The Legacy of John Bogle

The champion of low-cost index investing changed mutual funds forever.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The ancient Greek poet Archilochus wrote, “The fox knows many things, but the hedgehog one great thing.” The fable tells the story of a wily, hedgehog-stalking fox, repeatedly defeated by the hedgehog’s prickly spines, which proved to be an impenetrable defense. Jack Bogle did, in fact, know many things, but he never forgot the one important thing, which he defended until the end, sometimes in a prickly fashion: Costs matter in investing.

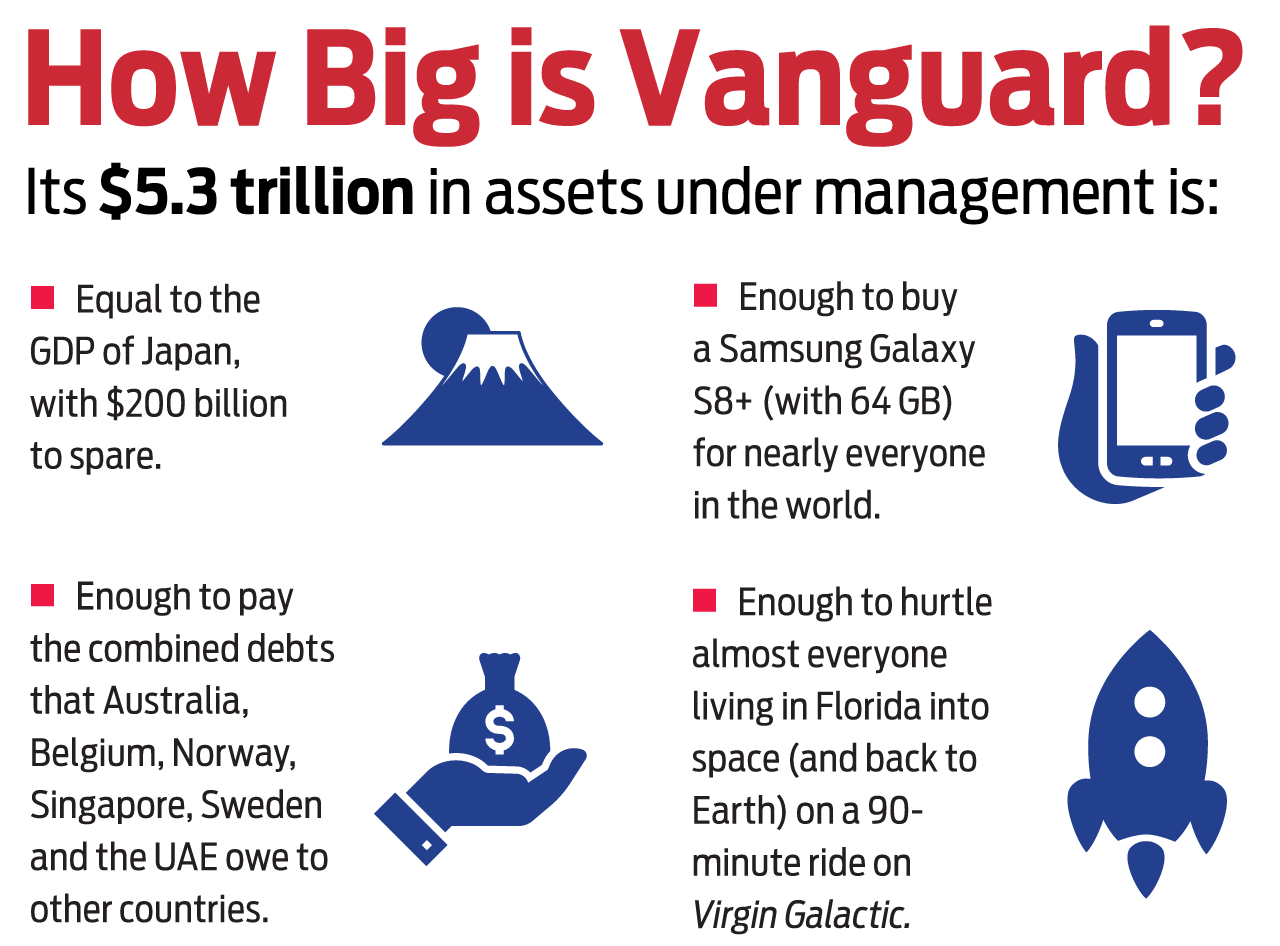

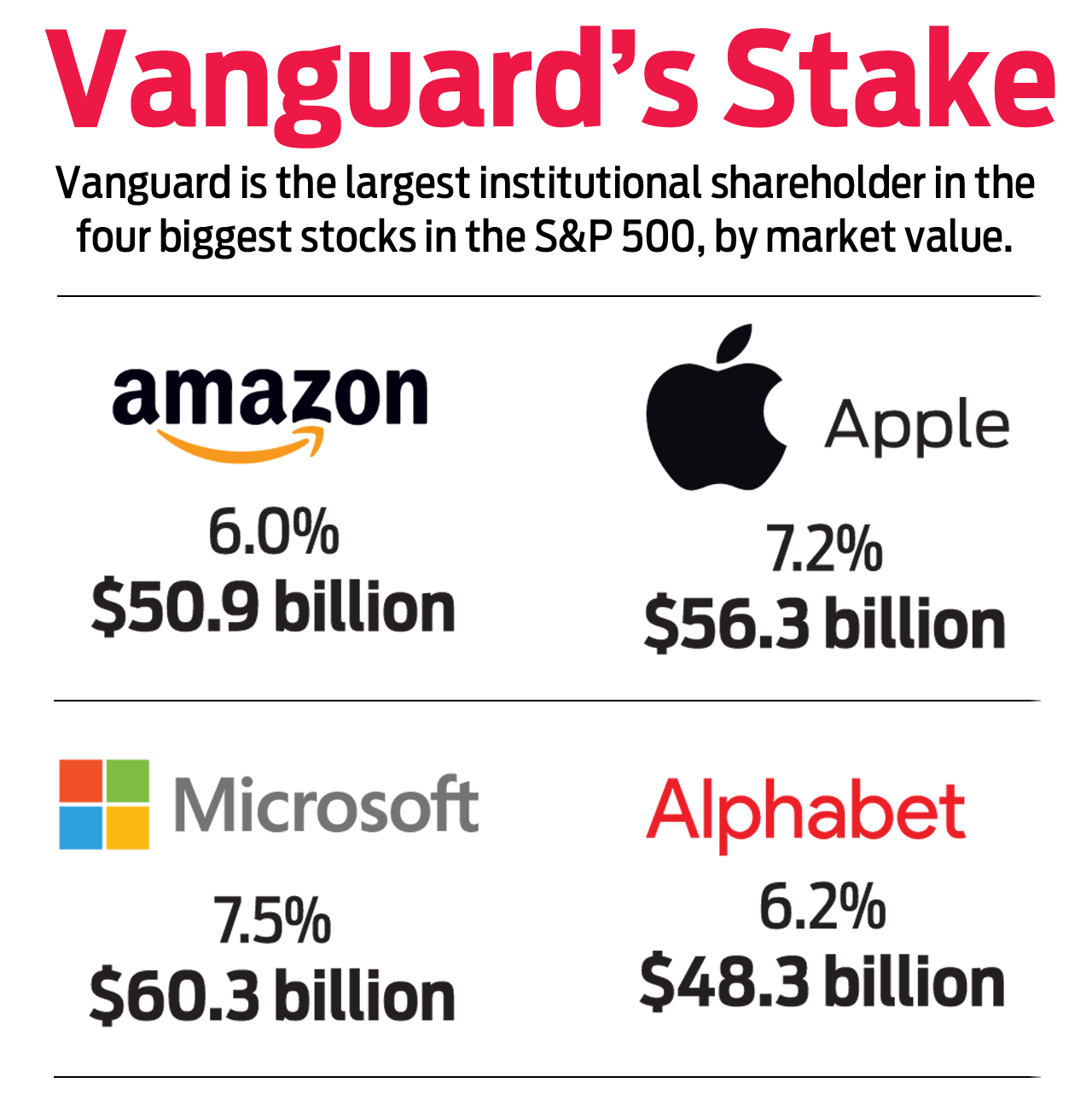

Bogle, founder of the Vanguard Group and creator of the first retail index fund, stuck by the conclusion of his senior thesis at Princeton. The mutual fund industry’s growth was best maximized by cutting sales loads and management fees, argued the young Bogle.

To a modern investor, this is just common sense. The less money you give to your fund (or your broker), the more money you keep. But to people in the pre-Vanguard world—especially those in the mutual fund industry—it was heresy. The commissions you paid for stocks and mutual funds were the entrance fee to the magic kingdom of Wall Street. Ads extolled listening to E.F. Hutton’s brokers, and the business press lionized active fund managers.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Bogle didn’t buy it, especially since fat commissions and fees kept investors from beating the returns of an index, such as Standard & Poor’s 500-stock index.

