock. The team tilts the portfolio toward high-quality companies with increasing revenues, stable profit margins and healthy balance sheets. The goal is to find firms with sustainable competitive advantages, where executives can boost earnings by percentages in the low to mid teens over the next five years or more.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The fund managers will pay up for high quality and growth potential. Stocks in the portfolio trade at an average 19 times estimated earnings, compared with 17 times for similar funds. But the managers expect International Stalwarts to hold up better than its peers during market dips. In 2018, the fund surrendered 17.7%; peers lost 19.1%, on average.

Toward the end of 2018, the managers lightened their positions in stocks that had held up well during the fourth-quarter slide and added to faster-growing names in the portfolio that had fallen in price. One such stock: Software engineering firm EPAM, which fell 16% over the quarter. The shares have returned 50.4% so far in 2019.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Ryan joined Kiplinger in the fall of 2013. He wrote and fact-checked stories that appeared in Kiplinger's Personal Finance magazine and on Kiplinger.com. He previously interned for the CBS Evening News investigative team and worked as a copy editor and features columnist at the GW Hatchet. He holds a BA in English and creative writing from George Washington University.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

7 Frugal Habits to Keep Even When You're Rich

7 Frugal Habits to Keep Even When You're RichSome frugal habits are worth it, no matter what tax bracket you're in.

-

White House Probes Tracking Tech That Monitors Workers’ Productivity: Kiplinger Economic Forecasts

White House Probes Tracking Tech That Monitors Workers’ Productivity: Kiplinger Economic ForecastsEconomic Forecasts White House probes tracking tech that monitors workers’ productivity: Kiplinger Economic Forecasts

-

The 5 Best Actively Managed Fidelity Funds to Buy and Hold

The 5 Best Actively Managed Fidelity Funds to Buy and Holdmutual funds Sometimes it's best to leave the driving to the pros – and these actively managed Fidelity funds do just that, at low costs to boot.

-

The 12 Best Bear Market ETFs to Buy Now

The 12 Best Bear Market ETFs to Buy NowETFs Investors who are fearful about the more uncertainty in the new year can find plenty of protection among these bear market ETFs.

-

Investing in Emerging Markets Still Holds Promise

Investing in Emerging Markets Still Holds PromiseEmerging markets have been hit hard in recent years, but investors should consider their long runway for potential growth.

-

Don't Give Up on the Eurozone

Don't Give Up on the Eurozonemutual funds As Europe’s economy (and stock markets) wobble, Janus Henderson European Focus Fund (HFETX) keeps its footing with a focus on large Europe-based multinationals.

-

Stocks: Winners and Losers from the Strong Dollar

Stocks: Winners and Losers from the Strong DollarForeign Stocks & Emerging Markets The greenback’s rise may hurt companies with a global footprint, but benefit those that depend on imports.

-

Vanguard Global ESG Select Stock Profits from ESG Leaders

Vanguard Global ESG Select Stock Profits from ESG Leadersmutual funds Vanguard Global ESG Select Stock (VEIGX) favors firms with high standards for their businesses.

-

Kip ETF 20: What's In, What's Out and Why

Kip ETF 20: What's In, What's Out and WhyKip ETF 20 The broad market has taken a major hit so far in 2022, sparking some tactical changes to Kiplinger's lineup of the best low-cost ETFs.