Midyear Investing Outlook, 2014

The bull market isn’t over. But expect a choppier ride.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Remember when you were younger, full of exuberance and able to jump higher and run faster? Was it only last year that a charging bull delivered a 32% return to investors in the U.S. stock market? The bull has matured and is now facing some of the setbacks of middle age. So far this year, Standard & Poor’s 500-stock index has returned just 3%. Still, we’re convinced that the bull market has got plenty of life left, so don’t give up on it yet.

In our January issue, we predicted that the S&P 500 would finish the year in the vicinity of 1900, and the Dow Jones industrial average would close above 17,000. At midyear, we still think that’s a good, conservative bet, although it’s possible that stocks could tack on a little more—with the S&P closing between 1950 and 2000. That would produce gains of 6% for the year and would translate to roughly 17,500 for the Dow. Stock returns will mirror growth in corporate earnings, which analysts estimate at 6% to 7% this year. Dividends will add another two percentage points to the market’s return.

But the market has grown more complicated, with a lot going on beneath the surface. The tide is no longer lifting all boats—in order to prosper, you’ll have to be choosier about where you invest. Many of yesterday’s market leaders are becoming today’s laggards, making for choppier waters overall. In general, we think the rest of the year will favor larger companies over smaller ones; companies that sell at reasonable values over high-growth, high-priced stocks; and companies that are more sensitive to improvement in the economy than those considered more defensive. (For our take on fixed-income investing, see The Bond Rally Isn’t Over. For our international outlook, see Struggling Economies Mean Bargain-Priced Stocks. All prices and returns are as of April 30.)

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Five-plus years into the bull market, “2014 will be a big test,” says Matthew Berler, co-manager of the Osterweis Fund. Investors will grade the bull on how well it manages some midlife crises—or, if not crises, at least challenges.

Readying for higher rates

The bull’s first challenge will be making the transition from a market driven by super-easy monetary policies and little competition from fixed-income investments to one more focused on corporate profits. The Federal Reserve is unwinding its bond-buying program aimed at keeping long-term rates low and will eventually look toward raising short-term rates, most likely next year. As investors begin to anticipate that tightening, the market could suffer a 5% to 10% pullback, perhaps in the fourth quarter, says David Joy, chief market strategist at Ameriprise Financial (see How Bull Markets Meet Their Demise). But if raising interest rates to a more normal level is seen as a vote of confidence in the economy, as he suspects will be the case, then it won’t be the end of the bull market.

As for earnings growth, companies must become less dependent on the plump profit margins engineered by cost-cutting and other maneuvers and more reliant on revenue growth. “I’m cautious,” says John Toohey, who directs stock investments for USAA. “And my caution revolves around one theme: We need to see more revenue growth.” Since the financial crisis, per-share earnings growth has been strong as companies have cut costs, refinanced high-cost debt, lowered tax bills and bought back shares. A recent spike in mergers and buyouts is aimed at buying revenue growth, Toohey adds. But he and others would prefer to see more growth coming from actually selling more goods and services. “We’re a little surprised we haven’t seen it yet,” says Toohey.

Such growth will hinge on whether the economy can finally accelerate convincingly. Kiplinger’s expects gross domestic product to expand by 2.4% this year, up from 1.9% growth in 2013, with the growth rate picking up to 3% or better in the second half. Many of those who are optimistic about the economy and the stock market are pinning their hopes on another crucial transition—the one in which companies segue from stockpiling cash to spending it. “We’re five years out from the Great Recession,” says Joseph Quinlan, chief market strategist at U.S. Trust, Bank of America Private Wealth Management. “Companies have been hoarding cash. The next five years will be about deploying it.”

In recent years, companies have spent generously on dividends and share buybacks. But a resurgence in corporate spending on physical assets, such as factories, equipment and office space, has been the missing link to more robust economic growth. Such capital expenditures are part of a virtuous cycle as increasing production necessitates spending, in turn creating jobs and income growth, which then increases consumer demand, boosting corporate revenues and profits.

