Oakmark International Finds Bargains in European Stocks

A new fund joined the Kip 25 in July 2017, bringing in bargains from across the pond.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

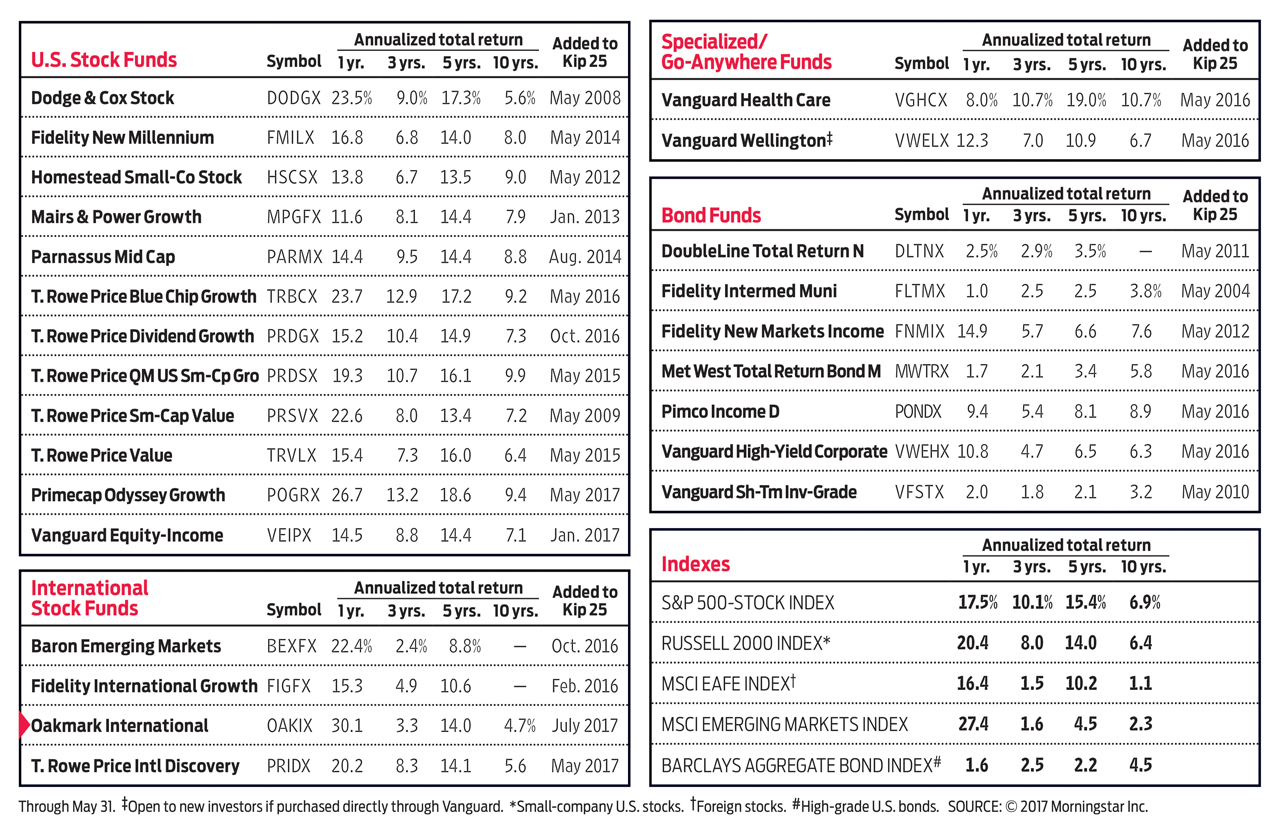

David Herro has either managed or comanaged Oakmark International (OAKIX) since its launch, in September 1992. Over that nearly 25-year-long period, the fund has earned an annualized 10.1%. That beat the MSCI EAFE index, which tracks large firms in developed foreign markets, by an average of four percentage points per year. Put another way, a $10,000 investment in International at its inception would be worth $106,000 today; the same amount in an EAFE index fund would be worth $41,000.

Herro is a classic bargain hunter, an approach he learned by reading the works of Benjamin Graham, considered the father of value investing. He and comanager Michael Manelli seek firms with executives who act like owners, that generate positive free cash flow (cash earnings after capital expenditures) and that reinvest profits wisely.

The final test is price: The managers buy only if a stock sells for at least 30% below their assessment of a firm’s intrinsic value per share—what a buyer would pay to acquire the entire business. “We’re looking for companies that can create value, which I define as growth in free cash flow per share,” says Herro. “We don’t care how they do it, as long as free cash flow is rising.”

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Lately, Herro and Manelli have been finding the most-attractive prospects in Europe. Oakmark has about three-fourths of its assets there, with financial-services firms, consumer-related companies and industrial stocks representing the biggest sector weightings. At last report, the fund’s top holding was Glencore, a global mining company headquartered in Switzerland. Other large positions included the United Kingdom’s Lloyds Banking Group, German automaker Daimler and CNH Industrial, an Anglo–Dutch maker of agricultural and construction equipment.

Like nearly all actively managed funds, International occasionally suffers through poor stretches. For instance, in 2007 the fund lost 0.5%, while the EAFE index gained 11.2%. “We don’t aim to have volatile periods,” says Herro. “We aim to take advantage of volatility by buying quality at a lower price, and sometimes that results in short-term underperformance. We’re willing to take short-term pain to make long-term gains.”

See Also: 26 Best Funds for Your Retirement Nest Egg

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Nellie joined Kiplinger in August 2011 after a seven-year stint in Hong Kong. There, she worked for the Wall Street Journal Asia, where as lifestyle editor, she launched and edited Scene Asia, an online guide to food, wine, entertainment and the arts in Asia. Prior to that, she was an editor at Weekend Journal, the Friday lifestyle section of the Wall Street Journal Asia. Kiplinger isn't Nellie's first foray into personal finance: She has also worked at SmartMoney (rising from fact-checker to senior writer), and she was a senior editor at Money.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

What Fed Rate Cuts Mean For Fixed-Income Investors

What Fed Rate Cuts Mean For Fixed-Income InvestorsThe Fed's rate-cutting campaign has the fixed-income market set for an encore of Q4 2024.

-

The Most Tax-Friendly States for Investing in 2025 (Hint: There Are Two)

The Most Tax-Friendly States for Investing in 2025 (Hint: There Are Two)State Taxes Living in one of these places could lower your 2025 investment taxes — especially if you invest in real estate.

-

The Final Countdown for Retirees with Investment Income

The Final Countdown for Retirees with Investment IncomeRetirement Tax Don’t assume Social Security withholding is enough. Some retirement income may require a quarterly estimated tax payment by the September 15 deadline.

-

Dividends Are in a Rut

Dividends Are in a RutDividends may be going through a rough patch, but income investors should exercise patience.

-

Municipal Bonds Stand Firm

Municipal Bonds Stand FirmIf you have the cash to invest, municipal bonds are a worthy alternative to CDs or Treasuries – even as they stare down credit-market Armageddon.

-

The Kiplinger 25: Our Favorite No-Load Mutual Funds

The Kiplinger 25: Our Favorite No-Load Mutual FundsThe Kiplinger 25 The Kiplinger 25 is a list of our top no-load mutual funds that have proven capable of weathering any storm.

-

High Yields From High-Rate Lenders

High Yields From High-Rate LendersInvestors seeking out high yields can find them in high-rate lenders, non-bank lenders and a few financial REITs.

-

Time to Consider Foreign Bonds

Time to Consider Foreign BondsIn 2023, foreign bonds deserve a place on the fringes of a total-return-oriented fixed-income portfolio.