3 Most Important Factors To Making Your Money Last in Retirement

It may seem complicated, but there are formulas to help you match your annual spending with growth in your portfolio.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Probably the biggest single concern of retirees is running out of money. It doesn't seem to matter how much money they have; the thought of not generating any outside income and living for many years off of an existing pool of assets and Social Security strikes fear in the hearts of many mortals.

That's where a financial adviser can help. It's one of our primary jobs. We spend many hours studying and learning about how best to accomplish this goal. I personally find the topic very interesting since many tools and techniques have been developed over the years to better understand this issue.

Some of these tools are nothing but sales pitches in disguise. Others are so complicated that many planners don't even understand them fully (i.e. "Monte Carlo simulations").

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Effective retirement planning is not a "set-it-and-forget-it" discipline either. A financial plan for someone who is in the distribution phase of their lives is one that calls for continuous monitoring and adjustment, as well as attention to the markets, economy and political environment.

Still, all good plans rely on a few key variables:

1. Getting the spending part right.

In a nutshell, how much will you be shelling out each year, both for normal and recurring items and for extraordinary or one-time expenses? Perhaps your plan calls for an annual expense of $15,000 for travel, as you like to visit your children a few times every year and also take one or two personal trips. Then, maybe every three to five years, you plan on a larger expenditure of $25,000 to spend three weeks in Europe.

Annual car expenses, including funds for an unexpected emergency, also must be factored in. You may have a normal expenditure of $5,000 in fuel and maintenance costs and a periodic expense of $30,000 every 10 years to replace a car, for example.

When calculating the lifespan of your portfolio, we look at the net or after-tax withdrawals from your accounts after other sources of income, such as Social Security and pensions, are used.

2. Understanding the total value of your liquid assets.

Liquid just means you can quickly cash in an asset, such as cash, certificates of deposit, money market accounts, stocks, bonds, mutual funds, etc.

3. Correctly estimating the expected growth rate of your investments.

This is after taxes, inflation and investment management expenses. Two of these three variables are within your control—taxes and investment management costs. Tax management can take on a large role in retirement, as asset sales can be timed and gains and losses can be netted against one another, distributions can be timed from taxable versus non-taxable accounts, etc.

Investment management fees should be evaluated and minimized where possible. This includes fees at the mutual fund level and at the adviser level.

As an example, consider a balanced portfolio of 60% stocks and 40% fixed income and cash. The blended return on this portfolio will probably be in the 7% range. Inflation today stands at around 1.1% (but with health care costs being a large factor for retirees, we're going to use 3%). A typical investor will pay somewhere in the range of 1.5% for investment management, so our net growth rate is around 2.5%.

Taxes may bring that down closer to 2%. I am giving you this detail to impress upon you the impact of the various factors on your portfolio, and to emphasize that it truly can be the small things that make a difference.

Ok, so now what? We know the portfolio value, the spending plan and the expected growth rate. How do we find out how long the portfolio will last?

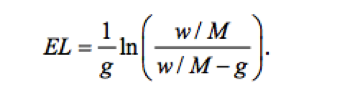

Moshe Milevsky, Associate Professor of Finance at York University in Toronto developed the following simple formula (simple if you have a financial calculator or use a spreadsheet program):

What this says is that the EL, or expected longevity of your portfolio is equal to 1 divided by the expected growth rate times the natural logarithm of the formula in parenthesis. "w" is your withdrawal amount in dollars, "M" your initial portfolio value and "g" is your expected growth rate.

It looks complicated, but it isn't. I built a simple spreadsheet in Excel using this formula, and I'd be happy to send it to you if you would like a copy.

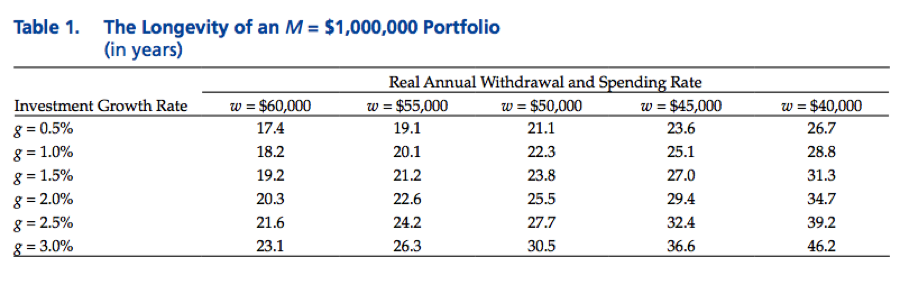

To get an idea of what the output looks like for a $1,000,000 portfolio, Mr. Milevsky provides the following excerpt:

You can quickly see the relationship between net growth rate and withdrawal rate. To go back to my earlier example, let's say you have a $1,000,000 portfolio and expect a 7% growth rate, which after inflation, fees, taxes, etc. is a net 2.5% rate of return. You could take as much as $60,000 a year out if you are a 65-year-old male and be reasonably certain that it will last for your lifetime (estimated mortality for a 65-year-old male is about 18 years, and 20 years for a female of the same age). There are more factors that should be considered, of course, such as the age of your beneficiaries (spouse, children, etc.), life insurance owned, etc., and that's why a complete financial plan is invaluable to make sure no stone is unturned when making such important decisions.

The bottom line is that this simple tool can at least get you started thinking, and maybe give you a little guidance in conversations with your financial adviser. And remember, sometimes small adjustments can have a big impact. Kind of like tools in the world of financial planning—sometimes the simpler tools and concepts are the most effective.

Doug Kinsey is a partner in Artifex Financial Group, a fee-only financial planning and investment management firm based in Dayton, Ohio.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Doug Kinsey is a partner in Artifex Financial Group, a fee-only financial planning and investment management firm in Dayton, Ohio. Doug has over 25 years experience in financial services, and has been a CFP® certificant since 1999. Additionally, he holds the Accredited Investment Fiduciary (AIF®) certification as well as Certified Investment Management Analyst. He received his undergraduate degree from The Ohio State University and his Master's in Management from Harvard University.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works Instead

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works InsteadFor retirees with a pension, traditional withdrawal rules could be too restrictive. You need a tailored income plan that is much more flexible and realistic.

-

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look Like

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look LikeThis is when you should be shifting your focus from growing your portfolio to designing an income and tax strategy that aligns your resources with your purpose.

-

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your Stress

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your StressTo be confident about retirement, consider building a safety net by dividing assets into distinct layers and establishing a regular review process. Here's how.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.