Bogle didn’t endear himself to the industry that he worked in his entire life, thanks to frequent—and frequently blunt—criticisms. “I have a lover’s quarrel with the industry,” he said. In his best-selling Common Sense on Mutual Funds: New Imperatives for the Intelligent Investor, first published in 1999, he wrote, “The mutual fund industry has been built, in a sense, on witchcraft.”

Bogle helped break the spell. Actively managed funds were 85% of the industry’s assets in 2007; that share is 65% today. Expense ratios, pressured by low-cost index investing, have fallen from an average of 1.04% for all U.S. stock funds in 1996 to 0.59%, on average. And the low-fee bandwagon he set into motion rolls on. Fidelity Investments now offers mutual funds with an expense ratio of zero. Fidelity and Charles Schwab & Co. have eliminated commissions on hundreds of ETFs.

John Clifton Bogle died on January 16, 2019, but his legacy lives on.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Best Mutual Funds to Invest In for 2026

Best Mutual Funds to Invest In for 2026The best mutual funds will capitalize on new trends expected to emerge in the new year, all while offering low costs and solid management.

-

Smart Ways to Invest Your Money This Year

Smart Ways to Invest Your Money This YearFollowing a red-hot run for the equities market, folks are looking for smart ways to invest this year. Stocks, bonds and CDs all have something to offer in 2024.

-

Vanguard's New International Fund Targets Dividend Growth

Vanguard's New International Fund Targets Dividend GrowthInvestors may be skittish about buying international stocks, but this new Vanguard fund that targets stable dividend growers could ease their minds.

-

Best 401(k) Investments: Where to Invest

Best 401(k) Investments: Where to InvestKnowing where to find the best 401(k) investments to put your money can be difficult. Here, we rank 10 of the largest retirement funds.

-

7 Best Stocks to Gift Your Grandchildren

7 Best Stocks to Gift Your GrandchildrenThe best stocks to give your grandchildren have certain qualities in common. Here, we let you know what those are.

-

How to Find the Best 401(k) Investments

How to Find the Best 401(k) InvestmentsMany folks are likely wondering how to find the best 401(k) investments after signing up for their company's retirement plan. Here's where to get started.

-

How to Master Index Investing

How to Master Index InvestingIndex investing allows market participants the ability to build their ideal portfolios using baskets of stocks and bonds. Here's how it works.

-

The Best Vanguard ETFs to Buy

The Best Vanguard ETFs to BuyThe best Vanguard ETFs all feature rock-bottom fees, large asset bases and long trading histories. Here are a few of our favorites.