A Q&A with Jerome Schneider, Managing Director/Portfolio Manager at PIMCO Investments, LLC

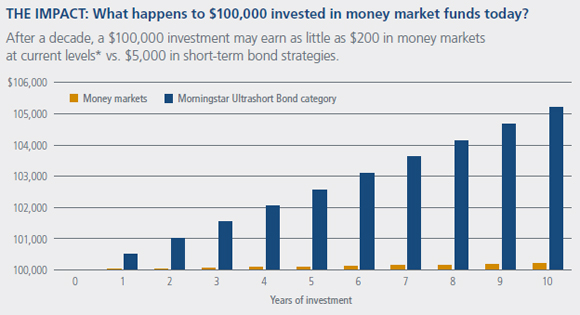

Source: Crane Data, Morningstar.

Why have so many investors been moving into cash and what are

the implications?

THE CONCERN: RISING RATES

Investors are concerned about what might happen to the value of their investments if interest rates begin to rise.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

THE REACTION: A FLIGHT TO “SAFETY”

As a result, a significant amount of assets have moved into money markets, which have minimal exposure to interest rate risk.

THE RESULT: LOSING MONEY

This flight to the perceived safety of money markets comes at a steep price – yields in these types of funds have dropped into negative territory when adjusted for inflation, which means investors may struggle to generate income.

As of 31 December 2013

Source: Crane Data, Morningstar. Past performance is no guarantee of future results. Investors should keep in mind all investments entail risks, including the loss of the principal amount invested.

* Reflects hypothetical cumulative return based on 1-yr return on Crane Money Fund Average as of 31 December 2013. Morningstar Ultrashort Bond category reflects hypothetical cumulative return based on trailing 12-month returns of the category as of 31 December 2013, which was 0.51%.

Unlike money market funds, funds within the Morningstar Ultrashort Bond category do not seek to preserve the value of your investment at $1.00 per share, and are subject to risks not associated with a money market investment. There are also substantial differences in the objectives and investment limitations between money market funds and other investments found in the Morningstar Ultrashort Bond Category.

Hypothetical Example for Illustrative Purposes Only.

A company of Allianz

Why are money market rates so low and when are they

expected to rise?

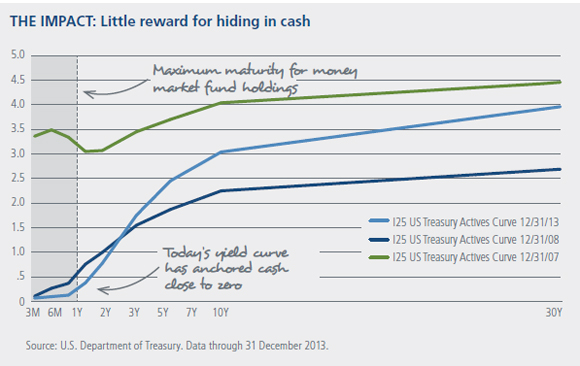

THE SITUATION: FINANCIAL REPRESSION

The Federal Reserve controls short-term rates through its fed funds rate and is currently keeping this rate artificially low to stimulate the economy.

Even as the Fed begins tapering, we believe it will keep its fed funds rate unchanged for the next few years, even if long-term rates increase.

ADDITIONAL FACTORS: SUPPLY CONSTRAINTS

Moreover, the supply of money market securities is shrinking, further compressing interest rates. Money market funds invest only in high quality securities with maturities of 397 days or less.

OUR EXPECTATIONS: LOW SHORT-TERM RATES

Therefore, we believe short-term rates should remain low and money market yields anchored near zero beyond 2014.

*Source: Repowatch.org. As of 10/4/13.

A company of Allianz

Money Market funds are not insured or guaranteed by FDIC or any other government agency and although the fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the fund.

Forecasts, estimates and certain information contained herein are based upon proprietary research and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product.

This material contains the current opinions of the author but not necessarily those of PIMCO and such opinions are subject to change without notice. Information contained herein has been obtained from sources believed to be reliable,but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO and YOUR GLOBAL INVESTMENT AUTHORITY are trademarks or registered trademarks of Allianz Asset Management of America L.P. and Pacific Investment Management Company LLC, respectively, in the United States and throughout the world © 2014 PIMCO

PIMCO Investments LLC, distributor, 1633 Broadway, New York, NY 10019, is a company of PIMCO.

This content was provided by PIMCO Investments, LLC, and did not involve the Kiplinger editorial staff.

