How Oil and Gold Help Your Portfolio

Owning gold or oil — or both — can even out the volatility of a stock-heavy portfolio.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

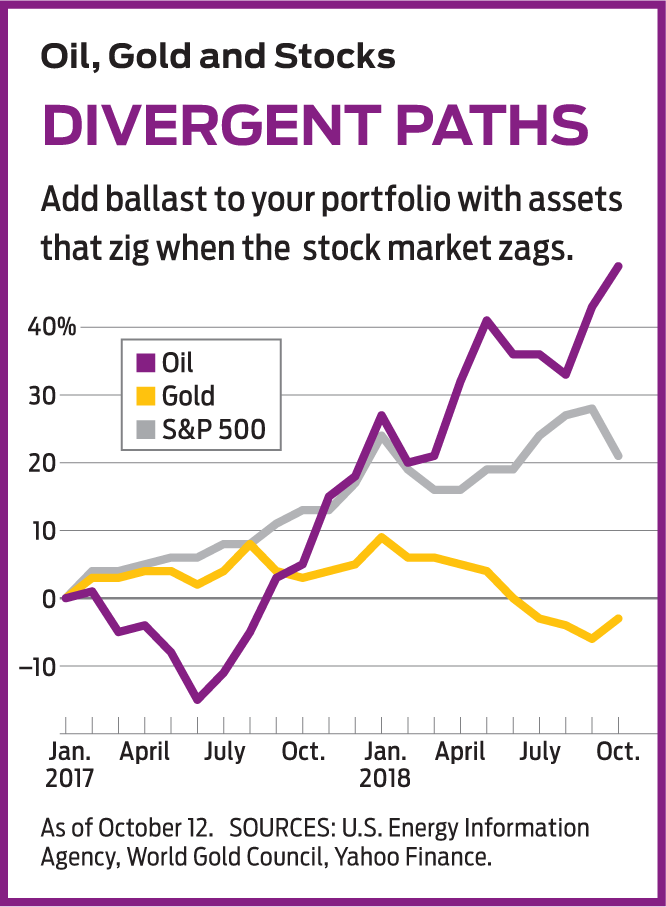

Since March 2009, U.S. stocks (including dividends) have returned 400%, quintupling in value, and many investors are naturally worried that the fun may end soon. They’re looking for other places to put their money, and two popular choices are oil and gold. In recent years, neither commodity has moved in tandem with the stock market.

Oil has taken a wild ride. A barrel of Brent Crude, the global benchmark, bottomed at about $34 at the end of 2008, soared to $126 in 2012 and fell to $29 in early 2016 before rising to $85 today. The price of an ounce of gold has increased by only about one-third since stocks bounced off their lows of nearly 10 years ago. Gold jumped above $2,000 in 2011, but the metal dropped by nearly half within four years and has since been trying to keep its head above water.

It’s smart to own assets that are uncorrelated—in other words, that move up and down in different, or even opposite, ways. In 2011, for example, Vanguard 500 Index (symbol VFINX), a mutual fund linked to Standard & Poor’s 500-stock index, returned just 2%, but United States Brent Oil (BNO), an exchange-traded fund that mimics the price of a barrel of oil, returned 19.5%. In 2013, the S&P 500 ETF rose 32.2%, while SPDR Gold Shares (GLD), an ETF linked to an ounce of gold, fell 28.3%. Conversely, in 2010, the gold ETF returned 29.3%, and the S&P fund returned 14.9%. As you can see, owning gold or oil—or both—can even out the volatility of a stock portfolio. Is this a good time to buy these commodities? And which one should you buy?

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Going their own ways. Gold and oil are not just uncorrelated to stocks, they are uncorrelated to each other, too. Since the end of June 2017, oil has been going up and gold has trended down. Oil has benefited from three developments. First, there’s the continued boom in the global economy. When business is good, more petroleum is needed to power cars and factories, generate electricity, heat homes, and convert into chemicals and fertilizer. Second, production has been constrained because the number of global rigs drilling for petroleum plummeted from 3,736 in February 2014 to 1,405 in May 2016. The most recent (September) rig count is 2,258. Third, the U.S. has imposed tough new sanctions on Iran, keeping much of the oil from the world’s number-five producer off the global market. Like the low rig count, the sanctions reduce supply, and in an environment of rising demand, prices go up.