The time is ripe for a capital-spending recovery. With some $1.6 trillion on the books of S&P 500 firms as of year-end, cash stockpiles are enormous. Commercial and industrial lending is also picking up. And companies are nearing the point at which they can’t squeeze any more production out of existing plants and equipment. The average U.S. structure, be it a power plant, hospital or restaurant, is 22 years old. That’s close to a 50-year high, reports Bank of America Merrill Lynch. The average age of business equipment, including computers and machinery, is more than seven years old, the highest since 1995.

Buybacks lose favor

Meanwhile, spending on share buybacks, a winning strategy until recently, is now penalizing companies and investors as rising stock prices make such programs expensive. The 20% of companies with the largest number of share buybacks in relation to their respective market values outpaced the S&P by nearly nine percentage points in 2013 but lagged the index slightly in the first quarter of 2014, says BMO Capital Markets. Shareholders are voicing their preference for spending on capital equipment over buybacks, dividends and acquisitions.

Bank of America Merrill Lynch sees capital spending growing at a rate of 4.7% this year and 5.7% next year, more than double the 2.6% growth rate in 2013. Beneficiaries of a spending boom would include tech, industrial and energy companies, as well as companies that discover and process raw materials. These economy-sensitive sectors together account for more than 40% of revenues generated by S&P 500 companies.

Tilting your portfolio toward economy-sensitive stocks in general is in order as economic growth picks up, and a number of money managers favor these so-called cyclical stocks. USAA’s Toohey recommends Eaton Corp. (symbol ETN), a maker of industrial equipment. The 2012 acquisition of Cooper Industries is boosting revenues at the company’s electrical products and services unit, its biggest division. Jim Stack, of InvesTech Research, is a fan of software giant Oracle Corp. (ORCL), which has attractive growth opportunities in cloud computing and is trading at just 13 times estimated year-ahead earnings. Osterweis manager Berler likes Occidental Petroleum (OXY), a resource-rich energy company that has decades’ worth of drilling opportunities with its existing assets, as well as one of the strongest balance sheets in the industry. Investors interested in owning a broad array of industrial concerns can explore iShares U.S. Industrials (IYJ), an exchange-traded fund.

Even if all goes according to the bullish scenario, however, investors will soon realize that investing in a bull market approaching senior-citizen status is different than what they’ve grown used to. Until recently, for instance, a winning strategy for investors was simply to buy and stick with winning stocks. But a momentum-based approach is no longer working. For evidence, look no further than the recent fall of high-flying biotech and social media issues. The Nasdaq Biotechnology index has fallen 16% from its February 25 peak, and shares of social media standouts Twitter (TWTR) and LinkedIn (LNKD) have plunged 48% and 40%, respectively, from their recent peaks.

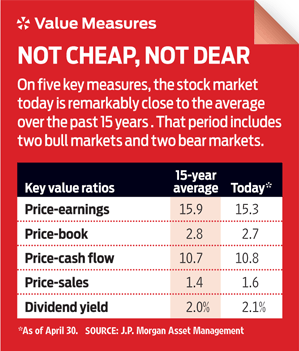

The good news is that the market’s most overpriced sectors are retreating without bringing the broader market down with them. “Bubble talk was applied broadly to the market, but really applied to only those high-flying areas,” says Liz Ann Sonders, chief investment strategist at Charles Schwab & Co. Stocks overall are still fairly valued, if no longer cheap. Based on estimated year-ahead profits, the S&P 500’s price-earnings ratio is 15—a tad below the long-term average and well below the levels of past market peaks. If the market’s hot spots can cool down on their own, “it’s possible we can wring out the excesses without a major calamity,” says Sonders.

The perils of politics

That’s unless Washington roils the markets again. Midterm election years bring political uncertainty and stock market volatility. In every midterm election year since 1962, says Sonders, the market has corrected, sometimes viciously, with average declines of 19%. But patient investors are rewarded, because 100% of the time, the market has rallied—and significantly, with average gains of 32% for the 12 months following the correction. Geopolitical upsets—especially in reaction to Russia’s activity in Ukraine—are another worry. “There may not be a fighting war, but an economic war could have an effect on the global economy,” says David Kelly, of J.P. Morgan Funds (see Less Lift, More Turbulence).

