Time to Tackle Social Security, Medicare

30 years ago, a bipartisan commission (yes!) helped fix these entitlement programs. Let's try it again.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Bitter winds have been whipping down the Potomac, but there are signs of a spring thaw in the rancorous partisan struggles between Republicans and Democrats. Republicans have delayed a showdown on the debt ceiling, there has been progress on immigration reform, and House majority leader Eric Cantor reportedly has called for a rethinking of the GOP position on the debt issue. Republicans have decided to make their stand against government spending when mandated budget cuts kick in and Congress must vote to continue funding government projects.

Some people fear that if the GOP softens its stance on spending cuts, the rating agencies will further downgrade U.S. government bonds. When Standard & Poor's downgraded U.S. debt in August 2011, the Dow Jones industrial average fell 635 points.

I explained why downgrading Treasury debt would be wrong two years ago, before S&P did it, and it would still be wrong now. The Federal Reserve will always lend the Treasury whatever money it needs to fulfill its debt obligations. The danger to bondholders is inflation, not default, and although rising prices may be a threat down the road, there are no signs of it now.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

In 2011, the stock market feared that China would dump a sizable portion of its Treasury securities — a fear that proved to be unfounded. In fact, the demand for U.S. Treasury issues soared. Investors rightly believed that Treasury bonds were still the world's safe haven and flocked to them as stocks plunged.

No impact. The situation is no different today. Even if the credit-rating agencies downgrade Treasuries again, I predict no negative impact on the bond market. And the dollar will remain strong because the U.S. economy is growing faster than Europe's or Japan's.

That doesn't mean we should forget about the deficit. Economists agree that, in the long run, Social Security and especially Medicare are unsustainable in their current form. The financial crisis and Great Recession have greatly worsened the long-run projections for these programs, and there is no question that taxes will have to be raised, benefits cut, or both.

But most of the current trillion-dollar annual budget deficit is caused by our sluggish economy operating well below full employment. If the U.S. economy begins growing at 3% to 4% a year again — the rate at which I believe it will be growing by year-end — the deficit will be cut significantly. In 2012, the deficit was 7% of gross domestic product, but the Congressional Budget Office believes it could fall to 2.5% of GDP by 2015. That would keep debt growth below the growth rate of the economy.

Entitlement changes. The problem is that stabilizing the ratio of debt to GDP is not enough. As more baby-boomers enter retirement and draw Social Security and Medicare benefits, deficits will balloon once again. The sooner substantive work is done on these entitlements, the happier markets will be.

I recommend that a bipartisan commission be appointed to propose changes to our entitlement programs. Such action worked before. In 1981, President Reagan appointed a commission to make recommendations to bolster the Social Security trust fund, which at the time was scheduled to run out of money in a few years. In its 1983 report, the commission proposed, among other things, that tax rates and the retirement age be increased, and its recommendations sailed through Congress. There is no reason why, on the 30th anniversary of the commission's report, we cannot do it again — and this time we can include Medicare.

Columnist Jeremy J. Siegel is a professor at the University of Pennsylvania's Wharton School and the author of Stocks for the Long Run and The Future for Investors.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

7 Frugal Habits to Keep Even When You're Rich

7 Frugal Habits to Keep Even When You're RichSome frugal habits are worth it, no matter what tax bracket you're in.

-

A Preview of the Fed Under Trump

A Preview of the Fed Under TrumpEconomic Forecasts John Taylor, a former Treasury official in the Bush administration, is a top candidate to replace Fed chair Janet Yellen.

-

Investors, Don't Fear Higher Rates

Investors, Don't Fear Higher Ratesinvesting Although interest rates will rise modestly in coming months, that should not derail the bull market.

-

Why Investors Shouldn't Be Afraid of Inflation

Why Investors Shouldn't Be Afraid of InflationEconomic Forecasts An inflation rate of 2% to 3% is good for stocks because it gives companies the power to raise prices, which helps boost profits.

-

A Positive Outlook for U.S. Interest Rates

A Positive Outlook for U.S. Interest RatesEconomic Forecasts Instead of the threat of deflation from weak growth and falling prices, the U.S. is facing the opposite: accelerating inflation.

-

Can the Fed Save the Stock Market?