Now imagine what could go wrong. The number of rigs could continue to rise, differences with Iran could be ironed out (or other countries could defy the U.S. sanctions), or the global economy could slow down. Trade wars could escalate, reducing demand in China and Europe, or, conversely, the U.S. economy could overheat. That would force the Federal Reserve to raise interest rates more aggressively, choking off growth, which would inevitably drive down oil prices.

Kiplinger projects 2018 U.S. growth at 2.9% and inflation at 2.5%—solid but hardly too hot. Still, unemployment is at the lowest level in 49 years, and labor costs may rise significantly—perhaps along with consumer prices, especially with new tariffs and other restrictions on imports.

Gold is another matter. The mythology is that gold is a hedge against inflation and a safe haven in a crisis. In fact, when inflation pushes up interest rates, gold suffers, as has been the case recently. The reason is that gold, unlike most other investments, does not generate income. If the rate on the two-year Treasury note is just 2%, then gold investors aren’t sacrificing much. But should the rate rise to 3% or 4%, the sacrifice increases, and bonds become relatively more attractive.

Nor does history validate the view that gold is shelter from a storm. Gold spiked by about 10% shortly after 9/11 but quickly settled back down. The price plummeted more than 20% during the Great Recession of 2008–09 and hit highs in 2010–12, a period of recovery and global stability. Patterns, however, can change. The most popular safe haven in recent years has been U.S. Treasury bonds, but in the next crisis, American debt may not prove to be as popular.

In addition, no one should underestimate the unpredictable psychology behind gold prices. After the Great Recession, people who worried about the potential for another major crisis held gold as protection. High confidence levels more recently may have depressed gold prices to bargain levels.

Time to get on the train? Right now, oil looks like a bet for momentum investors, who like to jump onto moving trains, and gold is for contrarians, who would rather board in the station and wait—sometimes for years—before starting to move. I’m a contrarian, and my preference today is for gold. Still, it makes good sense to own both as a way to provide the ballast of uncorrelated assets in your portfolio.

How to buy is another question. I am not a fan of commodities futures markets, where transaction fees are lofty and the temptation of leverage can cause you to lose everything on a single volatile move. With both oil and gold, there are two alternative categories of investments: the stuff itself and the companies that produce and sell it.

For example, the Brent ETF I mentioned earlier links to the price of global oil through a portfolio of futures contracts. United States Oil (USO) is an ETF that does the same but is linked to the price of the U.S. benchmark, West Texas Intermediate crude. Currently, WTI is trading about $10 less than Brent, but it makes little difference which ETF you choose. In both cases, the fees are high for funds that require no judgment from a manager: 0.90% for the Brent ETF and 0.77% for USO. Gold ETFs come with more-reasonable fees: SPDR Gold Shares charges 0.40%, and iShares Gold Trust (IAU), the one I prefer, charges 0.25%.

Or you can buy funds that own shares of businesses. For oil, focus on exploration and production companies, which are more exposed to the ups and downs of prices than the huge integrated energy firms, such as ExxonMobil. A good ETF choice is Invesco Dynamic Energy Exploration and Production (PXE), whose top assets include EOG Resources (EOG); another good choice is SPDR S&P Oil & Gas Exploration & Production (XOP), with a portfolio that includes as its third-biggest holding California Resources (CRC), a much smaller company that’s focused on one state. For gold, my preferences are Fidelity Select Gold (FSAGX), a mutual fund whose top holding is Newmont Mining (NEM), and iShares Global Gold Miners (RING). This ETF has 15% of assets in Newmont and 12% in Barrick Gold (ABX), its top two holdings.

Because they don’t move in concert with stocks, oil and gold should offer your overall portfolio a smoother ride through any storms ahead. And you can be sure that there will be storms.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.