One Simple Step to Get Good Investment Advice

You don't have to wait for the Labor Department to enact its new fiduciary rule. Make your adviser sign the pledge at the bottom of this column.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

By now it's certainly no surprise that the Department of Labor has issued its long awaited missive on fiduciary duty. With over 1,000 pages, there is a lot to absorb; however, I believe the DOL has done a Solomon-like job of streamlining, simplifying and clarifying the rule. Although, like many other supporters of the fiduciary concept, I would have liked to see something stronger, I do believe the actions of the DOL will absolutely make the system fairer.

The result is amazing and to be applauded, especially given the realities of today's political constraints. Multiple millions of dollars have been spent lobbying against the implementation of a DOL rule. Michael Piwowar, a commissioner of the Securities and Exchange Commission, opines that the rule "seems to ignore the chorus of voices that questioned whether it will restrict middle-class families' and minority communities' access to professional financial advice by making retirement advice unaffordable." Senator Johnny Isakson of Georgia stated, "This fiduciary rule will harm countless Georgians who have worked hard to make sure they make wise financial decisions for their families' futures. For families across the country, this rule is essentially the Obamacare for retirement planning, and I will do everything I can to overturn this rule."

The argument that small investors (i.e. the "countless Georgians") will lose access to advice is balderdash. First, brokers do not provide advice. If they did, they would have to do so as investment advisers and would already be held to a fiduciary standard. Second, there is a large universe of fiduciary advisers who are ready, willing and able to provide substantive advice. Third, as we've already seen, traditional commission-based platforms will quickly find a way to continue to operate under the new rule; for example, see LPL Cuts Prices, Account Minimums Ahead of DOL Fiduciary Rule.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

In fact, firms are provided significant latitude in how they adhere to the new rule. As the DOL noted, "Rather than create a highly prescriptive set of transaction-specific exemptions, the Department instead is publishing exemptions that flexibly accommodate a wide range of current types of compensation practices, while minimizing the harmful impact of conflicts of interest on the quality of advice."

However, the rule does have its shortcomings. While IRAs may be subject to fiduciary standards, the old suitability standard—with all of the potential conflicts of interest—will still hold true for non-IRA accounts.

Also, advisers can expect to hear more from their compliance officers. Under the current suitability standard, if there is a dispute, the ultimate responsibility for proving the claim rests on the shoulders of the client. Under a fiduciary standard, the responsibility shifts to the adviser. This is a distinction not lost on compliance departments. As a consequence, I believe the enforcement of fiduciary standards will not be a result of detailed rules and micro-managing regulators, but rather the actions of firm compliance departments and ultimately the results of arbitration and court rulings.

I believe the DOL rule is a seminal event that will significantly improve the investment outcome of individual investors for decades to come. My friend Bob Veres, publisher of Inside Information and longtime industry observer, best summed it up:

"…overall, the new rule fundamentally (and with pretty [much] zero exception) requires the broker… to act as a fiduciary. That brings a lot of people into the principles-based universe, which is alien territory for the brokerage firms… My take is that the DOL was a bit sly about its concessions, making it harder for the wirehouse arguments to prevail in court should there be (as I think there WILL be) a legal challenge to these provisions.

That means that this is a milestone for the planning profession, a stake in the ground further than anyone has gone before in the fiduciary requirement space."

