A Strange 2011 for the Kiplinger 25

Our favorite no-load fund picks included a few winners, but most of our domestic stock funds delivered returns in a narrow range that trailed the market slightly. One other positive: We had no disasters.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

As I was scanning the mutual fund tables over the New Year's weekend (a pastime suited mainly for finance geeks and investing editors), what struck me most was, first, how few U.S. stock funds beat Standard & Poor's 500-stock index and, second, by how little most funds seemed to trail the index.

So rather than wait for Morningstar and other arbiters of the official results to publish their year-end numbers, I decided to look specifically at the performance of the Kiplinger 25 funds. As most of you know, that is the list of our favorite no-load, actively managed mutual funds.

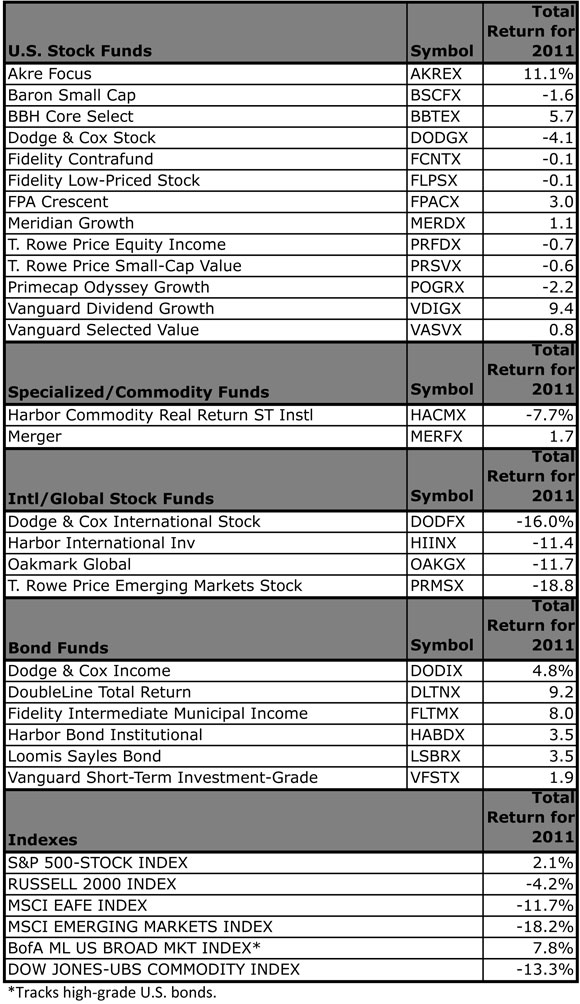

What I saw startled me. The range of results of the 13 U.S.-oriented stock funds on the Kip 25 was remarkably narrow: Eight of the funds returned between -2.2% and 1.1%. It mattered not whether they focused on small-company stocks or blue chips, bargain-priced value stocks or fast growers. The S&P 500, which is oriented toward large companies, returned 2.1% (ignore all those reports about the S&P breaking even for the year; the 2.1% figure, which includes dividends, is the true measure of the market's performance).

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The Kip 25's five outliers barely lived up to the term. The worst performer among our domestic stock fund picks was Dodge & Cox Stock (symbol DODGX); it lost 4.1%. The best, in ascending order, were: FPA Crescent (FPACX), up 3.0%; BBH Core Select (BBTEX), up 5.7%; Vanguard Dividend Growth (VDIGX), up 9.4%; and Akre Focus (AKREX), which gained 11.1%.

Thankfully, we had no flat-out disasters. Perhaps our best call of the year was to dump Fairholme Fund (FAIRX) from the Kip 25 in the May issue of Kiplinger's Personal Finance magazine, which began arriving in subscribers' mailboxes in late March. Fairholme lost a stunning 32.4% in 2011 as manager Bruce Berkowitz's huge bet on financial stocks came back to bite him and his fund's shareholders.