[page break]

What can bond investors do to help manage portfolio risk?

THE CHALLENGE: FINDING RISK-MANAGED RETURNS

The challenge for investors is to find opportunities for current income and long-term capital appreciation while managing risk.

A CONSIDERATION: SHORT-TERM BONDS

PIMCO’s short-term funds are actively managed to find this sweet spot by focusing on high quality issuers, maintaining a degree of liquidity and managing NAV (net asset value) volatility.

ROLE IN PORTFOLIO: CORE COMPLEMENT

Our modest exposure to interest rate and credit risk provides more attractive yield potential than money market funds while complementing traditional core bond allocations.

A company of Allianz

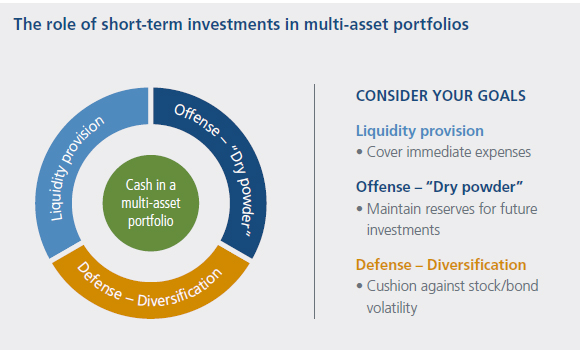

What are some alternatives to cash or money markets?

REMEMBER: CASH HAS ITS PLACE

It’s important to hold cash, but it should be done for the right reasons.

CONSIDER: A TIERED APPROACH

Investors can be defensive and still target higher returns by “tiering” their liquidity needs (i.e., determine how readily they’ll need cash).

An example of a tiered approach would be utilizing money market funds and T-bills for immediate cash needs and actively managed short-term bond funds (including exchange-traded funds) for less urgent requirements.

Money market funds may only invest in certain high quality short term investments issued by the U.S. government, U.S. corporations, and state and local governments that are subject to strict diversification and maturity standards and ultra-short bond funds are not subject to these requirements. Further, money market funds seek to maintain a stable NAV of $1.00 per share.

A company of Allianz

This content was provided by PIMCO Investments, LLC, and did not involve the Kiplinger editorial staff.

[page break]

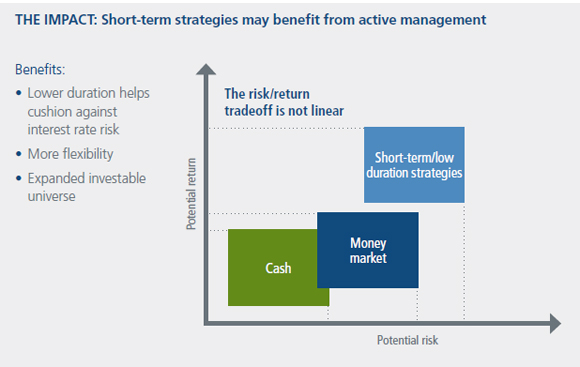

What are the benefits of active management in the

short-term space?

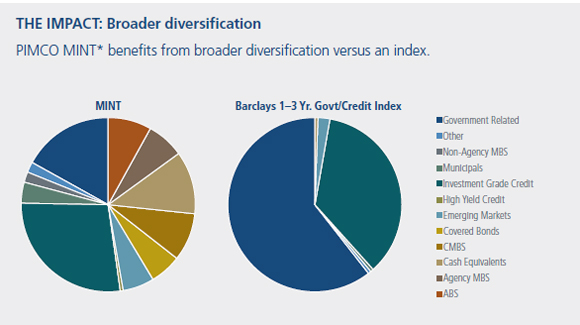

BENEFIT 1: EVALUATION OF GLOBAL OPPORTUNITIES

Since we first began managing dedicated short-term portfolios in 1986, PIMCO has assembled a global research infrastructure that allows us to evaluate the full opportunity set of short-term asset classes and individual securities. The result? Broadly diversified sources of yield in our short-term strategies.

BENEFIT 2: TOOLS TO FIND ATTRACTIVE YIELDS

Look for a portfolio manager with both the experience and resources necessary to actively manage portfolios in this competitive marketplace, because high demand and low availability are making it increasingly difficult to find short-term securities with attractive risk-adjusted yields.

BENEFIT 3: NAVIGATES CHALLENGING MARKETS

For investors concerned about interest rates, an active manager has flexibility to help navigate pitfalls and allocate to segments of the bond market that are less sensitive to rising rates.