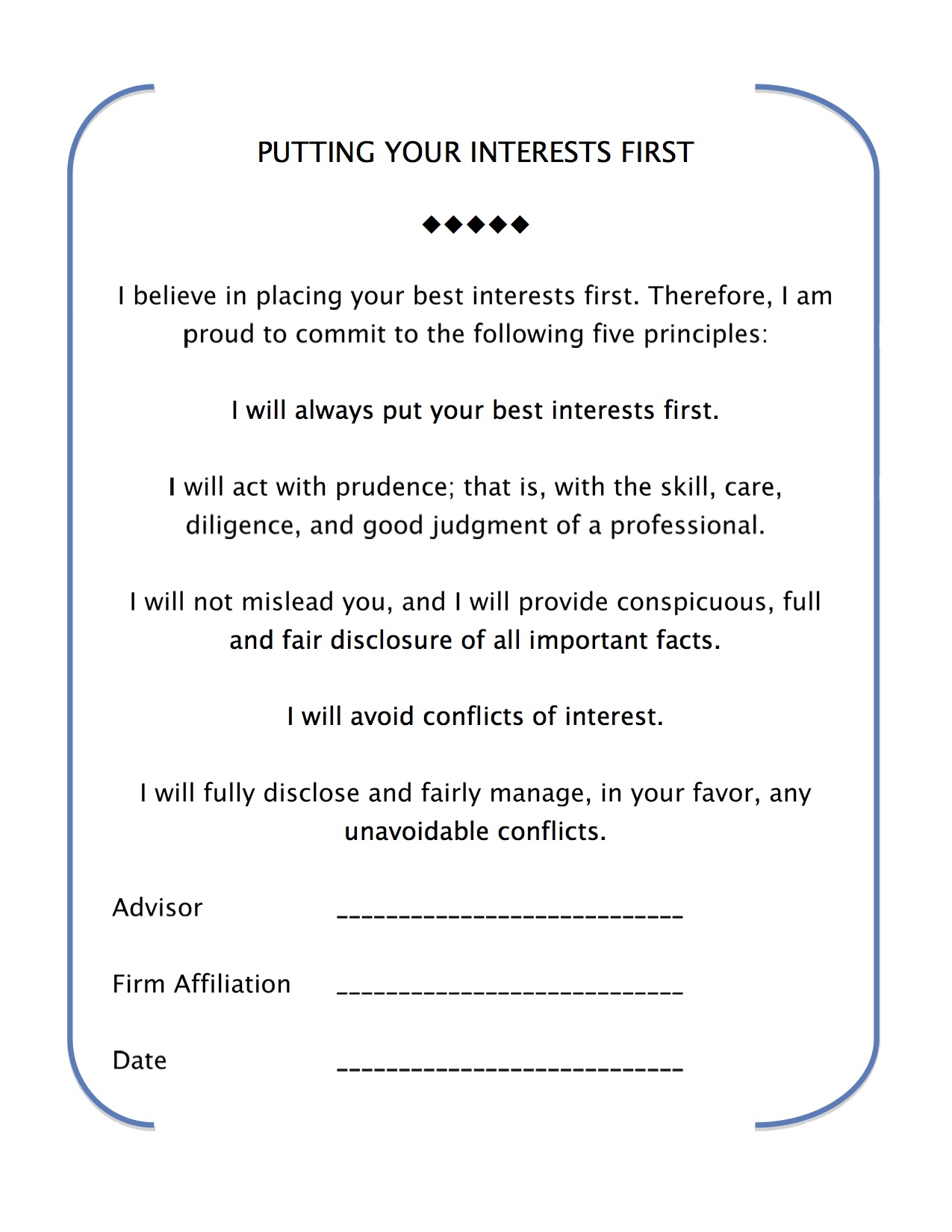

Finally, as legislators, businesses and the courts go about interpreting and implementing the more than 1,000 pages, individual investors might happily ignore the activity by simply having their advisor sign the Committee for the Fiduciary Standard's mom-and-pop ">fiduciary oath (see below or click on the link for a printable version of the oath). With that signed and in hand, you will at least know that your relationship with your adviser is structured so that your interest comes first, even with your non-IRA accounts.

Harold Evensky, CFP, is Chairman of Evensky & Katz, a fee-only wealth management firm and Professor of Practice at Texas Tech University.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Harold Evensky, CFP® is Chairman of Evensky & Katz, a fee-only investment advisory firm and Professor of Practice in the Personal Financial Planning Department at Texas Tech University. Evensky served as Chair of the TIAA-CREF Institute Advisor Board, Chair of the CFP Board of Governors and the International CFP Council. He is on the advisory board of the Journal of Retirement Planning and is the Research Columnist for Journal of Financial Planning. Evensky is co-author of The New Wealth Management and co-editor of The Investment Think Tank and Retirement Income Redesigned. Mr. Evensky has received numerous awards over the years. The most recent is Investment Advisor Magazine, 2015 IA 35 for 35 recognizing the advisor advocates, investors, politicians and thought leaders have stood out over the past 35 years and will influence financial services for decades to come. Don Phillips of Morningstar called Mr. Evensky the dean of financial planning in America.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.

-

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial Advice

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial AdviceCan financial advisers who earn commissions on product sales give clients the best advice? For one professional, changing track was the clear choice.

-

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AI

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AIFor financial advisers eager to embrace AI but unsure where to start, this road map will help you integrate the right tools and safeguards into your work.

-

The Referral Revolution: How to Grow Your Business With Trust

The Referral Revolution: How to Grow Your Business With TrustYou can attract ideal clients by focusing on value and leveraging your current relationships to create a referral-based practice.

-

This Is How You Can Land a Job You'll Love

This Is How You Can Land a Job You'll Love"Work How You Are Wired" leads job seekers on a journey of self-discovery that could help them snag the job of their dreams.

-

65 or Older? Cut Your Tax Bill Before the Clock Runs Out

65 or Older? Cut Your Tax Bill Before the Clock Runs OutThanks to the OBBBA, you may be able to trim your tax bill by as much as $14,000. But you'll need to act soon, as not all of the provisions are permanent.

-

The Key to a Successful Transition When Selling Your Business: Start the Process Sooner Than You Think You Need To

The Key to a Successful Transition When Selling Your Business: Start the Process Sooner Than You Think You Need ToWay before selling your business, you can align tax strategy, estate planning, family priorities and investment decisions to create flexibility.