Getting back to the narrow band of returns for our domestic stock fund picks, I think the explanation lies in what Kiplinger's columnist Jeremy Siegel calls the "nowhere to run" market. As Siegel writes in the magazine's February issue, the big story of 2011, other than the market's fearsome volatility, was the incredibly high degree of correlation among stocks and, for that matter, among most asset classes. On days when the U.S. stock market, for instance, made a huge move (The New York Times reports that the market went up or down at least 2% on 35 occasions in 2011), just about all stocks went up or just about all went down. Sure, you could have made more by focusing on defensive, dividend-paying stocks such as utilities and makers of consumer staples. Or you could have lost more by betting big on banks or on microcaps (stocks of tiny companies). But it appears that most of our Kiplinger 25 favorites stayed pretty much in the mainstream with their stock picks.

The results were less felicitous for the international and global stock funds in the Kip 25. Reflecting the euro zone crisis and Japan's longstanding woes, which were exacerbated by the tsunami and the nuclear-reactor disaster, the MSCI EAFE index, the most widely followed measure of performance in developed markets, lost 11.7% last year. Our two diversified foreign funds, Dodge & Cox International Stock (DODFX) and Harbor International (HIINX), lost 16.0% and 11.4%, respectively. T. Rowe Price Emerging Markets Stock (PRMSX) sank 18.8%, roughly matching emerging-markets indexes. And Oakmark Global (OAKGX), which invests in both U.S. and foreign stocks, surrendered 11.7%.

The bond funds in the Kip 25 did OK. Each made money, ranging from 1.9% for the very conservative Vanguard Short-Term Investment Grade Bond Fund (VFSTX) to 9.2% for DoubleLine Total Return (DLTNX), which was added to the Kiplinger 25 in last May's issue. Even the year's most disappointing bond fund, Harbor Bond (HABDX), run by Pimco's Bill Gross, the nation's most famous bond manager, managed a 3.5% gain. In a rocky year, that was nothing to sneeze at.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

The Kiplinger 25: Our Favorite No-Load Mutual Funds

The Kiplinger 25: Our Favorite No-Load Mutual FundsThe Kiplinger 25 The Kiplinger 25 is a list of our top no-load mutual funds that have proven capable of weathering any storm.

-

The 5 Best Actively Managed Fidelity Funds to Buy and Hold

The 5 Best Actively Managed Fidelity Funds to Buy and Holdmutual funds Sometimes it's best to leave the driving to the pros – and these actively managed Fidelity funds do just that, at low costs to boot.

-

The 12 Best Bear Market ETFs to Buy Now

The 12 Best Bear Market ETFs to Buy NowETFs Investors who are fearful about the more uncertainty in the new year can find plenty of protection among these bear market ETFs.

-

Don't Give Up on the Eurozone

Don't Give Up on the Eurozonemutual funds As Europe’s economy (and stock markets) wobble, Janus Henderson European Focus Fund (HFETX) keeps its footing with a focus on large Europe-based multinationals.

-

Vanguard Global ESG Select Stock Profits from ESG Leaders

Vanguard Global ESG Select Stock Profits from ESG Leadersmutual funds Vanguard Global ESG Select Stock (VEIGX) favors firms with high standards for their businesses.

-

Kip ETF 20: What's In, What's Out and Why

Kip ETF 20: What's In, What's Out and WhyKip ETF 20 The broad market has taken a major hit so far in 2022, sparking some tactical changes to Kiplinger's lineup of the best low-cost ETFs.

-

ETFs Are Now Mainstream. Here's Why They're So Appealing.

ETFs Are Now Mainstream. Here's Why They're So Appealing.Investing for Income ETFs offer investors broad diversification to their portfolios and at low costs to boot.

-

Do You Have Gun Stocks in Your Funds?

Do You Have Gun Stocks in Your Funds?ESG Investors looking to make changes amid gun violence can easily divest from gun stocks ... though it's trickier if they own them through funds.