A company of Allianz

Investors should consider the investment objectives, risks, charges and expenses of the funds carefully before investing. This and other information are contained in the Fund’s prospectus, which may be obtained by contacting your PIMCO representative. Please read the prospectus carefully before you invest.

A word about risk: Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, and inflation risk; investments may be worth more or less than the original cost when redeemed. Derivatives may involve certain costs and risks such as liquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Investing in derivatives could lose more than the amount invested.

The value of most bond strategies and fixed income securities are impacted by changes in interest rates. Bonds and bond strategies with longer durations tend to be more sensitive and more volatile than securities with shorter durations; bond prices generally fall as interest rates rise.

Exchange Traded Funds (“ETF”) are afforded certain exemptions from the Investment Company Act. The exemptions allow, among other things, for individual shares to trade on the secondary market. Individual shares cannot be directly purchased from or redeemed by the ETF. Purchases and redemptions directly with ETFs are only accomplished through creation unit aggregations or “baskets” of shares. Shares of an ETF are bought and sold at market price (not NAV). Brokerage commissions will reduce returns. Investment policies, management fees and other information can be found in the individual ETF’s prospectus.

Foreign (non-U.S.) fixed income securities will settle in accordance with the normal rules of settlement in the applicable foreign (non-U.S.) market. Foreign holidays that may impact a foreign market may extend the period of time between the date of receipt of a redemption order and the redemption settlement date. Please see the Funds Statement of Additional Information at www.pimcoetfs.com.

Money market funds may only invest in certain high quality short term investments issued by the U.S. government, U.S. corporations, and state and local governments that are subject to strict diversification and maturity standards and ultra-short bond funds are not subject to these requirements. Further, money market funds seek to maintain a stable NAV of $1.00 per share.

Premiums (when market price is above NAV) or discounts (when market price is below NAV) reflect the differences (expressed as a percentage) between the NAV and the Market Price of the Fund on a given day, generally at the time the NAV is calculated. A discount or premium could be significant. Data in chart format displaying the frequency distribution of discounts and premiums of the Market Price against the NAV can be found for each Fund at www.pimcoetfs.com.

This material contains the current opinions of the manager and such opinions are subject to change without notice. This material has been distributed for informational purposes only. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO and YOUR GLOBAL INVESTMENT AUTHORITY are trademarks or registered trademarks of Allianz Asset Management of America L.P. and Pacific Investment Management Company LLC, respectively, in the United States and throughout the world. © 2014 PIMCO

PIMCO Investments LLC, distributor, 1633 Broadway, New York, NY 10019, is a company of PIMCO.

This content was provided by PIMCO Investments, LLC, and did not involve the Kiplinger editorial staff.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

How the Stock Market Performed in the First Year of Trump's Second Term

How the Stock Market Performed in the First Year of Trump's Second TermSix months after President Donald Trump's inauguration, take a look at how the stock market has performed.

-

What the Rich Know About Investing That You Don't

What the Rich Know About Investing That You Don'tPeople like Warren Buffett become people like Warren Buffett by following basic rules and being disciplined. Here's how to accumulate real wealth.

-

How to Invest for Rising Data Integrity Risk

How to Invest for Rising Data Integrity RiskAmid a broad assault on venerable institutions, President Trump has targeted agencies responsible for data critical to markets. How should investors respond?

-

What Tariffs Mean for Your Sector Exposure

What Tariffs Mean for Your Sector ExposureNew, higher and changing tariffs will ripple through the economy and into share prices for many quarters to come.

-

How to Invest for Fall Rate Cuts by the Fed

How to Invest for Fall Rate Cuts by the FedThe probability the Fed cuts interest rates by 25 basis points in October is now greater than 90%.

-

Are Buffett and Berkshire About to Bail on Kraft Heinz Stock?

Are Buffett and Berkshire About to Bail on Kraft Heinz Stock?Warren Buffett and Berkshire Hathaway own a lot of Kraft Heinz stock, so what happens when they decide to sell KHC?

-

How the Stock Market Performed in the First 6 Months of Trump's Second Term

How the Stock Market Performed in the First 6 Months of Trump's Second TermSix months after President Donald Trump's inauguration, take a look at how the stock market has performed.

-

Fed Leaves Rates Unchanged: What the Experts Are Saying

Fed Leaves Rates Unchanged: What the Experts Are SayingFederal Reserve As widely expected, the Federal Open Market Committee took a 'wait-and-see' approach toward borrowing costs.