Can the Fed Save the Stock Market?Markets In retrospect, it was ill-timed for the Federal Reserve to start hiking short-term interest rates. But that can easily be fixed.

-

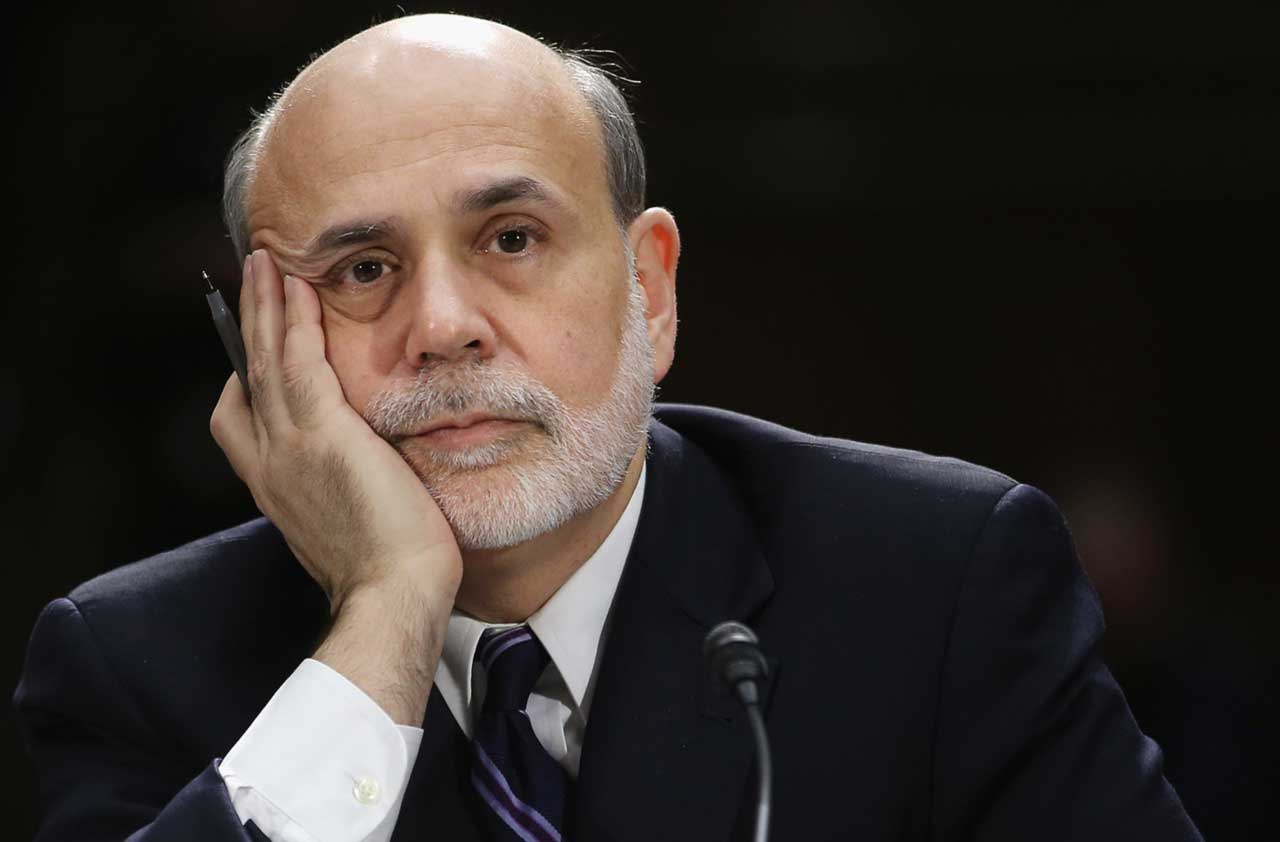

Bernanke's Ultimate Legacy

Bernanke's Ultimate Legacyinvesting The former Fed chairman's decisions in 2008 were an act of courage that averted an economic collapse far worse than we experienced.

-

Worries About China’s Economy Are Overblown

Worries About China’s Economy Are OverblownEconomic Forecasts Among the consequences of China's slowdown: lower commodity prices, which actually benefit the U.S.

-

Surviving the Greek Financial Crisis

Surviving the Greek Financial CrisisEconomic Forecasts Despite the recent friction, I believe the eurozone is stronger after putting down the Greek rebellion.