Thanks for the Memories: The Bull Market Nears 10-Year Mark

The bull market was born 10 years ago in March. We highlight some high (and low) points.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

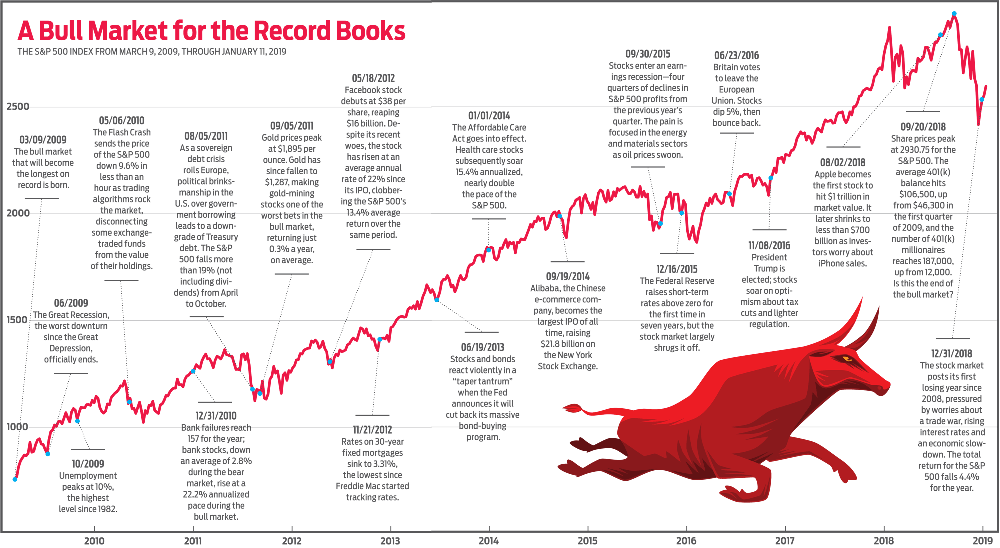

We know, of course, when the bull market began: March 9, 2009, when Standard & Poor’s 500-stock index closed at 676.53—down 57% from its previous high. The question every investor is asking now is, “When will it end?” It’s possible the end has come already and we just don’t know it yet.

Stock prices peaked on September 20, 2018, with the S&P 500 at 2930.75, and they have been on a roller coaster since. Should prices fall 20% (the generally accepted definition of a bear market) before surpassing that high, we’ll know in retrospect that that date was the end of the longest bull market on record. If the bull is still alive, then March will mark its 10th birthday. Its gift to us: a 17.1% annualized rate of return, including dividends. (Prices and returns in the story are through January 11.)

One thing we’ve learned is that bull markets often have near-death experiences. Measured by intraday prices, the bull market died in 2011, when the S&P 500 fell 21.6% from May to October of that year. More recently, the S&P 500 fell 20.2% from its intraday high in September to its intraday low in December. In both cases, the index managed to rally at the close, avoiding an official bear market.

Article continues belowFrom just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Bull markets don’t die of old age. They die of fear, and fear has been in no short supply recently. Volatility has soared as investors worry about trade wars, a slowing economy and rising interest rates. The Federal Reserve slashed the federal funds rate to zero during the financial crisis and kept it there until 2015. Such ultralow rates made it cheaper for businesses and individuals to borrow and made bonds less attractive relative to stocks. The Fed has hiked rates in quarter-point increments nine times since then, and those increases have slowed the bull down. The S&P 500 has returned an average of 9.8% a year since the first Fed hike on December 16, 2015.

Sooner or later, the bull market will give way to a bear market. Our advice for long-term investors won’t change: Allocate your assets in tune with your stage in life and your goals, invest regularly, and, when the inevitable bear market comes, keep calm and carry on.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.