Whether or not a major pullback occurs, investors should expect continued shifts in winning styles and sectors. For example, the long winning streak of small-company stocks is likely coming to an end. From the market bottom in March 2009 until March 4 of this year, cumulative price gains for the small fry far outpaced their blue-chip brethren: 228% for the Russell 2000, a small-company index, compared with 178% for the S&P 500, more of a large-company barometer. But since its recent peak, the Russell 2000 has retreated 6%, while the S&P has been essentially flat. Historically, small-company stocks have led the market in periods of slower economic growth, but they fall behind when GDP grows by 3% or more, says Russell Investments, the keeper of the index. Moreover, small-company stocks recently traded at an average P/E that is nearly 110% of the 20-year average, while the P/E of large-company stocks was 6% below their 20-year average.

Similarly, when economic growth lags, investors bid up the stocks of companies—of whatever size—that have rapidly growing earnings. So-called growth stocks have generally led the market since early 2007, an unusually long cycle of dominance. But with confidence in the economy improving, it makes sense to gravitate toward stocks selling at bargain levels relative to earnings and other traditional gauges of value. That means choosing shares of Caterpillar (CAT) over Tesla Motors (TSLA), International Business Machines (IBM) over Netflix (NFLX), and Merck (MRK) over Regeneron Pharmaceuticals (REGN). So far this year, iShares Russell 1000 Value (IWD), an ETF that focuses on large, undervalued companies, has gained 3.9%, while iShares Russell 1000 Growth ETF (IWF) has gained 1.1%. “Rotation is the lifeline of a bull market,” says veteran market analyst Ralph Acampora, of Altaira Ltd., a money-management firm based in Switzerland. “As long as the money goes somewhere else, but stays in the market, that’s fine.”

As you tweak your own portfolio, consider building some cash reserves. In a shifting market it doesn’t hurt to take some of the money you’ve made off the table to be able to pounce on new opportunities or if changes in your circumstances so dictate (see When Selling Makes Sense).

Sam Stewart, chairman of Wasatch Funds, has accumulated a little more cash than he normally holds in the funds that he manages as he prunes stocks he now considers overpriced from his portfolios. “Choppiness is a reasonable forecast for the year,” Stewart says. “I want to make sure we have some dry powder on hand in case the market does correct and we see companies we want to buy at attractive prices.” He says he will be looking for bargains among technology, health care and financial firms—particularly those that are lifting their dividends.

Stewart currently recommends shares in CVS Caremark (CVS) because he believes the corner drugstore is becoming more central to family health care. Stewart also likes Wells Fargo & Co. (WFC), trading at a reasonable 12 times estimated year-ahead earnings and yielding 2.8%. The bank navigated the financial crisis “just fine,” he says.

Let’s just hope that investors will be able to say the same thing about navigating the stock market this year.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Anne Kates Smith brings Wall Street to Main Street, with decades of experience covering investments and personal finance for real people trying to navigate fast-changing markets, preserve financial security or plan for the future. She oversees the magazine's investing coverage, authors Kiplinger’s biannual stock-market outlooks and writes the "Your Mind and Your Money" column, a take on behavioral finance and how investors can get out of their own way. Smith began her journalism career as a writer and columnist for USA Today. Prior to joining Kiplinger, she was a senior editor at U.S. News & World Report and a contributing columnist for TheStreet. Smith is a graduate of St. John's College in Annapolis, Md., the third-oldest college in America.

-

Look Out for These Gold Bar Scams as Prices Surge

Look Out for These Gold Bar Scams as Prices SurgeFraudsters impersonating government agents are convincing victims to convert savings into gold — and handing it over in courier scams costing Americans millions.

-

How to Turn Your 401(k) Into A Real Estate Empire

How to Turn Your 401(k) Into A Real Estate EmpireTapping your 401(k) to purchase investment properties is risky, but it could deliver valuable rental income in your golden years.

-

My First $1 Million: Retired Nuclear Plant Supervisor, 68

My First $1 Million: Retired Nuclear Plant Supervisor, 68Ever wonder how someone who's made a million dollars or more did it? Kiplinger's My First $1 Million series uncovers the answers.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

How the Stock Market Performed in the First Year of Trump's Second Term

How the Stock Market Performed in the First Year of Trump's Second TermSix months after President Donald Trump's inauguration, take a look at how the stock market has performed.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.

-

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have TodayHome Depot stock has been a buy-and-hold banger for truly long-term investors.